Paul Budde: What Does ‘Peak Telecom’ Mean for 5G? Asian Telecoms Maturity Index

By Paul Budde, edited by Alan J Weissberger

Peak Telecom and 5G:

“Peak telecom” is described as the maximum point of expansion reached by the traditional telecommunications industry before the internet commoditized the industry to a utility (dumb) pipe.

I thought of this when I read the recent outcomes of the famous Ericsson Consumer Lab survey. The company used the results of the survey to counteract market criticism regarding the viability of the telco business models in the deployment of 5G.

It will come as no surprise that Ericsson, as a manufacturer of 5G gear, has given the report a positive spin. However, I remain skeptical about the short-term business models for the deployment of 5G (so does the editor). Once full deployment happens over the coming decade, I certainly can see long-term opportunities. These will revolve around content and apps as well as areas such as IoT in smart homes, cities and energy. However, the question is, will this lead to new financial opportunities for the telcos? Peak telecom questions such an outcome.

What exactly do these broader 5G opportunities mean for the telecommunications operators — the companies who have to build the infrastructure? It is here that we can see that we have reached peak telecom. For several years now, we have seen that growth in the telecom industry is rather stagnant. Profits are still being made but mostly generated by lowering costs. For example, new telecom access speeds are provided at no extra cost to the users. Basically, consumers are getting more for the same price.

There has continuously been the promise of new revenues that could be generated through a range of new telecoms development (internet, broadband, smartphones). The telcos have, however, largely failed to move into the content/app market where the new profits are occurring. Companies such as Amazon, Facebook, Google, Alibaba, Tencent and Netflix have been the primary commercial beneficiaries of these developments.

The Ericsson report mentions that mobile access in congested areas and in mega-cities is becoming a problem and that 5G will assist here. I agree, but will customers pay extra for it?

It also mentions opportunities for 5G to be an alternative to fixed broadband and for it to become a key technology in fixed wireless networks. There certainly will be niche market opportunities here, but this is a highly price-sensitive market. The economics of mass fixed infrastructure favors it over mobile infrastructure. Any gains here will basically be a substitution of a fixed service they already provide, so the overall net gain for the industry will be neglectable.

The report indicates that 20% of smartphone users are prepared to pay a premium for 5G. The current commercial 5G service in South Korea is charging a meager 10% premium. No doubt, in coming years, through competition even that premium will disappear.

The report indicates that consumers expect new innovation such as foldable phones, VR glasses, AI, 360-degree camera, robotics and so on. All true but it all depends how affordable these products and service will be and again who will develop these next “must-have” products? Here, also, the telcos will most likely be missing out.

I fully agree with the report’s assessment that we have to look at 5G over the more extended period. As mentioned, there are good reasons to believe that once full deployment exists, it will open up many new business opportunities.

However, will this promise be enough for telcos to make the substantial upfront investments that are needed? This without a clear indication if they can extract any significant new revenues from 5G? The more likely scenario is that the digital giants are going to be the ones that will reap the real profits of those innovations.

I stick to my argument that the key reason for the telcos to move into 5G is because of network efficiencies, which lead to lower costs.

–>This is absolutely critical in this peak telecom market.

To end on a more positive note for the industry, there is the first mover advantage with short term premium price opportunities for those who can tap into the early adopters’ market. There is always a group of users who simply do want to have the newest of the newest, whatever the price. The size of this market varies — depending on how “hot” the new product is seen by this market segment — and could be anywhere between 10% and 25%.

This is certainly attractive for the telcos as it allows them to recoup some of the initial investment rapidly. In relation to mobile products and services, this mainly relates to “must have” gadgets and, in particular, the smartphone. The current price (in Korea) of a 5G phone is approximately US$1,500 (AU$2,153), without any outstanding features.

The lack of attractive smartphones could be another negative for some of the early adopters. Time will tell.

