Highlights of CTIA’s 2021 Annual Wireless Industry Survey

The U.S. cellular industry invested $30 billion in 2020 to power America’s world-leading wireless networks, according to CTIA’s 2021 Annual Wireless Industry Survey. This represents a five-year high and the third straight year of increasing capital expenditures (CAPEX), pushing cumulative mobile telecom industry investment over $600 billion.

The U.S. accounted for 18% of global mobile telecom CAPEX last year, while being only 4% of the world’s population and 6% of all global mobile connections.

Important CTIA survey results:

- Mobile speeds increased 50% in the past year.

- 5G networks nationwide now cover over 300 million people.

- 5G for home broadband services—capable of over 100M b/sec downstream—are deployed in communities across the country.

- Increases in wireless data use, cell sites and data-only devices—indicators of the ongoing shift to the “5G Economy.”

Other highlights:

- Sustained Wireless Investment. Over the past five years, wireless providers have invested nearly $140 billion, and over the life of the wireless industry, total capital investment is over $601 billion. This investment is in addition to the almost $200 billion in payments to the government for the spectrum needed to power wireless networks.

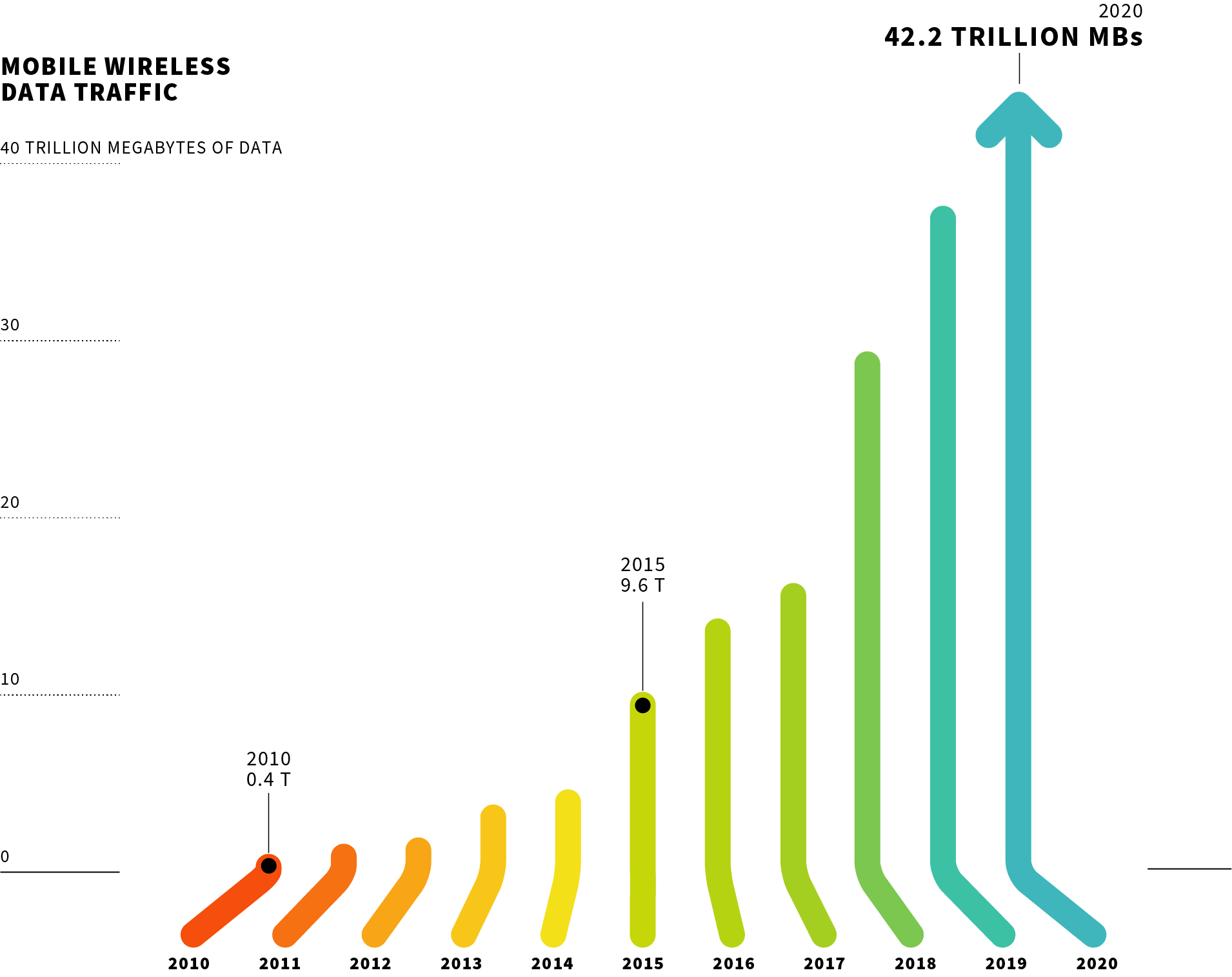

- America’s Demand for Wireless Data Continues to Grow. In 2020, mobile wireless data traffic topped 42 trillion megabytes, a 208% increase since 2016. Over the past decade, America’s wireless users drove a 108x increase in mobile data traffic—an amount equal to Gen Z’s 72 million members streaming TikToks for over 586 hours each.

- Wireless Providers Are Building the Infrastructure for Our Country’s Future. Over the past five years, operational cell sites have increased over 35%—and in just the two years since the implementation of historic federal siting reforms, more cell sites have been sited than the previous seven years combined. Now numbering over 417,000, these sites provide the physical platform for the U.S. 5G Economy.

- Providers’ Messaging Platforms See Continued Growth. Total carrier messaging traffic (SMS + MMS) reached 2.2 trillion, an increase of more than 119 billion over 2019, driven by a 28% jump in MMS messages as users send more GIFs, videos and other multimedia.

- Internet of Things More Than Two-Fifths of All Devices. Data-only devices—think smartwatches, hotspots, and medical sensors, for instance—now represent 41% of all estimated devices. Totaling over 190M, these data-only devices have grown 272% since 2013.

“These numbers show that while we were social distancing last year, U.S. wireless providers were busy both ensuring that wireless networks handled skyrocketing demand and constructing 5G networks, the foundation for our country’s post-pandemic recovery,” said Meredith Attwell Baker, CTIA’s President and CEO.

………………………………………………………………………………………..

U.S. Wireless Industry Continues to Lead the World in Capex:

