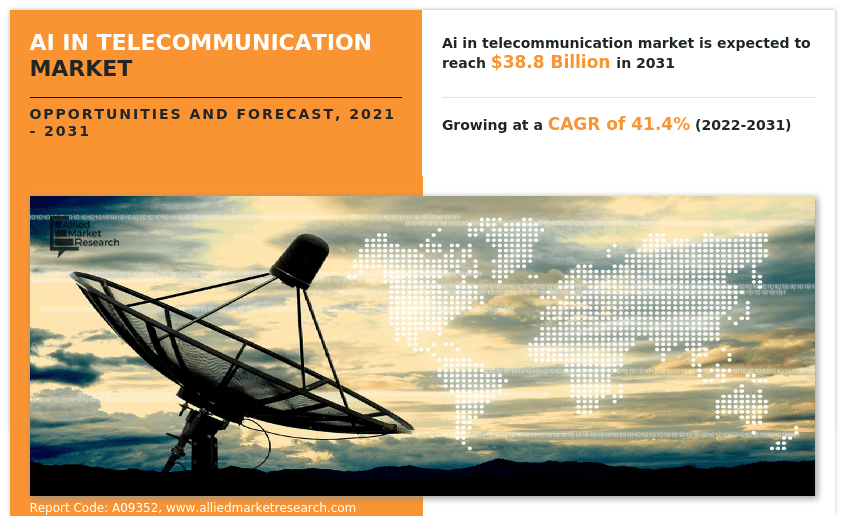

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

Executive Summary:

Artificial Intelligence (AI) in telecom uses software and algorithms to estimate human perception in order to analyze big data such as data consumption, call record, and use of the application to improve the customer experience. Also, AI helps telecommunication operators to detect flaws in the network, network security, network optimization & offer virtual assistance. Moreover, AI enables the telecom industry to extract insights from their vast data sets and made it easier to manage the daily business and resolve issues more efficiently and also provide improved customer service and satisfaction.

The growing adoption of AI solutions in various telecom applications is driving market growth. The rising number of AI-enabled smartphones with a number of features such as image recognition, robust security, voice recognition and many as compared to traditional phones is boosting the growth of AI in the telecommunication market. Furthermore, to cater to complex processes or telecom services, AI provides a simpler and easier interface in telecommunication. In addition, growing Over-The-Top (OTT) services, such as video streaming, have transformed the dissemination and consumption of audio and video content. With more consumers turning to OTT services, consumer demand for bandwidth has grown considerably. Carrying such ever-growing traffic from OTT services leads to high operational Expenditure (OpEx) for the telecommunication industry. Hence, AI helps the telecom industry to reduce operational costs by minimizing the human intervention needed for network configuration and maintenance. However, the major restraint of the AI in telecommunication market is the incompatibility between telecommunication systems and AI technology. Contrarily, the increasing penetration of AI-enabled smartphones in the telecommunication industry, and the advent of 5G technology in smartphones are expected to provide major growth opportunities for the growth of the market. Since advancements such as 5G technology in mobile and the rising need to monitor content on the tale communication network to eliminate human error from telecommunication are driving the growth of the market. For an instance, the Chinese government trying to improve its network services and telecommunication services; hence China Telecom Corporation has started a new 5G base station in Lanzhou city. Therefore, these factors are expected to provide numerous opportunities for the expansion of the AI in telecommunication market during the forecast period.

Allied Market Research published a report, titled, “AI in Telecommunication Market by Component (Solution, Service), by Deployment Model (On-Premise, Cloud), by Technology (Machine Learning, Natural Language Processing (NLP), Data Analytics, Others), by Application (Customer Analytics, Network Security, Network Optimization, Self-Diagnostics, Virtual Assistance, Others): Global Opportunity Analysis and Industry Forecast, 2021-2031.”

According to the report, the global AI in telecommunication industry generated $1.2 billion in 2021, and is estimated to reach $38.8 by 2031, witnessing a CAGR of 41.4% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chain, regional landscape, and competitive scenario.

Drivers, Restraints, and Opportunities:

Growing adoption of AI solutions in various telecom applications, the ability of AI to provide a simpler and easier interface in telecommunication and reduce the human intervention needed for network configuration and maintenance, and the growing demand for high bandwidth with more consumers turning to OTT services drive the growth of the global AI in telecommunication market. However, the incompatibility between telecommunication systems and AI technology hampers the global market growth. On the other hand, the increasing penetration of AI-enabled smartphones in the telecommunication industry, and the advent of 5G technology in smartphones likely to create potential opportunities for growth of the global market in the coming years.

Covid-19 Scenario:

- The global artificial intelligence in telecommunication market saw a stable growth during the COVID-19 pandemic, owing to the increasing digital penetration and rise in automation.

