Lumen to sell local incumbent carrier operations in 20 states to Apollo Funds for $7.5 billion

Lumen Technologies, formerly known as CenturyLink, has agreed to sell a large part of its U.S. network to Apollo Global Management for $7.5 billion, according to a report by The Wall Street Journal on Tuesday. The report was later confirmed by Lumen.

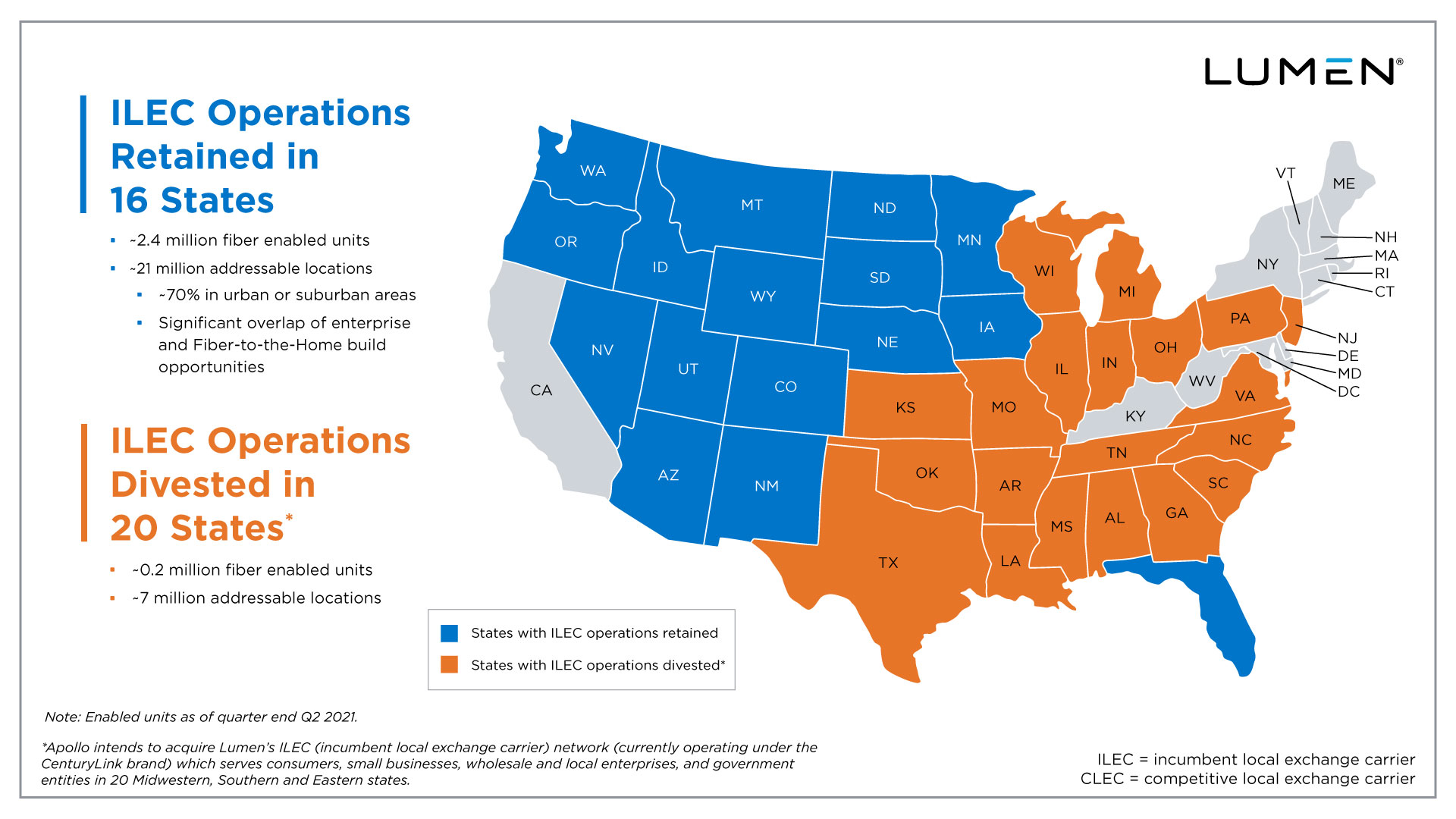

A collection of telephone lines and broadband infrastructure (which cover 6 million residential and business customers across 20 states, mostly in the U.S. Midwest and Southeast) are included in the deal. So is $1.4 billion of assumed debt by Lumen.