The U.S. wireless industry’s investment in 2020 represents, once again, 18% of the world’s total mobile capex—even though the U.S. has just 4.3% of the world’s population and 5.9% of the world’s mobile connections. That means that for two years in a row, the U.S. accounted for nearly one-fifth of global wireless capex.

Building More Cell Sites to Support 5G Economy:

America’s cell sites provide the physical platform that enables technological innovation in the U.S. 5G Economy, driving broader coverage and capacity to meet increasing consumer demand. By the end of 2020, over 417,000 cell sites were built and operational, an increase of 35% since 2016—and in just the two years since the implementation of historic federal siting reforms, more cell sites have been built than the previous seven years combined.

Source: CTIA

…………………………………………………………………………………………

Licensed Spectrum Investment Continues to Grow:

U.S. wireless networks depend on licensed spectrum, which enables providers to deliver faster speeds and higher capacity to consumers. The wireless industry invested ~$85 billion in the two auctions the FCC launched in 2020—airwaves that will be the foundation for the U.S. 5G Economy for years to come, creating millions of jobs and sparking hundreds of billions of dollars in economic growth.

The $82 billion C-band auction revenue represents the largest investment in a spectrum auction to date and brings the total to more than $200 billion in payments to the government for the spectrum needed to power wireless networks and carry the increasing volumes of services used by consumers across the country.

5G Rollouts Continue:

Since 5G was launched in 2019, three nationwide networks—and regional provider networks across the U.S.—already cover 300 million Americans, up from 200 million last year and amounting to over 90% of the entire country. 5G networks are also being built out and expanding faster than 4G. The first 5G network achieved nationwide coverage 2x as fast as 4G, and all three major providers built nationwide networks 42% faster than 4G.

Large national operators and small local start-ups are also bringing 5G for home broadband (also known as 5G fixed wireless) services to millions of homes across the country, including in unserved and underserved communities.

Mobile Wireless Data Traffic Continues to Increase:

Mobile wireless data traffic had another record year, topping 42 trillion MBs—a 208% increase since 2016. Over the past decade, Americans have driven a 108x increase in mobile data traffic.

Source: CTIA

……………………………………………………………………………………

Continued Growth of Data-Only Devices:

5G is driving our nation’s transition to the Internet of Things, where medical sensors, smartwatches, hotspots, and other IoT devices usher us into the “connected-everything” era. Data-only devices rose to 190.4 million in 2020, now representing 41.3 percent of all estimated devices. Data-only devices have grown 272 percent since 2013. Overall wireless connections grew to 468.9 million.

References: