Cable Broadband Access

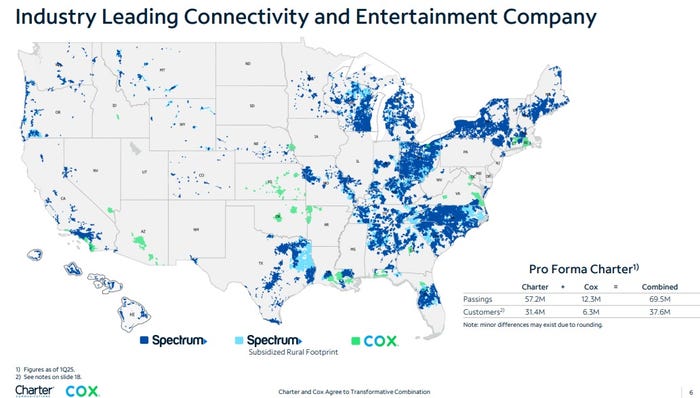

Charter and Cox Communications in $34.5B merger

Two of the biggest cable network providers – Charter Communications and Cox Communications – today announced that they have entered into a definitive agreement to combine their businesses in a transformative transaction. The new entity will compete with Comcast for industry leadership in mobile and broadband communications services, seamless video entertainment, and high-quality customer service.

The proposed transaction values Cox Communications at an enterprise value of approximately $34.5 billion1 based on, and at parity with, Charter’s recent enterprise value to 2025 estimated Adjusted EBITDA trading multiple. Within a year after the Charter-Cox deal closes, the combined company, which will be headquartered in Stamford, Conn., plans to change its name to Cox Communications. Spectrum will be the consumer-facing brand name.

Note 1. Comprised of $21.9 billion of equity and $12.6 billion of net debt and other obligations.

Cable internet service, once a reliable engine of high-octane growth that added millions of subscribers a year, is now a grind for the industry’s two heavyweights, Charter and Comcast. Selling a broadband connection remains their main way to reap profits from the internet economy, from streaming to gaming, but that’s not happening now as net broadband losses prevail.

Cable’s pay-TV business is all but dead as video streaming continues to eat away at cable providers’ video packages. So much so that Comcast’s Xfinity brand offers streaming TV packages such as Xfinity StreamSaver, NOW StreamSaver, and Xfinity Stream.

Meanwhile, mobile carriers like Verizon and T-Mobile have heightened the threat with home broadband service beamed over the air. Wireless companies have racked up millions of customers with the offerings, which use 5G technology to provide internet speeds that are competitive with fixed cable lines at lower prices. The pressures of this new landscape have come into focus in recent months: Charter lost 60,000 internet customers in the March quarter, while rival Comcast reported an acceleration in broadband customer losses.

“We have AT&T, Verizon, T-Mobile in 100% of our footprint. We have satellite everywhere we operate,” Charter chief Chris Winfrey said. “It’s significant.”

The deal with Cox gives the combined company more heft in competing for customers, negotiating with programmers and making network investments. It also expands the merged company’s enterprise offerings. Charter has 31.4 million customers while Cox has 6.3 million customers. The companies expect $500 million in annual cost savings within three years of the deal closing.

Source: Charter-Cox merger presentation, May 16, 2025

“Charter’s board and I are excited about this transaction and very supportive of Alex stepping into the board Chairman role,” said Eric Zinterhofer, Chairman of Charter’s Board of Directors. “The combination of Cox Communications with Charter is an excellent outcome for our collective shareholders, customers, employees and the industry.”

Photo: Jeff Roberson/Associated Press

“We’re honored that the Cox family has entrusted us with its impressive legacy and are excited by the opportunity to benefit from the terrific operating history and community leadership of Cox,” said Chris Winfrey, President and CEO of Charter. “Cox and Charter have been innovators in connectivity and entertainment services – with decades of work and hundreds of billions of dollars invested to build, upgrade, and expand our complementary regional networks to provide high-quality internet, video, voice and mobile services. This combination will augment our ability to innovate and provide high-quality, competitively priced products, delivered with outstanding customer service, to millions of homes and businesses. We will continue to deliver high-value products that save American families money, and we’ll onshore jobs from overseas to create new, good-paying careers for U.S. employees that come with great benefits, career training and advancement, and retirement and ownership opportunities.”

Cox is a major player in the internet and pay-TV business, but is still dwarfed by Charter and Comcast. The Atlanta-based family business has opted to stay private for the past two decades as other cable and wireless companies swelled through ever-bigger acquisitions. Cox is the longest continuous cable network operator in the industry, having acquired its first cable television franchise in 1962. “Our family has always believed that investing for the long-term and staying committed to the best interests of our customers, employees and communities is the best recipe for success,” said Alex Taylor, Chairman and CEO of Cox Enterprises. “In Charter, we’ve found the right partner at the right time and in the right position to take this commitment to a higher level than ever before, delivering an incredible outcome for our customers, employees, suppliers and the local communities we serve.”

Cox will eventually launch a range of products under the Spectrum brand, including Spectrum’s Advanced WiFi, Spectrum Mobile, the Spectrum TV app and Xumo, a streaming platform operated by a joint venture of Charter and Comcast.

Cox launched the Xumo Stream Box last fall. Cox also operates Cox Mobile, a mobile service based on an MVNO agreement with Verizon. Charter’s Spectrum Mobile service is also based on a Verizon MVNO. New Street’s Chaplin presumes that Cox’s mobile business will move over the Charter MVNO on Verizon and get better overall terms.

It’s not immediately clear how Cox’s network upgrade plans will change following the combination. Cox recently announced it would deploy a virtual cable modem termination system (vCMTS) from Vecima. Charter has tapped Harmonic as its initial vCMTS partner for a multi-tiered hybrid fiber/coax (HFC) upgrade.

“You really do need scale in this business,” said Andrew Cole, executive chairman of Glow Services, a telecom-focused software company, and board member of European cable company Liberty Global. Liberty Global, like Charter, is part of cable mogul John Malone’s communications empire. “The coming-together of cable in its entirety over time will happen because that’s the only way they can compete against these giants, which are the telcos,” Cole added.

Details of the Merger:

Charter will acquire Cox Communications’ commercial fiber and managed IT and cloud businesses, and Cox Enterprises will contribute Cox Communications’ residential cable business to Charter Holdings, an existing subsidiary partnership of Charter. Cox’s assets have been valued using Cox’s 2025 estimated Adjusted EBITDA, multiplied by Charter’s total enterprise value to 2025 estimated Adjusted EBITDA trading multiple of 6.44x, based on:

- Wall Street consensus for Charter’s 2025 Adjusted EBITDA, and

- Charter’s (NASDAQ: CHTR) 60-day Volume Weighted Average Price of $353.64, as of 4/25/25.