“If you look at the markets that we’re transferring to Apollo, these are markets that Lumen would not have invested as heavily in,” Lumen CEO Jeff Storey said in an interview. “Apollo will put the investment into these markets that we believe they can sustain.”

Lumen’s remaining operations will focus on large business clients, which generate most of its revenue, as well as home-broadband subscribers in 16 states including Colorado, Florida and Washington.

The sale is the latest course change for Lumen, the company known as CenturyLink until its 2020 rebranding. CenturyLink was among the few remnants of the former AT&T monopoly (e.g. US West then Qwest) to survive into the 21st Century, though it avoided copying peers’ pursuit of wireless customers and focused its attention on landlines. In July, Lumen said it was selling its Latin American assets to infrastructure investor Stonepeak Partners LP for $2.7 billion.

CenturyLink grew much bigger after it agreed in 2016 to merge with Level 3 Communications, a network operator focused on large U.S. business customers. The combination yielded billions of dollars in savings and tax advantages, though executives faced challenges stitching together the business cultures of CenturyLink, based in Monroe, LA, and the operations inherited from Level 3 in Broomfield, CO.

For Apollo, the Lumen deal plays into a thesis the firm has developed with the new company’s executives around the need for fiber-based broadband to be expanded in the U.S. While fiber is a superior consumer broadband technology, many potential providers of fiber have lacked the access to capital to upgrade their sprawling networks, according to Aaron Sobel, the Apollo partner who led the deal. As a standalone company, the new entity won’t have other capital needs that take priority.

“It’s very difficult to carve out these states from a large telco,” Mr. Sobel said. “You’re dealing with a business that is legacy and theoretically declining and returning it to growth.”

Lumen is keeping the customers and pieces of its consumer broadband network that seem like a good fit for its fiber business. Everything else it had no plans to invest in is headed to the new company, as it discussed would happen just a few weeks ago.

“We are actively looking at selling non-core assets to unlock value in our business,” Lumen CEO Jeff Storey said during an earnings conference call in May. “If we find transactions that are positive to shareholders, we won’t hesitate to move forward.”

Apollo’s plans aren’t laid out in detail in The WSJ’s article, but it did identify several former Verizon executives who would be leading the new telecom concern absorbing Lumen’s mostly copper-based customers. They include Bob Mudge, Chris Creager and Tom Maguire, a group that helped launch Verizon’s FiOS FTTH service.

Just last week Lumen announced it was selling its Latin American business to Stonepeak, an investment firm, for $2.7 billion. In that transaction, Lumen formed a U.S.-based company that would be in Stonespeak’s portfolio to operate and run its divested network and other assets.

About the Transaction

|

What Does Lumen Retain? |

What Will Apollo Acquire? |

|

21mm Enabled Units |

7mm Enabled Units |

|

2.4mm Fiber Enabled Units |

0.2mm Fiber Enabled Units |

|

3.4mm Broadband Subscribers |

~1.3mm Broadband Subscribers |

|

687k Fiber Subscribers |

59k Fiber Subscribers |

………………………………………………………………………….

MoffetNathanson’s Nick Del Deo, CFA, wrote in a note to clients:

During its Q1 earnings call, Lumen made clear that it was actively looking to optimize its portfolio and was open to asset sales. Moreover, it indicated that share repurchases might be under consideration if the stock price remained at what the company believes to be depressed levels. The company delivered on both fronts.

Last week, Lumen announced it had agreed to sell its Latin American unit to Stonepeak for $2.7B at a ~9x EBITDA multiple.

Not content with one deal, today it announced another to sell about one quarter if its ILEC business to Apollo for $7.5B at a ~5.5x EBITDA headline multiple. And it announced that its Board has approved a $1B share repurchase program that management may use opportunistically over the next two years.

Lumen secured a solid price for the ILEC assets that it is selling to Apollo. However, when considered in tandem with the LatAm deal, they are unlikely to be materially de-levering.

References:

https://news.lumen.com/apollo-transaction-resource-center