Vertical Systems Group: Mid-2022 U.S. Carrier Ethernet Leaders; Change is Coming

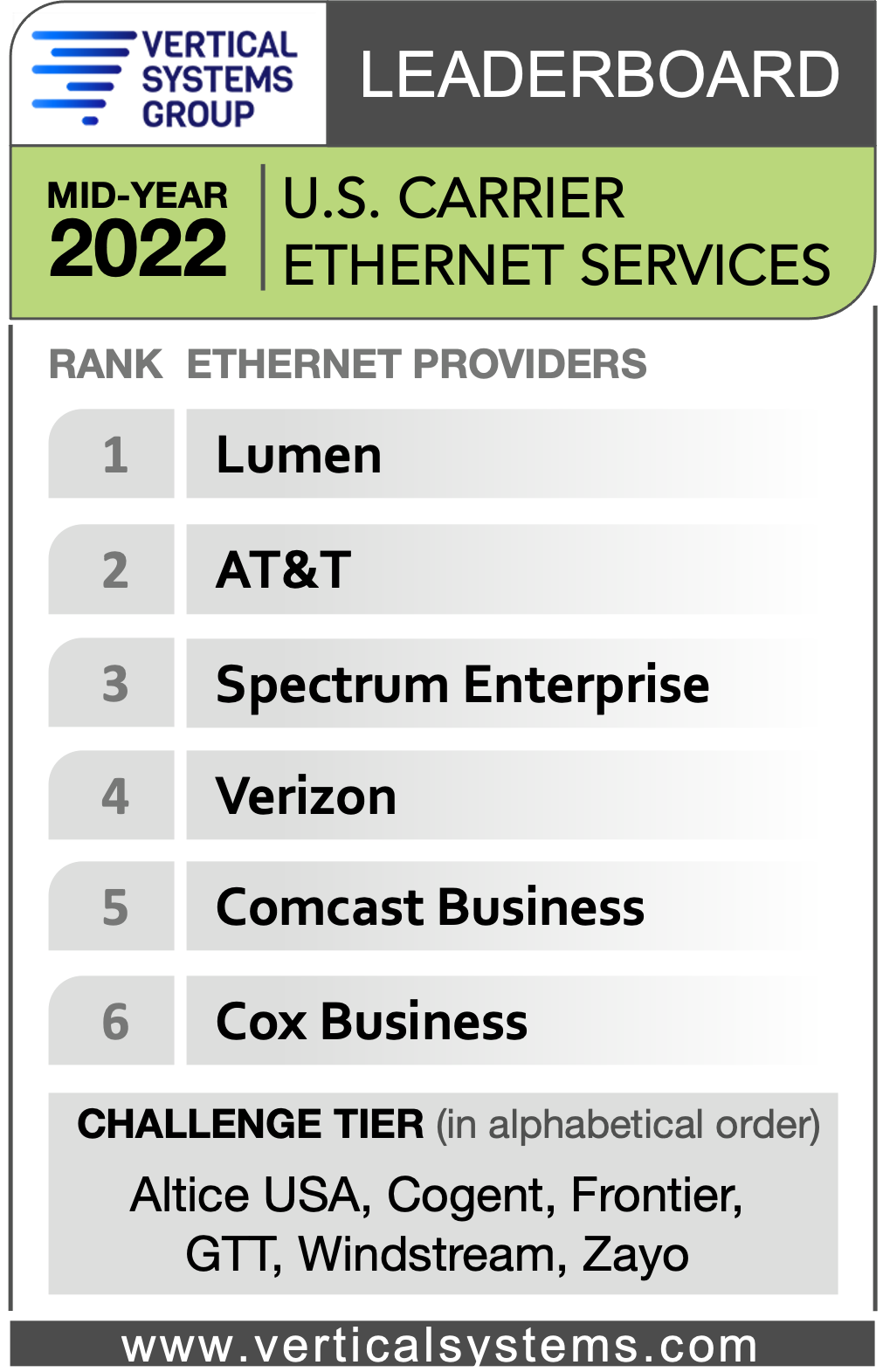

Vertical Systems Group (VSG) today revealed that seven companies achieved a rank on their Mid-2022 U.S. Provider Ethernet LEADERBOARD as follows (in order based on retail port share as of June 30, 2022): Lumen, AT&T, Spectrum Enterprise, Verizon, Comcast Business and Cox Business. To qualify for a rank on this LEADERBOARD, network providers must have four percent (4%) or more of the U.S. retail Ethernet services market.)

Research Highlights:

- Lumen continues to hold the top rank on the Mid-2022 U.S. Ethernet LEADERBOARD based on port share.

