ETTelecom survey: Challenges to 5G adoption in India

Availability of an inadequate ecosystem — spectrum and handsets – along with the financial burden on Indian telecom operators will prove to be the major challenges to adoption of 5G technology in the country, an ETTelecom 5G survey findings revealed.

A large portion of respondents believes that India will be ready to launch the technology commercially before 2022. However, 50% of the respondents who work at a telecom equipment vendor firms such as Nokia, Ericsson believe that 5G will be deployed during 2020.

About 80% executives from the industry further hold the view that 5G could account for more than 10% of operator revenues by 2023.

A large proportion of the respondents believe that an inadequate ecosystem in terms of spectrum and handsets (69%) and the financial burden on MNOs (68%) are the major challenges to 5G adoption in India. Moreover, 89% of the respondents working at C-level roles believe the financial burden on telcos be a major challenge.

Some respondents mentioned that lack of fiber for backhaul, and passive infrastructure such as towers and optical fiber cable will be some major challenges for telcos in India.

ETTelecom published a report on 5G evolution and roadmap in India in collaboration with Analysys Mason which showed that smart cities (70%) and high-speed broadband at home (69%) are the most relevant use cases of 5G in India.

Respondents working at telecom equipment vendors believed high-speed broadband at home to be the most relevant use case with 85% responding positively. Smart cities are the most relevant use case according to respondents currently working at telcos such as Airtel, Vodafone, Idea, Reliance Jio etc. with 78% mentioning it as a relevant use case.

The respondents also believe that smart manufacturing, smart home and cloud, AR/VR are also relevant to the Indian market.

Media and Entertainment driven by higher throughput on mobile broadband is believed to be the industry that will benefit the most from 5G and drive adoption with a large majority of the respondents (83%) believing so. Healthcare (64%) and automotive (60%) are other industries which the respondents feel will benefit from 5G and drive its adoption.

When it comes to industry’s expectations on the key spectrum bands for 5G, there is a mixed sentiment with no clear spectrum band getting more than 50% positive response. However, 67% of the respondents working at C-level positions expect the sub-1GHz band to be the preferred for 5G deployment.

68% of the respondents feel that fibre backhaul is the most important technology, which could be crucial towards deployment of 5G. Ultra-dense network of small cells (50%) and massive MIMO (48%) are other technologies that respondents believe could be crucial.

Also, 82% of the respondents working with Indian telcos believe fibre backhaul to be a crucial technology and 85% of those working at telecom equipment vendors believe the same.

53% of the respondents suggested that legacy technologies such as 2G and 3G could still co-exist with 4G and 5G by 2025, while 40% believe they will be replaced. However, 67% of the C-level respondents believe legacy technologies will be replaced and, on the other hand several users also point out that while 3G will be replaced, 2G will continue to co-exist.

A clear majority with 73% responses suggested that the initial rollout of 5G would be limited to urban pockets. Additionally, 59% of the respondents believe that 5G could cannibalize fixed broadband in India if it can offer high-speed broadband.

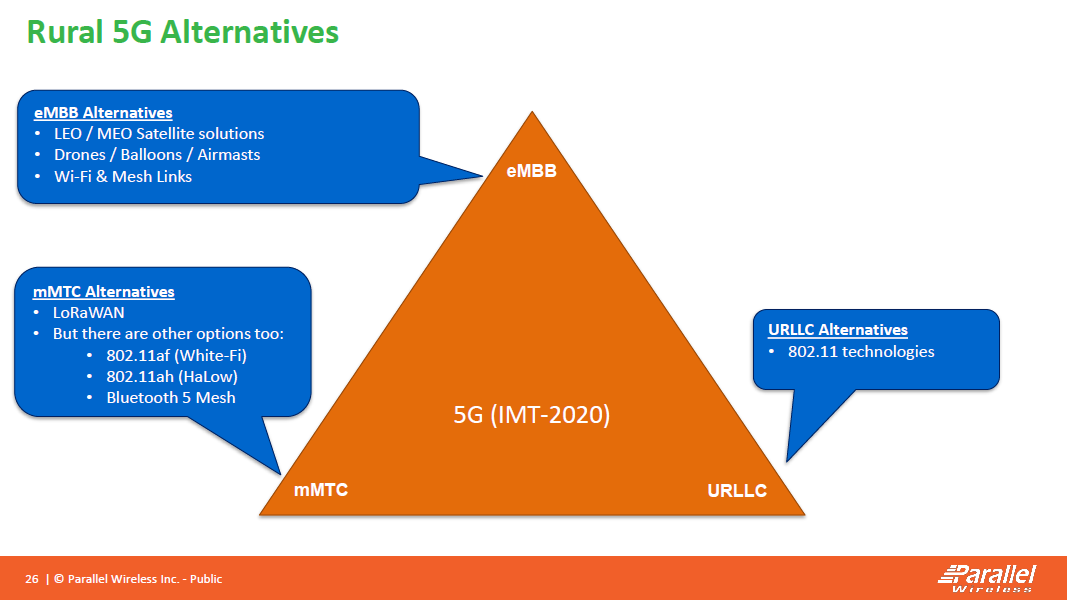

What about rural 5G which is needed in India?