- Moreover, the pandemic led the telecommunications infrastructure to keep businesses, governments, and communities connected and operational. The social and financial disruption caused by the pandemic forced people to depend on technology such as AI for information and remote working.

- AI also helped the telecom industry to reinvent customer relationships by identifying personalized needs and engaging with customers through hyper-personalized one-to-one contacts. It also helped configure fixed-line and mobile-network bundles that combine VPN, teleconferencing, and productivity apps.

The solution segment to dominate in terms of revenue during the forecast period:

Based on component, the solution segment was the largest market in 2021, contributing to more than two-thirds of the global AI in telecommunication market, and is expected to maintain its leadership status during the forecast period. This is due to the adoption of solutions by various end users for the automated processes. On the other hand, the service segment is projected to witness the fastest CAGR of 44.9% from 2022 to 2031, due to surge in the adoption of managed and professional services.

The on-premise segment to garner the largest revenue during the forecast period:

Based on deployment model, the on-premise segment held the largest market share of nearly three-fifths of the global AI in telecommunication market in 2021 and is expected to maintain its dominance during the forecast period. This is because it provides added security of data. The cloud segment, however, is projected to witness the largest CAGR of 43.8% from 2022 to 2031, as cloud provides flexibility, scalability, complete visibility, and efficiency to all processes.

The machine learning segment to exhibit a progressive revenue growth during the forecast period:

Based on technology, the machine learning segment held the largest market share of more than two-fifths of the global AI in telecommunication market in 2021, and would maintain its dominance during the forecast period. This is because machine learning algorithms are designed to keep improving accuracy and efficiency. The data analytics segment, however, is projected to witness the largest CAGR of 46.1% from 2022 to 2031, as it helps telecom companies to increase profitability by optimizing network usage and services.

Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/9717

Asia-Pacific to maintain its leadership in terms of revenue by 2031:

Based on region, North America was the largest market in 2021, capturing more than one-third of the global AI in telecommunication market. The growth in the region can be attributed to the infrastructure development and technology adoption in countries like the U.S. and Canada. However, the market in Asia-Pacific is expected to lead in terms of revenue and manifest the fastest CAGR of 45.7% during the forecast period, owing to the growing digital and economic transformation of the region.

Leading Market Players:

- Intel Corporation

- Nuance Communications, Inc.

- AT&T

- Infosys Limited

- ZTE Corporation

- IBM Corporation

- Google LLC

- Microsoft

- Salesforce, Inc.

- Cisco Systems, Inc.

The report analyzes these key players of the global AI in telecommunication market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report is helpful in determining the business performance, operating segments, product portfolio, and developments by every market player.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Download free sample of this report at:

https://www.alliedmarketresearch.com/request-sample/9717

You may buy this report at:

https://www.alliedmarketresearch.com/checkout-final/a6dc279b20c4a61f8a7f328812bfd76c

……………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.alliedmarketresearch.com/ai-in-telecommunication-market-A09352

Global AI in Telecommunication Market at CAGR ~ 40% through 2026 – 2027

The case for and against AI in telecommunications; record quarter for AI venture funding and M&A deals

Emerging AI Trends In The Telecom Industry

One thought on “Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)”

Comments are closed.

FT- 17 January 2023: Microsoft’s $10bn bet on ChatGPT developer marks new era of AI

Tech giants race to stake out their place in new field of generative artificial intelligence

by Richard Waters and Tabby Kinder in San Francisco

The $10bn investment that Microsoft is considering in San Francisco-based research firm OpenAI looks set to become the defining deal for a new era of artificial intelligence.

If the US software giant is right about the far-reaching implications of the technology, it could also trigger a realignment in the AI world as other tech groups race to stake out their place in the new field of generative AI.

OpenAI grabbed global headlines last month with the launch of ChatGPT, an AI system that can answer queries and produce text in natural-sounding language.

But Microsoft executives believe the technology behind the service will soon have a deeper impact throughout the tech world.

“These [AI] models are going to change the way that people interact with computers,” said Eric Boyd, head of AI platforms at Microsoft. Talking to a computer as naturally as a person will revolutionise the everyday experience of using technology, he added.

“They understand your intent in a way that hasn’t been possible before and can translate that to computer actions,” Boyd said in an interview with the Financial Times before news of the possible deal.

Microsoft’s potential investment, first reported by the newsletter Semafor last week and confirmed by two people familiar with the situation, would see it take a significant minority stake that would value OpenAI, after the investment, at $29bn. Microsoft declined to comment.

The potential landmark investment comes as venture capitalists are rushing to back the latest AI trend at a time when previous investment fads like blockchain and cryptocurrencies have faded.

