Huawei reports 3rd straight quarter of revenue growth despite U.S. sanctions

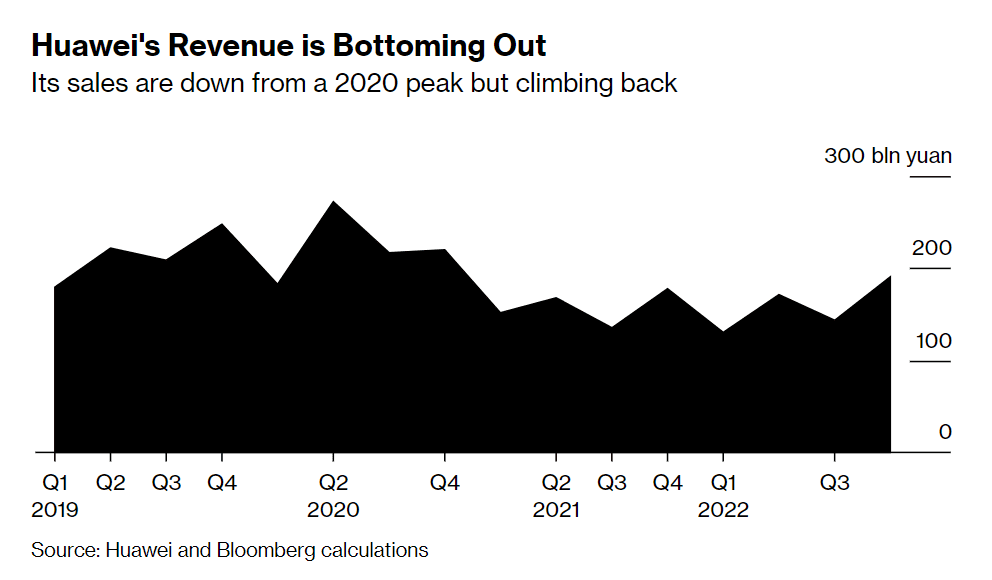

Huawei Technologies Co. posted its third consecutive quarter of growth, declaring a return to normalcy after overcoming a plethora of U.S. restrictions this year. The company’s sales rose 7.2% to 191 billion yuan ($27.4 billion) in the December quarter, according to Bloomberg’s calculations off annual figures, after carving out new income streams from areas such as smart cars and cloud services. 2022 sales stood at 636.9 billion yuan, the Shenzhen-based company said, up marginally from a year earlier.

Huawei is trying to open up new markets and businesses after U.S. tech export restrictions gutted its smartphone business — briefly the world’s largest — and curtailed the sale of advanced gear in developed markets. Among those trade restrictions is a ban on contract chipmakers producing semiconductors designed by Huawei, effectively kneecapping its HiSilicon design business. Selling patents has been a new revenue stream. The company also began levying patent royalties on Apple, Samsung, and other firms. According to Alan Fan, Huawei’s global head of IP, the Chinese firm signed more than 20 patent license agreements in 2022, covering connected automobiles, IoT, networking, and smartphones.

…………………………………………………………………………………………………………………………………………………………………………….

Rotating Chairman Eric Xu warned in an annual new year’s message to employees of macroeconomic uncertainty in 2023, though he made no mention of China’s abrupt reversal on Covid policy. That about-face has spurred concerns about the fallout on economies from a subsequent surge in infections. But Xu said longer-term demand for technology remains intact. He didn’t specify how the company might overcome export restrictions, but Huawei has spent much of the past three years developing, researching and sourcing alternatives to American components. “In 2022, we successfully pulled ourselves out of crisis mode.

“U.S. restrictions are now our new normal, and we’re back to business as usual,” Xu wrote in the letter that was addressed to staff and released to media.

…………………………………………………………………………………………………………………………………………………………………………….

U.S. restrictions are now our new normal, and we’re back to business as usual,” Xu said. “The macro environment may be rife with uncertainty, but what we can be certain about is that digitalization and decarbonization are the way forward, and they’re where future opportunities lie.”

…………………………………………………………………………………………………………………………………………………………………………….

