Vertical Systems Group Leaderboard

AT&T Tops VSG 2022 Global Provider Carrier Managed SD-WAN Leaderboard

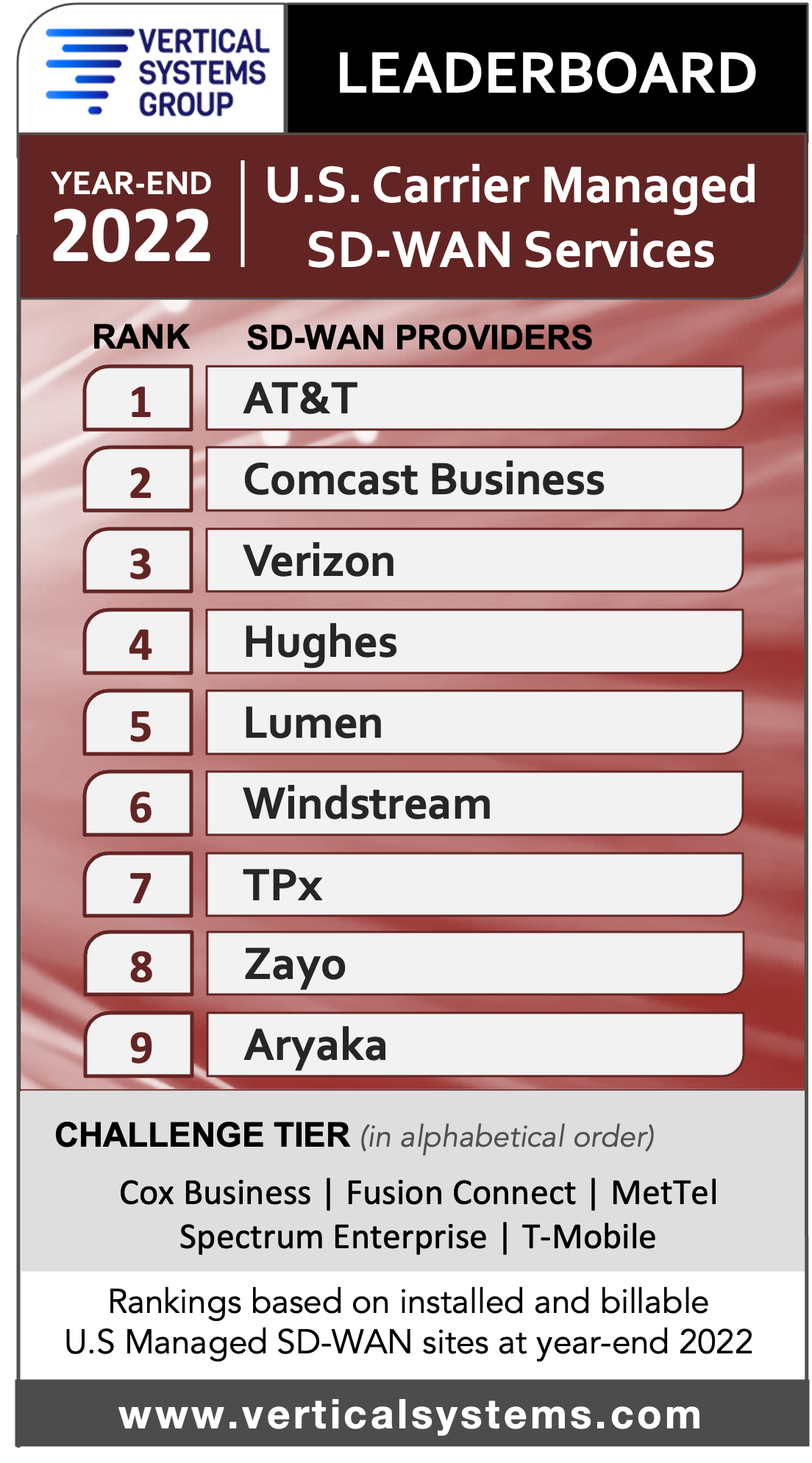

AT&T attained first place on Vertical Systems Group’s (VSG) 2022 Global Provider Carrier Managed SD-WAN Leaderboard, followed by Orange Business, Verizon, BT Global Services, NTT, Telefonica Global Solutions, Hughes and Vodafone. AT&T bumped Orange out of first place on the 2022 leaderboard. No surprise as AT&T continues to top VSG’s 2022 U.S. Carrier Managed SD-WAN Leaderboard for five consecutive years!