Asia Telecoms Maturity Index:

This index, created by Paul Budde, analyzes the Broadband, Mobile and Fixed Line markets of a specific country as well as a range of parameters to help you evaluate the economic development of a country.

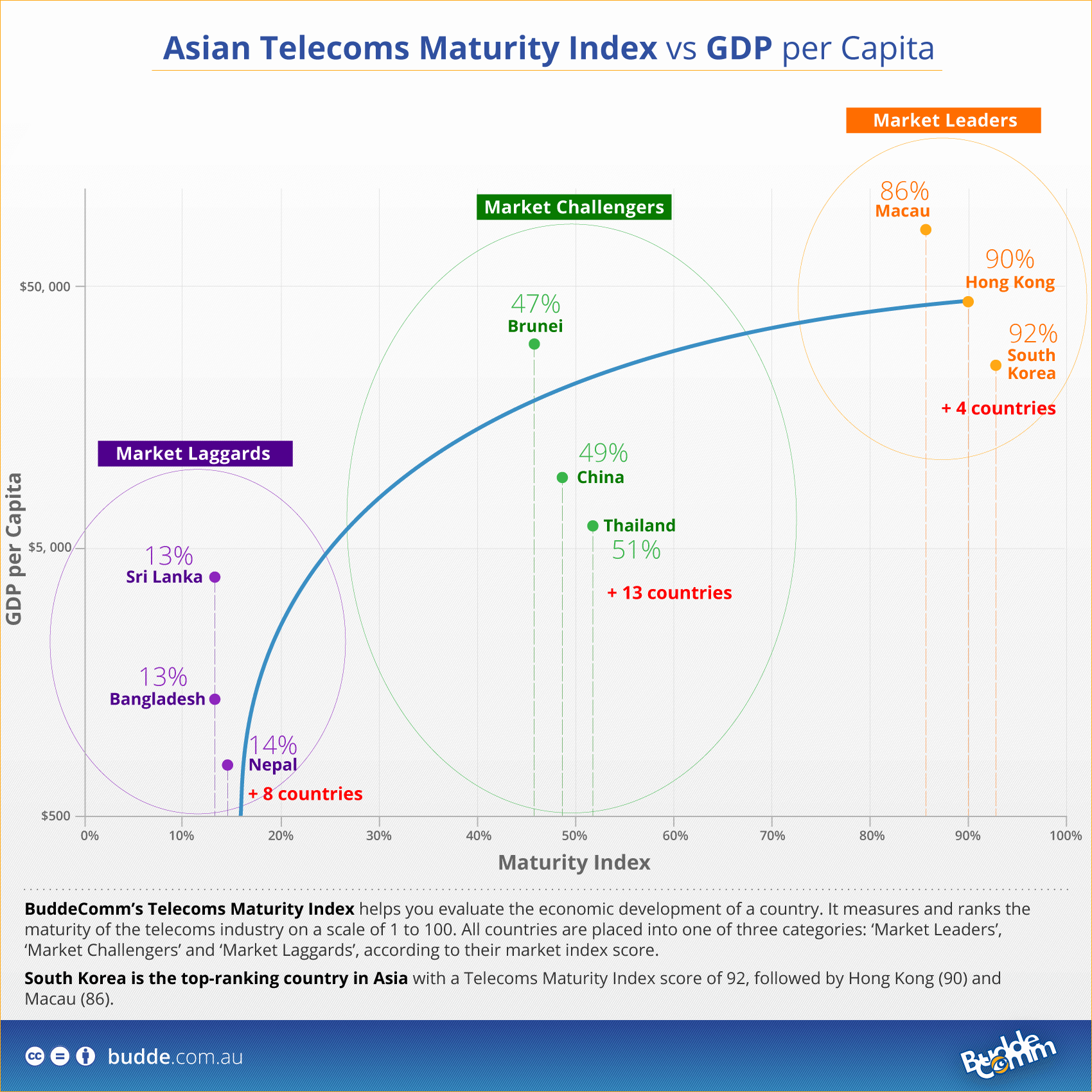

BuddeComm’s Telecoms Maturity Index measures and ranks the maturity of a country’s telecoms industry on a scale of 1 to 100. All countries are placed into one of three categories: ‘Market Leaders’, ‘Market Challengers’ and ‘Market Laggards’, according to their Market Index score.

