Huawei

Omdia: Huawei increases global RAN market share due to China hegemony

Due to China’s enormous mobile network market (where foreign vendors are mostly shut out), Huawei remained the world’s largest vendor of radio access network (RAN) equipment – a market worth about $35 billion last year – according to Omdia (an Informa owned company). In 2023, the Chinese behemoth had a 31.3% share of the global RAN market. Omdia says Huawei’s market share was up by an unspecified amount in 2024, due to “a more favorable regional mix as well as market share gains in emerging markets,” according to Remy Pascal, principal analyst at Omdia.

Huawei recently reported a 22% increase in sales last year, to 860 billion Chinese yuan (US$ 118.6 billion), and it looks in better shape than its ailing western rivals. Its share of the global 5G networks market appears to have grown, according to the market research firm.

Omdia’s findings seems further to highlight the futility of U.S. sanctions against Huawei, originally imposed by Donald Trump in his first term as U.S. President and then expanded by President Joe Biden.

Image Credit: Huawei

China still lacks the ability to make the most advanced chips featuring the tiniest transistors. But technical workarounds or loopholes in trade rules have enabled Huawei to revive its smartphone business and remain competitive in networks. Late last year, telco executives who spoke on condition of anonymity said there had been no discernible impact on the quality of its products. And Ericsson continues to regard Huawei as its chief rival.

……………………………………………………………………………………………………………………………………….

“After two years of significant acceleration and exceptionally high investment in 2021 and 2022, and two years of steep decline in 2023 and 2024, Omdia expects 2025 to be a year of stabilization for the RAN market,” said Remy Pascal of Omdia. “Different regions will follow different trajectories, but at a global level, the market is expected to be flattish. North America has returned to growth in 2024 and we expect this to continue, we also expect a positive trajectory in some emerging markets.”

……………………………………………………………………………………………………………………………..

Other results and forecasts from Omdia:

- The total global RAN market (which includes hardware and software but not services) was just over $35 billion last year, which represented a 12 percent decline on the previous year.

- There was a very slight drop in the aggregate market share of the top five RAN equipment vendors – Huawei, Ericsson, Nokia, ZTE and Samsung. In 2023, Omdia had that figure at about 95%. In 2024, it was roughly 94%.

- Ericsson was one of the main gainers last year thanks to its huge AT&T (non) OpenRAN contract.

- As a result, Nokia lost market share in the U.S., but claims that its global RAN footprint grew by 18,000 sites in 2024.

- Tejas Networks, an Indian RAN equipment vendor (not in the top five) that landed a large 4G contract with state-owned BSNL was another winner.

- Global RAN revenue will be “essentially flat” this year and marked by “low single digit percentage growth” outside China.

- A “positive trajectory” in emerging Asian markets as well as Africa, the Middle East and Latin America is forecast. Europe risks falling behind other parts of the world in mobile network markets.

Top RAN vendors, full year 2024 RAN revenue:

|

Global |

Global ex-China |

|---|---|

|

Huawei |

Ericsson |

|

Ericsson |

Nokia |

|

Nokia |

Huawei |

|

ZTE |

Samsung |

|

Samsung |

ZTE |

Top RAN vendors, full year 2024 RAN revenue, top 3 by region:

|

North America |

Asia & Oceania |

Europe |

Middle East and Africa |

Latin America & the Caribbean |

|---|---|---|---|---|

|

Ericsson |

Huawei |

Ericsson |

Huawei |

Huawei |

|

Nokia |

ZTE |

Nokia |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Ericsson |

……………………………………………………………………………………………………………………………………….

Dell’Oro Group’s most recent RAN report a few weeks ago stated that the global RAN market is expected to improve slightly over the short term, but the long-term outlook remains subdued. “The underlying message we have communicated for some time has not changed,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “Regional imbalances will impact the market dynamics over the short term while the long-term trajectory remains flat. This is predicated on the assumption that new RAN revenue streams from private wireless and FWA, taken together with MBB-based capacity growth, are not enough to offset slower MBB coverage-based capex,” said Dell’Oro’s Stefan Pongratz.

References:

https://www.lightreading.com/5g/huawei-defies-us-to-grow-market-share-as-ran-decline-ends-omdia

RAN Equipment Market to Remain Uninspiring, According to Dell’Oro Group

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

vRAN market disappoints – just like OpenRAN and mobile 5G

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Huawei’s “FOUR NEW strategy” for carriers to be successful in AI era

At the 10th Ultra-Broadband Forum (UBBF 2024) in Istanbul, Turkey, James Chen, President of Huawei’s Carrier Business, delivered a speech entitled “Network+AI, Unleashing More Business Value.”

“To explore the potential of AI, the ‘FOUR NEW’ strategy — new hub, new services, new experience, and new operation is crucial. It helps carriers to expand market boundaries, foster innovative services, and enhance market competitiveness, while also optimize network O&M and achieve business success. Huawei is committed to working with global carriers and partners to unleash more business value and forge a win-win digital and intelligent future through the “FOUR NEW” strategy.”

James Chen, President of Huawei’s Carrier Business, delivering a keynote speech

……………………………………………………………………………………………..

Huawei believes that its “FOUR NEW” strategy is key to unleashing more business value through the combination of networking and AI.

- New Hub: The new Hub is the AI Hub for home services. The core of the AI Hub is the development of AI agents. AI agents need to connect people, things, and applications, understand and respond to the requirements of family members, control smart devices to meet family requirements, and connect AI applications to expand the boundaries of home services. The new hub helps carriers achieve business breakthroughs in the home market.

