Month: January 2017

IHS Markit: 100GE Router Port Purchases to More Than Double from 2016 to 2018

By Michael Howard, senior research director and advisor, carrier networks, IHS Markit

Highlights:

- IHS Markit’s operator respondents say that 100GE will make up 38 percent of their 10/40/100GE port purchases during 2018—more than two times that of 2016

- 70 percent of operators surveyed are deploying packet-optical transport systems (P-OTS) or plan to do so by 2018

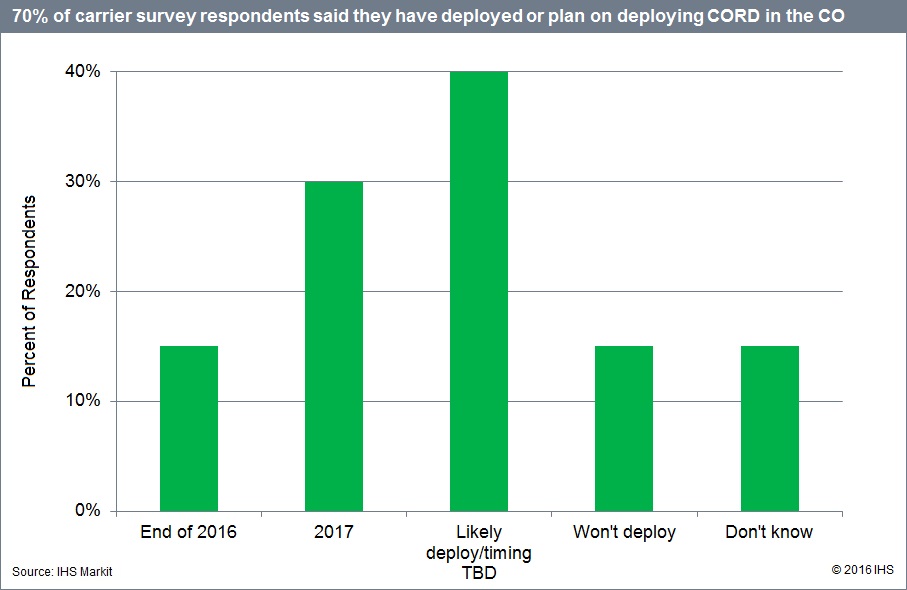

- 70 percent of respondents plan to deploy central office re-architected as a data center (CORD) in their smart central offices (COs)

IHS Markit Analysis:

Our routing, network functions virtualization (NFV) and packet-optical study covers hot and emerging topics in the carrier Ethernet, routing and switching space, with a focus on the IP edge—the area where architectural changes are occurring closer to the customer. The survey looks at operator deployment plans and strategies, deployment locations, router bypass, port mix, expected price per port, and more.

What’s clear from this latest survey is that telecom is moving to 100G now. Sixteen percent of the 10/40/100GE router ports our survey participants purchased in 2016 were 100GE on average, and these service providers expect their 100GE port purchases to more than double to 38 percent in 2018.

In 2017, almost all operator respondents (88 to 96 percent) expect to be paying “10GE parity” or less in three main areas of their networks. “Parity” means that a 100GE port is priced at ten times the price of a 10GE port.

P-OTS remains an integral part of carrier network architecture. Seventy percent of respondents are deploying P-OTS or plan to do so by 2018. Between 2016 and 2018, the percentage of nodes with P-OTS is anticipated to grow six-fold in core/long haul and almost double in access, aggregation, metro core and regional. We believe these plans will keep a damper on router sales. And despite much industry talk, respondents have little current demand for a multi-layer data/transport control plane.

95 percent of operators surveyed are using or planning to use smart COs by deploying servers and storage in selected COs to create mini data centers to offer cloud services and to use them as the NFV infrastructure on which to run virtual network functions (VNFs).

……………………………………………………………………………………………………………………………………………..

For this year’s survey we added questions about CORD. CORD combines NFV and software-defined networking (SDN) software to improve elasticity and bring data center economics and cloud agility to the telco CO. Seventy percent of respondents plan to deploy CORD in their smart COs—30 percent by the end of 2017 and an additional 40 percent in 2018 or later.