BT Global Services overtook NTT for 4th place. Hughes moved out of the Challenge Tier and onto the leaderboard. The top three service providers – AT&T, Orange Business and Verizon – also have MEF 3.0 SD-WAN certification.

This leaderboard includes service providers with 4% or more billable retail site share outside their home countries, which are shown in the graphic below:

Twelve companies qualify for the 2022 Global Provider Managed SD-WAN Challenge Tier (in alphabetical order): Aryaka (U.S.), Colt (U.K.), Comcast Business (U.S.), Deutsche Telekom (Germany), Global Cloud Xchange (India), GTT (U.S.), Liberty Networks [formerly Cable & Wireless] (Barbados), PCCW Global (Hong Kong), Singtel (Singapore), Tata (India), Telia (Sweden), and Telstra (Australia). The Challenge Tier includes companies with site share between 1% and 4% of this defined SD-WAN segment.

“Leading global SD-WAN providers continued to expand their footprints into dozens of new countries during 2022, with the goal of providing multinational customers with seamless connectivity,” said Rosemary Cochran, principal of Vertical Systems Group. “There was some shuffling of provider rankings since our last Leaderboard release, as competition for global customers is intense and share differentials in this segment are extremely tight.”

Research Highlights:

- Share results for this new Global Provider Managed SD-WAN LEADERBOARD include each provider’s installed year-end 2022 base of multinational customer sites, excluding home country. Vertical’s initial benchmark for this specialized segment was the Mid-2021 Global Provider Managed SD-WAN LEADERBOARD, which included site installations as of June, 30 2021. The share comparisons provided in this analysis are based on these two time periods.

- The roster of companies ranked on the LEADERBOARD increased to eight in 2022, up from seven previously.

- AT&T advances to first position on the LEADERBOARD, up from second and displacing Orange Business. AT&T also ranks first on the 2022 U.S. Carrier Managed SD-WAN LEADERBOARD.

- BT Global Services moves up to the fourth LEADERBOARD position, which drops NTT to fifth position.

- Hughes enters the LEADERBOARD in seventh position, moving up from the Challenge Tier. Vodafone dips from seventh to the eighth and final position.

- The 2022 Challenge Tier remains at twelve companies, however with lineup changes. Lumen drops from the Challenge Tier into the Market Player tier, and Comcast Business (includes Masergy) moves up from the Market Player tier.

- Carrier Managed SD-WAN solutions for multinational customers are typically custom hybrid network configurations that require global infrastructures and technical expertise, and may incorporate MPLS VPNs bundled with cloud connectivity, plus advanced security that is integral or provided with technology partners.

- MEF 3.0 SD-WAN certification has been attained by the top three companies ranked on the 2022 Global Provider Carrier Managed SD-WAN LEADERBOARD – AT&T, Orange Business, and Verizon. Additionally, five companies cited in the Challenge Tier have MEF 3.0 SD-WAN certification as follows: Colt, Comcast Business, PCCW Global, Tata and Telia.

- The primary technology suppliers utilized by the Global Provider SD-WAN LEADERBOARD and Challenge Tier companies are as follows (in alphabetical order): Cisco, Fortinet, HPE Aruba, Nuage Networks from Nokia, Palo Alto, Versa and VMware.

The Market Player tier includes all other companies with Global Provider SD-WAN site share below one percent (1%), including the following companies (in alphabetical order): Batelco (Bahrain), China Telecom (China), Cirion (Argentina), Claro Enterprise Solutions (Mexico), CMC Networks (South Africa), Cogent (U.S.), Embratel (Brazil), Epsilon (Singapore), Etisalat (Abu Dhabi), Exponential-e (U.K.), Flo Networks (Mexico), Fusion Connect (U.S.), HGC Global (Hong Kong), Intelsat (U.S.), KDDI (Japan), Lumen (U.S.), Meriplex (U.S.), PLDT Enterprise (Philippines), Retelit (Italy), SES (Luxembourg), Sparkle (Italy), StarHub (Singapore), T-Mobile (U.S.), Telenor (Norway), Telin (Singapore), TelMex (Mexico), Transtelco (U.S.), Virgin Media (U.K.), Zayo (U.S.) and other providers selling SD-WAN services outside their home country.