- New Services: Carriers enable new services and aggregate high-quality contents with AI to gradually build a home AI application ecosystem. AI not only can upgrade traditional services, such as interactive fitness and motion-sensing games, but also innovate home services, such as home service robots, health care, and education, etc. It improves quality of life and gradually builds a home AI ecosystem.

- New Experience: New services such as cloud gaming, live commerce, AI searches for photos and videos, are emerging one after another. These services have high requirements on network quality, including latency, uplink and downlink bandwidth, and jitter. This brings new network monetization opportunities to carriers. Carriers can seize monetization opportunities through new business models, such as latency-based charging, upstream bandwidth-based charging, and AI-function based charging. High-quality service experience requires high-quality networks. Carriers build “Premium vertical and premium horizontal” high-quality networks to support high-quality service experience and business monetization. The key to building a “Premium vertical and premium horizontal” network is to build 1 ms connections between data centers and 1 ms access to a data center.

- New Operation: As carriers’ network scale is getting larger, autonomous driving network is becoming more important. AI supports high-level network autonomous driving and improves network operation efficiency. Huawei’s L4 autonomous driving network based on the Telecom Foundation Model helps operators reduce customer complaints, shorten the complaint closure time, improve service provisioning efficiency, reduce the number of site visits, and accelerate fault rectification.

In the wave of digital intelligence transformation, the “FOUR NEW” strategy is not only the embodiment of network technology innovation, but also the important driving force for continuously releasing network business value. New Hub, New Services, New Experience, and New Operation support each other and together form a complete road to digital intelligence business success.

In the future, Huawei will continue to remain customer-centric, work with global carriers and partners to explore the digital intelligence era, accelerate the release of the business value of network + AI, and embrace a prosperous intelligent world.

References:

Huawei’s First-Half Net Profit Rose on Strong Smartphone Sales, Car Business

China Unicom-Beijing and Huawei build “5.5G network” using 3 component carrier aggregation (3CC)

Despite U.S. sanctions, Huawei has come “roaring back,” due to massive China government support and policies

Huawei to revolutionize network operations and maintenance

Huawei’s First-Half Net Profit Rose on Strong Smartphone Sales, Car Business

Huawei Technologies Co.’s revenue grew for the sixth straight quarter as its smartphones gained significant market share in China. Net profit climbed 18% in the first half of the year, thanks to strong smartphone sales and robust growth in its car business. Huawei reports a handful of unaudited financial figures throughout the year and releases a more detailed audited annual report each spring. It didn’t provide data broken down by business segment for the first half.

The Chinese networking and electronics behemoth posted revenue of 239 billion yuan ($33.6 billion) in the June quarter, up 33.7% from a year earlier, according to calculations based on the company’s six-month financial figures. Implied net profit was 35.5 billion yuan, a drop of 18.6% from a year ago when Huawei recorded one-time gains from divestments. The company sold mobile maker Honor Device Co. to a consortium in 2020 and parts of its server business in 2021, with proceeds from both paid out in installments.

