Broadband Access Subscriber Growth

U.S. Home Internet prices DECLINE amidst fierce competition between wireless carriers and cablecos

Home internet prices in the U.S. are being driven down by fierce competition between mobile carriers offering Fixed Wireless Access (FWA) and cable internet companies offering legacy Hybrid Fiber Coax connections. The increased competition has driven down the cost of home internet service, a welcome break for consumers when prices are rising for many other essential products. The price of home internet service fell 3.1% in May from a year earlier, while the overall consumer-price index rose 2.4%, according to the Labor Department.

The WSJ reports that major home-internet service providers including Verizon VZ, Comcast/Xfinity and T-Mobile launched a flurry of price-lock guarantees, promising steady rates for as long as five years. CableCos Charter, which is acquiring Cox, unveiled a three-year deal last year.

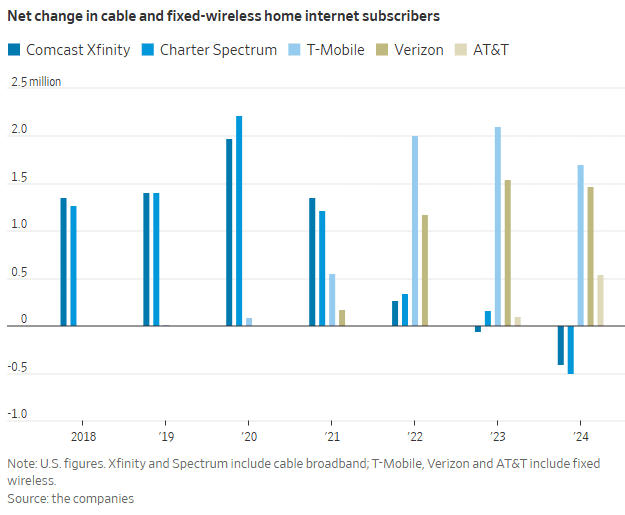

Cable companies have struggled to retain broadband internet subscribers since mobile carriers began offering more affordable 5G fixed-wireless access (FWA) internet service in 2018. FWA, which relies on over the air transmission to cell towers instead of HFC access, brought competition into markets where cable companies had long enjoyed being the only game in town. Now both types of providers are growing more aggressive to attract—and keep—customers.

“The cable companies went from gaining subscribers and raising rates every year to declining subscribers and giving people price locks,” said John Hodulik, a UBS analyst. “They’re seeing churn rise in their broadband subscriber base. And they’re trying to nip that in the bud.” Fixed wireless can sometimes cost half as much as a cable-provided internet plan. Though network congestion and other connectivity issues can be an issue for some users, the lower price point has been luring cable customers away.

T-Mobile, Verizon and AT&T added a combined 3.7 million FWA customers in 2024. In sharp contrast, Comcast’s Xfinity and Charter’s Spectrum lost more than 900,000 home internet subscribers. That’s depicted in this graph:

“Our pricing wasn’t breaking through in the marketplace,” said Steve Croney, chief operating officer for Comcast’s connectivity and platforms business. He said the company’s five-year price lock, introduced in April, competes well against the telecom companies’ offerings.

Frank Boulben, chief revenue officer at Verizon’s consumer group, said his company has been trying to address the “pain points” customers have with cable companies, such as price hikes. That’s why the telco is emphasizing FWA vs its FiOS fiber to the home based service. Boulben said his company would focus on selling fiber service to customers as it becomes available to them.

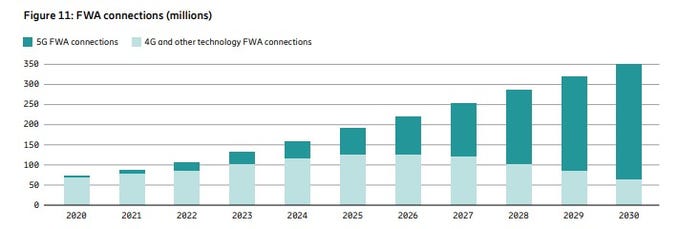

Is FWA the ONLY real killer application for 5G? Even though it was NOT one of the envisioned use cases? Ericsson’s recently released Mobility Report says FWA will account for more than 35% of all new fixed broadband connections, with an expected increase to 350 million by the end of 2030. The report states that more than half of all network service providers (wireless telcos) who offer FWA now do so with “speed-based monetization benefits enhanced by 5G.”

About 80% of the global network operators sampled by Ericsson currently offer FWA, with the most rapid area of growth among CSPs (communications service providers) offering 5G-enabled speed-based tariff plans. These opportunities are about the ability to offer a range of subscriber packages with different downlink and uplink data options with 5G FWA. As with fiber deals, “increasing monetization opportunities for CSPs compared to earlier generations of FWA.” 51% of operators with FWA offerings now include these speed-based options, which is up from 40% on the same period in June 2024 and represents a 27.5% increase. The June 2024 number had grown 50% on the June 2023 equivalent.

Source: Ericsson Mobility Report

…………………………………………………………………………………………………………………………………………………………………..

“We are at an inflection point, where 5G and the ecosystem are set to unleash a wave of innovation,” said Erik Ekudden, Ericsson Senior Vice President and Chief Technology Officer. “The recent advancements in 5G standalone (SA) networks, coupled with the progress in 5G-enabled devices, have led to an ecosystem poised to unlock transformative opportunities for connected creativity. Service providers have recognized this potential of 5G and are beginning to monetize it through innovative service offerings that extend beyond merely selling data plans. To fully realize the potential of 5G, it is essential to continue deploying 5G SA and to further build out mid-band sites. 5G SA capabilities serve as a catalyst for driving new business growth opportunities.”

Fixed-wireless doesn’t work everywhere. Besides congestion weak signals can make coverage spotty. If your cell phone doesn’t pick up 5G coverage smoothly, fixed-wireless from the same company probably won’t work either.