Huawei’s also sought out alternative sources of income by selling patents, technology services and wireless gear to new customers from automakers to coal mines and industrial parks. It began levying royalties from the world’s biggest smartphone brands, including Apple Inc. and Samsung Electronics Co.

…………………………………………………………………………………………………………………………………………………………………………….

The Chinese powerhouse has signed more than 20 patent license agreements this year, covering smartphones, connected vehicles, networking and the Internet of Things, according to Alan Fan, the company’s global head of IP. “We’ve managed to keep our heads above the water because we fought together, united as one,” Xu wrote. “2023 will be the first year that we return to business as usual with external restrictions still in place.”

…………………………………………………………………………………………………………………………………………………………………………….

Huawei is trying to open up new markets and businesses after U.S. tech export restrictions gutted its smartphone business — briefly the world’s largest — and curtailed the sale of advanced gear in developed markets. Among those trade restrictions is a ban on contract chipmakers producing semiconductors designed by Huawei, effectively kneecapping its HiSilicon design business.

…………………………………………………………………………………………………………………………………………………………………………….

Selling patents has been a new revenue stream. The company also began levying patent royalties on Apple, Samsung, and other firms. According to Alan Fan, Huawei’s global head of IP, the Chinese firm signed more than 20 patent license agreements in 2022, covering connected automobiles, IoT, networking, and smartphones.

…………………………………………………………………………………………………………………………………………………………………………….

The Chinese powerhouse has signed more than 20 patent license agreements this year, covering smartphones, connected vehicles, networking and the Internet of Things, according to Alan Fan, the company’s global head of IP. “We’ve managed to keep our heads above the water because we fought together, united as one,” Xu wrote. “2023 will be the first year that we return to business as usual with external restrictions still in place.”

…………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.reuters.com/technology/chinas-huawei-sees-2022-revenue-6369-bln-yuan-report-2022-12-30/

2 thoughts on “Huawei reports 3rd straight quarter of revenue growth despite U.S. sanctions”

Comments are closed.

From Reuters:

Revenue for 2022 still remained well below the company’s record of $122 billion in 2019. At the time the company was at its peak as the top Android smartphone vendor globally.

In 2019, the U.S. Trump administration imposed a trade ban on Huawei, citing national security concerns, which barred the company from using Alphabet Inc’s Android for its new smartphones, among other critical U.S.-origin technologies.

The sanctions caused its handset device sales to plummet. It also lost access to critical components that barred it from designing its line of processors for smartphones under its HiSilicon chip division.

The company continues to generate revenue via its networking equipment division, which competes with Nokia (NOKIA.HE) and Ericsson (ERICb.ST). It also operates a cloud computing division.

The company began investing in the electric vehicle (EV) sector as well as green technologies around the time sanctions took effect.

2 minute readDecember 30, 20227:58 AM PSTLast Updated a day ago

China’s Huawei sees ‘business as usual’ as U.S. sanctions impact wanes

By Josh Horwitz

SHANGHAI, Dec 30 (Reuters) – Chinese tech giant Huawei Technologies Co Ltd (HWT.UL) estimated on Friday its 2022 revenue remained flat, suggesting that its sales decline due to U.S. sanctions had come to a halt.

Despite sales increasing a mere 0.02%, rotating chairman Eric Xu struck an upbeat tone in the company’s annual New Year’s letter, where he revealed the figure.

“U.S. restrictions are now our new normal, and we’re back to business as usual,” Xu wrote in the letter that was addressed to staff and released to media.

article-prompt-devices

Register for free to Reuters and know the full story

Advertisement · Scroll to continue

Revenue for the year is expected to be 636.9 billion yuan ($$91.53 billion), according to Xu.

That represents a tiny increase from 2021, when revenue hit 636.8 billion yuan, and marked a 30% year-on-year sales tumble as the U.S. sanctions on the company took effect.

Xu’s letter did not mention Huawei’s profitability. The company typically discloses its full annual results in the following year’s first quarter.