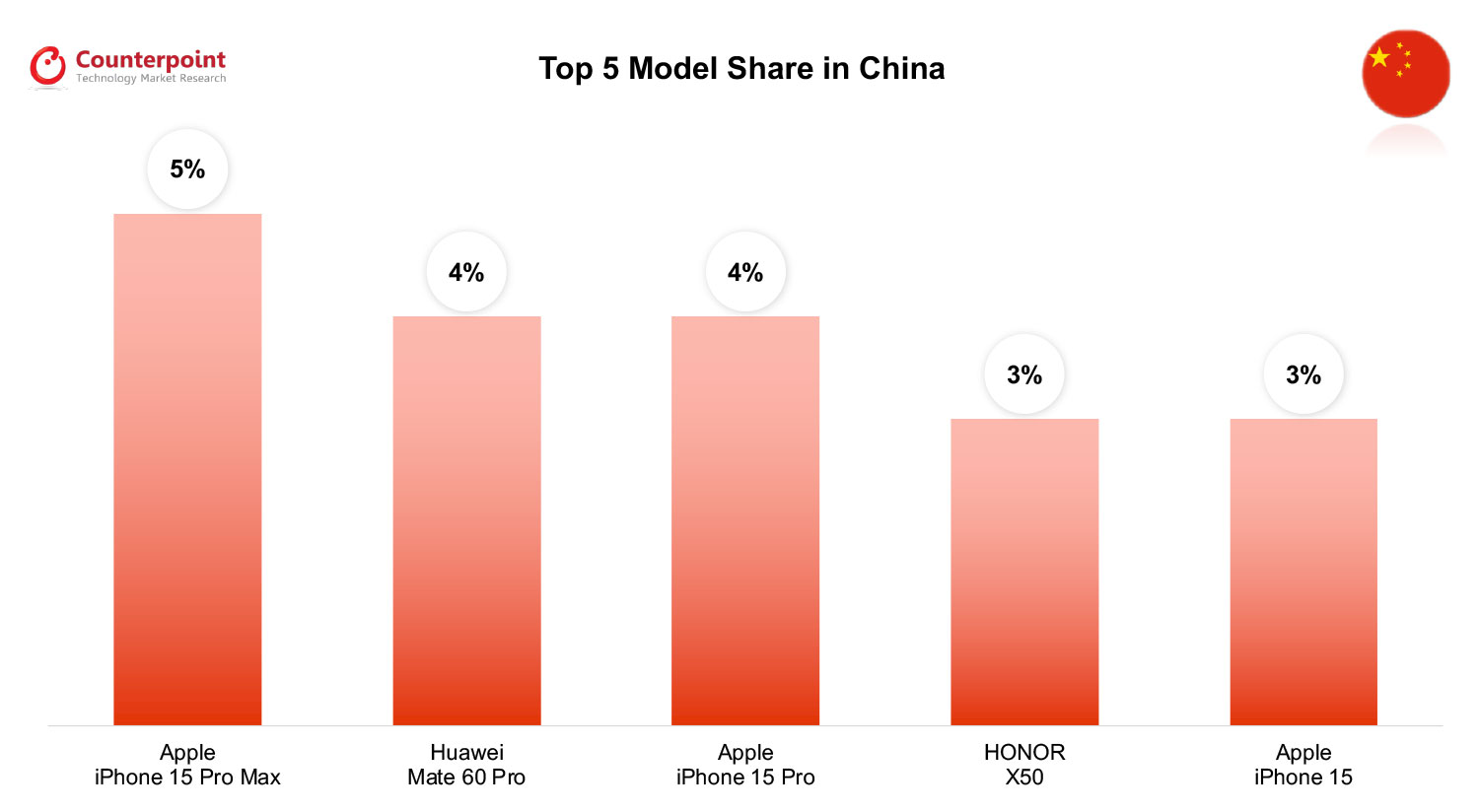

The Shenzhen-based company’s smartphone shipments rose by 50% last quarter as it and other local players like Vivo and Xiaomi Corp. beat out Apple, which dropped to sixth place among handset makers in China, according to market tracker IDC. Apple’s sales in China fell 6.5% in the June quarter, missing Wall Street projections, even as overall shipments in China grew.

Huawei’s next flagship Mate 70 will be closely watched for any processor upgrades when the device is introduced later this year. The Mate 60 roiled US policymakers when it debuted a China-made 7-nanometer chip a year ago, despite US-imposed sanctions and export controls geared to stem advances in China’s chip technologies.

Last year, Huawei more than doubled its net profit as it rebuilt the market share of its core businesses in consumer electronics and cloud computing, which were severely eroded by several years of U.S. sanctions that limited its access to advanced semiconductors.

In the second quarter, Huawei was the No. 2 smartphone seller in China, the world’s largest smartphone market, with an 18.1% market share, according to market-research firm International Data Corp. Counterpoint Research said Huawei’s sales jumped 44.5% in the quarter from a year earlier, the fastest growth among Chinese original equipment manufacturers, thanks to the Pura 70 and Nova 12 series. The company launched its Pura 70 series in April.

Huawei and other local smartphone makers like Vivo and Xiaomi Corp. beat out Apple, which dropped to sixth place among handset makers in China, according to market tracker IDC.

………………………………………………………………………………………………………………………..

Huawei has invested in its car business as Beijing ramps up support for high-tech industries as part of efforts to reduce the economy’s reliance on the property sector for growth.

The company’s automotive unit, which offers self-driving technology to electric vehicle makers, earned a revenue of 10 billion yuan as of early July, according to a report by a Chinese media outlet, more than the combined revenue in the previous two years. Huawei didn’t provide a breakdown of its sales.

Changan Automobile-backed Avatr Technology said in an exchange filing last week that it will acquire a 10% stake in Yinwang Smart Technology, Huawei’s car unit that provides autonomous-driving technology to automakers, valuing the company at 115 billion yuan. Seres on Monday said it will acquire a 10% stake in Yinwang.

……………………………………………………………………………………………………………………………………………

References:

Despite U.S. sanctions, Huawei has come “roaring back,” due to massive China government support and policies

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

China Unicom-Beijing and Huawei build “5.5G network” using 3 component carrier aggregation (3CC)

AI winner Nvidia faces competition with new super chip delayed

The Clear AI Winner Is: Nvidia!

Strong AI spending should help Nvidia make its own ambitious numbers when it reports earnings at the end of the month (it’s 2Q-2024 ended July 31st). Analysts are expecting nearly $25 billion in data center revenue for the July quarter—about what that business was generating annually a year ago. But the latest results won’t quell the growing concern investors have with the pace of AI spending among the world’s largest tech giants—and how it will eventually pay off.

In March, Nvidia unveiled its Blackwell chip series, succeeding its earlier flagship AI chip, the GH200 Grace Hopper Superchip, which was designed to speed generative AI applications. The NVIDIA GH200 NVL2 fully connects two GH200 Superchips with NVLink, delivering up to 288GB of high-bandwidth memory, 10 terabytes per second (TB/s) of memory bandwidth, and 1.2TB of fast memory. The GH200 NVL2 offers up to 3.5X more GPU memory capacity and 3X more bandwidth than the NVIDIA H100 Tensor Core GPU in a single server for compute- and memory-intensive workloads. The GH200 meanwhile combines an H100 chip [1.] with an Arm CPU and more memory.

Photo Credit: Nvidia

Note 1. The Nvidia H100, sits in a 10.5 inch graphics card which is then bundled together into a server rack alongside dozens of other H100 cards to create one massive data center computer.

This week, Nvidia informed Microsoft and another major cloud service provider of a delay in the production of its most advanced AI chip in the Blackwell series, the Information website said, citing a Microsoft employee and another person with knowledge of the matter.

…………………………………………………………………………………………………………………………………………

Nvidia Competitors Emerge – but are their chips ONLY for internal use?

In addition to AMD, Nvidia has several big tech competitors that are currently not in the merchant market semiconductor business. These include:

- Huawei has developed the Ascend series of chips to rival Nvidia’s AI chips, with the Ascend 910B chip as its main competitor to Nvidia’s A100 GPU chip. Huawei is the second largest cloud services provider in China, just behind Alibaba and ahead of Tencent.