As consideration in the transaction, Cox Enterprises will receive:

- $4 billion in cash,

- $6 billion notional amount of convertible preferred units in Charter’s existing partnership, which pay a 6.875% coupon, and which are convertible into Charter partnership units, which are then exchangeable for Charter common shares, and

- Approximately 33.6 million common units in Charter’s existing partnership, with an implied value of $11.9 billion1, and which are exchangeable for Charter common shares.

Based on Charter’s share count as of March 31, 2025, at the closing, Cox Enterprises will own approximately 23% of the combined entity’s fully diluted shares outstanding, on an as-converted, as-exchanged basis, and pro forma for the closing of the Liberty Broadband merger. The transaction is subject to customary closing conditions, including the receipt of regulatory and Charter shareholder approvals. The combined entity will assume Cox’s approximately $12 billion in outstanding debt.

Within a year after the closing, the combined company will change its name to Cox Communications. Spectrum will become the consumer-facing brand within the communities Cox serves. The combined company will remain headquartered in Stamford, CT, and will maintain a significant presence on Cox’s Atlanta, GA campus following the closing.

Governance:

Following the closing, Mr. Winfrey will continue in his current role as President & CEO, and board member. Mr. Taylor will join the board as Chairman, and Mr. Zinterhofer will become the lead independent director on Charter’s board. Cox will have the right to nominate an additional two board members to Charter’s 13-member board. Advance/Newhouse, another storied cable innovator, which contributed its operations to Charter’s partnership in 2016, will retain its two board nominees.

It is expected that Charter’s combination with Cox will be completed contemporaneously with the previously announced Liberty Broadband merger. As a result, Liberty Broadband will cease to be a direct shareholder in Charter and will no longer designate directors for election to the Charter Board. Accordingly, the three current Liberty Broadband nominees on Charter’s board will resign at closing. Liberty Broadband shareholders will receive direct interests in Charter as a result of the Liberty Broadband merger.

Upon closing, Charter, Cox Enterprises and Advance/Newhouse will enter into an amended and restated stockholders agreement, which will provide for preemptive rights over certain issuances, voting caps and required participation in Charter common share repurchases at specified acquisition caps, and transfer restrictions among other shareholder governance matters.

Community Leadership:

The Cox family of businesses was founded 127 years ago on the promise of “building a better future for the next generation.” Both Cox and Charter want to see that intent reinforced in this new partnership. The Cox family’s commitment to supporting its communities through the philanthropic work of the James M. Cox Foundation will be continued by Charter’s $50 million grant to establish a separate foundation that will encourage community leadership and support where the combined company does business. Additionally, Charter will make an initial $5 million investment to establish an employee relief fund that mirrors the Cox Employee Relief Fund, which Cox and the Cox family created in 2005 to help employees through times of hardships such as natural disasters or other unexpected life challenges.

Strategic and Customer Objectives:

Following the closing, the combined company’s industry-leading products will launch across Cox’s approximately 12 million passings and 6 million existing customers, under the Spectrum brand – including Spectrum’s Advanced WiFi, Spectrum Mobile with Mobile Speed Boost, the Spectrum TV App, Seamless Entertainment and Xumo – and which, when coupled with Spectrum’s transparent and customer-focused pricing and packaging structure, will provide Cox customers with enhanced flexibility and convenience, as well as the choice to pay less for new Spectrum bundled services or to keep their current plans.

The new combination will create a best-in-class customer service model. That model will integrate Cox’s rich service history with Charter’s 100% U.S.-based, employee-focused service and sales model and industry-leading customer commitments. Charter customers will benefit from Cox Business’ well-known industry leadership in business telecommunications, including Segra and RapidScale.

Charter and Cox employees will benefit from investments in employee-focused technology and AI tools and an expansion of Charter’s self-progression career advancement model for promotions and standardized pay increases.

Specific benefits from the combination include:

- The combined company will bring together the best products and practices of each company to benefit all of the combined company’s customers and employees.

- The combined company will be better positioned to aggressively compete in an expanding and dynamic marketplace that includes:

- Larger, national broadband companies with wireline and wireless capabilities,

- Regional wireline and mobile competitors,

- Global video distribution providers and platforms, and satellite broadband companies.

- The combined company also will be better positioned for continued and expanded investment and innovation:

- In mobile, given the increased footprint;

- In video, where Big Tech currently leverages global scale in content and distribution;

- In advertising, where the transaction will expand opportunities for advertisers large and small, national, regional, and local, bringing new competition in an area now dominated by Big Tech;

- In the business sector, where the combined company will have additional coverage, yet still remain a regional player competing against larger, national competitors;

- And through greater product innovation in areas including AI tools and small cell deployment of licensed, shared licensed and unlicensed spectrum, bringing new and advanced services and capabilities to consumers and businesses.

- Cox customers will gain access to Charter’s simple and transparent pricing and packaging structure, including no annual contracts for any residential services, which means customers are free to change service providers at any time, with no risk of early termination fees.

- Cox customers also will benefit from Charter’s industry-first Customer Service Commitments, which include:

- Charter’s 100% U.S.-based customer service team available 24/7.

- Charter has committed to fixing service disruptions quickly, including same-day technician dispatch when requested before 5:00 pm; if not, the next day.

- Charter provides customers credits for outages that last longer than two hours.

- This proposed transaction puts America first by returning jobs from overseas and creating new, good-paying customer service and sales careers.

- The combined company will adopt Charter’s sales and service workforce model, which will fully return Cox’s customer service function to the U.S.

- All employees will earn a starting wage of at least $20 per hour and will gain access to Charter’s industry-leading benefits, which include:

- Comprehensive medical, dental, and vision coverage for all full-time and part-time employees; Charter has absorbed the full premium cost increase for the last 12 years.

- Market-leading retirement benefits, including a 401(k) plan with a company match up to 6% of their eligible pay, with an additional 3% contribution available for most employees.

- Free or discounted Spectrum Mobile, TV and Internet service.

- Multiple opportunities for upward advancement and to build careers, including through tuition-free undergraduate degree and certificate programs via flexible online learning; self-progression programs with standardized pay raises, and formal development programs, such as the Broadband Field Technician Apprenticeship program.

- Employee Stock Purchase Plan, which provides frontline employees the ability to purchase stock and receive a matching grant of Charter Restricted Stock Units (RSUs) up to 1 for 1 based on years of service, offering employees another meaningful incentive to grow their careers with Charter.

- The combined company will expand Charter’s award-winning local Spectrum News stations in the Cox footprint, bringing hyper-local, unbiased news coverage to more communities. The combined company will not own any national programming.

- The combined company will retain its industry leadership in protecting the security of U.S. communications networks from foreign threats.

End Note:

Adding to the near-term uncertainty for internet service providers like Charter, the Trump administration put Biden’s $42.5 billion broadband-construction program on hold. The Broadband Equity, Access, and Deployment (BEAD) Program, is a key component of the “Internet for All” initiative, aiming to expand high-speed internet access across the United States. The program, funded by the Bipartisan Infrastructure Law, allocates grants to states and territories to deploy or upgrade broadband networks, ensuring reliable, affordable, high-speed internet service for all.The Commerce Department has frozen grants to state authorities that were set to start awarding contracts this year while it reviews the program’s criteria.