Routing, NFV and Packet-Optical Survey Synopsis:

The 25-page 2016 IHS Markit routing, NFV, and packet-optical strategies survey is based on interviews with router/CES purchase decision-makers at 20 global service providers that control 36 percent of worldwide telecom capex and a third of revenue. The survey provides insights into plans for moving router functions from physical routers to software vRouters and VNFs; 100GE adoption and use of IPoDWDM; router and CES protocols; planned uses of vRouters; plans to deploy P-OTS versus routers; and metro architectural changes and deployment of CORD in smart COs.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

FBR: 2017 Technology, Media & Telecom Outlook – Kumbaya?

by FBR Media & Telecom Staff

Summary

We see 2017 as the year when telecom and media sing “kumbaya.” We see the regulatory stance under the Trump Administration as supportive of M&A, causing investors to increasingly discount the possibility of more combinations. We see this becoming a meaningful, investable, multiyear theme for the group—helpful for potential targets, and possibly threatening for those left single.

■ TMT outlook: kumbaya. We see AT&T’s (T) acquisition of Time Warner (TWX) closing and setting a template for future deals. While investors have reasonably pushed back on the merits of content/pipe combinations by citing a dearth of synergy at CMCSA/NBCU, they forget synergies were constrained by regulations that we see going away in a Republican FCC. So we see potential for cable companies to gain more freedom to use their own backhaul facilities to favor in-house 5G services, driving more cable/wireless mergers. We also see wireless/wired operators gaining freedom to favor in-house content, with such things as 0-based data service and performance advantaged private nets, or by charging rivals more for data access/performance. That should drive more telecom/content mergers, like T/TWX and Sky/Fox, helpful for big content brands that could be seen as in the cross-hairs for the next big deal, such as CBS. Internet video services unattached to a physical plant, like NFLX, Google/YouTube, and AMZN Prime Video, could face new competitive hurdles. The environment also seems poised for a loosening of constraints on local media combinations, which could spark more duopoly-driven asset swaps by TV station owners or expansion of national TV station footprints by broadcast nets, helpful for TV station equities like TGNA.

■ Media & leisure outlook: fundamentals improving. The entire media group would benefit from what seems to be the most likely tax reform, as outlined in our report published on December 16. We see the currently modest pressure on affiliate fees potentially easing slightly, driven by cord-cutting moving toward “app-shaving.” We see income-challenged millennial cohorts migrating away from dropping pay TV altogether and toward embracing the new, low cost virtual bundles, like DirecTV Now. TV advertising will have to comp recurring lifts in 2016 from political and Olympics but should benefit from a stronger economy. Normal weather would be positive for theme parks after a tough summer 2016. Regional ski resorts also have easy comps versus a historically bad season in the Northeast/Midwest last year.

■ Telecom services outlook. We increase our view on the telecom services sector from Underweight to Overweight for 2017 driven by potential valuation upside from regulatory relief, tax reform, and M&A activity under a Republican Administration. We see higher likelihood of an Sprint/T-Mobile combination but less likelihood of a wireless acquisition by a cable company in the near term as their in-house services can be disruptive to wireless valuations ahead of a deal. A politically influenced DOJ may be necessary given the extensive public record justifying four nationwide wireless providers and a limited economic versus legal admin skill set. The ongoing broadcast incentive auction will likely wrap up in early 2017, with final proceeds likely much lower than expectations as the industry continues the shift to higher bands, leveraging a lower-cost, software-centric technology cycle, which we believe will drive up spectrum reuse and drive down valuations for high-band spectrum. We expect a capex investment shift from efficiency-driven automation to edge security and analytics engines that evaluate unstructured data from the device to the application server. Legacy capex trends will again be ugly as telecom network returns on incremental capital investment remain negative, which is driving a change in investment strategy across the industry.

……………………………………………………………………………….

Will cable enter the wireless space in the near term?