Vertical Systems Group’s Definition: Carrier Managed SD-WAN Service:

Vertical Systems Group defines a Carrier Managed SD-WAN Service for segment analysis and share calculations as a carrier-grade offering for business customers that is managed by a network operator. Required components and functionality for these offerings include an SDN service architecture that provides dynamic optimization of traffic flows, a purpose-built SD-WAN appliance or CPE-hosted SD-WAN VNF at each customer edge site, support for multiple active underlay connectivity services, automated failover fast enough to maintain active sessions, and centralized network orchestration with traffic and application visibility end-to-end. Security is the most essential additional managed SD-WAN service capability that may be provided or integrated based on specific customer requirements.

References:

Vertical Systems Group’s 2022 U.S. Wavelength Services Leaderboard

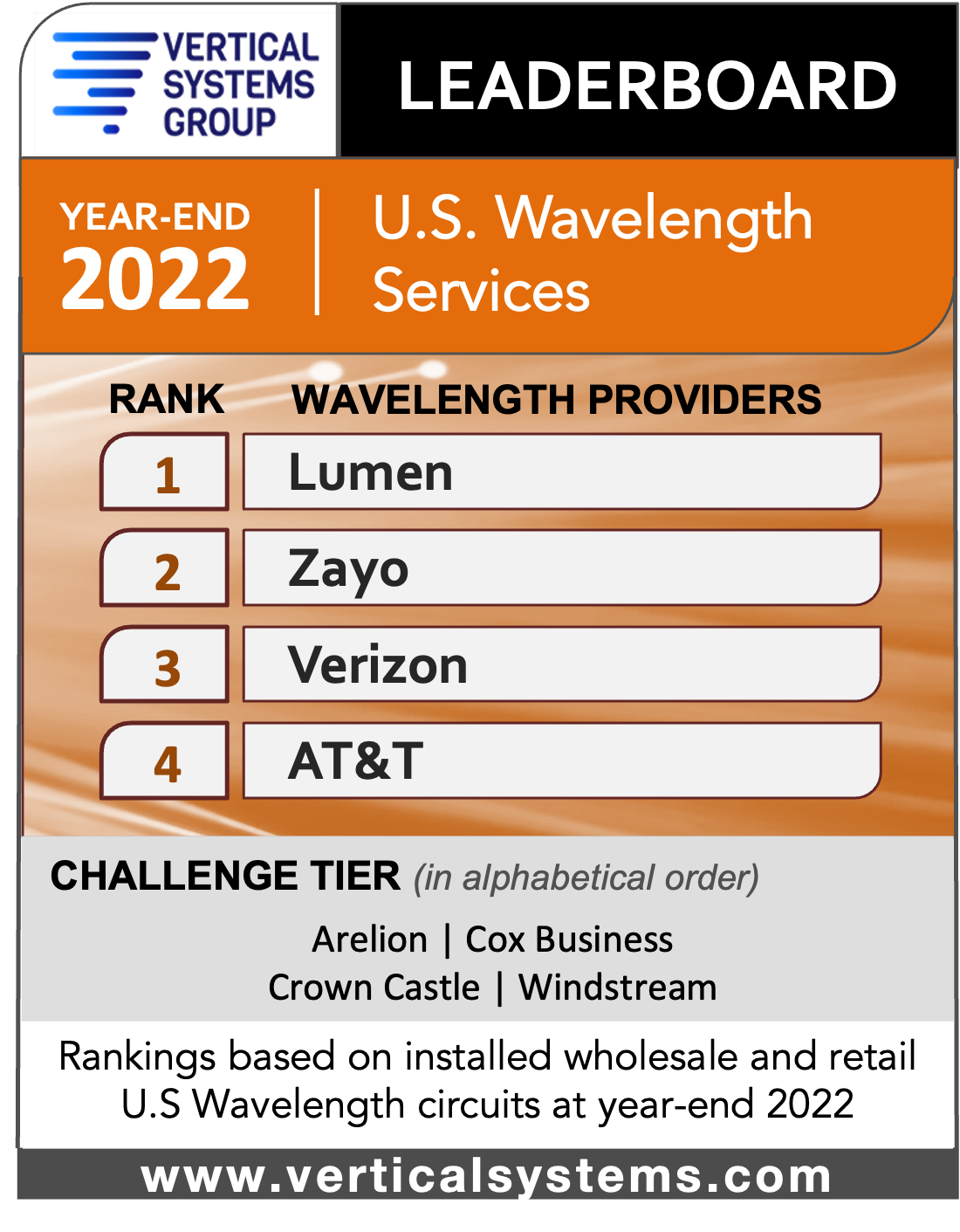

Lumen, Zayo, Verizon and AT&T topped Vertical Systems Group’s Wavelength Services Leaderboard [1.] for 2022 as they did the previous year. Those companies each have 4% or more of the U.S. market for retail and wholesale wavelength services — which involve the allocation of capacity on an optical network, essentially creating dedicated highways for data.

……………………………………………………………………………………………………………………………………………………………

Note 1. A Wavelength Service is a large bandwidth connection providing high-speed Internet or data service delivered over lit fiber-optic lines using Dense Wave Division Multiplexing (DWDM) to create wavelengths or optical channels.

……………………………………………………………………………………………………………………………………………………………

Vertical Systems Group found that expansion of the U.S. base of wavelength circuits is being driven by double-digit growth for 100+ Gbps connections and expects that to continue through 2027.

High bandwidth requirements are driving the growth of wavelength services in the U.S., according to Vertical Systems Group Principal Rick Malone. Telecom carriers use wavelength services to extend their core backbone networks, connect mobile towers and strengthen the resiliency of their network infrastructures, while hyperscale network operators employ wavelengths for data center interconnectivity, cloud computing, business continuity and backup/disaster recovery.