- Microsoft has unveiled an AI chip called the Azure Maia AI Accelerator, optimized for artificial intelligence (AI) tasks and generative AI as well as the Azure Cobalt CPU, an Arm-based processor tailored to run general purpose compute workloads on the Microsoft Cloud.

- Last year, Meta announced it was developing its own AI hardware. This past April, Meta announced its next generation of custom-made processor chips designed for their AI workloads. The latest version significantly improves performance compared to the last generation and helps power their ranking and recommendation ads models on Facebook and Instagram.

- Also in April, Google revealed the details of a new version of its data center AI chips and announced an Arm-based based central processor. Google’s 10 year old Tensor Processing Units (TPUs) are one of the few viable alternatives to the advanced AI chips made by Nvidia, though developers can only access them through Google’s Cloud Platform and not buy them directly.

As demand for generative AI services continues to grow, it’s evident that GPU chips will be the next big battleground for AI supremacy.

References:

AI Frenzy Backgrounder; Review of AI Products and Services from Nvidia, Microsoft, Amazon, Google and Meta; Conclusions

https://www.nvidia.com/en-us/data-center/grace-hopper-superchip/

https://www.theverge.com/2024/2/1/24058186/ai-chips-meta-microsoft-google-nvidia/archives/2

https://news.microsoft.com/source/features/ai/in-house-chips-silicon-to-service-to-meet-ai-demand/

Huawei to revolutionize network operations and maintenance

Huawei rotating chair Eric Xu kicked off the company’s annual analyst summit in Shenzhen underlining a near ubiquitous focus on AI and outlined a broad strategy designed to improve the competitiveness of its products and operations, without sharing specifics or targets.

Xu explained the company is pursuing a number of initiatives across multiple tracks to take advantage of new opportunities in AI. In addition to driving advancements in AI to build “thriving ecosystems for shared success”, he said Huawei is actively integrating the technology into its internal management to improve operating efficiency.

The company aims to “revolutionize network operations and maintenance” with its autonomous driving network offering, but Xu didn’t provide an update on the ongoing initiative. He added it is working to upgrade its Celia smart assistant, launched in 2018, which is connected to its evolving Pangu AI models developed for a number of sectors.

Eric Xu speaking at 2024 Huawei Analyst Summit

With the company facing tight restrictions on the import of advanced chips and other equipment as well as curbs in many western markets on its networking gear, Xu avoided talking about its core network carrier group and any mention of handsets now sporting high-end domestic chips.

Steven Zhao, Vice President of Huawei’s Data Communication Product Line, delivered a speech entitled “Accelerating Network Transformation Towards All Intelligence”. Mr. Zhao shed light on how Huawei introduced AI technologies to upgrade network capabilities at case-, process-, and system-levels and accelerate network intelligence. Participants, including industry partners, also explored the current trends and future prospects of the Net5.5G industry.

Despite broad trade sanctions, Huawei last August secured 7nm processors for its Mate 60 Pro from state-owned Semiconductor Manufacturing International Corp, raising concerns among U.S. officials if the Chinese chipmaker bypassed export controls.

During the 21st Huawei Analyst Summit, the “Building F5.5G All-Optical Target Network, and Ushering in 10 Gbps UBB Intelligent Era” forum was held, where industry stakeholders deliberated on how to apply F5.5G optical technologies to build home and industry intelligence. Also at this forum, Bob Chen, President of Huawei Optical Business Product Line, said, “To stride to the intelligent era in the next 10 years, a high-quality computing bearer network, that is, F5.5G all-optical premium computing network, needs to be built to ensure that computing power is always-on with 99.9999% availability and instantly-accessible with 1 ms latency. With its ubiquitous 10 Gbps access, the network makes computing power accessible everywhere and connects ubiquitous intelligence, enabling intelligence in various industries.”

…………………………………………………………………………………………………………………

Huawei’s net profit in 2023 increased 144.5% year-on-year to CNY86.9 billion ($12 billion), with revenue rising 9.6% to CNY704.2 billion, driven by a 17.3% increase in consumer revenue to CNY251.5 billion.

Last year, the company combined revenue from its carrier network business and enterprise unit into a single figure. In 2022, Huawei’s carrier group accounted for 44.2% of total revenue.

References:

https://www.huawei.com/en/news/2024/4/has-net-5-point-5g-ai

https://www.huawei.com/en/news/2024/4/has-net-5-point-5g-ai

https://www.huawei.com/en/news/2024/4/has-f5-point-5g-all-optical

Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground

Huawei expects to report revenue exceeding 700 billion yuan ($98.5 billion) for 2023, according to comments from rotating deputy chairman Ken Hu in an internal new year message seen by Reuters.

Mr. Hu Houkun (Ken Hu), Huawei’s deputy chairman Photo Credit: Huawei

That optimistic forecast offers further evidence that Huawei is rebounding after U.S. sanctions starting in 2019 crippled some of its business lines by restricting access to critical global technologies such as advanced chips.

“Thanks to our partners across the value chain for standing with us through thick and thin. And I’d also like to thank every member of the Huawei team for embracing the struggle – for never giving up,” Hu said.

“After years of hard work, we’ve managed to weather the storm. And now we’re pretty much back on track.”

“In 2023, we expect to wrap up the year with over 700 billion yuan [US$98.9 billion] in revenue,” he added. That would be a 9% increase on sales from 2022, when the comparable rate of global telecom revenue growth was less than 1%.