Verizon, AT&T and T-Mobile are winning converts to FWA at a faster pace than many anticipated, said Jonathan Chaplin, a managing partner at equity research firm New Street Research. Charter agreed to buy Cox last month for $21.9 billion in equity and assume $12 billion of its outstanding debt, in part to acquire scale to better compete with fixed wireless access. However, fixed-wireless growth can’t last indefinitely. The wireless networks on which they run will eventually hit capacity, limiting how many subscribers they can add. Chaplin estimates the networks can support around 19 million total fixed-wireless subscribers—which he predicts they will reach in about five years, accounting for planned network expansions that the companies have announced. When that limit is reached, cable companies may regain the upper hand and keep growing their fiber customer base, Chaplin said.

The big three wireless carriers (AT&T, Verizon and T-Mobile) have all been investing in fiber-based wired networks via build-outs and acquisitions. AT&T is bringing new customers in via FWA, with the long-term goal to convert them to fiber-based service, said Erin Scarborough, who runs that company’s broadband and connectivity initiatives.

References:

https://www.telecoms.com/5g-6g/ericsson-says-fwa-is-boosting-telco-monetization-opportunities

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.consumeraffairs.com/news/cable-vs-wireless-war-is-driving-prices-down-062525.html

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

FWA a bright spot in otherwise gloomy Internet access market

Comcast faces competitive intensity; loses 120K broadband subs in 2Q-2024

Comcast today reported adjusted earnings of $1.21 a share for the quarter, beating Wall Street’s call for $1.12, according to FactSet. Revenue of $29.7 billion was slightly below consensus estimates of $30 billion. However, the company reported a loss of 120,000 total domestic broadband customers and 419,000 domestic video subscribers in the 2nd quarter.

“The competitive intensity that we’ve seen for the past several quarters, and which is particularly felt in the market for price-conscious consumers, remains essentially unchanged,” Comcast President Mike Cavanagh said on today’s earnings call.

“One of the most important metrics we monitor is the magnitude of data traffic flowing across our network. And again, we saw a double-digit year-over-year growth this quarter, with broadband-only households consuming over 700 gigabytes of data each month. And our customers continue to take faster speeds, with around 70% of our residential subscribers receiving speeds of 500 megabits per second or higher and one-third getting a gigabit or more. These positive consumer trends play to our strengths and will only accelerate with the shift of live sports to streaming, which together with entertainment on streaming accounts for nearly 70% of our network traffic today.My final thought on broadband is the importance of bundling with mobile, with 90% of Xfinity Mobile smartphone traffic traveling over our WiFi network. These two products work seamlessly together to benefit our customers from both the products’ experience and financial value standpoint.”

Seaport Research analyst David Joyce:

“Due to continued Broadband subscriber losses (where growth is driven by pricing), an elevated competitive environment for the time being, and the mixed Media topline and profitability trajectories, we remain Neutral,” Joyce wrote. Sentiment will improve when there are signs of stabilization in broadband market share, he added.

Comcast is moving ahead with HFC network upgrades, including “mid-splits” that dedicate more capacity to the upstream. Watson said mid-splits have been completed in about 42% of Comcast’s HFC footprint, a figure he expects to reach 50% by the end of the year. Comcast’s mid-splits are occurring alongside a plan to deploy DOCSIS 4.0 upgrades that are initially delivering symmetrical speeds of up to 2 Gbit/s. Comcast has D4.0-based services available in three markets – Philadelphia, Atlanta and Colorado Springs – with Seattle up next.

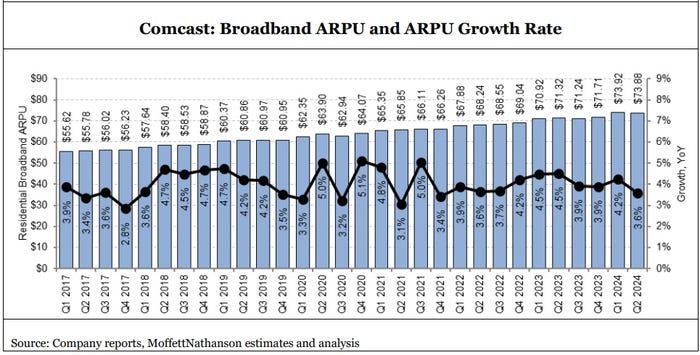

Broadband average revenue per unit (ARPU), which was up 3.6% in the quarter, remains a bright spot as customers continue to gravitate to higher speed tiers. Comcast CEO Brian Roberts: “Broadband ARPU increased by 3.6% and we delivered 6% revenue growth in our connectivity businesses, while expanding our Adjusted EBITDA margin across Connectivity & Platforms to a record-high 41.9%.”

“Faster homes passed growth shouldn’t be expected to turn broadband subscribership back into a growth engine, but it is a critical factor in keeping broadband subscriber results stable,” MoffettNathanson analyst Craig Moffett explained in a research note (payment required) issued today.

Comcast also expects to participate in the $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

Comcast’s pay-TV business continued its downward spiral. The company lost 419,000 video subs in Q2, an improvement from a year-ago loss of 543,000. Analysts were expecting Comcast to shed about 502,000 video subs in Q2.

The Peacock streaming service, which broadcasts live sporting events like the upcoming summer Olympics, reported paid subscribers soared 38% from a year ago to 33 million, while revenue rose 28% in the 2nd quarter to $1 billion.

2nd Quarter 2024 Highlights:

• Adjusted EPS Increased 7.0% to $1.21; Generated Free Cash Flow of $1.3 Billion, Including a Tax

Payment Related to the Previously Announced Hulu Transaction and Other Tax Related Matters

• Return of Capital to Shareholders Totaled $3.4 Billion Through a Combination of $1.2 Billion in

Dividend Payments and $2.2 Billion in Share Repurchases

• Connectivity & Platforms Adjusted EBITDA Increased 1.6% to $8.5 Billion and Adjusted EBITDA

Margin Increased 90 Basis Points to 41.9%, Its Highest on Record

• Continued the Successful Execution of Our Domestic Network Expansion and Upgrade Strategy;

Expanded Deployment of Mid-Split Technology to 42% of Our Footprint; And Added 302,000 New

Homes and Businesses Passed in the Second Quarter

• Domestic Broadband Average Rate Per Customer Increased 3.6%, Driving Domestic Broadband

Revenue Growth of 3.0% to $6.6 Billion.

