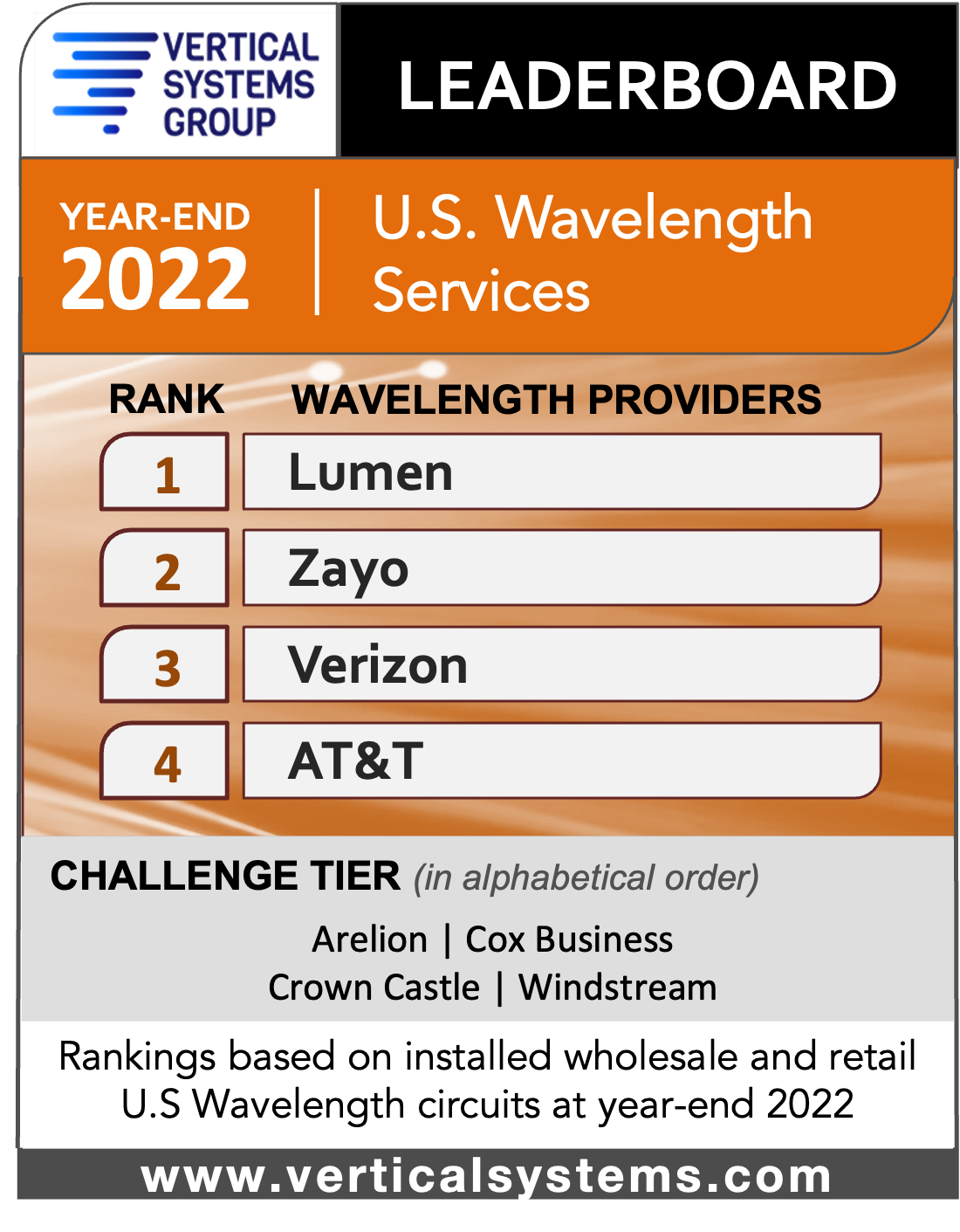

Vertical Systems Group’s 2022 U.S. Wavelength Services Leaderboard

Lumen, Zayo, Verizon and AT&T topped Vertical Systems Group’s Wavelength Services Leaderboard [1.] for 2022 as they did the previous year. Those companies each have 4% or more of the U.S. market for retail and wholesale wavelength services — which involve the allocation of capacity on an optical network, essentially creating dedicated highways for data.

……………………………………………………………………………………………………………………………………………………………

Note 1. A Wavelength Service is a large bandwidth connection providing high-speed Internet or data service delivered over lit fiber-optic lines using Dense Wave Division Multiplexing (DWDM) to create wavelengths or optical channels.

……………………………………………………………………………………………………………………………………………………………

Vertical Systems Group found that expansion of the U.S. base of wavelength circuits is being driven by double-digit growth for 100+ Gbps connections and expects that to continue through 2027.

High bandwidth requirements are driving the growth of wavelength services in the U.S., according to Vertical Systems Group Principal Rick Malone. Telecom carriers use wavelength services to extend their core backbone networks, connect mobile towers and strengthen the resiliency of their network infrastructures, while hyperscale network operators employ wavelengths for data center interconnectivity, cloud computing, business continuity and backup/disaster recovery.

“Enterprises are purchasing wavelength services for their backbone networks, driven by IT cloud transformations, and for specific applications requiring predictable latency and low jitter,” Malone stated. U.S. network providers have upgraded their fiber footprints to support wave services above 10 Gbps, with general availability of 100 Gbps circuits nationwide.

“At the same time, fiber footprints have been expanded to include buildings that previously may have had only a single fiber provider,” he told Fierce Telecom. “And with multiple wavelength providers in a building, customers are negotiating more favorable pricing terms.”

Market Players include all other wavelength providers with U.S. circuit share below the one percent (1%) threshold. For year-end 2022, Market Players include the following wavelength providers (in alphabetical order): 11:11 Systems, Armstrong Business Solutions, Astound Business Solutions, Breezeline Business, Brightspeed Business, Cogent, Colt, Consolidated Communications, C Spire, Comcast Business, DQE Communications, Epsilon, Everstream, Exa Infrastructure (formerly GTT), ExteNet Systems, Fatbeam, FiberLight, First Digital, FirstLight, Frontier, Great Plains Communications, Horizon, Lightpath, Logix Fiber Networks, LS Networks, Midco, Ritter Communications, Segra, Shentel Business, Silver Star Telecom, Sparklight Business, Spectrum Enterprise, Syringa, T-Mobile, TDS Telecom, Unite Private Networks, Uniti, U.S. Signal, WOW!Business, Ziply Fiber and others.

Billable installations of 400+ Gbps services are emerging as wavelength providers expand availability and roll out new services to support higher speeds across a wider footprint. Many are actively planning for 400 and 800 Gbps service deployment in response to “early adopter requirements,” according to Malone.

Zayo recently debuted a new Waves on Demand product for customers looking to rapidly light up added bandwidth, for example. Waves on Demand will initially focus on providing 100G services across eight routes, though a 400G route between Newark, NJ and New York is available.

References:

https://www.fiercetelecom.com/broadband/lumen-and-zayo-hold-strong-us-wavelength-service-leaders

Lumen Technologies tops Vertical Systems Group’s 2021 U.S. Wavelength Services Leaderboard