The Telecoms maturity index is used to fuel regional analysis, it provides a unique approach and allows a comprehensive country vs region comparison.

Asia – Mobile Network Operators and MVNOs

Asian countries in the Market Leaders category have fixed broadband penetrations in the range of 25% and 42% and mobile broadband penetrations in the range of 98% and 135%. South Korea is the top-ranking country in Asia with a Telecoms Maturity Index score of 92, followed by Hong Kong (90) and Macau (86).

Find more information on the Asian telecoms market or Contact Us.

For more information on BuddeComm’s Telecoms Maturity Index, see:

- Africa – Fixed Broadband Market – Statistics and Analyses

- Africa – Mobile Network Operators and MVNOs

- Asia – Fixed Broadband Market – Statistics and Analyses

- Asia – Mobile Infrastructure and Mobile Broadband

- Asia – Mobile Network Operators and MVNOs

- Asia – Telecom Forecasts

- Europe – Mobile Network Operators and MVNOs

- Latin America – Mobile Network Operators and MVNOs

- Middle East – Mobile Infrastructure and Mobile Broadband

- Middle East – Mobile Network Operators and MVNOs

https://www.budde.com.au/Research/Buddecomm-Telecoms-Maturity-Index

2 thoughts on “Paul Budde: What Does ‘Peak Telecom’ Mean for 5G? Asian Telecoms Maturity Index”

Comments are closed.

This IEEE techblog tells us that telcos will move into 5G because of network efficiencies, which lead to lower costs. Part 2 shows how far ahead Asia has come in telecom within the last few years.

The graph of Asia Telecoms Maturity Index delineates each country’s combined broadband, mobile and fixed line growth vs GDP ranking. One might have expected that Hong Kong (92%) and South Korea (90%) are ranked #1 and #2. But China at only 49% was a surprise. Perhaps it’s because China’s GDP is so large- 2nd largest in the world (U.S. is still #1, but for how long?).

Meanwhile, the U lags behind in the effort to deploy real 5G. It’s not to be found anywhere within Silicon Valley – the so called capital/hub of technology in the U.S.

AT&T has put “5G” on right side of their precious iPhone screen (I have one!). Yet it isn’t 5G at all -it’s really enhanced 4G. Specifically, AT&Ts 5GE or 5G Evolution, is AT&T’s moniker for its latest iteration of LTE Advanced Pro that utilizes specific technologies (like 256 QAM, 3-way carrier aggregation and 4X4 MIMO). AT&T has deployed pre- IMT 2020 standard “5G” (based on 3GPP Rel 15 NR NSA), but only a WiFi hotspot made by Netgear can connect to it at this time.

Maybe we are falling behind so fast we are the third world country in telecom and 5G? Hard to swallow but could be a reality!

Worldwide 5G vailability:

UNITED STATES

5G fixed wireless broadband internet from Verizon, C Spire, and Starry is currently available at a handful of locations, and Verizon, AT&T, and Sprint have mobile 5G services available for select customers in a few cities. More areas will get at-home and mobile 5G in 2019, from those companies and others like T-Mobile and U.S. Cellular.

CANADA

Canada’s Telus Mobility has given 2020 as the year 5G is available to its customers, but explains that people in the Vancouver area can expect early access.

Rogers Communications will invest $4.7 billion USD on 5G in 2019 and is making a 5G test site on campus at the University of British Columbia, set to go live in 2019. Learn more about the plans Rogers has for 5G to see when they expect a live network.