Indeed, 2023 has been a very difficult year for telecom network equipment makers such as Ericsson and Nokia. Ericsson’s revenues for the first nine months fell 7% on a constant-currency basis. Nokia’s were down 3%.

…………………………………………………………………………………………………….

What sectors might be responsible for the 9% sales growth Huawei expects this year? From the first paragraph of Ken Hu’s commentary.

“Our ICT infrastructure business has remained solid, and results from our device business surpassed expectations. Both our digital power and cloud businesses are growing steadily, and our intelligent automotive solutions have become significantly more competitive.”

Huawei’s improvement might be due to the upbeat performance of its devices business which includes smartphones and smartwatches. In 2020, the company’s consumer unit accounted for about 54% of all Huawei’s revenues, but its sales halved the following year. It was badly hurt by sanctions because smartphones have a greater need than networks do for advanced chips. Huawei was also cut off from Google software that runs on other Android smartphones. Its response to all this included the sale of Honor, a big smartphone subsidiary.

This past August, Huawei launched its Mate 60 series of smartphones, which are believed to be powered by a domestically developed chipset. The release was widely viewed as marking Huawei’s comeback into the high-end smartphone market after years of struggling under U.S. sanctions.

Huawei’s smartphone shipments surged 83% in October year-on-year, helping the overall Chinese smartphone market to grow 11% over the same period, according to Counterpoint Research which wrote:

Huawei’s success and climb in the rankings has been helped by the recent launch of its Mate 60 series 5G phones and popularity of its older P-series 4G devices. “The company is posting some very good growth numbers, but obviously there’s base effects happening,” notes China analyst Archie Zhang. “We expect it will grow by more than half this year, but that still doesn’t bring them close to pre-COVID levels. But it’s signalling a promising 2024.”

Huawei’s smartwatch business is doing very well. Counterpoint’s Woojin Son wrote:

“There is significant value in examining the growth drivers of the global smartwatch market in Q3 2023. Amid a global economic slowdown, most consumer device markets like smartphones are still experiencing stagnation compared to a year ago. In contrast, the smartwatch market has recorded YoY growth for two consecutive quarters in both premium and budget segments. Notably, High-level Operating System (HLOS)* smartwatches, typically featuring higher specification and price, have grown largely driven by Huawei in Q3 2023 as the company posted its highest quarterly performance ever. Most of this surge occurred in the Chinese domestic market, coupled with the launch of new Huawei 5G smartphones.”

……………………………………………………………………………………………………………………..

Looking ahead to 2024, Huawei said in the letter the device business would be one of the major business lines it would focus on for expansion. “Our device business needs to double down on its commitment to developing best-in-class products and building a high-end brand with a human touch,” the letter said.

Missing from Hu’s remarks was any reference to Huawei’s profits, which plummeted 69% last year, to just RMB35.6 billion ($1 billion).

Huawei watchers will probably have to wait until the publication of its 2023 annual report for an update. For sure, the company is cutting costs. “We will continue to streamline HQ, simplify management, and ensure consistent policy, while making adjustments where necessary,” said Huawei’s chairman.

Yet the company will likely continue to ramp up R&D spending. RMB161.5 billion ($22.8 billion) was spent on R&D in 2022, about a quarter of total revenues and a 13% year-over-year increase. Expect a similar increase for 2023 and 2024.

References:

Singles Day Growth Boosts Odds of China Market Smartphone Recovery in Q4 2023

Global Smartwatch Market Rebounds; Huawei and Fire-Boltt Hit New Peaks

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Huawei reported a flat third quarter, with sales of 145.7 billion Chinese yuan ($19.9 billion), up just 1% over last year and a net profit margin of 16.0%. The Shenzhen based telecom equipment and mobile phone vendor said the profit margin had been boosted by the latest tranche from the sale of the Honor handset assets three years ago. It said improved efficiencies and optimized sales and product strategies had also had a positive impact on profitability.

“The company’s performance is in line with forecast,” said Ken Hu, Huawei’s Rotating Chairman. “I’d like to thank our customers and partners for their ongoing trust and support. Moving forward, we will continue to increase our investment in R&D to make the most of our business portfolio and take the competitiveness of our products and services to new heights. As always, our goal is to create greater value for our customers, partners, and society.”

Huawei reported growth in the consumer business unit and “strong growth” in the new digital power and cloud businesses, but the company was silent on its carrier equipment unit, its largest, suggesting it has also been hit by the decline in operator spending.

Huawei smartphone summary:

Huawei was the fastest-growing smartphone maker in China in the third quarter after the company released a smartphone with a surprisingly advanced chip inside.

- In September, Huawei launched the Mate 60 Pro in China. It’s equipped with an advanced chip and 5G connectivity, technology that U.S. sanctions had been designed to stop Huawei getting its hands on.

- The success of that device helped Huawei’s smartphone sales in China grow 37% year on year, according to a report from Counterpoint Research.

- Sales of Honor, the largest smartphone maker by market share, rose just 3% year on year. Vivo, Oppo and Apple all saw double-digit declines, according to Counterpoint Research.

References:

https://www.huawei.com/en/news/2023/10/businessresults-threequarters

https://www.lightreading.com/5g/huawei-reports-no-real-growth-in-q3

https://www.lightreading.com/5g/huawei-lifts-handset-outlook-wins-1b-in-5g-orders

Nikkei Asia: Huawei demands royalties from Japanese companies

Huawei Technologies is seeking patent licensing fees from roughly 30 small to midsize Japanese companies for the use of patented technology, Nikkei Asia has learned. That indicates the sanctions-hit Chinese telecommunication giant’s growing reliance on such revenue. A source at Huawei’s Japan unit revealed that “talks are currently underway with about 30 Japanese telecom-related companies.”