References:

https://www.lightreading.com/cable-technology/cablepalooza-charter-and-cox-strike-34-5b-merger

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications adds broadband subs and raises CAPEX forecast

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Cox Communications commits to symmetrical 10-Gig; many upgrade paths are possible

T‑Mobile and EQT close JV to acquire FTTH network provider Lumos

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Apparently, there’s no place to hide in any telecom or datacom market? We all know the RAN market has been in a severe decline, but recent Dell’Oro Group reports indicate that Optical Transport, Mobile Core Network and Cable CPE shipments have also declined sharply in the 1st Quarter of 2024.

Here are a few selected quotes from Dell’Oro analysts:

“The North American broadband market is in the midst of a fundamental shift in the competitive landscape, which is having a significant impact on broadband equipment purchases,” said Jeff Heynen, Vice President with Dell’Oro Group. “In particular, cable operators are trying to navigate mounting, but predictable, broadband subscriber losses with the need to invest in their networks to keep pace with further encroachment by fiber and fixed wireless providers,” explained Heynen.

Omdia, owned by the ADVA, expects cable access equipment spending to grow later in 2024 and peak in 2026 at just over $1 billion, then drop off to $700 million in 2029.

………………………………………………………………………………………………………

“Customer’s excess inventory of DWDM systems continued to be at the center stage of the Optical Transport market decline in the first quarter of 2024,” said Jimmy Yu, Vice President at Dell’Oro Group. “However, we think the steeper-than-expected drop in optical transport revenue in 1Q 2024 may have been driven by communication service providers becoming increasingly cautious about the macroeconomic conditions, causing them to delay projects into future quarters,” added Yu.

…………………………………………………………………………………………………..

“Inflation has impacted the ability of some Mobile Network Operators (MNOs) to raise capital, and it has also impacted subscribers when it comes to upgrading their phones to 5G. Many MNOs have lowered their CAPEX plans and announced that they have fewer than expected 5G subscribers on their networks; which limits MNOs’ growth plans. As a result, we are lowering our expectations for 2024 from a positive growth rate to a negative one,” by Research Director Dave Bolan.

- As of 1Q 2024, 51 MNOs have commercially deployed 5G SA (Stand Alone) eMBB networks with two additional MNOS launching in 1Q 2024.

References:

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Charter Communications: surprise drop in broadband subs, homes passed increased, HFC network upgrade delayed to 2026

Charter Communications posted a surprise drop in broadband subscribers in the Q4-2023, the company announced on Friday. Charter’s internet customers decreased by 61,000 (-62,000 residential and +1,000 business) in the 4th quarter, with nearly all of the decline from residential customers. That was much worse than expectations for 17,290 additions, according to Visible Alpha and a year-ago gain of +105,000. The broadband subscriber drop was especially disappointing given Charter’s homes passed growth accelerated to 2.5% year-over-year, Craig Moffett said in a research note.

“Internet growth in our existing footprint has been challenging, driven by admittedly more persistent competition from fixed wireless and similar levels of wireline overbuild activity,” CEO Chris Winfrey said on a post-earnings call, adding that new investments will help drive growth despite the “temporary challenges.” Chief Financial Officer Jessica Fischer had warned in December that the company could lose internet customers in the quarter. At the time, speaking at an analyst conference, she said the company was facing short-term challenges and that results would be in line with the rest of the industry.

Charter was not the only cableco/MSO to report decreased broadband internet subscribers in the 4th quarter. Last week, rival Comcast reported a loss of 34,000 broadband customers, fewer than expectations, but exceeding the 18,000 broadband customers it lost in the previous quarter.

Stiff competition across broadband and wireless mobile and the decline of traditional television have been causes of concern, with Charter trying to expand its reach into rural areas in an effort to boost subscriber and earnings growth. Charter is facing heightened competition from Verizon and T-Mobile’s wireless home internet offerings, and the cable company could soon lose even more subscribers when a key government program runs out of funding in April, JPMorgan analysts say in a research note. In particular, the end of the Affordable Connectivity Program (ACP), which provided up to $30 per month to eligible customers to put toward their internet bills, could hurt Charter more than its peers. If ACP is not refunded, “we’ll work very hard to keep customers connected,” Winfrey said. Charter has more than 5 million ACP recipients, the highest in the industry. The majority of them were Charter broadband subscribers before the program began.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 142,000 broadband subs via its rural subsidy program in Q4, for a total of 420,000, and an overall penetration rate of 33.8% – up from 27.2% in the year-ago quarter. The company posted $74 million in rural revenues, up from $39 million a year earlier. Charter pulled in subsidy revenues of $29 million in Q4. Total capex for the project in Q4 was $426 million, down from $567 million in the year-ago quarter. Charter plans to activate 450,000 new subsidized rural passings in 2024. With all programs rolled up, Charter has committed to build 1.75 million subsidized rural passings.

Charter expects to complete its Rural Digital Opportunity Fund (RDOF) builds by the end of 2026 – two years ahead of schedule. Charter also intends to participate in the much larger $42.45 billion Broadband Equity Access and Deployment (BEAD) program.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Completion of Charter’s hybrid fiber/coax (HFC) network upgrade has been delayed to 2026 due in part to a lengthier certification process for distributed access architecture (DAA) technology. Charter’s original plan was to complete its HFC upgrades by the end of 2025. Charter’s HFC evolution plan consists of three steps:

- An upgrade to 15% of its network to 1.2GHz with an upstream-enhancing “high-split” using traditional integrated cable modem termination systems (CMTSs). That enables multi-gigabit downstream speeds and upstream speeds up to 1 Gbit/s.

- An upgrade to 1.2GHz with DAA and a virtual CMTS in 50% of the HFC footprint, enabling downstream speeds up to 5 Gbit/s and upstream speeds up to 1 Gbit/s.

- A full DOCSIS 4.0 upgrade by deploying 1.8GHz with DAA and a vCMTS to 35% of the HFC footprint. That’ll put Charter in position to deliver up to 10 Gbit/s downstream and at least 1 Gbit/s upstream.

Speaking on today’s Q4 2023 earnings call, Charter CEO Chris Winfrey said the operator has launched symmetrical speed tiers in two markets (Reno and Rochester, Minnesota, an official confirmed), with deployments in six additional markets underway that, once completed, will fulfill the phase one plan. Charter expects to start DAA deployments in its phase two markets later this year, Winfrey said.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Charter added 546,000 mobile lines in Q4, down from a gain of +615,000 in the year-ago quarter and +594,000 in the prior quarter. Analysts were expecting Charter to add 594,000 mobile lines in the 4th quarter and +2.5 million lines for full 2023, up from 1.7 million in full 2022. The MSO ended 2023 with 7.76 million mobile lines. Charter is also expanding its deployment of CBRS spectrum to help the company offload MVNO costs in high-usage areas. Winfrey said “thousands” of CBRS units have been deployed in one “large” market (believed to be Charlotte, North Carolina). Charter expects to roll CBRS to an additional market later this year, he said.