When Is 5G Coming to Canada? (Updated for 2019)

MEXICO

In late 2017, the Mexican telecommunications company América Móvil announced the release of 4.5 networks in anticipation of a 5G release.

Its CEO says 5G should be available in 2020 but could come as soon as 2019 depending on the technology that’s available at that time.

PUERTO RICO

Wireless provider Claro plans to roll out 5G in Puerto Rico in 2019, possibly in June.

Central America 5G

Central American countries will most likely see a slow 5G rollout

Asia 5G

5G is live in a handful of areas, but widespread coverage isn’t expected until 2020.

SOUTH KOREA

These three South Korean companies collaborated to bring mobile 5G to the country on December 1, 2018: SK Telecom, LG Uplus, and KT. They began with 5G service for select businesses only, but on April 5, opened up 5G for others, too, via the Samsung Galaxy S10 5G.

The SK Telecom service provider started offering 5G service to a wide population on April 5 via their four 5G plans. This came after the company started a limited 5G service with the Myunghwa Industry manufacturing company. SKT’s 5G service plans come after trialing 5G in 2017 and using 5G in their self-driving test site K-City.

LG Uplus’ 5G network went live in Seoul and surrounding locations, with LS Mtron as their first customer. With over 4,000 5G base stations positioned in Incheon, Seoul, and Gyeonggi, the company planned over 7,000 more to be deployed by the end of 2018. Their goal is to roll out 5G infrastructure in major cities before 2020.

KT Corporation launched pre-commercial 5G services at Lotte World Tower in Seoul and six other areas including Jeju, Ulleungdo, and Dokdo. On April 5, the company launched unlimited 5G services called KT 5G Super Plans, and will expand coverage in Korea to a total of 85 cities by the end of 2019.

KT previously collaborated with Intel to showcase 5G service at the 2018 Olympic Winter Games in PyeongChang, and plans to invest over $20 billion through 2023 in 5G and other innovative technologies.

According to the ICT and Broadcasting Technology Policy director at the Ministry of Science and ICT, Heo Won-seok, five percent of the country’s mobile users will be on a 5G network by 2020, and 90 percent by 2026.

When Is 5G Coming to South Korea? (Updated for 2019)

JAPAN

NTT DOCOMO is Japan’s largest wireless carrier. They’ve been studying and experimenting with 5G since 2010 and plan to launch pre-commercial 5G services in September 2019, with an official launch in 2020.

In September 2018, NTT DOCOMO successfully achieved 25–27 Gbps download speeds in a 5G trial with Mitsubishi Electric. The test could be used to develop a high-speed 5G network that works with vehicles.

According to the company, “The demonstration was conducted during joint outdoor field trials using 28GHz-band massive-element antenna systems and 16-beam spatial-multiplexing technology with 500MHz bandwidth.”

DOCOMO and Toyota tested controlling a humanoid robot on 5G in November 2018. Toyota’s robot, T-HR3, was initially tested using a wire but can now run remotely on 5G with low latency. The robot was built to “safely support human activities in a variety of circumstances, such as homes and healthcare institutions.”

KDDI, SoftBank, and Rakuten plan to begin providing 5G services in 2020 as well.

CHINA

China’s director of Ministry of Industry and Information Technology (MIIT), Wen Ku, has said that “The goal is to launch pre-commercial 5G products as soon as the first version of standards comes out…”.

Along with the Chinese state-owned telecommunications operator, China Unicom, who’s already built out 5G in various areas like Shenzhen’s Qianhai-Shekou Free Trade Zone and is expected to complete 5G pilot projects in several cities — including Beijing, Hangzhou, Guiyang, Chengdu, Fuzhou, Zhengzhou, and Shenyang — is China Mobile who will reportedly deploy 10,000 5G base stations by 2020.

3 Hong Kong is in the early stages of 5G development. They tested 5G outdoors in late 2018 in Causeway Bay, and reached speeds over 2 Gb/s.

https://www.lifewire.com/5g-availability-world-4156244