• Domestic Wireless Customer Lines Increased 20% Compared to the Prior Year Period to 7.2 Million,

Including Net Additions of 322,000 in the Second Quarter.

• Business Services Connectivity Adjusted EBITDA Increased 4.4% to $1.4 Billion and Adjusted

EBITDA Margin Was 57.0%.

• Media Adjusted EBITDA Increased 9.0% to $1.4 Billion, Driven by Improved Performance at Peacock

• Peacock Paid Subscribers Increased 38.0% Compared to the Prior Year Period to 33 Million;

Peacock Revenue Increased 28% to $1.0 Billion; Best Year-Over-Year Improvement in Adjusted

EBITDA for Any Quarter Since Launch in 2020.

…………………………………………………………………………………………………………………………………

References:

https://www.cmcsa.com/static-files/68abe434-80f7-437e-8e7a-fa457e43e63b

https://seekingalpha.com/article/4705822-comcast-corporation-cmcsa-q2-2024-earnings-call-transcript

Point Topic: FTTP broadband subs to reach 1.12bn by 2030 in 29 largest markets

Point Topic forecasts 1.39 billion fixed broadband connections by the end of the decade in the 29 largest broadband markets in the world. Fiber to the Premises (FTTP) is already dominating most of the markets and it will be the preferred option for most consumers, where it is available.

Between 2023 and 2030 Point Topic projects a 15% growth in total fixed broadband subscribers in the top 29 markets. The growth will come mainly from FTTP – although the increase in the total fiber lines will be lower than that in Fixed Wireless Access lines – 25% and 61% respectively, the sheer number of already existing and new FTTP connections will drive the total growth.

Figure 1. Fixed broadband lines by technology (Top 29 markets)

………………………………………………………………………………………………………..

Split by technology we estimate that by 2030 there will be 1.12 billion FTTP, 149 million cable, 79 million FTTX, 16 million FWA[1] and only 28 million DSL lines in these markets.

Figure 2. Change in fixed broadband lines, 2023-2030 (Top 29 markets)

Figure 2. Change in fixed broadband lines, 2023-2030 (Top 29 markets)Cable is a term used as a proxy for those legacy MSOs/cablecos (e.g. Charter, VMO2, Comcast, etc.) that still have significant networks based on coaxial cable, mainly DOCSIS 3.0 and 3.1. We forecast some decline (-6%) in cable broadband lines by the end of the decade as these networks are being replaced with full fibre. The new generation DOCSIS4, which is in development, will match the capabilities of FTTH with XGPON, so markets with established cable networks will see a slight growth or stable take-up figures for ‘cable’ broadband lines.

FTTX (where fibre is present in the local loop with copper, mainly fiber to the cabinet) will decline over the next seven years (-19%). Some modest growth from new subscribers will remain in a few markets where legacy infrastructure is still widespread. Also, it will remain a cheaper option even where other technologies are available as it still offers enough bandwidth for some users.

DSL will see the largest decline at -44%. However, while being a slower and less reliable solution, it can provide enough bandwidth at a low price to some single or older households that are reluctant to upgrade. Besides, some of them will not have a choice of other technologies, especially in certain regions and markets.

………………………………………………………………………………………………………………

Figure 3. Fixed broadband penetration, 2023 and 2030 (top 29 markets)

…………………………………………………………………………………………………………………………

Point Topic only included FWA in its data in significant markets and where it was able to source reliable figures, such at the U.S., Canada, and Italy. Therefore, the total number of FWA subscribers could end up higher if FWA takes off in other markets.

In the U.S., T-Mobile US and Verizon are the FWA leaders with 8.6 million connections between them as of March 2024. T-Mobile recently added a new FWA service offer to its portfolio aimed at customers who might need a back-up for unreliable fiber or cable connections.

……………………………………………………………………………………………………………………..

China will be among the 16 markets with 90%-plus broadband penetration in seven years time. The potential for signing up new customers in those markets will shrink, leaving broadband providers with the task of converting existing customers to higher bandwidths and more advanced technologies for growth.

At the other end of the scale, there is still lots of room for broadband growth. India will have the lowest percentage of premises with a fixed broadband connection by 2030 at 33%, up from just 11% last year.

“There is significant growth to come in the ‘youthful’ markets with low fixed broadband penetration, with plenty of consumers in India, Indonesia and other fast-growing economies hungry for the advantages offered by fixed broadband and full fibre in particular,” Point Topic said.

……………………………………………………………………………………………………………………..

References:

https://www.point-topic.com/post/fttp-broadband-subscriber-forecasts-q4-2023

https://www.telecoms.com/fibre/fibre-to-drive-15-broadband-growth-by-2030

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Apparently, there’s no place to hide in any telecom or datacom market? We all know the RAN market has been in a severe decline, but recent Dell’Oro Group reports indicate that Optical Transport, Mobile Core Network and Cable CPE shipments have also declined sharply in the 1st Quarter of 2024.

Here are a few selected quotes from Dell’Oro analysts:

“The North American broadband market is in the midst of a fundamental shift in the competitive landscape, which is having a significant impact on broadband equipment purchases,” said Jeff Heynen, Vice President with Dell’Oro Group. “In particular, cable operators are trying to navigate mounting, but predictable, broadband subscriber losses with the need to invest in their networks to keep pace with further encroachment by fiber and fixed wireless providers,” explained Heynen.

Omdia, owned by the ADVA, expects cable access equipment spending to grow later in 2024 and peak in 2026 at just over $1 billion, then drop off to $700 million in 2029.

………………………………………………………………………………………………………

“Customer’s excess inventory of DWDM systems continued to be at the center stage of the Optical Transport market decline in the first quarter of 2024,” said Jimmy Yu, Vice President at Dell’Oro Group. “However, we think the steeper-than-expected drop in optical transport revenue in 1Q 2024 may have been driven by communication service providers becoming increasingly cautious about the macroeconomic conditions, causing them to delay projects into future quarters,” added Yu.

…………………………………………………………………………………………………..

