Month: December 2016

Verizon to test 5G “wireless fiber” for Internet & TV in Spring 2017

Verizon Communications CEO Lowell McAdam described the teleco’s first 5G fixed-wireless trial, planned for early next year, as “wireless fiber.” The trial will focus on several small towns and will support gigabit speeds and over-the-top (OTT) video.

“We won’t be charging for the service, but we will be learning from it and figuring out the distance between the transmitter and the receiver in a 5G environment,” McAdam said at a UBS investor conference in New York.

Verizon has long touted 5G technology, well in advance of the ITU-R standard. 5G can be up to 100 faster than current 4G wireless service, as the basis for a new cable and Internet service. Analysts claim 5G is needed for Verizon’s six year, $300 million plan to offer TV and Internet in Boston, for example. But McAdam had not previously given the early 2017 timeline and additional details about Verizon’s efforts.

“We could go to a 300-channel bundle,” McAdam commented. But he noted that the industry is seeing increased demand for “skinny bundles” with fewer channels and that a “skinny bundle” would be part of the Verizon 5G fixed wireless trial. The customer premises equipment (CPE) supporting the offering will be “very simple,” according to McAdam. It essentially will be a traditional home router with a 5G chip in it, he said.

The carrier is looking for ways to save money and crack new markets as growth in its two main lines of business, wired and wireless phone service, have slowed. In addition to 5G video service, McAdam has also targeted service for smart, connected devices in the Internet of things and online advertising, via the acquisition of AOL and pending purchase of Yahoo.

Verizon’s FiOS unit, which offers TV and Internet service, largely ceased expanding years ago because of the expense of building fiber optic lines to customers. But the 5G wireless plan could dramatically reduce those costs. A customer would only need a typical router placed by a window to receive signals for high speed Internet and TV service from a neighborhood-based cell tower. Verizon has even discussed deploying more numerous microcells, with new technology that can put a 5G transmitter inside a street light, for example.

“This will allow you to stop anywhere from 200 feet to 1,000 feet, somewhere in that range, we think, from the home and then make it a wireless last leg into the home,” McAdam said. “And I think that is going to be the predominant architecture for wireless service going forward,” he added.

Author Notes:

- FiOS is available in about 54% of the three-state territory Frontier acquired from Verizon in September, 2015. While Verizon’s wireless network operates nationwide, the telco has reduced wireline operations to focus on the Northeast US.

- Google Fiber has apparently been put on hold as parent company Alphabet contemplates moving away from fiber to the home service towards a wireless platform that could provide high speed Internet access and TV service in urban areas for much less money. Google is hoping to use wireless technology to connect homes, rather than cables, in about a dozen new metro areas, including Los Angeles, Chicago and Dallas, according to people familiar with the company’s plans. As a result Alphabet has suspended projects in San Jose, Calif., and Portland, OR. http://www.wsj.com/articles/googles-high-speed-web-plans-hit-snags-1471193165

References:

Verizon’s Wireless TV And Internet Service Coming To Small Towns Soon

CEO: Verizon 5G Fixed Wireless Trial Will Offer Gigabit Broadband via ‘Wireless Fiber’

Verizon to Sell Data Centers to Equinix for $3.6 Billion

Verizon Communications will reap $3.6 billion when it sells the 24 data center sites it gained in its $1.3 billion acquisition of Terremark Worldwide five years ago to Equinix, a real estate investment trust. The deal will enable Verizon to raise cash after its expected $4.83 billion purchase of Yahoo! Inc. and the acquisition of wireless spectrum licenses.

For Verizon, the nation’s largest wireless carrier, the deal marks a retreat from the data-centers business five years after it bought Terremark Worldwide Inc. for $1.3 billion. As prospects faded and Verizon invested in more areas like mobile video and advertising, the company decided to put the data-centers unit up for sale about two years ago.

As the telecommunications industry matures, Verizon is shedding assets and turning the business in a new direction. Using go90, its video-streaming business, AOL’s web properties and the pending purchase of Yahoo! Inc., Verizon is entering a mobile video and advertising arena to challenge Google and Facebook Inc.

……………………………………………………………………………….

The acquisition of these assets will enable Equinix customers to further respond to a key market trend that is enabling their evolution from traditional businesses to “digital businesses” — the need to globally interconnect with people, locations, cloud services and data. Additionally, customers will have the opportunity to operate on an expanded global platform to process, store and distribute larger volumes of latency sensitive data and applications at the digital edge, closer to end-users and local markets.