“Enterprises are purchasing wavelength services for their backbone networks, driven by IT cloud transformations, and for specific applications requiring predictable latency and low jitter,” Malone stated. U.S. network providers have upgraded their fiber footprints to support wave services above 10 Gbps, with general availability of 100 Gbps circuits nationwide.

“At the same time, fiber footprints have been expanded to include buildings that previously may have had only a single fiber provider,” he told Fierce Telecom. “And with multiple wavelength providers in a building, customers are negotiating more favorable pricing terms.”

Market Players include all other wavelength providers with U.S. circuit share below the one percent (1%) threshold. For year-end 2022, Market Players include the following wavelength providers (in alphabetical order): 11:11 Systems, Armstrong Business Solutions, Astound Business Solutions, Breezeline Business, Brightspeed Business, Cogent, Colt, Consolidated Communications, C Spire, Comcast Business, DQE Communications, Epsilon, Everstream, Exa Infrastructure (formerly GTT), ExteNet Systems, Fatbeam, FiberLight, First Digital, FirstLight, Frontier, Great Plains Communications, Horizon, Lightpath, Logix Fiber Networks, LS Networks, Midco, Ritter Communications, Segra, Shentel Business, Silver Star Telecom, Sparklight Business, Spectrum Enterprise, Syringa, T-Mobile, TDS Telecom, Unite Private Networks, Uniti, U.S. Signal, WOW!Business, Ziply Fiber and others.

Billable installations of 400+ Gbps services are emerging as wavelength providers expand availability and roll out new services to support higher speeds across a wider footprint. Many are actively planning for 400 and 800 Gbps service deployment in response to “early adopter requirements,” according to Malone.

Zayo recently debuted a new Waves on Demand product for customers looking to rapidly light up added bandwidth, for example. Waves on Demand will initially focus on providing 100G services across eight routes, though a 400G route between Newark, NJ and New York is available.

References:

https://www.fiercetelecom.com/broadband/lumen-and-zayo-hold-strong-us-wavelength-service-leaders

Lumen Technologies tops Vertical Systems Group’s 2021 U.S. Wavelength Services Leaderboard