“Inflation has impacted the ability of some Mobile Network Operators (MNOs) to raise capital, and it has also impacted subscribers when it comes to upgrading their phones to 5G. Many MNOs have lowered their CAPEX plans and announced that they have fewer than expected 5G subscribers on their networks; which limits MNOs’ growth plans. As a result, we are lowering our expectations for 2024 from a positive growth rate to a negative one,” by Research Director Dave Bolan.

- As of 1Q 2024, 51 MNOs have commercially deployed 5G SA (Stand Alone) eMBB networks with two additional MNOS launching in 1Q 2024.

References:

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

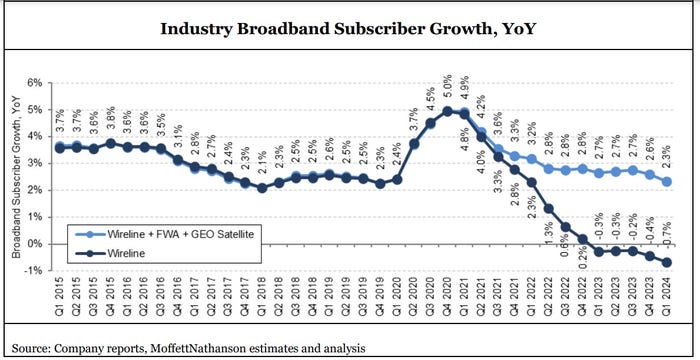

The pace of U.S. broadband subscriber growth slowed considerably in the first quarter of 2024 as fiber, fixed wireless access (FWA) and cable broadband service providers collectively turned in results that were worse than what they posted in the year-ago period.

Total industry net additions, including or excluding FWA and geosynchronous (GEO) satellite broadband providers, decelerated noticeably in Q1 2024. The total market’s growth rate decreased to just 2.3% year-over-year, the slowest since the COVID-19 pandemic, analysts at MoffettNathanson estimated in its latest broadband industry trends report (paid subscription required). When FWA and GEO satellite categories were excluded, the growth rate was much worse: -0.7%.

The overall number of U.S. broadband market subscribers decelerated by 299,000 net adds versus the year-ago quarter. “That was the most abrupt since Q2 2022,” said MoffettNathanson analyst Craig Moffett. “The bottom line is that penetration of home broadband stalled, and perhaps even declined in the quarter, particularly if one adjusts for the growth in homes passed in rural areas under RDOF [Rural Digital Opportunity Fund] subsidies and unsubsidized edgeouts,” Moffett wrote.

Here’s a breakdown of U.S. broadband subscribers by access type:

- Fixed Wireless Access (FWA) providers added 879,000 subs in Q1 2024, down from a gain of 925,000 in the year-ago period.

- Fiber net adds also slowed – from 487,000 in Q1 2024 versus a gain of 517,000 in the year-ago quarter.

- DSL losses of 560,000 in Q1 were similar to a year-ago loss of 571,000.

- MSO/cable network operators shed 169,000 broadband subs in Q1, much worse than a year-ago gain of about 71,000 subs.

“The culprit for cable’s weaker broadband net additions was a slower market growth rate,” though lower new household formation and cessation of ACP enrollments in the quarter also played a role, Moffett noted.

……………………………………………………………………………………………………………..

According to Statista, the total number of broadband subscribers in the U.S. stood at 114.7 million at the end of 2023, This was an increase of over four million subscribers compared to the previous year.

Source: Statista

…………………………………………………………………………………………………………………………

In March 2024, Leitman Research found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 96% of the market – acquired about 3,520,000 net additional broadband Internet subscribers in 2023, similar to a pro forma gain of 3,530,000 subscribers in 2022.

Leitman Research findings for 2023:

- The top cable companies lost about 65,000 subscribers in 2023 – compared to about 530,000 net adds in 2022

- The top wireline phone companies lost about 80,000 total broadband subscribers in 2023 – compared to about 180,000 net losses in 2022

- Wireline Telcos had about 1.97 million net adds via fiber in 2023, offset by about 2.05 million non-fiber net losses

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 3,665,000 subscribers in 2023 – compared to about 3,185,000 net adds in 2022

- Fixed wireless services accounted for 104% of the total net broadband additions in 2023, compared to 90% of the net adds in 2022, and 20% of the net adds in 2021

“Top broadband providers added about 3.5 million subscribers in 2023, similar to the number of broadband adds in 2022,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Over the past four years, top providers added about 15.9 million broadband subscribers, compared to about 10.2 million net broadband adds in the prior four (pre-pandemic) years.”

………………………………………………………………………………………………………..

References:

https://www.lightreading.com/broadband/us-broadband-subscriber-pace-slows-across-the-board

https://www.statista.com/statistics/217938/number-of-us-broadband-internet-subscribers/