Latest Updates

Bankman-Fried set to enter not guilty plea in FTX fraud case

First pre-trial hearing in Microsoft-Activision case set for Jan. 3

Russia’s Yandex co-founder Volozh pens farewell message to staff

U.S. examining crypto wallets linked to FTX’s Bankman-Fried – Bloomberg News

FTX says Bahamas regulators hold $296 million, not $3.5 billion of company’s assets

World Artificial Intelligence Conference in Shanghai

A person stands by a sign of Huawei during World Artificial Intelligence Conference, following the coronavirus disease (COVID-19) outbreak, in Shanghai, China, September 1, 2022. REUTERS/Aly Song

Revenue for 2022 still remained well below the company’s record of $122 billion in 2019. At the time the company was at its peak as the top Android smartphone vendor globally.

In 2019, the U.S. Trump administration imposed a trade ban on Huawei, citing national security concerns, which barred the company from using Alphabet Inc’s (GOOGL.O) Android for its new smartphones, among other critical U.S.-origin technologies.

Advertisement · Scroll to continue

The sanctions caused its handset device sales to plummet. It also lost access to critical components that barred it from designing its line of processors for smartphones under its HiSilicon chip division.

The company continues to generate revenue via its networking equipment division, which competes with Nokia (NOKIA.HE) and Ericsson (ERICb.ST). It also operates a cloud computing division.

The company began investing in the electric vehicle (EV) sector as well as green technologies around the time sanctions took effect.

“The macro environment may be rife with uncertainty, but what we can be certain about is that digitisation and decarbonisation are the way forward, and they’re where future opportunities lie,” said Xu in the letter.

https://www.reuters.com/technology/chinas-huawei-sees-2022-revenue-6369-bln-yuan-report-2022-12-30/

EU gives Huawei millions in R&D funding:

Huawei has received millions of euros from the EU to fund some of its R&D activities, despite the EU itself heaping pressure on telcos to avoid using the vendor’s kit.

The Financial Times reported (paywall) on Wednesday that Huawei is participating in no fewer than 11 projects under the EU’s Horizon Europe research and innovation programme, which runs to 2027 and has a budget of €95.5 billion. One of its pillars, called ‘Global challenges and European industrial competitiveness’, covers everything from healthcare, agriculture and animal welfare, to high-performance computing, transport, and smart networks and services, among others.

Huawei has hoovered up €3.89 million, which isn’t much a of dent, but as the FT notes, this is more about a Chinese vendor playing a role in the development of next-generation network technologies that could one day underpin European comms infrastructure.

That wouldn’t be a problem if the EU was fine with Huawei technology being present in European telco networks. But it is very much not fine with that.

Thierry Breton, EU commissioner in charge of the internal market, emphasised at an event last week the importance for telcos to take seriously the EU’s 5G toolbox framework.

Developed in 2020, it stopped short of banning Huawei from networks, but advised operators not to buy kit from what the EU termed ‘high-risk’ vendors that it warned may jeopardise the security of their networks. It essentially meant the EU could be anti-Chinese tech without resorting to bombast.

Breton last week praised those telcos that have interpreted the advice as more of a tacit instruction, but noted that others “are late”, and urged those late-runners to get a move on.

At the same time, a separate FT report alleged that the EU is close to issuing an outright ban on member states using companies that represent a risk to the security of 5G networks. Citing Breton, the report claims just a third of EU countries have taken action to prevent Huawei 5G gear from ending up in comms networks.

The EU is also quite prepared to use its influence to pressure countries beyond its borders into not using Chinese network equipment.

The EU’s envoy to Malaysia, in tandem with their US counterpart, last month warned Malaysia against taking any action that might open the door to Huawei. The intervention was prompted by the government’s decision to review the tender process for its state-backed shared 5G network. Since then, Malaysia has confirmed plans to create a second national wholesale network, and doesn’t seem particularly bothered by telcos collaborating with Chinese vendors, undoubtedly to the US and the EU’s chagrin.

This staunch anti-China stance therefore makes Huawei’s participation in Horizon Europe all the more puzzling.

If Huawei really does represent a threat to the future security of Europe’s 5G infrastructure, then there is no justification for paying it millions of euros to help design the future of this infrastructure.

https://telecoms.com/522224/eu-gives-huawei-millions-in-rd-funding/