References:

Charter Communications adds broadband subs and raises CAPEX forecast

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

Omdia: Cable network operators deploy PONs

In addition to the traditional hybrid fiber/coax (HFC) topology, several cable network operators (MSOs) are also deploying Passive Optical Network (PON) technologies for targeted fiber-to-the-premises (FTTP) buildouts in rural areas and other greenfield environments. Others, like Altice USA and Virgin Media O2, are moving aggressively with PON overlays of their legacy HFC networks.

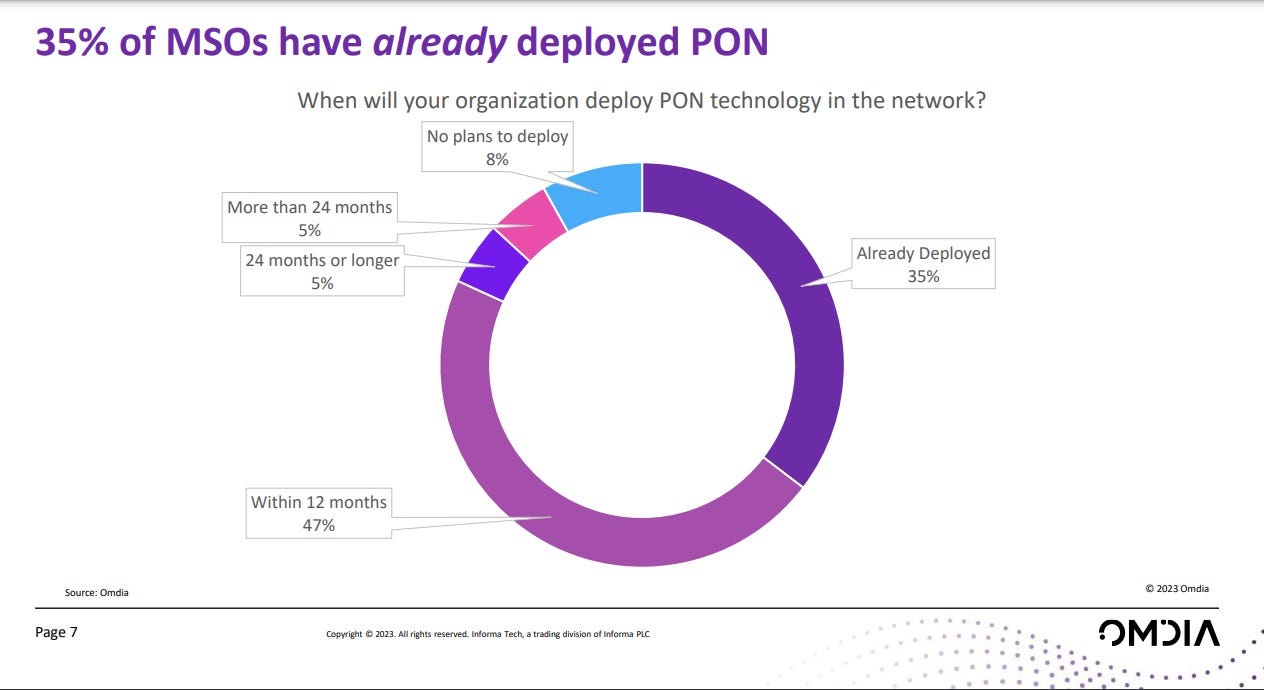

A recent Omdia (an Informa company) survey reveals that PON activity is rising among cable operators. Omdia found that about 35% of cable operators surveyed have already deployed PON in their networks, with another 47% expected to do so within the next year. Just 8% said they have no plans to deploy PON at this time. Collectively, about 80% of operators, as surveyed by Omdia, will be deploying PON in some form or fashion by next spring.

CableLabs recently launched a pair of fiber-oriented working groups focused on optical operations and maintenance and on specifying a DOCSIS framework for the provisioning of ITU-T based PON technology, including 10-Gig-capable XGS-PON. 10G-PON technology, first standardized in 2009 and first deployed in 2012, 10G-PON allows for 10 G symmetric capacity. The emerging 25G-PON and 50G-PON technology will allow cable operators to deploy cost-effective all-fiber solutions over the same optical distribution network far into the future to meet high-speed data trends.

While today’s PON deployments are largely focused on 10-Gig technologies, there’s already some action focused on next-gen 25-Gig technologies.

- Google Fiber (not a MSO) is starting to head in that direction with Nokia’s 25G PON technology (see pic below), as per this IEEE Techblog post.

- EPB (a municipal network operator in Chattanooga, Tennessee) has already introduced symmetrical 25 Gbit/s services across a footprint that passes about 180,000 homes and businesses. Katie Espeseth, VP of new products at EPB, notes that 25G PON lowers costs while also delivering the kind of bandwidth required by hospitals, universities and other local institutions. “It [25G PON] has opened a whole new world for us,” she said.

“The real issue here probably isn’t the speed,” but how operators manage these new networks and make the required upgrades to their back-office systems, Richard Loveland, director of product line management, PON for FTTP products, Vecima Networks told Light Reading. Cable operators, he said, will have to decide to focus on DOCSIS-style technologies or consider changing over to new systems and platforms. Loveland said merchant silicon is not available to support widespread PON deployment, and likewise isn’t convinced if the next big play will be for 25G or 50G PON.

References:

https://www.lightreading.com/fttx/cable-s-in-hot-pursuit-of-pon

https://www.lightreading.com/fttx/cablelabs-gets-laser-focused-on-fttp

https://www.cablelabs.com/technologies/pon

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

Omdia Surveys: PON will be a key part of network operator energy reduction strategies

Ooredoo Qatar is first operator in the world to deploy 50G PON

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

Telefonica España to activate XGS-PON network in 2022; DELTA Fiber to follow in Netherlands

Charter Communications adds broadband subs and raises CAPEX forecast

Cableco Charter Communications added 63,000 broadband internet subscribers in the third quarter. Net adds in new markets hit 31,000 in the third quarter, accelerating from 26,000 last quarter. A note from New Street Research said the company passed fewer homes in new markets than expected, “and so the pace of penetration growth is tracking ahead of expectations.”

Charter’s third-quarter revenue of $13.6 billion grew by 0.2% year-over-year, driven by residential internet revenue growth of 3.7%, residential mobile service revenue growth of 33.8% and other revenue growth of 28.8%, mostly driven by higher mobile device sales.

Free cash flow of $1.1 billion decreased from $1.5 billion in the prior year, due to higher capital expenditures, mostly driven by Charter’s network evolution and expansion initiatives.

As of September, Charter had a total of 32.2 million residential and SMB customer relationships, excluding mobile-only relationships.

“We continue to make significant progress against the multi-year strategic initiatives we outlined last year,” said Chris Winfrey, President and CEO of Charter. “These initiatives drive continuing improvements in the quality of our products, and when combined with our customer-friendly pricing and packaging and high-quality service, will drive significant, long-term growth in shareholder value.”