- Our latest Ethernet research shows that port shares are tightening between several of the market leading providers.

- Dedicated Internet/Cloud Access (DIA) was the fastest growing Ethernet service for the first half of 2022 and is on pace to be the largest Ethernet service overall by year-end based on billable U.S. customer installations. Primary Ethernet DIA applications are connectivity for Cloud services and Managed SD-WANs.

- Market demand is rising for Ethernet services ranging up to 100+ Gbps.

- Customers requiring higher bandwidth connectivity are also evaluating alternatives to Ethernet, including Wavelength and Dark Fiber services.

- Ethernet service providers continue to grapple with supply chain challenges, including lengthy lead times and shortages of the supplies necessary for customer deployments and backbone network operations.

- Lumen and Verizon are the only LEADERBOARD companies with MEF 3.0 Carrier Ethernet (CE) certification.

Challenge Tier citations were attained by the following six companies (in alphabetical order): Altice USA, Cogent, Frontier, GTT, Windstream and Zayo. The Challenge Tier includes providers with between 1% and 4% share of the U.S. retail Ethernet market.

The Market Player tier includes all providers with port share below 1%. Companies in the Market Player tier include the following providers (in alphabetical order): ACD, AireSpring, Alaska Communications, Alta Fiber, American Telesis, Arelion, Armstrong Business Solutions, Astound Business, Breezeline, BT Global Services, Centracom, Consolidated Communications, Conterra, Crown Castle, Douglas Fast Net, DQE Communications, ExteNet Systems, Fatbeam, FiberLight, First Digital, FirstLight, Flo Networks, Fusion Connect, Global Cloud Xchange, Great Plains Communications, Hunter Communications, Intelsat, Logix Fiber Networks, LS Networks, MetTel, Midco, Momentum Telecom, NTT, Orange Business, Pilot Fiber, PS Lightwave, Ritter Communications, Segra, Shentel Business, Silver Star Telecom, Sparklight Business, Syringa, T-Mobile, Tata, TDS Telecom, TPx, Unite Private Networks, Uniti, US Signal, WOW!Business, Ziply Fiber and other companies selling retail Ethernet services in the U.S. market.

“Share rankings on the U.S. Ethernet LEADERBOARD remain unchanged for the first half of 2022, however a shakeup is possible by the end of the year,” said Rick Malone, principal of Vertical Systems Group. “Escalating requirements for Gigabit Ethernet services – and particularly 100+Gbps – are spurring capacity upgrades and intensifying competition among fiber-based providers.”

In contrast, the 2021 Global Carrier Ethernet leaders are: Orange Business Services (France), Colt (U.K.), Verizon (U.S.), AT&T (U.S.), Lumen (U.S.), BT Global Services (U.K.) and NTT (Japan). This industry benchmark for multinational Ethernet network market presence ranks companies that hold a 4% or higher share of billable retail ports at sites outside of their respective home countries.

VSG Principal Rick Malone told Fierce Telecom that he expects a reshuffling in the order of the top six U.S. Carrier Ethernet operators by the end of this year. According to Malone, the U.S. Carrier Ethernet arena is a relatively mature market (this author says it is VERY MATURE as it’s >20 years old). Malone noted “there are multiple companies, not just the top two, but multiple companies that are fairly close together in share of those six” at the top of its leaderboard. Cox Business is the sixth company on the mid-2022 Leaderboard, ranking just behind Comcast.

Malone said VSG will be keeping a close eye on Lumen in light of the recent divestiture of its Latin America assets. While that move likely won’t have a direct impact on its number of Ethernet ports in the U.S., it could impact some of Lumen’s global customers, he said. Malone added that the market overall achieved a year-on-year port growth rate “in the low single digits,” so below 5%. But he noted only about half the companies VSG surveyed grew and that is to be expected in a mature market!

“There are quite a few of them (Carrier Ethernet service providers) that actually have lower port counts than they had previously. Some of that is that they’re consolidating lower speed circuits into higher speed circuits,” he explained. “But there are some that don’t view their Ethernet service as their lead strategic service when they go and talk to an enterprise. They are leading with SD-WAN and SASE and the security products that you’d expect.”

Some of the companies that have been successful in the Ethernet arena are those which have been migrating their customer base away from MPLS to SD-WAN and using Ethernet as a transport mechanism for the latter. “That managed migration is helping them sell additional Ethernet services as an underlay,” Malone concluded.

References:

https://www.fiercetelecom.com/telecom/shakeup-brewing-lumen-led-us-carrier-ethernet-market