Dell’Oro: 5G Mobile Backhaul + WDM equipment market grew 15% in 3Q-2018

- 5G MOBILE BACKHAUL ISN’T ALL FIBER:

Point-to-point microwave has a place in the future

Mobile radio technology is moving from 4G to 5G, but it cannot move in isolation. Operators learned this valuable lesson with the move to 4G. In particular, the transport layer, often referred to as mobile backhaul, became a network choke point at cell sites with upgraded 4G mobile radios and legacy backhaul systems. To avoid these past mistakes, operators are placing as much emphasis on the transport layer as they do on 5G mobile radios.

5G will need more backhaul capacity

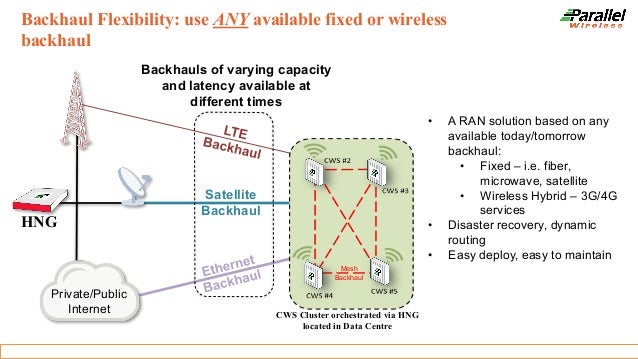

One area of concern for operators planning their transport layer is determining whether the mobile backhaul network must shift away from wireless systems, such as point-to-point (PTP) microwave, to fiber-based systems, such as packet transport network (PTN) systems.

The main issue, of course, is not the cost of the equipment; it is the cost of either installing fiber, maintaining fiber (ex. fixing fiber breaks), or leasing fiber. One of the benefits of a wireless backhaul system is the freedom from incurring the high cost of owning a large fixed asset—a fiber plant.

The second issue is operators have already invested a large amount of resources (time and money) on the 4G backhaul network using a mix of fiber and wireless systems. We estimate that by the end of 2017, the percentage of macro cells using wireless backhaul systems was approximately 45%, so one can imagine the cost if all those cell sites have to be retrofitted with fiber links. The good news for the operators and major microwave vendors—Ceragon, Ericsson, Huawei, 5G mobile backhaul isn’t all fiber NEC, and Nokia—is that we do not think this will be the case. In fact, we think that 5G will bring back a growing demand for PTP microwave. In our latest study of mobile backhaul and microwave (July 2018), we assessed that operators have installed fiber and microwave backhaul capacities ranging from 50 Mbps to 500 Mbps in their 4G networks. Therefore, with a 500 Mbps backhaul link, a mobile phone user will likely experience a peak download speed ranging from 65 Mbps to 130 Mbps in a non-congested area, based on factors such as the distance from the antenna, number of antenna sectors, and spectrum. With a 50 Mbps backhaul link, the user peak download speeds should be about 1/10th of those values.

Is this capacity enough for 5G? Perhaps initially but it is unlikely for the long term. That being said, we also predict that only a few sites will be installed to operate at the maximum 5G advertised user download rate of 20 Gbps.

We think that in most cases, a 5G mobile radio network will double or triple the user download speed from what users have experienced with 4G. Research we have seen states that the average 4G user experiences only about 20 Mbps of download speed with the more developed countries such as Singapore and South Korea averaging closer to 50 Mbps. Therefore, if an operator aspires to triple this download speed, a cell site with six sectors would likely require no more than about 1 Gbps of backhaul capacity, which can be accomplished with PTP microwave. The latest microwave systems operating in E-band (70/80 GHz) have 10 Gbps of link capacity over a single carrier and 20 Gbps over dual carriers. Hence, the use of wireless backhaul systems becomes a point of congestion only when the backhaul link capacity requirement exceeds 20 Gbps, which can provide a user download speed exceeding 2.5 Gbps. Simply stated, PTP microwave will meet the capacity demands of most 5G macro cell sites for many years to come, and operators that want to stay with wireless backhaul over fiber can continue to do so with 5G.

https://www.telecomasia.net/system/files/story/file_attachments/5GInsights_1118_digital.pdf

Editor’s Note: We were told today at the SCWS Americas conference in Santa Clara, CA.. that 5G backhaul could be 5G itself, microwave or (more likely) fiber. It all depends on densification of the network, e.g. number of small/macro cells within a given geographical area.

…………………………………………………………………………………………………..

- The optical transport WDM equipment market grew 15% year-over-year in the third quarter, according to a report by Dell’Oro Group.

The majority of the optical transport WDM equipment growth occurred in the Asia Pacific region, according to the report. In the third quarter, coherent wavelength shipments increased 30%.

Service providers are replacing legacy gear to accommodate the growth of higher speed fixed broadband and data center interconnection, which has, for the most part, driven up WDM equipment shipments.

Shipments of 100 Gbps wavelengths increased by nearly 15% year-over-year while shipments of 200 Gbps and higher wavelengths more than doubled over the same time frame. Over the past few years, service providers have been migrating from 100 Gbps to 200 and 400 Gbps.

The top third-quarter manufacturers of WDM systems on a revenue basis were Huawei, Ciena, ZTE, and Nokia.

“The Optical market outperformed in the third quarter,” said Jimmy Yu, Vice President at Dell’Oro Group. “All of the growth was driven by rising demand for coherent wavelengths in metro and long haul WDM systems. Shipment of 100 Gbps wavelengths continued to rise, but it was a newer, higher speed wavelengths operating at 200 Gbps that truly moved the market revenue higher,” added Yu.

Additional highlights from the 3Q 2018 Optical Transport Quarterly Report:

- Majority of optical transport WDM equipment revenue growth occurred in the Asia Pacific region.

- Lead manufacturers of WDM systems on a revenue basis were Huawei, Ciena, ZTE, and Nokia.

- Shipment of 100 Gbps wavelengths grew nearly 15 percent year-over-year.

- Shipment of 200+ Gbps wavelengths (speeds higher than 100 Gbps) more than doubled year-over-year.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, 200 Gbps, and 400 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul).

To purchase this report, please contact us at [email protected]

Optical Transport WDM Equipment Market Grew 15 Percent in 3Q 2018, According to Dell’Oro Group