Dell’Oro: PON ONT spending +15% Year over Year

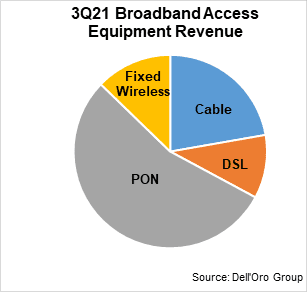

According to a newly published report by Dell’Oro Group, total global revenue for the Broadband Access equipment market increased to $3.9 B in 3Q 2021, up 7% year-over-year (Y/Y). Growth came from spending on both PON infrastructure and fixed wireless CPE. Please see chart below.

“5G fixed wireless deployments joined fiber as the primary drivers for spending this quarter,” noted Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group. “Despite supply chain constraints and increased costs, operators continue to focus on expanding broadband connectivity,” explained Heynen.

Additional highlights from the 3Q 2021 Broadband Access and Home Networking quarterly report:

- Total cable access concentrator revenue decreased 27 percent Y/Y to $257 M. There was a clear mix shift this quarter to remote PHY and remote MACPHY devices, both of which saw Y/Y revenue increases.

- Total PON ONT unit shipments reached 32 M units, marking the fourth quarter in row-unit shipments have exceeded 30 M globally.

- Component shortages are clearly impacting cable CPE and home networking device sales, with unit shipments down markedly Y/Y.

The Dell’Oro Group Broadband Access and Home Networking Quarterly Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for Cable, DSL, and PON equipment. Covered equipment includes Converged Cable Access Platforms (CCAP) and Distributed Access Architectures (DAA); Digital Subscriber Line Access Multiplexers ([DSLAMs] by technology ADSL/ADSL2+, G.SHDSL, VDSL, VDSL Profile 35b, and G.FAST); PON Optical Line Terminals (OLTs), Cable, DSL, and PON CPE (Customer Premises Equipment); and SOHO WLAN Equipment, including Mesh Routers. For more information about the report, please contact [email protected].

Separately, Dell’Oro reports that the worldwide Campus Switch market revenue reached a record level in 3Q 2021. Growth was mostly propelled by 1 Gbps, which reached a record level in shipments during the quarter, while Ethernet NBase-T ports were down Y/Y.

“We have been predicting the demand in the market to remain strong, but what surprised us is the level of shipments and revenues that vendors were able to achieve during the quarter, despite ongoing supply challenges,” said Sameh Boujelbene, Senior Director at Dell’Oro Group. “It appears, however, that these supply challenges are impacting the newer technologies more than the older ones, due to a less diversified ecosystem, and in some cases, a less mature supply chain,” added Boujelbene.

Additional highlights from the 3Q 2021 Ethernet Switch – Campus Report:

- Extreme, HPE, and Juniper each gained more than one point of revenue share in Europe, Middle East and Africa (EMEA)

- H3C outperformed the market and captured the revenue leading position in China

- Power-over-Ethernet (PoE) ports up strong double-digits and comprised 30 percent of the total ports

The Dell’Oro Group Ethernet Switch – Campus Quarterly Report offers a detailed view of Ethernet switches built and optimized for deployment outside the data center, to connect users and things to the Local Area Networks. The report contains in-depth market and vendor-level information on manufacturers’ revenue, ports shipped and average selling prices for both Modular and Fixed, and Fixed Managed and Unmanaged Ethernet Switches (100 Mbps, 1, 2.5, 5, 10, 25, 40, 50, 100 Gbps), Power-over-Ethernet, plus regional breakouts as well as split by customer size (Enterprise vs. SMB) and vertical segments. To purchase these reports, please contact us by email at [email protected].

About Dell’Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

2 thoughts on “Dell’Oro: PON ONT spending +15% Year over Year”

Comments are closed.

Frontier Communications (NASDAQ: FYBR) announced today that it completed the U.S.’ first-ever trial of Nokia’s 25G PON broadband technology. PON, or Passive Opitical Network, is the technology used to provide blazing-fast broadband to customers over fiber-optic cables. The two companies will continue trials on Frontier’s network while planning for commercial deployment in the second half of 2022.

Consumer and business customers need increased bandwidth to advance beyond basic applications and amplify their use of the Internet of Things, artificial intelligence, machine learning, and big data analytics. Nokia’s 25G PON technology allows Frontier to use its current fiber-optic network to easily provide increased bandwidth for consumers and enterprise customers. Since GPON, XGS-PON, and 25G PON operate on different wavelengths, they can co-exist on the same fiber, avoiding the capital expense of building a parallel network.

In addition to strengthening Frontier’s fiber-optic network speed advantage, 25G PON technology will increase the cost efficiency of deploying high-capacity networks to business and consumers and enable the company to sell capacity to 5G mobile operators.

Source: Frontier Communications Dec 14, 2021

Jeff Heynen, Dell’Oro Group VP of Broadband Access and Home Networking, gave Fierce his take on what to expect in the coming year. First and foremost, he said, fiber isn’t going away.

“I don’t think that you can talk about cable without also talking about fiber,” he said. According to Heynen, there’s a growing mindset among certain cable players that “now would be a good time to go ahead and start to overbuild with fiber, particularly if some of the subscriber growth that has slowed down continues to impact the bottom line.” Indeed, the beginnings of this trend could already be seen in 2021, as companies like Blue Ridge Communications in the U.S. and Virgin Media O2 in the U.K. announced plans to rebuild their entire cable networks with fiber.

In North America, Heynen said Tier 2 and Tier 3 players are the ones jumping ship to fiber the fastest, in part because it’s less expensive for them to do so than it would be for a company like Comcast or Charter Communications. They’re also being driven by a need to stay competitive and the prospect of cost savings stemming from the removal of active electronics in the field.

For larger cablecos like Comcast and Charter which are sticking with DOCSIS, Heynen tipped 2022 to bring more activity around distributed access architecture (DAA) and more work to prep their outside plant for the rollout of DOCSIS 4.0. Comcast is expected to press ahead with Remote PHY technology, driving an increase in Remote PHY device shipments. But those like Charter and Cox Communications who want to pursue Remote MAC-PHY technology will run into one key problem.

“The challenge is going to be the silicon,” Heynen said. “Unfortunately, the silicon issues and the supply chain issues are going to be the thing that holds Remote MAC-PHY back in 2022.”

In terms of technology, Heynen tipped automation to be another focus area for cable in the coming year. For broadband in general “speed is going to become less important because we’re starting to get to equivalencies with gigabit and all that,” he said. Instead, consumers will start focusing on factors like reliability and latency, among other things.

“Cable, they need to get to that point where they can customize the provisioning of services based on a customer profile,” he added.

Cable players are obviously expected to face competitive pressure from fiber going forward. But Heynen and analysts from New Street Research indicated they’ll also need to keep a wary eye on fixed wireless access (FWA) broadband.

“We think fiber and FWB adds will increase as the footprint across which each is offered expands. Unless the entire market accelerates, cable adds have to slow,” New Street Research analyst Jonathan Chaplin wrote in November.

Heynen concurred, stating “I do think it’s a threat.” While FWA providers are finding early success pulling unhappy DSL customers, he argued there’s going to be a point at which existing cable subscribers could be lured away by a FWA provider with stellar customer service.

“There’s a real potential challenge here coming from on one side fiber and on the other side fixed wireless,” Heynen concluded. “Discounting it is just the wrong approach.”

https://www.fiercetelecom.com/broadband/heres-how-fiber-fwa-factor-cables-future-2022