The telecom equipment and phone maker is believed to be stepping up royalty collection in Southeast Asia as well. It is highly unusual for a major manufacturer to directly negotiate with smaller clients regarding patent fees. Huawei is facing an increasingly tough business environment as U.S. sanctions stemming from data security concerns have made it difficult to sell products overseas.

Huawei is seeking fees from manufacturers and others that use components called wireless communication modules. Sources at several Japanese companies said businesses as small as just a few employees to startups with over 100 workers have received requests from Huawei.

Requested payment levels range from a fixed fee of 50 yen (35 cents) or less per unit to 0.1% or less of the price of the system.

“The level is on par with international standards,” said Toshifumi Futamata, a visiting researcher at the University of Tokyo.

Huawei holds a high share of so-called standard-essential patents that are crucial to using such wireless communications standards as 4G or Wi-Fi. Equipment made by other companies compatible with those IEEE 802.11/ITU-R standards also use Huawei’s patented technology. This means if Huawei demands it, many companies using related internet-connected devices will have to pay patent royalties.

Even Japanese companies that do not use Huawei products could incur unexpected expenses. Furthermore, many small and medium-sized companies are unfamiliar with patent negotiations, raising concerns about signing contracts with unfavorable terms.

“Depending on the content of the contracts, it could lead to data leaks for Japanese companies,” Futamata warned. “They need to enlist lawyers and other experts for help to avoid signing disadvantageous contracts.”

Contracts that include authorization to access the communication module’s software pose risk of data leaks, Futamata added.

Negotiations over telecommunications technology patents are generally conducted between major equipment manufacturers. Such negotiations are time-consuming and selling their own products is far more profitable.

But Huawei’s profit has plunged as U.S. sanctions have cut its access to American technology and goods. Without access to Google’s Android, for example, it has struggled to sell devices overseas. Growing U.S.-China tensions have prompted Japanese companies to avoid adopting Huawei products.

As patent royalties are not subject to trade restrictions, this could be a source of stable income for Huawei. The company established an intellectual property strategy hub in Japan to oversee its IP business in the Asia-Pacific region, including Singapore, South Korea, India and Australia.

Japanese automaker Suzuki Motor agreed with Huawei by the end of 2022 to license standard essential patents related to 4G communications technology used for connected cars. More Japanese companies could face payments demands from Huawei. Wireless communication modules using Huawei’s patented technology are indispensable for connected Internet of Things (IoT) networks, according to Tokyo-based research company Seed Planning. The technology is being adopted in autonomous driving, automated factories, medicine, power and logistics.

References:

Huawei forecast to increase mobile phone shipments despite Android ban

UAE’s Du demonstrates 5G VoNR with Huawei and Nokia

Huawei says 5.5G is necessary with fully converged cloud native core network

Huawei’s blueprint to lay the foundation for 5.5G and the “intelligent world”

Huawei reinvents itself via 5G-enabled digitalized services to modernize the backbone of China’s industrial sectors

Huawei says 5.5G is necessary with fully converged cloud native core network

Huawei maintains that a new 5.5G core network is needed to address a plethora of new use cases and new opportunities. That despite of the very limited deployment of 3GPP’s 5G SA Core network architecture specs. The company is calling on partners to promote industry consensus and commercial deployments for the era of 5.5G, an evolution of 5G technology.

Yang Chaobin, senior vice-president of Huawei, said: “The rapid growth of 5G has led to new service requirements that are becoming more diverse and complex. Such changes demand stronger 5G capabilities.”

Yang said that as 6G is still in the early stages of research, 5.5G is a necessary and natural evolution of 5G, which has become an industry consensus.

According to GSA, 35 network operators in 20 countries have launched commercial public 5G SA networks. In addition to those, GSA identified 77 other operators that are currently investing in 5G SA for public networks (including those evaluating/testing, piloting, planning, or deploying).

In 2020, containers and micro-services were introduced as key components of cloud-native network design and migration path to 5G core networks with high degree of much needed automation. At this point, intent-driven algorithms are used to automate large-scale cloud-native 5G telecom networks.

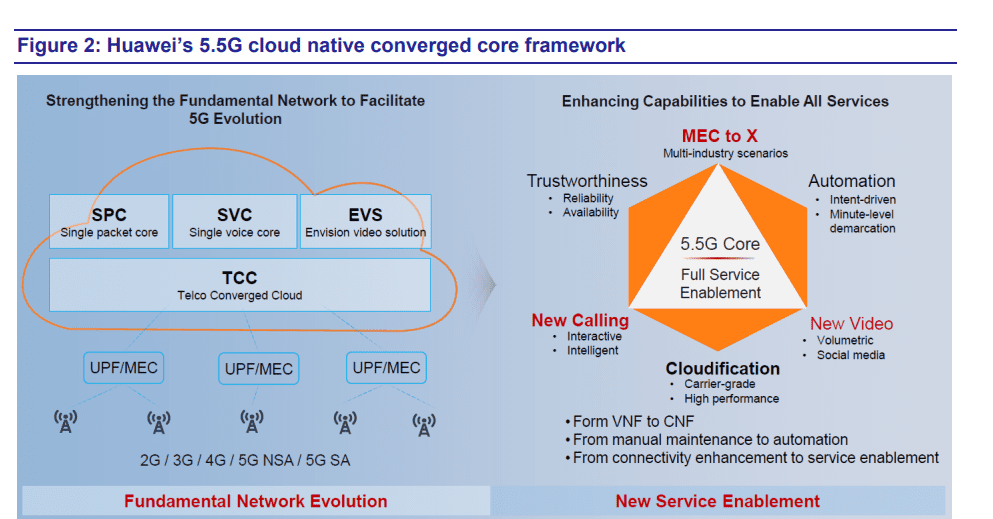

Figure 1. Huawei at MWC 2023

Figure 2. below illustrates Huawei’s complete 5.5G cloud-native converged core strategy that is based on strengthening the current networking building blocks that paved the way to where we are today, and continuously adding new capabilities and enhancing them to enable all services needed to address the plethora of new 5G use cases.