The data centers to be acquired include approximately 900 customers, with a significant number of enterprise customers new to Equinix’s platform, and it adds approximately 2.4 million gross square feet. It will bring Equinix’s total global footprint to 175 data centers in 43 markets and approximately 17 million gross square feet across the Americas, Europe and Asia-Pacific markets.

The transaction is expected to close by mid-2017, subject to the satisfaction of customary closing conditions.

IHS: China’s Optical Spending Spree Slows; WWide +7% YoY but -9% QoQ

By Heidi Adams, senior research director, transport networks, IHS Markit

Highlights:

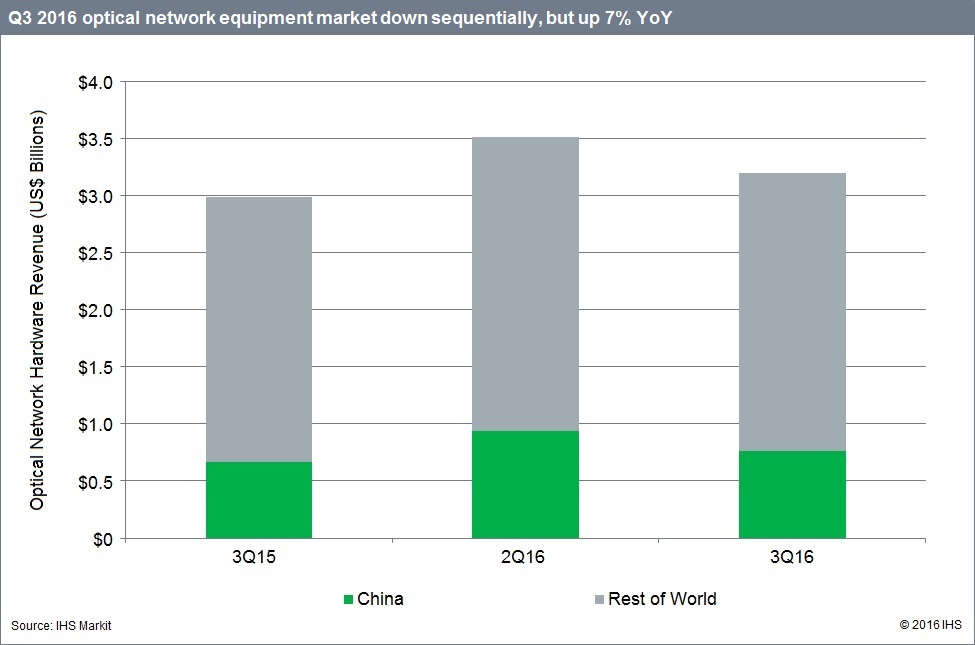

- In the third quarter of 2016 (Q3 2016), optical equipment revenue was down sequentially, but up on a year-over-year basis

- The extremely high growth rates seen in the Chinese optical market in the first half of 2016 have moderated

- 100G wavelength-division multiplexing (WDM) long haul and data center interconnect (DCI) applications continue to be hot areas for optical equipment investment

IHS Analysis:

Worldwide, the optical equipment market totaled $3.2 billion in Q3 2016, gaining 7 percent year-over-year, but declining 9 percent quarter-over-quarter. The market was buoyed by continuing spend in China—although at lower levels—and solid year-over-year performance across all regions. The sequential drop was a result of the typical seasonal slowdown in Europe, the Middle East and Africa (EMEA) and the Caribbean and Latin America (CALA)—and also a dip in Asian Pacific investment from an extremely high Q2 2016.

The great China optical gear spending spree seen in the first half of the year began to slow down in Q3 2016, with optical spending in the country down more than 19 percent sequentially. Although the high growth rates experienced in Q1 and Q2 2016 could not be sustained over the long run, spending increased over 14 percent year-over-year, as 100G infrastructure investment led by China Mobile continued.

North America was the only region to see both quarter-over-quarter and year-over-year growth. 100G long haul continues to perform well despite a drop in investment from Infinera customers. And the DCI market driven by the internet content providers (ICPs) is also driving growth.

The WDM equipment segment, at $2.9 billion in Q3 2016, was down 6 percent sequentially but up a solid 10 percent year-over-year. WDM is and will continue to be the growth engine for optical networks, and we forecast a 2015‒2020 compound annual growth rate (CAGR) of 7 percent for this segment. Meanwhile, the Synchronous Optical Networking (SONET) and Synchronous Digital Hierarchy (SDH) segment reverted back to its secular decline, with revenue down 18 percent from the year-ago quarter.