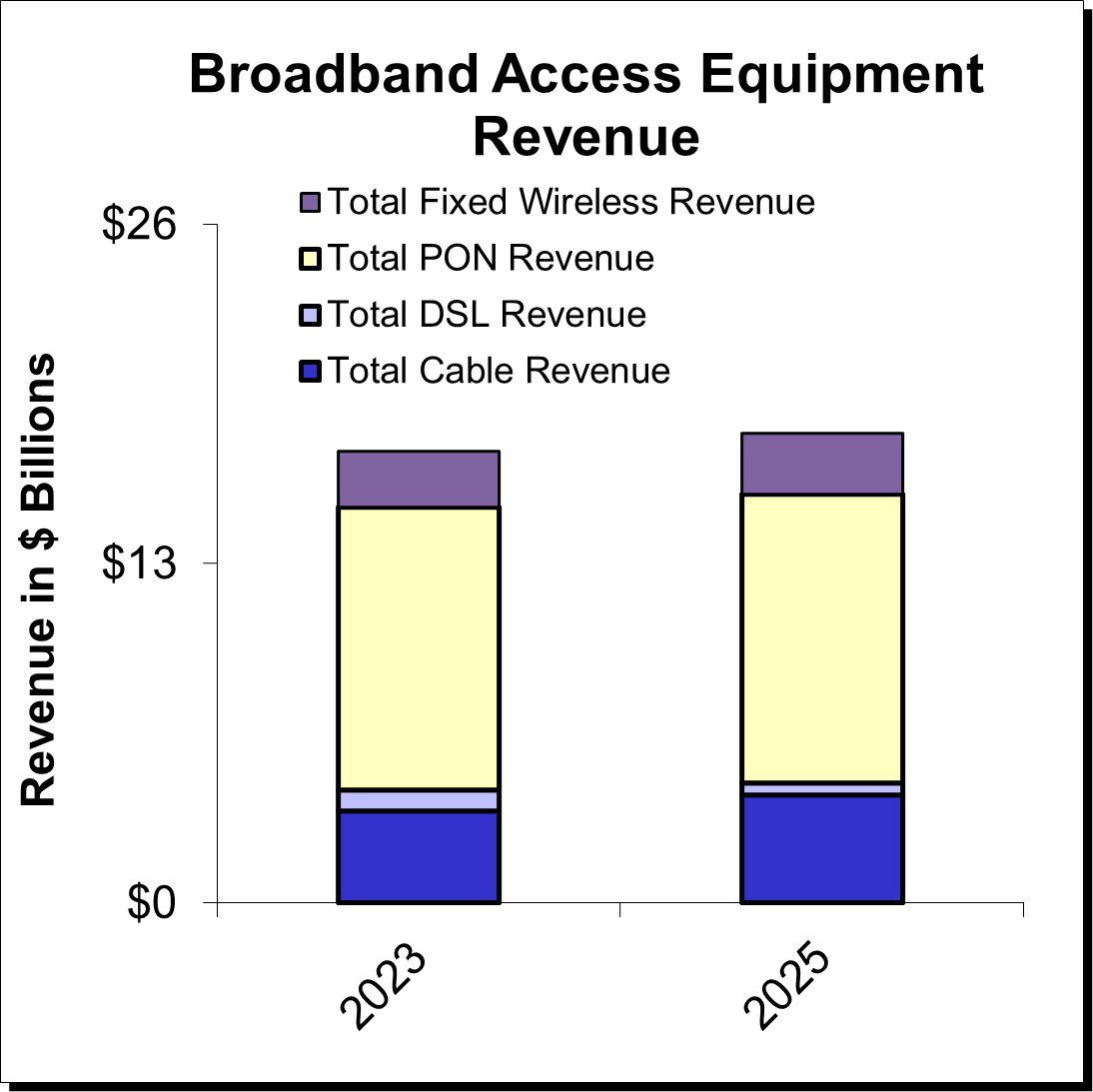

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Verizon’s 2023 broadband net additions led by FWA at 375K

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Dell’Oro Group expects broadband access equipment sales to decline by 1% in 2024 versus 2023, with the first half of 2024 seeing continued weakness followed by a surge in spending in the second half of the year. The first half of 2024 will continue to see some of the inventory corrections that marked a tough 2023 that saw a spending decline of 8% to 10%, according to Dell’Oro VP Jeff Heynen.

“Although the inventory corrections seen in 2023 will continue through the first half of 2024, the second half of the year is expected to be the turning point towards renewed growth,” said Jeff Heynen, Vice President at Dell’Oro Group. “Service providers still have the same goals of increasing their fiber footprint, increasing the bandwidth they can offer their customers, and improving the reliability of their broadband services through the distribution of intelligence closer to subscribers,” added Heynen.

Additional highlights from the Broadband Access & Home Networking 5-Year January 2024 Forecast Report:

- PON equipment revenue is expected to grow from $10.8 B in 2023 to $11.8 B in 2028, driven largely by XGS-PON deployments in North America, EMEA, and CALA and early 50 Gbps deployments in China.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MAC/PHY Devices, and Remote OLTs) is expected to reach $1.3 B by 2028, as operators continue their DOCSIS 4.0 and early fiber deployments.

- Revenue for Fixed Wireless CPE is expected to reach $2.5 B by 2028, led by shipments of 5G sub-6GHz and a growing number of 5G Millimeter Wave units.

- Revenue for Wi-Fi 7 residential routers and broadband CPE with WLAN will reach $9.3B by 2028, as the technology is rapidly adopted by consumers and service providers alike.

Source: Dell’Oro Group

About the Report:

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

References:

Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Alaska Communications uses XGS-PON, FWA, DSL in ~5K homes including Fairbanks and North Pole

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

Telefonica España to activate XGS-PON network in 2022; DELTA Fiber to follow in Netherlands

Leichtman Research Group: U.S. added 840,000 broadband subs in 2Q-2023

Leichtman Research Group, Inc. (LRG) found that the largest cable and wireline phone providers and fixed wireless services in the U.S. – representing about 96% of the market – acquired about 840,000 net additional broadband Internet subscribers in 2Q 2023, compared to a pro forma gain of about 700,000 subscribers in 2Q 2022.

These top broadband providers now account for over 112.9 million subscribers, with top cable companies having about 76.2 million broadband subscribers, top wireline phone companies having about 30.7 million subscribers, and top fixed wireless services having about 5.9 million subscribers.

Findings for the quarter include:

- Overall, broadband additions in 2Q 2023 were 120% of those in 2Q 2022

- The top cable companies added about 10,000 subscribers in 2Q 2023 – compared to a loss of about 60,000 in 2Q 2022

- The top wireline phone companies lost about 60,000 total broadband subscribers in 2Q 2023 – similar to about 60,000 net losses in 2Q 2022

- Wireline Telcos had about 450,000 net adds via fiber in 2Q 2023, and about 510,000 non-fiber net losses

- Fixed wireless/5G home Internet services from T-Mobile and Verizon added about 890,000 subscribers in 2Q 2023 – compared to 815,000 net adds in 2Q 2022

“Top broadband providers added about 840,000 subscribers in 2Q 2023, led by another strong quarter from fixed wireless,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Fixed wireless services have acquired over 800,000 net adds in each of the past five quarters, accounting for about 4.45 million net adds in that period.”