…………………………………………………………………………………………………………………….

On its earnings call, CEO Winfrey said that “given the greater subsidized rural passings and construction opportunity,” Charter may even look to partially fund those new markets by “very modestly slowing our network evolution plan” — which includes upgrades to its hybrid fiber-coaxial footprint.

Winfrey said Charter expects to add approximately 300,000 new subsidized rural (NSR) passings in 2023 and to accelerate that pace in 2024. In the third quarter, 78,000 rural passings were activated. He added that Charter is ahead with its Rural Digital Opportunity Fund (RDOF) builds and “will end up with more (rural) passings than originally expected.”

However, NSR said Charter’s results in core markets were “disappointing,” with adds of 47,000 way below their estimate of 79,000. While NSR expected stabilization in pressure from fixed wireless access (FWA), Charter continues to see some impact from FWA competitors in the lower usage and price sensitive customer segments of its residential and SMB businesses.

Charter is raising its capital-expenditures (CAPEX) forecast for the year as it pours billions back into upgrading its network and its Xumo business. The company now expects to spend about $7.2 billion in CapEx, up from prior guidance of $6.5 billion to $6.8 billion. That excludes line-extension CapEx, which is still expected to be about $4 billion for the year. The $7.2 billion will be put to work upgrading and maintaining the cable company’s network. Some of it will also go toward sending Xumo stream boxes to customers. Xumo is a joint venture between Charter and Comcast that offers free ad-supported streaming TV. Charter shares fall 6%.

References:

https://corporate.charter.com/newsroom/charter-announces-third-quarter-2023-results

https://www.fiercetelecom.com/broadband/charter-adds-63k-subscribers-q3-eyes-more-rural-builds

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

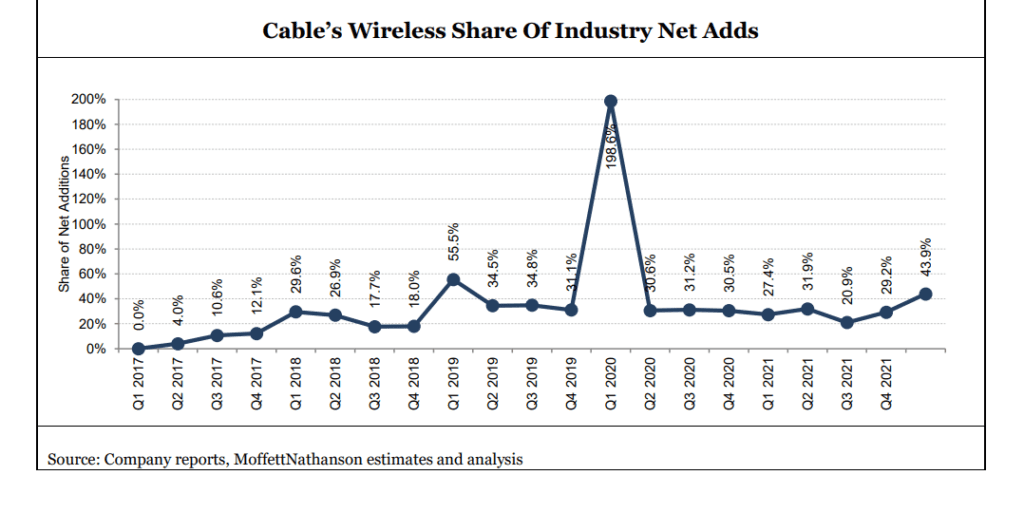

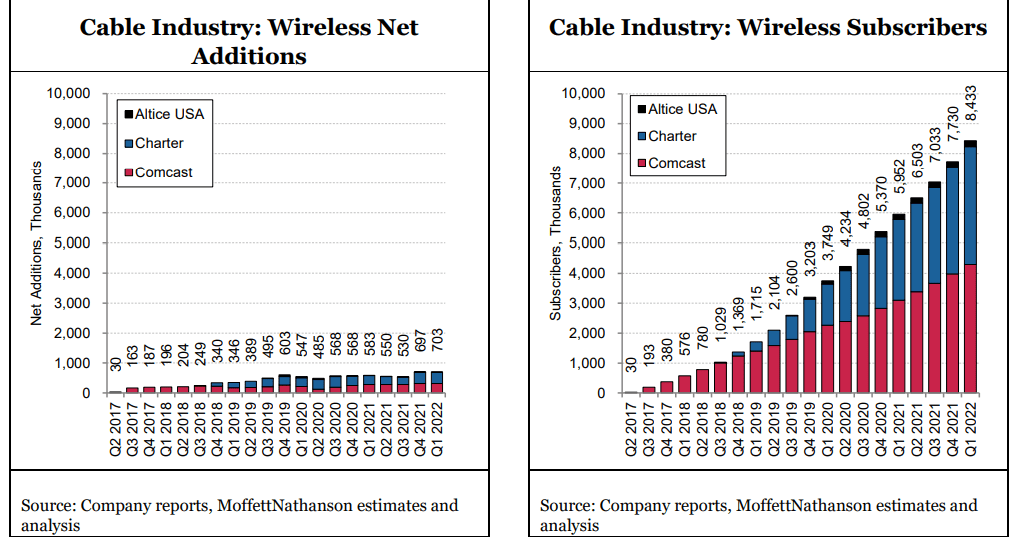

Cable companies big gains in wireless threaten incumbent cellular telcos

by Craig Moffett of MoffettNathanson (edited by Alan J Weissberger)

Cable company’s 98% share of the wireless industry subscriber growth in Q1-2022 is a little known fact. And that does not include the free WiFi they offer to their customers, e.g. Xfinity WiFi and CableWiFi® (created through a collaboration of U.S. Cable and Internet Service Providers including Cox Communications, Optimum, Spectrum, and XFINITY. It allows each other’s eligible Internet customers free access to a collective network of more than 500,000 WiFi hotspots across the nation).

Until Q1-2022, Cable’s gains were almost exclusively from Comcast and Charter. Altice has now renegotiated its contract with T-Mobile, and they have moved to pricing that is even more aggressive than Comcast and Charter. [Interestingly, Altice’s contract allows Altice to name T-Mobile in their advertising as the underlying network, a contract term we’ve not seen before.]

Cox Communications, the nation’s third largest cable operator, is poised to join Cable’s ranks in offering wireless service, as well. The company won a Delaware Supreme Court decision in March, reversing a lower court decision that had previously upended their launch plans by finding they were bound to launch using T-Mobile’s instead of Verizon’s network, even if doing so was under less favorable contract terms. [They have not yet announced precise timing for their expected wireless relaunch.]

The pending addition of a wireless offering from Cox, and the more aggressive posture from Altice, will certainly compound the pressure Cable is putting on cellular telcos (e.g. Verizon, AT&T, T-Mobile, US Cellular, etc).