Microsoft made its first $1bn investment in OpenAI in 2019, sealing a role as the tech platform for the firm’s highly demanding AI models and giving it first rights to commercialise its technology.

The software giant has already used OpenAI’s technology in a number of its own products, though its executives say this only scratches the surface of what will come next.

Its cloud customers have been able to pay for access to GPT-3, a text-generating AI model, since 2021. Dall-E 2 — part of a wave of image generating systems that took the AI world by storm last year — is the foundation of a recent Microsoft graphic design product called Designer, and has also been made available through the Bing search engine.

Meanwhile Codex, a system which prompts software developers with suggestions of which lines of code to write next, has been turned into a product by GitHub, a Microsoft service for developers.

The speed at which AI tools like this are passing from advanced research to everyday product may be unparalleled in tech history, according to AI experts. Codex was introduced in an OpenAI research paper only in the middle of 2021, but within a year Microsoft had turned it into a commercial subscription service.

According to GitHub chief executive Thomas Dohmke, 40 per cent of the code created by developers who use the service, called Copilot, is automatically generated by the AI system, halving the time it takes to create new code — a huge leap in efficiency after a decade of largely ineffective efforts to boost developer productivity.

“It’s a mind-blowing productivity statistic,” said Dohmke.

Much of OpenAI’s tech stems from the creation of so-called large language models, which are trained on huge amounts of text. Unlike earlier forms of machine learning — which has dominated AI for the last decade — the technique has led to systems that can be used in a wider variety of circumstances, boosting their commercial value.

“The real power of these models is they have the capability to do so many different tasks at the same time,” said Boyd at Microsoft. He added that makes it possible to do so-called “zero-shot” learning — using the AI for new tasks without needing to train them.

Google and other tech giants, as well as a number of start-ups, have also ploughed resources into creating giant AI models like this. But since GPT3 stunned the AI world in 2020 with its ability to produce large blocks of text on demand, OpenAI has set the pace with a succession of eye-catching public demonstrations.

Microsoft executives are looking to use the technology in a wide range of products. Speaking at a company event late last year, chief executive Satya Nadella predicted that generative AI would lead to “a world where everyone, no matter their profession” would be able to get support from the technology “for everything they do”.

Generative AI is set to become a central part of “productivity” applications like Microsoft’s Office, said Oren Etzioni, an adviser and board member at A12, the AI research institute set up by Microsoft co-founder Paul Allen.

All workers will eventually use productivity software that presents relevant information to them, checks their work and offers to generate content automatically, he said.

The potential upheaval this could cause in the software world has not been lost on Microsoft’s rivals, who see the technology as a rare opportunity to break into markets dominated by Big Tech.

Emad Mostaque, head of London-based Stability AI, which made a splash last year with the launch of its open-source image generating system, claimed his organisation was building a “PowerPoint killer” — an AI tool that is designed to make it much easier to create presentations than the widely-used Microsoft application.

That makes the move both defensive and offensive for Microsoft, as it tries to protect established products like Office while also mounting a stronger challenge in markets like internet search.

With its potential OpenAI investment, meanwhile, Microsoft is also trying to use its technology and financial muscle to position itself as the main platform on which the next era of AI will be built.

“The amount of cloud computing power [OpenAI] needs is beyond the capability of a start-up” or venture capital investor to support, one of the company’s investors said. That meant OpenAI had little choice but to seek financial backing from one of the handful of tech giants, this person added.

Microsoft has sought to use its first investment in OpenAI to get a head start, building what it describes as a supercomputer to train the research firm’s giant AI models. The same technology platform is also now used by Facebook parent Meta for its AI work.

Nadella claimed recently that the head start it got from working with OpenAI meant that calculations carried out by its AI supercomputer cost only around half as much as its biggest rivals. Any cost advantage could be key: analysts at Morgan Stanley estimate that the higher cost of natural language processing means that answering a query using ChatGPT costs around seven times as much as a typical internet search.

Microsoft’s biggest cloud computing rivals have also been seeking to align themselves with some of the most promising generative AI companies, though none of the other start-ups in the field has produced AI models with the scale or range of OpenAI.

Amazon’s cloud division has a three-year deal to act as the computing platform for Stability AI. Another AI start-up, CohereAI, which was founded by three researchers from Google, reached a deal in 2021 to use the search company’s computing platform to train their own AI.

If a handful of tech giants become the central platforms for — and investors in — the start-ups building the next generation of AI technology, it could stir concern among regulators.

One person familiar with Microsoft’s investment plans conceded that its alliance with OpenAI was likely to come under close scrutiny, but added that the minority investment should not provoke any regulatory intervention.

But as owners of the cloud computing platforms needed to support the coming age of generative AI, it seems inevitable that Big Tech will have a significant say in what comes next.