Cable companies big gains in wireless threaten incumbent cellular telcos

by Craig Moffett of MoffettNathanson (edited by Alan J Weissberger)

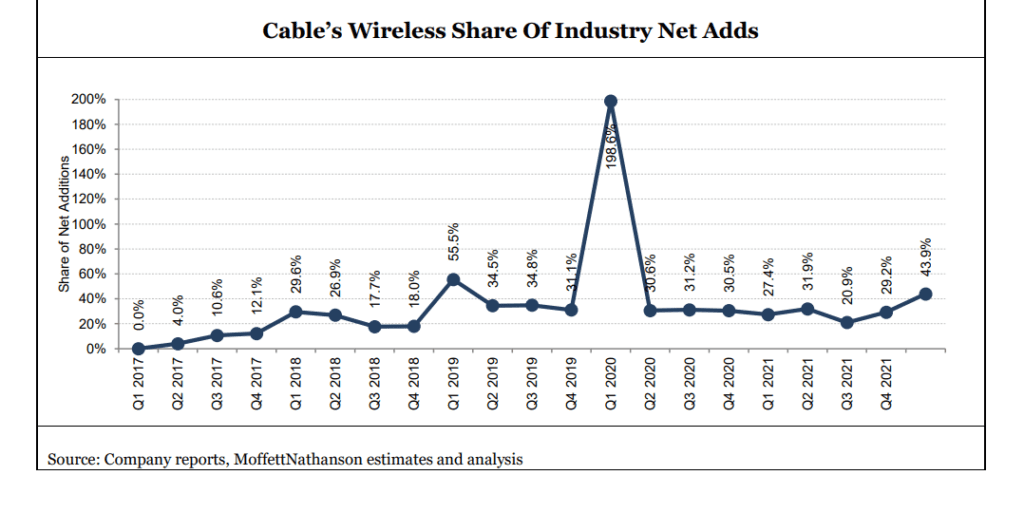

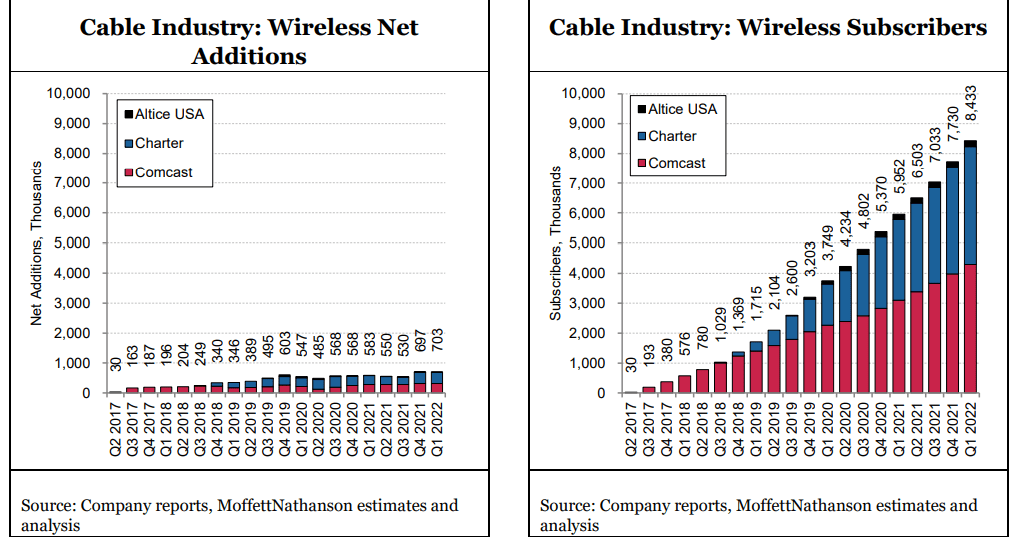

Cable company’s 98% share of the wireless industry subscriber growth in Q1-2022 is a little known fact. And that does not include the free WiFi they offer to their customers, e.g. Xfinity WiFi and CableWiFi® (created through a collaboration of U.S. Cable and Internet Service Providers including Cox Communications, Optimum, Spectrum, and XFINITY. It allows each other’s eligible Internet customers free access to a collective network of more than 500,000 WiFi hotspots across the nation).