Source: Huawei

……………………………………………………………………………………………………………………………………………………………

Backgrounder on 5G Advanced:

3GPP initiated the 5G-Advanced project in early 2021 and started the formulation of Release 18 specs to enhance the existing mobile network capabilities. Case in point: UPF (User Plane Function) Mesh and MEC (Multi-access Edge Computing) enhancements were introduced to enable 5G to cover more industry scenarios, which in the new 5.5G core platform, is addressed through the “MEC to X” concept to accelerate the digital transformation of industries.

In addition, the Rel. 18 NG-RTC (Next Generation Real-Time Communications) feature enhances the communication capability and enriches the communication services, including calling and video, or “New Calling” and “New Video” in 5.5G core (see Figure 2. above).

……………………………………………………………………………………………………………………………………………………………

Huawei laid out five major characteristics of the 5.5G era – 10 Gbps experiences, full-scenario interconnection, integrated sensing and communication, autonomous networks and green information communications technology.

Yang called on the global telecom industry to jointly promote 5.5G development in four areas including setting clear roadmaps for industry standardization and a clear strategy for spectrum, which is fundamental to wireless networks.

Huawei and Saudi Arabian telecommunications operator Zain KSA signed a memorandum of understanding (MoU) last month for the”5.5G City” joint innovation project.

Under the MoU, both parties will work together to promote technological innovation for 5.5G evolution and expand scalable offerings to individuals, enterprises and government customers. Additionally, they will strengthen the digital infrastructure and build a global 5.5G evolution pioneer network, providing a strong engine to achieve the national digitalization goals outlined in Saudi Vision 2030.

Abdulrahman Al-Mufadda, chief technology officer of Zain KSA, said, “Our commitment to driving digital transformation has been made possible by combining innovative technology investments with pioneering digital solutions across multiple fields, including cloud computing, fintech, business support and drone technologies.”

The cooperation came as 5G is now in the fast lane after three years of commercial use. By the end of 2022, global 5G users exceeded 1 billion, gigabit broadband users reached 100 million, and more than 20,000 industry applications were put into use, according to data compiled by Huawei.

Leading operators in China, South Korea, Switzerland, Finland and Kuwait have already achieved 5G user penetration rates of more than 30 percent with more than 30 percent of their traffic coming from 5G, Huawei said.

Network intelligence and connectivity insights provider Ookla’s latest 5G City Benchmark Report showed Huawei has played an important role in 5G network construction in all of the top 10 cities among the world’s 40 most 5G-enabled cities. Performance results in these 10 cities show 5G networks constructed by Huawei offer the best experience.

Last month, Huawei also revealed a collaboration with Botswana’s Debswana Diamond Co (Pty) Ltd on the world’s first 5G smart diamond mine project.

Debswana’s Head of Information Management Molemisi Nelson Sechaba said that the Huawei-enabled smart mine solution has been deployed at Debswana’s Jwaneng open-pit diamond mine. The project started operation in December 2021.

At present, Huawei’s 4G eLTE, an advanced version of 4G technology, provides stable connectivity for the Jwaneng mine, connecting more than 260 pieces of equipment, including drilling rigs, excavators, heavy trucks and pickup trucks. This enables interconnection between the mine’s production, safety and security systems, Sechaba said.

The Jwaneng mine is the world’s first 5G-oriented smart diamond mine, which means the hardware equipment such as base stations used in the mine’s digital transformation support network has upgraded to 5G, Huawei said.

Huawei claims they’ve seamlessly migrated their existing and dedicated core network platforms (e.g., SPC, SVC, EVS in Figure 2) as well as its telco converged cloud to a fully converged cloud-native 5.5G core that features full-service enablement. In other words, the company says the transition from virtual network functions (VNF) to cloud native network functions (CNF), from manual operation to automation and from connectivity provisioning and enhancement to full-service enablement has been completed.

–>That’s all in advance of 3GPP Release 18 specs on 5G Advanced (which won’t be frozen till March 2024)?

…………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.chinadaily.com.cn/a/202303/20/WS6417b0a5a31057c47ebb55b2.html

Huawei’s blueprint to lay the foundation for 5.5G and the “intelligent world”

Virtual Network Function Orchestration (VNFO) Market Overview: VMs vs Containers

Huawei’s blueprint to lay the foundation for 5.5G and the “intelligent world”

According to Huawei, the intelligent world will be deeply integrated with the physical world. Everything, including personal entertainment, work, and industrial production, will be intelligently connected. This means that networks will have to evolve from ubiquitous Gbps to ubiquitous 10Gbps, connectivity and sensing will need to be integrated, and the ICT industry will have to shift its focus from energy consumption to energy efficiency. The evolution from 5G to 5.5G will be key to meeting these growing requirements.

At MWC 2023, Huawei unveiled its “GUIDE to the Intelligent World“ as a business blueprint to lay the foundation for 5.5G. Whatever happened to 5G Advanced and 3GPP Release 18? and ITU-R WP5D M.2150 recommendation?.