Looking at Q3 market share, Huawei continued to lead by a wide margin, supported by strong spending on 100G projects in China, as well as strength in EMEA and CALA. Ciena maintained its commanding lead in the North American market and maintained second place overall. Nokia edged out ZTE to regain third place overall based on solid performance in the submarine line terminating equipment (SLTE) segment, where it regained the number-one market share position.

Optical Report Synopsis:

The quarterly IHS Markit optical network hardware report tracks the global market for metro and long-haul WDM and SONET/SDH equipment and ports. The report provides market size, market share, forecasts through 2020, analysis and trends.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

SVIEF 2017 Silicon Valley Smart Future Summit: January 9, 2017

Organized by SVIEF (Silicon Valley Innovation and Entrepreneurship Forum), the SV Smart Future Summit (January 9, 2017 at the Santa Clara Convention Center) is an international conference designed to foster innovation and promote business partnerships connecting US and Asia-Pacific region. The Summit includes two parts: Smart Future keynotes and panel discussions, and SVIEF-Star Demos.

During the Summit, attendees will experience first-hand demos of next-generation applications run on this new network. Learn from engaging keynotes, tech presentations, and panel discussions lead by visionaries in the field. Hear from community leaders highlighting recent case studies, success stories, and best practices to improve your group’s next-generation technology initiatives.

The Summit has been carefully designed to offer value to all experience levels, from students to investors, senior researchers, software architects, network engineers and senior management. SVIEF staff looks forward to having you join us for this exciting event.

IEEE ComSoc is a co-sponsor of this event.

Race to 5G: It’s all about the Internet Of Things (IoT)

by Reinhardt Krause, Investor’s Business Daily (IBD)

Note: The content manager and moderator of this website strongly disagrees with the theme of this article. We don’t think IoT is a valid use case for 5G because most IoT devices are low bandwidth and low duty cycle. Also, the 5G standards won’t be finalized till late 2020 so talk of 5G deployment anytime before that is preposterous. Yet we present this IBD article (without adverts or stock charts) to provide another viewpoint as we strived for balanced content. Mr Krause’s IBD article has been shortened and edited for clarity and to suit our readership.

……………………………………………………………………….

Introduction:

Now the 5G, or fifth generation, wireless revolution is near (editor asks: really?), promising data speeds 50 to 100 times faster than 4G LTE networks. Sure it’ll improve smartphones, but that’s not the point. Analysts say 5G’s biggest impact will be to drive the proliferation of the Internet of Things — billions of connected devices.

The business case for 5G is all about IoT, an evolution, or maybe revolution, that will take the internet era into new territories. Companies including chipmakers, network equipment makers and telecom service providers are investing heavily in the technology, with the first products to roll out in 2017.

“With 5G, there are going to be many more device categories,” Matt Grob, Qualcomm chief technology officer, told IBD.

IoT encompasses such burgeoning arenas as self-driving cars, advanced robotics, telemedicine, automated factories, smart cities and the development of massive sensor networks in such fields as agriculture. Farmers will, for example, know exactly when to harvest for best yields based on air temperature and soil moisture.

Many of the companies aiming to put 5G on the fast track — Qualcomm (QCOM), Intel(INTC), Cisco Systems (CSCO) and Verizon Communications (VZ) to name a few — expect new revenue streams from the IoT and game-changing apps outside of smartphones.

Qualcomm To Ship First 5G Chips In 2017:

Qualcomm aims to ship its first 5G modem chips for phones in the second half of 2017, with follow-on chips targeting the IoT.

Qualcomm, like others, expects 5G to evolve on multiple tracks: IoT, smartphones and fixed residential. While Apple, Samsung and others will ship 5G smartphones only after standards are rubber-stamped, which observers say will be a work in progress until 2020 or later, carriers are closer with “fixed” 5G, a wireless broadband service provided from a fixed point to homes in limited areas. If fixed 5G to homes works well in trials, Verizon says it will pursue a commercial rollout city-by-city in 2018 and 2019. It hasn’t identified the cities yet.

With 4G networks, it costs wireless firms about $1 to deliver a gigabyte of data. 5G networks promise much better economics. It also will provide virtually uninterrupted communications for new apps.