Cable’s 703K combined net additions were their best ever, and they have grown their subscriber base to 8.4M customers incredibly quickly. But those 8.4M subscribers still represent less than 3% market share of the U.S. market. They have a very long runway ahead.

Cable has achieved these gains without offering handset subsidies, something that seems inevitable sometime before the end of the year (Cable’s originally-BYOD subscribers will eventually demand new devices). Handset subsides from Cable, if and when they come, will only put more pressure on the cellular telco incumbents.

It is through this lens that one must view Verizon’s attempt to lead the industry to higher pricing [1.]. Subscriber growth is slowing. Cable’s share gains are accelerating. Cable has made clear that they do not plan to increase pricing. Nor does the industry price leader, T-Mobile. And Cable’s promotionality is likely to increase. That is a very tough backdrop against which to assume that price increases will “stick.”

Note 1. Verizon’s price increase, which will drop directly to the bottom line, will increase Verizon’s

service revenue and EBITDA by roughly $750M over the balance of the year, and by approximately $1.5B for next year, neither of which was contemplated in their previous guidance.

After accounting for 3G terminations, AT&T’s growth fell to just 360K net additions, leaving T-Mobile once again the industry’s fastest growing cellular telco. Not only is T-Mobile taking the industry’s largest share of gross additions – the best measure of customer choice – their churn rate is falling faster than any in the industry, as well, as they complete the transition of Sprint subscribers to their T-Mobile Magenta network. T-Mobile’s falling churn rate starves the industry gross add pool of what had been a critical source of “supply.”

The company is now most of the way through their migration of Sprint customers, and they have repeatedly suggested that churn on their Magenta network is the lowest in the industry, suggesting that churn should continue to fall, even if at a slightly slower pace going forward.

Only T-Mobile is growing ARPU at the moment, as more customers opt for higher value plans (Magenta Max). In contrast to the positive ARPU trend at T-Mobile, ARPU growth has been negative for eight straight quarters at AT&T (with the moderation in the rate of decline in Q1 largely attributable to the aforementioned extension of customer lives, which reduced amortization of historical promotional subsidies, and an easier comp against the same period last year).

ARPU growth at Verizon is not only negative, it is accelerating downward. For Verizon to post both negative subscriber growth and ARPU growth is a shock, and it points to the challenge facing the industry in getting ARPU increases to stick. Absent their wholesale contract with Cable, Verizon’s anemic 1.5% service revenue growth would be close to zero.

Verizon’s price increase comes at a time when industry unit growth is slowing, and at a time when Cable’s market share gains are accelerating both at the gross addition and net addition level. Without broad industry buy-in, and with subscribers looking harder to come by, we find it unlikely that Verizon’s price increases – even if AT&T does initially follow – will “stick.”

If wireless industry growth continues to decelerate, and Cable’s growth rate remains high, Cable’s share of growth will remain elevated, and the wireless industry will increasingly resemble a zero sum game for the Big Three incumbents, where one player’s gain (T-Mobile’s) will necessarily be another’s (Verizon’s and AT&T’s) loss. Huge losses at Dish Network’s Boost unit, and losses at U.S. Cellular, have helped soften the blow, but they are only so big. The pressure of falling industry growth and falling market share unavoidably falls on the cellular telco incumbents.

References:

Wireless Q1 2022: The Elephant in the Room, MoffettNathanson report to clients

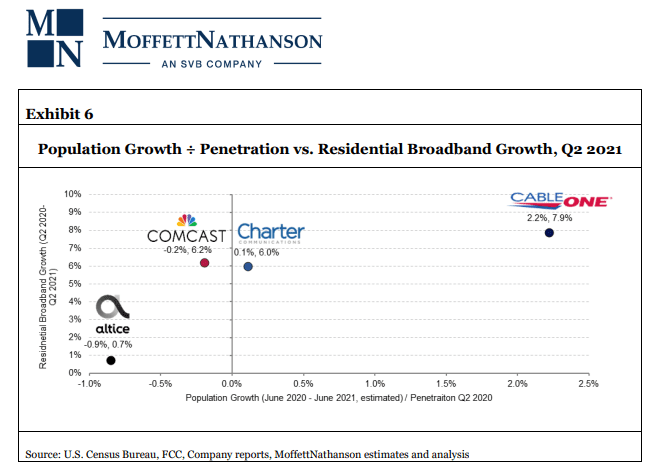

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

Altice USA recently disclosed a plan to overbuild its hybrid fiber-coaxial (HFC) network to blanket 6.5 million locations with fiber by 2025. The NYC based cableco/MSO operates the Optimum and Suddenlink brands, which it plans to rebrand under the Altice USA name.

During a New Street Research investor conference, Altice USA EVP of corporate finance and development Nick Brown said the decision to make that move was a “no brainer” for the company, but acknowledged that it’s in a slightly different position than fellow cable giants Comcast and Charter Communications. Brown stated Altice USA’s own experience and that of its sister companies in Europe gave it better insight into what the transition to fiber would look like in terms of costs and returns, leaving it unafraid to take the leap. But it also already faces “a lot of fiber-based competition relative to others,” especially from Verizon Fios in its legacy Cablevision footprint in the eastern part of the country.

Altice has already upgraded its head ends and backbone rings with fiber. Since DOCSIS would require it to push fiber deeper and deeper into the network anyway, Brown said it made sense to go all-in to pull forward the benefits full fiber has to offer. “The FTTH end-to-end glass network that we’re deploying here in the U.S. for us is pretty much the end state, the logical end state, of a coax upgrade anyway,” Brown argued.

Brown said the move to fiber will allow Altice USA to save in the “low hundreds of millions” of dollars in operating expenses and “materially” reduce its capital expenditures over time. It’s also expected to help Altice more effectively compete by allowing it to offer a better product, reduce churn and improve network reliability. He also pointed out it’ll make future network upgrades easier. Today, it has around half a million active components in its coax network, nearly all of which need to be touched for a DOCSIS upgrade. But with fiber “the equivalent is about 1,000 to 2,000 pieces of equipment that you would need to upgrade to go to next generations of fiber technology as we’re doing this year as we’re moving to XGS-PON,” he said, noting its current fiber footprint of more than 1 million locations was originally built with GPON technology.

“I think it’s just a lot more scalable, a lot more future-proof in our mind, and a lot more cost effective to move to future broadband technologies,” Brown concluded.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

To determine which operators might have been most negatively affected by low population growth (and therefore likely low household growth) from July 2020 to July 2021, and which might have been net beneficiaries of the fastest growth, analysts at MoffettNathanson aggregated the population by county in each cable operator’s footprint using FCC Form 477 data as of Q4 2020. Using those totals, we calculated a weighted average population growth for each operator’s total footprint based on the county-level annual estimates published by the Census Bureau. The weighted-average population growth implies a meaningful headwind to Altice USA (at -0.4% growth), and a significant tailwind to Cable One (at 0.7% growth).