Following on from Huawei’s concept of “Striding Towards the 5.5G Era” that was proposed in July 2022, Huawei is highlighting the five major characteristics of the 5.5G era:

- 10 Gbps experiences

- Full-scenario interconnection

- Integrated sensing and communication

- L4 autonomous driving networks

- Green ICT

For Huawei, 5.5G represents a 10-fold improvement in performance over 5G in every metric. That means 10 Gbps headline connection speeds, 10 times the number of IoT connections – which translates to 100 billion in total – and reducing latency by a factor of 10. Networks also need to consume a tenth of the energy that they consume today on a per Terabyte basis, and they need to be 10x more intelligent, which means supporting level 4 autonomous driving, and making operations and maintenance (O&M) more efficient by a factor of 10.

With these capabilities in place, 5.5G networks will enable a boom in immersive interactive experiences, like VR gaming in 24K resolution, and glasses-free 3D video, predicts Huawei. It expects the installed user base of these services will grow 100-fold to 1 billion. On the enterprise side, the vendor expects the number of private cellular networks to increase from 10,000 today to 1 million by 2030.

Huawei says that leading global operators, standards organizations, and industry ecosystem partners are coming together to promote innovation and exploration for this 5.5G era, as it will create more new applications and business opportunities. This author disagrees- they are not coming together at all!

According to Ookla’s latest 5G City Benchmark Report, Huawei has played an important part in 5G network construction in all of the top 10 cities among the world’s 40 representative 5G-enabled cities. It’s important to note that 5G performance results in these 10 cities show that the 5G networks constructed by Huawei offer the best experience.

…………………………………………………………………………………………………………………………………………..

David Wang, Huawei’s Executive Director of the Board, Chairman of the ICT Infrastructure Managing Board, and President of the Enterprise BG, said, “Huawei will deepen our roots in the enterprise market and continue our pursuit of innovation. We are ready to use leading technologies and dive deep into scenarios. Together with our partners, we will enable industry digitalization, help SMEs access intelligence, and promote sustainable development, creating new value together.”

Bob Chen, Vice President of Huawei Enterprise BG, delivered a keynote speech entitled “Digital Technology Leads the Way to the Intelligent World,” which outlined how digital technologies have impacted the development of the world’s economy, cultures, societies, and environment. He stated, “Archimedes, a great Greek physicist, said, ‘Give me a place to stand and I shall move the earth.’ Digital technology is the right place for us to help industries go digital. Huawei will focus on connectivity, computing, cloud, and other digital technologies. We will continue inspiring innovation to drive industry digital transformation. Together, let’s build a fully connected, intelligent world!”

Huawei said they would continue to work with customers to build next-generation network infrastructure to better serve all industries. Here are a few of their focus areas:

- Smart campus: Huawei redefines campus networks and launches the Next-Generation enterprise flagship core switch CloudEngine S16700, first enterprise-level Wi-Fi 7 AP AirEngine 8771-X1T, along with first 50G PON OLT and optical terminal product.

- Easy branch: Huawei launches the industry’s first simplified hyper-converged branch solution.

- Single OptiX: Huawei launches the industry’s first end-to-end optical service unit (OSU) product portfolio.

- Cloud WAN: Huawei defines a brand-new cloud WAN and launches the NetEngine 8000 series routers oriented to the all-service intelligent router platform in the cloud era.

- Data Center solution: Four industry-first products and product portfolios, unleashing the power of digital innovation

Storage and computing power have become one of the core strategic resources of enterprises. Huawei focuses on data center infrastructure innovation, leads the development of new data centers, helps enterprises cope with uncertain threats, ensures ultimate service experience, processes massive and diversified computing power, and brings data centers more green, more reliability, and more efficiency.

For large enterprises,Huawei launches the industry’s first multi-layer DC ransomware protection solution powered by network-storage collaboration, the industry’s first unified DC DR product portfolio featuring storage and optical connection coordination (SOCC),and CloudEngine 16800-X, which is the industry’s first DC switch designed for diversified computing power.

For SMEs, Huawei also launches OceanStor Dorado 2000 and OceanProtect X3000, which are the industry’s first entry-level storage combination based on the active-active architecture.

Juan De Dios Navarro Caballero, councillor of Alicante province, Spain, stated, “Huawei’s SDN-based CloudFabric Solution and All-Wireless Campus Network Solution enable network automation, intelligent O&M, and ubiquitous connectivity. Through these solutions, the government offices of Alicante province are now more efficient, and offer a better user experience for public services. The province has seen faster digital transformation along with digital economy development.”

Faith Burn, CIO of Eskom, a South African electric power company, shared the company’s digital transformation methodology and practical experience. She stressed that Eskom seeks to work with partners that can help realize the company’s digital vision, saying that, “It is very important to find capable partners to realize our digital vision. Eskom would like to collaborate with OEMs like Huawei to build advanced electricity ICT infrastructure to achieve comprehensive digitalization.”

Steven Zhu, President of Partner Development and Management of Huawei Enterprise BG, mentioned that “Huawei is committed to working with partners to complement each other, motivate partners to support customers proactively, and serve customers well together.”

In the future, Huawei says they will continue to invest and innovate, working alongside global customers and partners to deeply integrate ICT, accelerate digital transformation, promote digital economy development and speed up the realization of the intelligent world within industries, in order to create new value.

References:

https://www.huawei.com/en/news/2023/2/mwc2023-5g-huawei%20-connectivity

https://www.huawei.com/en/news/2023/2/mwc2023-industry-digital-transformation

https://telecoms.com/520240/huaweis-5-5g-vision-is-what-5g-should-have-been-all-along/