“5G is going to bring lower costs per bit, lower latency and highly reliable services,” Grob said. “So it’s going to be great for autonomous vehicles, medical devices and for infrastructure and smart cities. There are more companies taking part in the standards development for 5G than ever.”

Medical applications include remote monitoring of devices like EKGs or blood pressure monitors. Smart city technologies include traffic signals that adjust to vehicle flows and sensor-based water systems that test for contaminants in real time.

The Internet of Things isn’t waiting on 5G. AT&T (T) already has some 8 million web-connected cars linked to its 4G network. U.K.-based Vodafone (VOD) says it had 41 million IoT connections as of Sept. 30. Cisco says its gear links 4.9 billion devices now and will connect 12.2 billion by 2020, and few will be 5G.

Vendors Jockey For 5G Position:

Some companies might get a good boost early in the 5G revolution, such as makers of network testing gear like Keysight Technology (KEYS). Independent testing is a big part of the standards-setting process.

Early on, analysts say Xilinx (XLNX) programmable chips will be useful for prototyping 5G products, while the higher radio frequency bands associated with 5G may create long-term opportunities for RF chip leaders Broadcom (AVGO) , Qorvo (QRVO) and Murata.

As small cells are deployed in urban areas, cell tower firm Crown Castle (CCI) and startup Tarana Wireless aim to capture share. Tarana’s biggest investor is AT&T. Some analysts view Zayo Holdings (ZAYO) as a takeover candidate, because small cell systems require fiber-optic links in metro areas for long-haul transport.

Next-generation data centers — to keep all these things humming on the internet — will be another battleground, as Cisco takes on Arista Networks (ANET), startup Affirmed Networks and others.

Meanwhile, startup SigFox, the LoRa alliance — with members including Cisco and IBM(IBM) — and others aim to provide all IoT devices with low-power connections via Wi-Fi and unlicensed spectrum.

5G backers aim to create flexible networks that provide both the high-bandwidth connections required by fast-moving, self-driving cars in urban areas and always-on, reliable, low-data-rate connections needed by parking meters, oil rig sensors or other devices.

While 4G networks provide cars with infotainment, 5G services are expected to provide real-time environmental data so, for example, driverless cars can avoid collisions.

To service various types of devices, wireless networks will need to utilize both very high radio frequencies not yet commercialized and lower-band airwaves. Improved radio antennas and more complex semiconductors are expected to make higher frequencies usable for 5G.

In urban areas, hundreds of “small cell” antennas hung on utility poles or buildings will work together, analysts say.

Wireless networks and telecom data centers will be upgraded to provide both high and low data rate services, again to service various types of sensors and devices. AT&T and Verizon are among the leaders in moving to software-defined-network technology. SDN will help usher in 5G. With it, wireless firms can improve network bandwidth allocation and provide cloud-based, on-demand services.

Power Of Connected Data Centers Unleashed By 5G:

Part of the 5G revolution involves connecting a network of data centers to the IoT. That’s a focus for Intel, Cisco, China’s Huawei and many other companies.

“5G will be a whole transformation of the network to virtualization, providing more flexibility and agility,” said Jean Luc Valente, vice president of product management for Cisco’s cloud and virtualization group. “With 5G, with connected cars, some data is going to be collected, maybe at a traffic light intersection. Those data nuggets will be (analyzed), maybe not in the back-end data center, maybe much closer in a micro-cloud.” The upshot, among many benefits, is that self-driving cars won’t collide.

Cisco aims to provide cloud-based IoT services as it shifts away from hardware sales. The company partnered in February with Intel and Sweden’s Ericsson (ERIC) to start selling a swath of 5G hardware and services. They are involved in 5G trials by Verizon and others.

As 5G sparks partnerships, it’s also generating M&As with 5G or IoT angles.

Qualcomm expects its pending acquisition of NXP Semiconductors (NXPI) to pay dividends in autonomous cars. Japan-based SoftBank acquired wireless chip designer ARM Holdings for $31 billion with an eye toward I0T.

AT&T says it will move to 5G faster if regulators approve its acquisition of media giant Time Warner (TWX), part of its strategy to whisk more video to mobile devices.

Cisco bought Jasper in March for $1.4 billion, gaining a cloud-based IoT platform. Verizon in February announced an agreement to acquire XO Communications, which owns high-frequency spectrum for 5G services, for $1.8 billion.

Internet leaders, too, are jockeying for leading roles in 5G. Facebook (FB) is working with equipment vendors and carriers on standards. Google-parent Alphabet (GOOGL) is developing open software for the IoT.