| Broadband Providers | Subscribers at end of 2Q 2023 | Net Adds in 2Q 2023 |

| Cable Companies | ||

| Comcast | 32,305,000 | (19,000) |

| Charter | 30,586,000 | 77,000 |

| Altice | 4,576,100 | (36,600) |

| Cable One | 1,057,900 | (5,100) |

| Breezeline* | 680,785 | (6,734) |

| Other major private companies** | 7,035,000 | 0 |

| Total Top Cable | 76,240,785 | 9,566 |

| Wireline Phone Companies | ||

| AT&T | 15,304,000 | (41,000) |

| Verizon | 7,562,000 | 34,000 |

| Lumen | 2,909,000 | (72,000) |

| Frontier | 2,865,000 | 2,000 |

| Windstream^ | 1,175,000 | 0 |

| TDS | 523,600 | 8,200 |

| Consolidated | 376,829 | 6,967 |

| Total Top Wireline Phone | 30,715,429 | (61,833) |

| Fixed Wireless Services | ||

| T-Mobile | 3,678,000 | 509,000 |

| Verizon* | 2,260,000 | 384,000 |

| Total Top Fixed Wireless | 5,938,000 | 893,000 |

| Total Top Broadband | 112,894,214 | 840,733 |

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on broadband, media and entertainment industries. LRG combines ongoing consumer surveys with industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the potential impact and adoption of new products and services. For more information about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com.

Leichtman Research Group: Fixed Wireless Services Accounted for 90% of the Broadband Net Adds in 2022!

AT&T, Verizon and Comcast all lost fixed broadband subscribers in 2Q-2023

ABI Research joins the chorus: 5G FWA is a competitive alternative to wired broadband access

Leichtman Research Group: U.S. broadband growth returns to pre-pandemic levels in Q3-2021

BroadbandNow Research: Best & Worst States for Broadband Access

A recent study by BroadbandNow Research has assessed the best and worst states in the U.S. for broadband internet access in 2023. The study evaluated each state and the District of Columbia based on various factors such as access to wired or fixed wireless broadband, access to low-priced broadband, median download speed, and median upload speed.

Key Findings:

- Availability of low-priced broadband has increased across the U.S. There is now only 1 state with less than 20% of the population having access to a broadband plan for $60 per month or less (down from 25 states last year). Having said that, in only one state, Wyoming, more than half of residents have access to such a plan.

- Latency (round trip time) is a measure of responsiveness–the time between when you click something and when you get a response–and it’s critical for a smooth internet experience, especially for real-time interactions such as gaming or video calls. There is a huge geographic disparity between states that do well in this metric, like New York or Washington with median round trip times less than 7.5 milliseconds, and states that do poorly, like Hawai’i and Massachusetts with median round trip times greater than 61 milliseconds.

- Delaware is the best state for broadband internet, with 46.2% of its population having access to low-priced broadband and a median download speed of 96.1 Mbps. On the other hand, Alaska ranked at the bottom of the list, with only 20% of its population having access to affordable broadband and a median download speed of 58.5 Mbps.

- We support changing the definition of broadband speeds from 25Mbps down and 3Mbps up to 100Mbps down and 25Mbps up, but we’re a long way away from widespread access to those speeds. Nationally, only 39% of Americans are getting 100Mbps down, and only 25% are getting 25Mbps up.

10 Best States for Broadband

10 Worst States for Broadband

According to the study, there is only one state, Nevada, with less than 20% of its population having access to a broadband plan for $60 per month or less. This is a significant drop from the 25 states that had such limited access last year.

In the Tri-State area, Illinois secured the 14th spot with 95.7% of its residents having access to wired or fixed wireless broadband. Additionally, 31.4% of the population had access to low-priced broadband. Illinois also boasted a median download speed of 85.3 Mbps, surpassing the national median.

Indiana ranked 23rd overall, with an impressive download speed of 85.7 Mbps. 31.4% of its population also had access to low-priced broadband. However, the state fell short in terms of overall broadband access, with only 92.8% of residents having access to wired or fixed wireless broadband.

Kentucky landed at the 36th spot, with a mere 25% of its population having access to affordable broadband. In an effort to improve access, Governor Andy Beshear, Senator Mitch McConnell, and other lawmakers secured over $1 billion in funding for broadband access in June, marking the largest public investment in high-speed internet in the state’s history.

References:

GAO: U.S. Broadband Benchmark Speeds Too Slow; FCC Should Analyze Small Business Speed Needs

FCC proposes 100 Mbps download as U.S. minimum broadband speed

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro Group predicts the broadband equipment market will surpass $120 billion in cumulative spending between 2022 and 2027. The market research firm says sales of PON equipment for fiber-to-the-home deployments, cable broadband access equipment, and fixed wireless CPE will show a 0.2% Compounded Annual Growth Rate (CAGR) from 2022 to 2027. Service providers continue to expand their fiber and DOCSIS 3.1/4.0 networks, while also increasing the reliability and sustainability of their broadband access networks.

“After three consecutive years of tremendous broadband network expansions and upgrades, 2023 is expected to show a return to normalized levels of spending,” said Jeff Heynen, Vice President of Broadband Access and Home Networking research at Dell’Oro Group. “After 2023, spending is expected to increase through 2026 and 2027, driven by 25 Gbps and 50 Gbps PON, Fixed Wireless CPE, as well as DAA and DOCSIS 4.0 deployments.”

Labor markets are “still being challenged” and a number of fiber based network operators (AT&T, Altice USA, Frontier) have reduced their expansion plans and homes passed targets. “To close out 2022 we did see a significant uptake in equipment purchases, and what happened there was supply chains appeased. A lot of orders that had been on the books for a long time have been fulfilled.”

Network equipment vendors are working through that inventory they had built up while taking on “additional equipment purchases.

Additional highlights from the Broadband Access & Home Networking 5-Year July 2023 Forecast Report:

- PON equipment revenue is expected to grow from $11.8 B in 2022 to $13.3 B in 2027, driven largely by XGS-PON deployments in North America, EMEA, and CALA.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MACPHY Devices, and Remote OLTs) is expected to reach $1.6 B by 2027, as operators ramp their DOCSIS 4.0 and fiber deployments.

- Revenue for Fixed Wireless CPE is expected to reach $2.7 B by 2027, led by shipments of 5G sub-6GHz and 5G Millimeter Wave units.

- Revenue for Residential Wi-Fi Routers will surpass $5.2 B in 2027, owing to massive shipments of Wi-Fi 7 units.

“Which isn’t going to float to manufacturers until you know, late 2024, really into 2025,” he said. “I think in the interim, XGS-PON in the European market is certainly going to catch up. We’re also seeing considerable growth in XGS-PON deployments now in China.”

In Dell’Oro’s five-year forecast published in January, Heynen expected fixed wireless subscriber growth, particularly in North America, would “start to moderate” beginning in 2024, due to factors like “capacity issues and fiber expansion.”

Heynen has increased his revenue predictions for the fixed wireless CPE market – which he previously tipped would hit $2.2 billion in five years – and now predicts subscriber growth to continue into 2025.

“Part of that is because of the net reduction in homes passed for fiber,” he said. “In the meantime, fixed wireless will be able to cover more ground while the operators who are building out fiber kind of extend their overall deployment plans.”

Further, operators like T-Mobile and Verizon “are seeing fixed wireless as a way to secure broadband subscribers away from cable operators. The U.S. market is really dynamic in terms of how services can be marketed.”

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

https://www.fiercetelecom.com/telecom/broadband-equipment-market-eclipse-120b-2027-delloro

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Dell’Oro: Bright Future for Campus Network As A Service (NaaS) and Public Cloud Managed LAN

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Futuriom and Dell’Oro weigh in on SD-WAN and SASE market: single vendor solutions prevail

AT&T, Verizon and Comcast all lost fixed broadband subscribers in 2Q-2023

The three most dominant broadband wireline ISPs in the U.S. all lost wireline subscribers in Q2-2023.

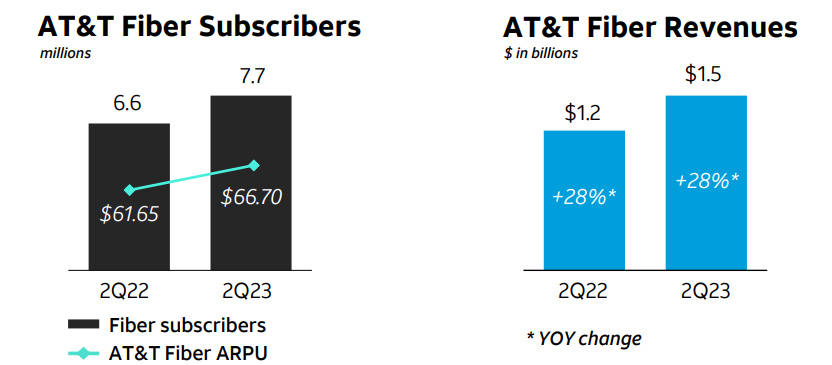

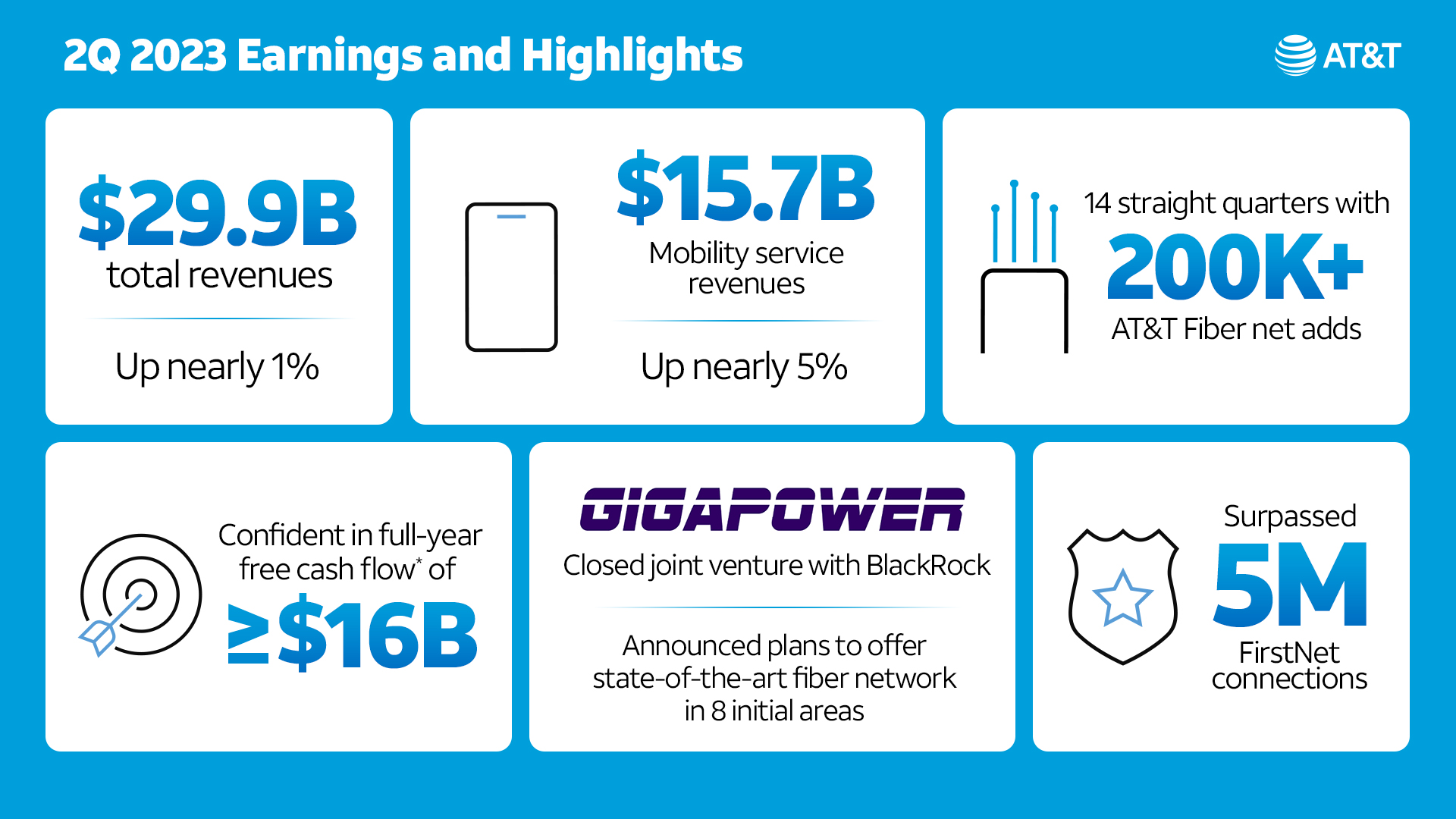

1. AT&T’s net total broadband access showed a loss of 35,000 subscribers in Q2-2023, which widened from a loss of -25,000 in the year-ago quarter. AT&T ended Q2 with 15.3 million broadband connections (including DSL), down 1.3% from 15.5 million a year earlier.