Craig concluded: “Again, there’s a lot more at work in broadband subscriber growth rates than just population (new household formation) growth or starting penetration. Different operators have different demographics. They face different overlaps with fiber, and some will face more FWA than others. They have different pricing strategies.”

References:

https://www.fiercetelecom.com/telecom/altice-usa-exec-fiber-logical-end-state-coax

Analysts: Increased Fiber internet services may force cablecos to alter pricing & deploy FTTP

Several analysts believe the increased availability of Giga bit/sec FTTP (fiber to the premise) service offerings (with flat rates) could force cablecos to rethink their pricing strategy. For example, Jonathan Chaplin of New Street Research stated in a note to clients that cable’s promotional pricing is generally competitive with fiber offers. The problem, however, is that cable service ends up costing consumers significantly more than fiber based broadband access once those introductory rates disappear. “We have hypothesized for a couple of years that 1) Cable’s pricing strategy contributes to high churn and low NPS scores and 2) that it is unsustainable. We don’t think Cable has to cut price to remain competitive; we suspect they do have to fix the pricing model.”

Recon Analytics founder Roger Entner agreed, telling Fierce Telecom his research has shown price is the number one reason people join or leave a service provider. While consumers find promotional pricing very attractive, they’re generally unhappy when their promotions end. “So, for the cable companies, it’s both a gross addition driver and a churn driver as well,” he explained. While cable’s pricing strategy worked well when there was no competition to offer similar broadband speeds or features, that is now changing as fiber is becoming more broadly available, Entner said.

Indeed, fiber based telcos are already seizing on the opportunity to lure customers in with the promise of more simplistic pricing. For instance, AT&T used its recent launch of multi-gig fiber broadband plans as an opportunity to introduce new “straightforward” pricing which promises a flat rate with equipment and other fees included.

Speaking on an episode of Entner’s podcast, AT&T’s EVP and GM of Broadband Rick Welday stated there is “significant” demand in the market for simple pricing. “It’s obvious that consumers are done with this intro pricing where you see a fun, attractive, low rate advertised on television, you go sign up with that ISP and then 12 months later your rate jacks up considerably. Frankly, this is the model that cable has chosen. It seems to align with their video business and annual increases in carriage fees,” he said. Welday argued AT&T’s new cost model is a “game changer in terms of an ISP really obsessing over how to be transparent and upfront with the market.”

Chaplin said a shift by cable to the flat pricing model fiber players use might “weigh on gross adds initially.” However, he predicted net additions would ultimately “land in a similar place” over the course of a couple years while reduced churn would yield “lower costs and higher margins.”

Despite the potential benefits, Entner said he doesn’t expect cable to change its approach right away. “The system is still working and so you have a lot of inertia in the system. Only when cable is actually losing customers will this change,” he concluded.

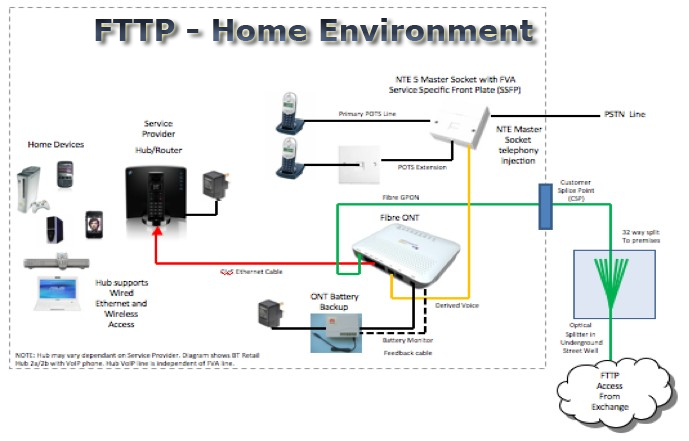

Source: https://kitz.co.uk/adsl/fttp.htm

In addition, cablecos are planning FTTP deployments in the near future. I’ve heard that directly from an anonymous Comcast executive who told me to look out for their upcoming 10G bit/sec service.

We previously reported that a Cable One joint venture (JV) with three private equity firms is seeking to speed its expansion of fiber based Internet access to underserved markets. Clearwave Fiber is a newly formed joint venture that holds Clearwave Communications and certain fiber assets of Hargray Communications. Cravath is representing Cable One in connection with the transaction. With the formation of the JV, Clearwave Fiber intends to invest heavily in bringing Fiber-to-the-Premise (“FTTP”) service to residential and business customers across its existing footprint and near-adjacent areas.

Meanwhile, CableLabs has developed technologies that fall under the platform’s key tenets including capacity, security and speed. Increasing the number of bits per second that are delivered to subscribers can improve download and upload speed, a primary objective for the 10G platform. As data demands increase, many operators are considering increasing capacity on the existing optical access network.

To help operators better meet that demand, CableLabs recently published its first set of specifications for a new device, called the Coherent Termination Device, that enables operators to take advantage of coherent optics technologies in fiber-limited access networks.

References:

https://www.fiercetelecom.com/broadband/analysts-fiber-could-force-cable-overhaul-its-pricing-model

https://www.fiercetelecom.com/operators/at-t-puts-cable-companies-notice-fiber-plan

https://kitz.co.uk/adsl/fttp.htm

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

10-Gbps last-mile internet could become a reality within the decade from Futurology

WideOpenWest picks Seminole County, FL as its 1st greenfield area for FTTP deployments

MetroNet’s FTTP buildout in Florida; Merger with Vexus Fiber

Cable One joint venture to expand fiber based internet access via FTTP

Dell’Oro: Broadband Access equipment spending increased 18% YoY

A newly published Broadband Access and Home Networking 1stQ2021 report by Dell’Oro Group stated that the total global revenue for the Broadband Access equipment market increased to $3.3B in 1st Quarter, up 18 percent year-over-year (YoY). The growth was driven by strong fiber infrastructure investments such as PON (Passive Optical Network) OLT (Optical Line Terminal) ports, particularly 10 Gbps PON technologies.

XGS-PON revenue jumped 500% year-on-year to about $200 million, reflecting several quarters of steady growth as fiber players up their game in anticipation of competition from cable operators deploying DOCSIS 4.0.

- Total broadband access equipment revenue was down 6 percent from the record revenue of 4Q 2020.

- Total cable access concentrator revenue (a category that includes DOCSIS infrastructure elements such as converged cable access platform cores and chassis, virtual CCAP licensing and DAA nodes and modules) increased 15 percent YoY to $243 M.

- Though DOCSIS license purchases were down, new hardware purchases in the form of CCAP chassis, line cards, and DAA nodes and modules helped push revenue higher.

- CommScope led the cable access concentrator market with about 40% of revenues in Q1 2021, followed by Cisco (16%), Harmonic (16%) and Casa Systems (15%).

- 80% of DOCSIS modems shipped in Q1 2021 were of the DOCSIS 3.1 variety.

- Revenue from purchases of remote-PHY and remote MAC-PHY equipment were up 66% from Q4 2020, which can be interpreted as a sign that cable operators are resuming long-term projects that were put on hold during the height of the pandemic last year.