Until Q1-2022, Cable’s gains were almost exclusively from Comcast and Charter. Altice has now renegotiated its contract with T-Mobile, and they have moved to pricing that is even more aggressive than Comcast and Charter. [Interestingly, Altice’s contract allows Altice to name T-Mobile in their advertising as the underlying network, a contract term we’ve not seen before.]

Cox Communications, the nation’s third largest cable operator, is poised to join Cable’s ranks in offering wireless service, as well. The company won a Delaware Supreme Court decision in March, reversing a lower court decision that had previously upended their launch plans by finding they were bound to launch using T-Mobile’s instead of Verizon’s network, even if doing so was under less favorable contract terms. [They have not yet announced precise timing for their expected wireless relaunch.]

The pending addition of a wireless offering from Cox, and the more aggressive posture from Altice, will certainly compound the pressure Cable is putting on cellular telcos (e.g. Verizon, AT&T, T-Mobile, US Cellular, etc).

Cable’s 703K combined net additions were their best ever, and they have grown their subscriber base to 8.4M customers incredibly quickly. But those 8.4M subscribers still represent less than 3% market share of the U.S. market. They have a very long runway ahead.

Cable has achieved these gains without offering handset subsidies, something that seems inevitable sometime before the end of the year (Cable’s originally-BYOD subscribers will eventually demand new devices). Handset subsides from Cable, if and when they come, will only put more pressure on the cellular telco incumbents.

It is through this lens that one must view Verizon’s attempt to lead the industry to higher pricing [1.]. Subscriber growth is slowing. Cable’s share gains are accelerating. Cable has made clear that they do not plan to increase pricing. Nor does the industry price leader, T-Mobile. And Cable’s promotionality is likely to increase. That is a very tough backdrop against which to assume that price increases will “stick.”

Note 1. Verizon’s price increase, which will drop directly to the bottom line, will increase Verizon’s

service revenue and EBITDA by roughly $750M over the balance of the year, and by approximately $1.5B for next year, neither of which was contemplated in their previous guidance.

After accounting for 3G terminations, AT&T’s growth fell to just 360K net additions, leaving T-Mobile once again the industry’s fastest growing cellular telco. Not only is T-Mobile taking the industry’s largest share of gross additions – the best measure of customer choice – their churn rate is falling faster than any in the industry, as well, as they complete the transition of Sprint subscribers to their T-Mobile Magenta network. T-Mobile’s falling churn rate starves the industry gross add pool of what had been a critical source of “supply.”

The company is now most of the way through their migration of Sprint customers, and they have repeatedly suggested that churn on their Magenta network is the lowest in the industry, suggesting that churn should continue to fall, even if at a slightly slower pace going forward.

Only T-Mobile is growing ARPU at the moment, as more customers opt for higher value plans (Magenta Max). In contrast to the positive ARPU trend at T-Mobile, ARPU growth has been negative for eight straight quarters at AT&T (with the moderation in the rate of decline in Q1 largely attributable to the aforementioned extension of customer lives, which reduced amortization of historical promotional subsidies, and an easier comp against the same period last year).

ARPU growth at Verizon is not only negative, it is accelerating downward. For Verizon to post both negative subscriber growth and ARPU growth is a shock, and it points to the challenge facing the industry in getting ARPU increases to stick. Absent their wholesale contract with Cable, Verizon’s anemic 1.5% service revenue growth would be close to zero.

Verizon’s price increase comes at a time when industry unit growth is slowing, and at a time when Cable’s market share gains are accelerating both at the gross addition and net addition level. Without broad industry buy-in, and with subscribers looking harder to come by, we find it unlikely that Verizon’s price increases – even if AT&T does initially follow – will “stick.”

If wireless industry growth continues to decelerate, and Cable’s growth rate remains high, Cable’s share of growth will remain elevated, and the wireless industry will increasingly resemble a zero sum game for the Big Three incumbents, where one player’s gain (T-Mobile’s) will necessarily be another’s (Verizon’s and AT&T’s) loss. Huge losses at Dish Network’s Boost unit, and losses at U.S. Cellular, have helped soften the blow, but they are only so big. The pressure of falling industry growth and falling market share unavoidably falls on the cellular telco incumbents.

References:

Wireless Q1 2022: The Elephant in the Room, MoffettNathanson report to clients