AT&T continued to add new fiber subscribers, but the pace of that growth slowed. AT&T added 251,000 fiber subs in Q2, down from +316,000 in the year-ago quarter and down from +272,000 in the prior quarter.

AT&T ended the period with 7.73 million fiber subs. Fiber average revenue per user (ARPU) was $62.26, up from $57.64 in the year-ago period.

(Source: AT&T Q2 2023 earnings presentation)

AT&T added about 500,000 fiber locations during the quarter, ending Q2 with 20.2 million. CEO Stankey said AT&T remains on track to build fiber-to-the-premises (FTTP) tech to 30 million locations by 2025.

AT&T’s average fiber penetration rate is hovering at 38%. “Everywhere we put fiber in the ground, we feel good about our ability to win with consumers,” Stankey said.

AT&T shed 286,000 non-fiber subscribers in the quarter, lowering that total to 5.95 million. AT&T also lost another 25,000 DSL subs in the quarter, ending the period with just 259,000.

Source: AT&T

…………………………………………………………………………………………………………………..

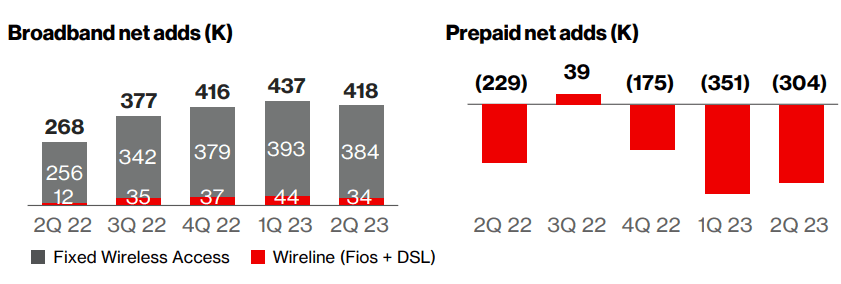

2. While Verizon added 54K FiOS internet subscribers in 2Q-2023 (51K FiOS net adds from Consumer, 3K from Business customers), it had a net loss of 304K wireline broadband subs when the loss of DSL subscribers was factored in.

From Verizon’s 2Q-2023 earnings call presentation:

Source: Verizon

Remarkably, Verizon added a net 384K fixed wireless subscribers, an increase from 256,000 fixed wireless net additions in second-quarter 2022. Verizon now has nearly 2.3 million subscribers on its fixed wireless service.

Due to FWA growth, Verizon reported total broadband net additions of 418,000 in 2Q-2023.

……………………………………………………………………………………………………………………………..

Comcast, the largest U.S. ISP, lost 20,000 residential broadband subscribers, lowering its total to 29.79 million. Comcast’s total broadband subscriber loss of 19,000 (including a gain of 1,000 business broadband customers), was better than the -74,000 expected by Wall Street analysts.

Comcast, which lost 10,000 residential broadband subs in the year-ago quarter, warned in April that it doesn’t expect to see much in the way of broadband subscriber growth gains in the near-term. The company also noted that it expected those numbers to be even lower in Q2 due to a slow housing move market paired with traditional “seasonality” driven by students and retirees returning for the summer.

Dave Watson, president and CEO of Comcast Cable, said on today’s earnings call that he expects Comcast to return to broadband subscriber growth “over time.” One way Comcast is pursuing subscriber growth is through network expansion and edge-outs that will total about 1 million locations in 2023. Comcast, which operates in 39 US states, also intends to participate in the Broadband Equity Access and Deployment (BEAD) program, which recently announced state-by-state funding allocations.

Comcast has cited average revenue per user (ARPU) growth as the key metric of its broadband business. And Comcast’s broadband ARPU grew 4.5% in the quarter, matching the ARPU growth rate it posted in the prior quarter.

……………………………………………………………………………………………………………………..

Here are the top 20 broadband wireline ISPs in the U.S.:

| # | Internet Service Provider | Type | States |

| 1 | Comcast | Cable | National |

| 2 | Charter Communications | Cable | National |

| 3 | AT&T | Fiber | National |

| 4 | Verizon | Fiber | Mid-Atlantic, Northeast |

| 5 | Cox Communications | Cable | National |

| 6 | Altice USA | Cable/Fiber | National |

| 7 | Lumen Technologies | Fiber | West, Florida |

| 8 | Frontier Communications | Fiber | National |

| 9 | Mediacom Communications | Cable | Midwest, Southeast |

| 10 | Astound Broadband | Cable/Fiber | National |

| 11 | Windstream Holdings | Fiber | South, Midwest, Northeast |

| 12 | Brightspeed | Fiber | Midwest, Southeast |

| 13 | Cable One | Cable | West, Midwest, South |

| 14 | Breezeline | Cable/Fiber | East Coast |

| 15 | WideOpenWest (WOW!) | Cable/Fiber | AL, FL, GA, MI, SC, TN |

| 16 | TDS Telecom | Cable/Fiber | National |

| 17 | Midco (Midcontinent Communications) | Cable | MN, ND, SD, WI, KS |

| 18 | Consolidated Communications | Fiber | National (22 states) |

| 19 | Google Fiber | Fiber | National (16 states) |

| 20 | Ziply Fiber | Fiber | WA, OR, ID, MT |

Source: https://dgtlinfra.com/top-internet-providers-us/

……………………………………………………………………………………………………………………………..

References:

https://about.att.com/story/2023/q2-earnings.html