- Total DSL Access Concentrator revenue was down 30 percent YoY, driven by slower port shipments worldwide as more operators shift their spending to fiber.

- Total PON ONT (Optical Network Terminal which is CPE) revenue was down quarter over quarter, but unit shipments remained above 30M globally for the second straight quarter.

The Dell’Oro Group Broadband Access and Home Networking Quarterly Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for Cable, DSL, and PON equipment. Covered equipment includes Converged Cable Access Platforms (CCAP) and Distributed Access Architectures (DAA); Digital Subscriber Line Access Multiplexers ([DSLAMs] by technology ADSL/ADSL2+, G.SHDSL, VDSL, VDSL Profile 35b, and G.FAST); PON Optical Line Terminals (OLTs), Cable, DSL, and PON CPE (Customer Premises Equipment); and SOHO WLAN Equipment, including Mesh Routers. For more information about the report, please contact [email protected]

…………………………………………………………………………………………………………………………………………….

Long term, MoffetNathanson analysts forecast cable operators (MSOs) having a 50% broadband share in the markets where they compete with FTTH—significantly less than cable’s 85% market share against VDSL and 95% market share against DSL.

References:

Will Cable Broadband Market Share Decline as Telcos Deploy Fiber?

Comcast Earnings Report: Record Broadband Growth; 3 Core Strategy Tenets; Wireless Expansion

Comcast added a record 633,000 residential and business broadband Internet customers in the Q3-2020, but lost another 273,000 video customers. Cable Communications total customer relationship net additions of 556,000, were the best quarterly result ever for the company.

Xfinity Mobile, Comcast’s mobile service via Verizon MVNO agreement, added 187,000 wireless subscriber in Q3-2020. That was down from additions of 204,000 lines in the year-ago quarter. There were 2.58 million mobile subs at the end of the quarter.

“We are nearly eight months into this pandemic – and despite many harsh realities, I couldn’t be more pleased and proud of how our team has worked together across the company to find safe and creative solutions to successfully operate in this environment. We are executing at the highest level; and perhaps, most importantly, accelerating innovation, which will drive long-term future growth. This third quarter, we delivered the best broadband results in our company’s history. Driven by our industry-leading platform and strategic focus on broadband, aggregation and streaming, we added a record 633,000 high-speed internet customers and 556,000 total net new customer relationships. At the same time, we’re growing our entertainment platforms with the addition of Flex, which has a significant positive impact on broadband churn and customer lifetime value. Our integrated strategy is also driving results in streaming with nearly 22 million sign-ups for Peacock to date, and we are exceeding our expectations on all engagement metrics in only a few months. And Sky continues to add customer relationships at higher prices while reducing churn to all-time lows in our core UK business. Going forward, and as we emerge from the pandemic, we believe we are extremely well positioned to provide seamless and integrated experiences for our customers and to deliver superior long-term growth and returns for our shareholders,” said Brian L. Roberts, Chairman and Chief Executive Officer of Comcast Corporation.

Cable Communications revenue increased 2.9% to $15.0 billion in the third quarter of 2020, driven by increases in high-speed internet, business services, wireless and advertising revenue, partially offset by decreases in video, voice and other revenue. These results were negatively impacted by accrued customer regional sports network (RSN) fee adjustments related to canceled sporting events as a result of COVID-19. Excluding these adjustments5, Cable Communications revenue increased 3.9%. High-speed internet revenue increased 10.1%, due to an increase in the number of residential high-speed internet customers and an increase in average rates.

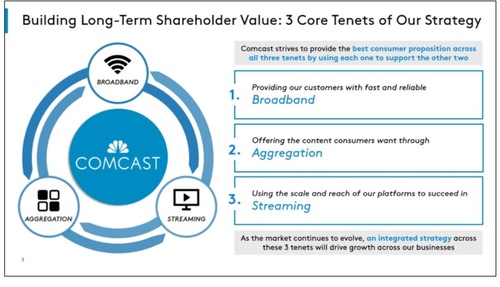

Comcast defined three “core tenets” that will drive its strategy focused on broadband Internet, content aggregation and scaling up its tech platforms for video streaming.

Source: Comcast

Xfinity Flex, Comcast’s free streaming video/smart home product for broadband-only customers, has helped the company retain its broadband base. Flex, which has about 1 million active users, has cut churn rates by 15% to 20% among new broadband customers that engage with the platform. Flex has also helped to offset Comcast’s pay-TV subscriber losses for the past two quarters.

“The goal of our common tech stack is to build once and deploy as many times in as many markets and in as many ways as possible on our network or through wholesale distribution,” Brian Roberts, Comcast’s chairman and CEO, said on the company’s earnings call. He noted that the approach generates “good margins” for the company.

Indeed, cable profit margins of 42.7% were up 290 bps YoY, continuing a steady uptrend and beating analyst consensus of 41.7% by 100 bps. Absent wireless, margins would have been 44.3%, the highest ever and fully 300 bps above the levels a year ago.

Meanwhile, Capital Expenditures (CAPEX) decreased 4.9% to $2.4 billion in the third quarter of 2020. Cable Communications’ capital expenditures decreased 2.5% to $1.8 billion. NBCUniversal’s capital expenditures decreased 29.3% to $357 million. Sky’s capital expenditures increased 127.3% to $237 million. For the nine months ended September 30, 2020, capital expenditures decreased 7.6% to $6.3 billion compared to 2019.

“We’re committed to accelerating the wireless business,” Dave Watson, CEO of Comcast Cable, said on today’s earnings call. Comcast may build out its own cellular infrastructure, at least on a targeted basis, which would effectively complement its MVNO arrangement with Verizon. Notably, Comcast was one of several cable operators that bid for and won CBRS spectrum, which it could use to offload mobile traffic in high-traffic areas. “We have the ability to evolve this [mobile] offering over time to where we choose to include our own wireless network with cellular infrastructure to generate even greater profitability in the most highly trafficked mobile areas,” Roberts said.

……………………………………………………………………………………………………………………………………………………………………………

Analyst Assessment:

Craig Moffett, principal of MoffettNathanson asks: Where are all the broadband subscribers coming from?

Verizon, AT&T, and now Comcast have all beaten expectations, and blown away historical growth rates. But it could also be asked of wireless, where, again, Verizon, AT&T, and now Comcast have all grown (Comcast a bit more slowly than expected, but it was solid growth nonetheless). It could even be asked of video, where, yes, Verizon, AT&T, and now Comcast have all lost fewer subscribers than expected. We, and the market, will be grappling with these questions for the next three months or longer. Let’s start by acknowledging the obvious: Comcast’s subscriber metrics in Q3 were absolutely stellar, whatever the explanation.

……………………………………………………………………………………………………………………………………………………………………………

References:

https://www.cmcsa.com/news-releases/news-release-details/comcast-reports-3rd-quarter-2020-results

https://www.cmcsa.com/events/event-details/q3-2020-comcast-corporation-earnings-conference-call