MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”

MTN Consulting’s Mid Year Update:

There are three different types of network operators: telecom operators (telcos), webscale network operators (webscalers), and carrier-neutral operators (CNNOs). In 2022, these three groups accounted for $4.1 trillion (T) in revenues, $559 billion (B) in capex, and 8.87 million employees. The report provides 2011-22 actuals and projections through 2027, and includes projections from past forecasts for reference.

Review of the 3 Market Segments:

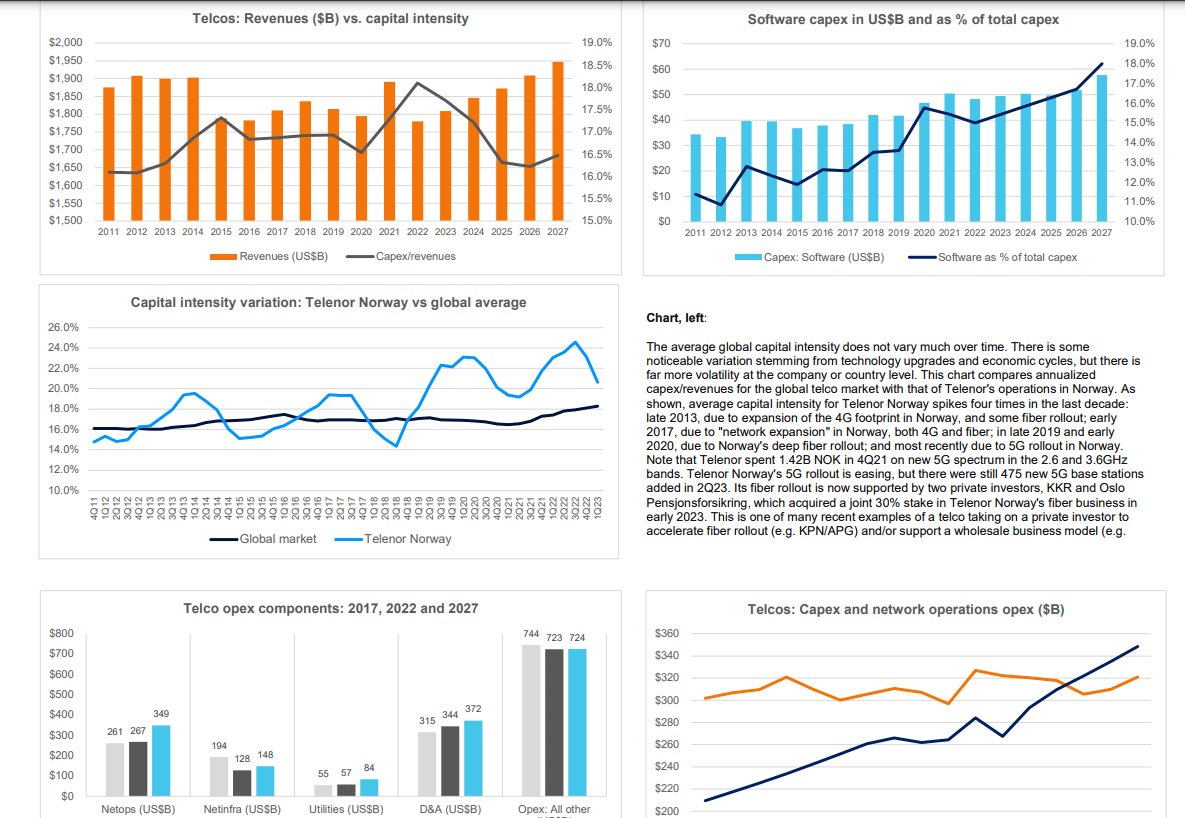

1. Telco: Telecom is essentially a zero-growth industry. Specific countries and companies do grow from time to time, in part from market share shifts, the different timing of growth cycles, or M&A. But global telco revenues have hovered in a narrow range ($1.7-$1.9 trillion) since 2011, and this will likely remain true through 2027. In 2022, revenues were $1.78T, and will grow an average annual rate of 1.8% to reach $1.95T by 2027.