The combination of an intensely competitive wireless environment, negative incremental returns on invested capital, and organic disruption from cable companies to the wireless sector should discourage a near-term wireless acquisition by cable companies, in our view. However, we believe cable will gain greater leverage over the wireless sector over time, and a wireless asset or partnership is likely in the medium to longer term to augment delivery of profitable content to customers beyond their footprints. In the short term, we think cable companies prefer to better understand their impact on the wireless business model. Ahead of an acquisition, we think they will focus on testing the disruptive capabilities of their in-home and in-building assets as they incorporate LTE on commodity spectrum bands into their hardware. In the meantime, Verizon and AT&T continue to diversify away from a fiercely competitive wireless access market into content and are positioning their respective companies to manage the next wave of wireless network usage by pivoting to a lower-cost dark fiber–rich distributed compute platform. We expect additional M&A activity in both content and dark fiber in 2017. Sprint’s firmer footing suggests there is potential to make another attempt at a merger with T-Mobile US. We believe a second merger attempt could pass regulatory muster under a business-friendly Republican-led Administration.

Will a rollback of regulatory restraints under the new Trump Administration spark more M&A over time?

We believe so. Trump’s early FCC brain trust is populated by free market enthusiasts who seem diametrically opposed to the Obama Administration’s embrace of constraints like net neutrality and the threat of Title II–backed rate regulation. To us, this suggests that wireless and cable companies will gain new freedoms to leverage their investments in wired, wireless, and content assets for their own benefit. We see this favoring more mergers of wireless companies with those owning physical plants, such as cable companies, and more mergers of wireless and cable companies with content companies.

………………………………………………………………………………………………………..

Editor’s Note: We strongly disagree with many points made above by FBR, especially related to M&A, which we feel is incredibly destructive to the telecom industry, results in less competition and higher prices for consumers and concentrates too much power in the acquiring company, e.g. AT&T if they take over Time Warner.

According to a January 5th Bloomberg article:

Donald Trump remains opposed to the megamerger between AT&T Inc. and Time Warner Inc. because he believes it would concentrate too much power in the media industry, according to people close to the president-elect, who has been publicly silent about the transaction for months.

Trump told a friend in the last few weeks that he still considers the merger to be a bad deal, said one of the people, who asked not to be identified because the conversation was private. Trump’s chief strategist, Steve Bannon, is also opposed to the deal, another person said.

It remains unclear whether Trump would try to influence the regulatory review of the merger, either by pushing officials to impose conditions or to block the deal entirely. The transaction, which would combine the biggest U.S. pay-TV and internet provider with one of the largest creators of TV programming, will be reviewed by the Justice Department and possibly by the Federal Communications Commission.

Trump, who takes office Jan. 20, has nominated Senator Jeff Sessions, an Alabama Republican, to lead the Justice Department, and hasn’t named a successor to departing FCC Chairman Tom Wheeler.

In October, before the election, Trump said his administration wouldn’t approve the merger, saying, “It’s too much concentration of power in the hands of too few.” He cited the deal as “an example of the power structure I’m fighting.”

AT&T to Deliver “DirecTV Now” Internet Video Service via mm wave in 2018

AT&T hopes to begin using “5G”-based millimeter wave spectrum technology to wirelessly deliver its “DIRECTV Now” (Internet TV) service to homes. The company has achieved speeds of 14 gigabits per second in lab tests with several partners that include Intel, Ericsson and Qualcomm. AT&T’s goal is to see how millimeter wave “last mile” technology handles high volume video traffic.

AT&T’s John Donovan says the mega carrier plans to offer commercial point-to-point “5G” next year (2018), which is two years before ITU-R completes the first round of true 5G standards. Nonetheless, AT&T says its mobile 5G service should be commercially available in 2019, according to Mr. Donovan who has led AT&T’s network upgrades over the past nine years from 2G to 3G to 4G. He now says 5G will have a bigger impact by enabling things like driverless cars, live maps and virtual reality.

“Five G is a bigger thing than I have ever been involved in my career because it opens up whole new worlds,” he said.

To read more:

http://www.prnewswire.com/news-releases/att-details-5g-evolution-300385196.html

https://www.engadget.com/2017/01/04/atandt-to-conduct-5g-streaming-tests-with-directv-now/

IHS Markit Router & Switch Survey: Cisco, Juniper, Huawei & Nokia form Top Tier

By Michael Howard, senior research director and advisor, carrier networks, IHS Markit

Highlights:

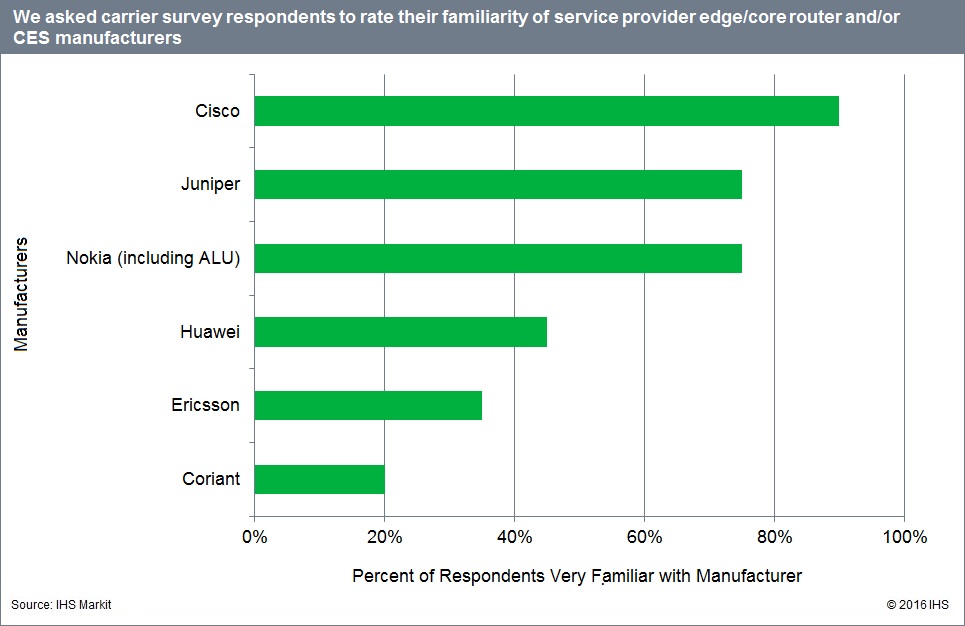

- Among IHS Markit’s service provider respondents, Cisco, Juniper, Huawei and Nokia form a top tier separated by a wide margin from other router and switch vendors

- Cisco was the top-scoring company in edge/core router and Carrier Ethernet Switch (CES) leadership

- All four vendors—Cisco, Juniper, Huawei and Nokia—were named by respondents as leaders in next-generation routing technologies such as 100GE, vRouter and IP data center interconnect (DCI)

IHS Markit Analysis:

The IHS Markit router and switch vendor leadership survey measures service provider attitudes toward and perceptions of edge router, core router and CES manufacturers. The 20 responding operators to our study control 36 percent of worldwide telecom capex and one-third of revenue.

In the 2016 study, Cisco was at the top of respondent edge/core router and CES manufacturer leadership scores. Cisco—along with Juniper, Huawei and Nokia (including Alcatel-Lucent)—form a top tier clearly separated by a wide margin from the other manufacturers. Together, these four manufacturers account for about 86 percent of worldwide revenue market share for routers and CES.

Cisco, Juniper, Huawei and Nokia were the leaders in all five of the carriers’ top manufacturer selection criteria: price-to-performance ratio, product reliability, service and support, technology innovation and product roadmap. There was a big gap between these four and their competitors, with the sole exception being price-to-performance ratio.

Looking at the individual manufacturer selection criteria, when it comes to product reliability and service and support, Nokia was tops among respondents, followed by Cisco and Juniper. For technology innovation and product roadmap, Cisco and Nokia were numbers one and two, respectively. And for price-to-performance ratio, the Chinese vendors led with Huawei at number one and ZTE at number two.

Cisco, Juniper, Huawei and Nokia also led in other measures including unaided awareness, familiarity (or aided awareness), and equipment installed and under evaluation. The vendors likewise ranked at the top when survey respondents named leaders in next-gen routing technologies including 100GE, vRouter and IP DCI.

Router and Switch Survey Synopsis:

The 15-page 2016 IHS Markit switch and router vendor leadership survey sheds light on how global service providers select router and CES manufacturers, whose equipment they have installed and will evaluate for future purchases, and which manufacturers they consider to be leaders in key manufacturer selection criteria. The study features operator ratings of 11 vendors (Brocade, Cisco, Coriant, ECI, Ericsson, Fujitsu, Huawei, Juniper, NEC, Nokia [including Alcatel-Lucent] and ZTE) on 9 criteria.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]