For more insights, download ETTelecom-Analysys Mason’s 5G readiness in India report.

2 thoughts on “ETTelecom survey: Challenges to 5G adoption in India”

Comments are closed.

Nokia says India needs 5G more than entire Europe

Nokia said that India has a huge unserved market opportunity that will drive the 5G adoption in the country, and need for the next-generation technology will be higher here as compared to the entire European region.

“Even if you only have 1% of your subscriber’s base taking the service in India that’s still 3 to 4 million people and in Europe, that’s a 100% of your subscriber base in any country. So, there is a huge opportunity and then an unserved market opportunity,” Phil Twist, Vice President of Networks Marketing and Communications at Nokia, told ET.

The executive said that fixed wireless access could prove to be a significant 5G use case for providing broadband coverage in rural parts of the country. “It will all depend upon if the government wants to support and make spectrum available, besides telcos making plans to invest in these types of new market opportunity,” he added.

The Indian government expects to complete processes for 5G spectrum auction by August and the services will be rolled out by 2020.

https://telecom.economictimes.indiatimes.com/news/nokia-says-india-needs-5g-more-than-entire-europe/67129419

Telcos must bravely invest in 5G airwaves: Huawei India CEO

Huawei India CEO Jay Chen says telcos must strongly invest in 5G spectrum once it’s available in India, failing which they run the risk of being left behind in a mobile broadband turf where the competition benchmark has shifted from affordability to network quality. Chen told ET’s Kalyan Parbat in Shenzhen that customers are no longer as price-sensitive as they were earlier, and are rapidly demanding an enhanced network experience with 4G services gaining mass traction and mobile video emerging as the new basic telecom service in India. Edited excerpts.

Q: India’s older carriers have been averse to an early 5G spectrum sale and reluctant to spend big sums on 5G airwaves in the absence of a compatible ecosystem and relevant 5G use cases. Will such a strategy could prove counter-productive?

A: Telecom operators must bravely invest in 5G airwaves (once available) as the 5G devices ecosystem will grow much faster than either 3G or 4G, coupled with the fact that spectrum utilisation efficiency levels will also be higher, which will make customer experience on 5G networks a superior one. These are important considerations, especially if they wish to enjoy sustainable leadership in terms of network quality and user experience in a competitive market.

Q: But telcos say they are under immense financial stress in the sector…

A: The Indian telecom industry is witnessing a gradual shift from affordability to quality. Customers are no longer as price-sensitive as they were before, and are increasingly demanding an enhanced network experience, especially with the mass popularity of mobile video and further development of 4G.

Q: You mean the competition benchmark has shifted from low tariffs to one based on better network quality and user experience?

A: Well, in metros and key cities, an operator’s core competitiveness will be defined by high quality networks offering a superior customer experience, and will no longer be determined by low tariffs. Operators having low quality networks will lose competitiveness and eventually their high-value users and markets.

Q: Some operators blame the decline in overall quality of mobile services to heavy clogging in networks, amid explosive demand for data services. Your views.

A: Operators have to a degree been compelled to compromise on network quality amid sustained financial stress caused by continuing price wars. But in an era where users are willing to pay for a superior mobile broadband network experience, any compromise on network quality and experience would automatically compromise the competitiveness of a telco.

Q: From a global network vendor’s perspective, what ought to be the immediate priorities of telcos to survive and grow in a market where network capacity requirements are huge, spectrum cost is high and there is a paucity of last-mile fiber?

A : Operators must resolutely invest in solutions that improve spectrum efficiency to address capacity requirements in any given spectrum band. Besides speeding up VoLTE rollouts across the country and refarming 2G/3G airwaves for 4G services, telcos must also invest in large-capacity transmission and backhaul solutions and simultaneously in customer experience management.

Q: How is Huawei partnering with telcos to help them realise such objectives?

A: Operators and network gear suppliers are natural allies in chasing the twin goals of superior network quality and experience. But operators must adopt positive vendor strategies to leverage OEM (original equipment manufacturer) interest and investment in network quality and experience improvement by working hand-in-hand. Huawei has customised a spate of solutions such as Massive MIMO, CloudAIR and SuperBAND that improve spectrum efficiency and quality. Indian operators have welcomed Huawei’s solutions in large-capacity 5G microwave along with 200G/400G WDM (wavelength division multiplexing) transmission technologies that can complement fiber and reduce fiber-related concerns to a minimum.

(The journalist was in Shenzhen on the invitation of Huawei)

https://telecom.economictimes.indiatimes.com/news/high-quality-networks-offering-superior-customer-experience-preferred-over-low-tariffs-huawei-india-ceo/68983990