For Intel, 5G and IoT offer an opportunity to turn its money-losing mobile business around, says Citigroup. For Qualcomm, the shift to 5G should provide higher profit margins as the 4G generation matures.

5G Going for Gold at Winter Olympics:

South Korea’s KT and Verizon are forging ahead in prestandard deployment of 5G, aiming to drive technical specifications for 5G radio gear. KT plans to showcase 5G technology at the 2018 Winter Olympics, though just how isn’t known.

Aside from the Internet of Things and 5G mobility, Verizon is eyeing fixed 5G wireless broadband services to homes, potentially taking on cable TV companies. It’s not clear yet if 5G fixed broadband could provide high-speed internet in neighborhoods or blanket bigger areas, analysts say. The Verizon trials will help determine that.

Verizon has been investing across the board — in SDN, small cell technology and fixed wireless, says Adam Koeppe, vice president of technology planning at Verizon.

“We’re putting in the building blocks for what comes next. IoT is one of them,” he said. “The goal of the IoT device evolution is to have very low-cost modules, with long battery life. Think of sensors, smart meters — things that get embedded in day-to-day infrastructure and products that communicate on low bandwidth, on a sliver of spectrum, gobbling up very little of network resources.”

“Where 5G fits into the equation is scale,” Koeppe added. “IoT will be about tens of billions of devices connected to the network. When you think of truly connected societies — traffic lights, stop signs, parking meters and everything within a city connected and interacting with itself — that’s where 5G comes into play.”

Yet 5G-related revenue is still on the distant horizon for most companies, analysts say. The marketing hype has picked up long before 5G networks and services will be deployed.

IoT revenue is about 1% of global mobile revenue now and will grow at about 20% annually over the next five years, says market research firm Analysys Mason. Revenue is small in part because monthly revenue from IoT devices might come to just $1 or $2, not the $60 or more from smartphone users.

http://www.investors.com/news/technology/5g-internet-of-things-will-change-telecom/

Broadcast Incentive Auction Near Final Stages; Below Expectations Due to Less Interest from AT&T

by David Dixon, FBR & Co.

On December 1, the FCC broadcast incentive auction reached another milestone but still tracks below expectations. We believe AT&T is showing less-than-expected interest in the auction. AT&T is one of only two public companies in a three-company bidding process for the FirstNet RFP to build a nationwide, 22,000-site, interoperable wireless network for first responders.

We surmise that, absent the required SEC filing for a public company when being advised of rejection, AT&T has won the FirstNet RFP, providing access to 2×10 MHz of 700 MHz spectrum.

Yesterday, the reverse auction portion of Stage 3 ended with broadcasters setting a clearing cost of $40.3B for 108 MHz of spectrum, equivalent to $1.20/MHz/PoP, setting in motion Stage 3 of the telecom broadband service provider forward auction’s start on Monday. The previous stage of the forward auction generated $21B for 126 MHz, equaling $0.53/MHz/PoP.

Assuming less interest from AT&T, we expect Stage 3 forward auction proceeds of $27.3B for 70 MHz of spectrum, at $1.25/MHz/PoP, below the expected Stage 4 clearing price of $30B for 84 MHz required by broadcasters in the reverse auction.

………………………………………………………………………………………………………………………………………….

WSJ: The Federal Communications Commission has adjusted its target price for the forward portion of the wireless incentive auction to $40.3 billion, a 26% decline from the agency’s previous attempt to balance the supply of broadcaster spectrum with telecom demand. The forward auction is expected to resume Monday, December 5th with the FCC hoping service providers will meet that price.

In addition to the wireless carriers AT&T, Verizon, and T-Mobile US Inc., Comcast Corp.and Dish Network Corp. are also participating in the auction. Some bidders may not win licenses.

Among those that have filed to sell stations are CBS Corp. and Univision Communications Inc., as well as local PBS stations and investors such as billionaire Michael Dell.

http://www.wsj.com/articles/fcc-to-pay-less-for-airwaves-as-auction-moves-to-third-round-1480633266

……………………………………………………………………………………………………………………………………………

Other References:

https://www.fcc.gov/about-fcc/fcc-initiatives/incentive-auctions

https://www.fcc.gov/about-fcc/fcc-initiatives/incentive-auctions#block-menu-block-4

FCC Completes Reverse Auction as Forward Auction Looms Large