Capex continues to vary with technology upgrade cycles (e.g. 5G) and government actions (e.g. newly issued spectrum, or rural fiber subsidies). In 2022, capex totaled $322B, or 18.1% of revenues; that’s an all-time high capital intensity, for coverage timeframe (2011-present). Capex will decline slightly through 2025, though, and then rise modestly again to reach $321B in 2027, which would be a 16.5% capital intensity. US capex surged in 2022, but will drop dramatically in 2023; we already expected this, though, so the current forecast is not significantly different. Software capex is growing more slowly than expected, and now likely to remain under 20% of total capex for the forecast period.

Headcount in telecom is declining faster than expected, and now likely to fall below 4.2 million in 2027, from just under 4.6 million in 2022. Labor costs per head will revert to a growth trajectory in 2023, as telcos develop a more IT/software-centric workforce.

2. Webscalers: growth from webscale has lifted the overall network operator market over the last decade. Webscalers surged during COVID, by all measures – revenues, capex, employment. Demand for data center chips and related gear also surged. Now, parts of the sector are cutting back slightly.

In 2022, revenues were $2.23 trillion, up just 4% YoY, far less than the average growth of 12% per year from 2011-22. We expect revenues to grow at a ~6% CAGR through 2027. Webscale capex was $203B in 2022, a healthy increase from 2021; due in part to generative AI interest, capex will grow again in 2023 and 2024, dip for a couple years of capacity absorption, and then end 2027 at around $231B. A larger portion of this capex will be for Network/IT/software investments: around 46%, from 44% in 2022. R&D spending by webscalers will remain high but fall from the record-breaking level of 2022 (12.0% of revenues), to about 10% in 2027. As topline growth gets harder for webscalers, they will become more cost conscious and short-term oriented.

3. CNNOs: the carrier-neutral sector remains tiny, with just $95B in 2022 revenues, but will grow to about $132B by 2027. Webscalers and telcos alike will both rely more on CNNOs over time for expansion of their data center, tower and fiber footprints.

Telcos will continue to spin out portions of their infrastructure to third-parties – both traditional CNNOs, and joint ventures like Gigapower, the AT&T-Blackrock partnership. Total CNNO capex for 2022 was $34B, and will grow to about $45B by 2027; a large chunk of the CNNO sector’s expansion will be inorganic, though, via acquisition of existing assets from other sectors. By 2027, the CNNO sector will have under its management approximately 3.7 million cell towers (2022: 3.3M), 1,607 data centers (2022: 1,224), and 1.1M route miles of fiber (2022: 960K).

Source: MTN Consulting

……………………………………………………………………………………………………………………………………………………………

Market drivers, constraints and risk factors:

This forecast represents only a modest revision from the edition published in December 2022. Most of the realities facing the operator market today were anticipated by our last forecast. For instance, we already expected that service revenues were not growing for telcos, and that 5G device sales distorted the market; an MTN Consulting report published in 2Q23 confirmed this fact, and supports a more cautious outlook for telco spending. We also thought that open RAN was overhyped, and was not likely to change the capex calculus for most established mobile operators. The 2023 dip in US telco capex was baked into our old forecast. The one big sector-specific change from the last forecast to this one is, the recent spike in interest in generative AI. This is a plus for the webscale market’s capex outlook, even if new revenue models are unclear and government regulations will slow adoption.

What about the macroeconomic climate? Wars, economic growth, inflation, interest rates, climate change, etc. Russia’s war on Ukraine remains ongoing, but hasn’t expanded to new countries. China has not invaded Taiwan as of yet, although this is a serious risk over the 5-year forecast horizon. Global economic growth is weaker than historic averages – about 3% this year and next, per the IMF – but inflation is easing, and the IMF’s GDP growth outlook improved slightly from April to July 2023. Interest rates continue to rise; the US federal funds rate has risen from 3.83% to 5.08% between 12/22 and 7/23, and further increases seem likely. Rising interest rates were already assumed to modestly depress 2023-24 capex, though.

Climate change is the one macro area that is quite a bit different than 8 months ago. The news gets worse each week. Government action continues to be gradual and consensus is hard to achieve. Increasingly the pressure will be on private companies to make voluntary, verifiable changes in how they operate. This doesn’t impact the forecast directly, but will impact how operators spend their tech budgets, as we have discussed in separate reports. Energy, sustainability and climate change will continue to be key themes in MTN Consulting research.

References: