MTN Consulting: Satellite network operators to focus on Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services

Satellite network operators are being forced to expand their addressable markets in the near term, due to several factors: rising competition, with the emergence of players such as SpaceX along with several upstarts including AST SpaceMobile and Lynk. A difficult funding climate resulting from a grim economic outlook and rising interest rates is a challenge. There are also market concentration risks arising from the current focus on satellite broadband internet.

To address these challenges, satellite network operators are raising stakes in new pursuits and developing new offerings. MTN Consulting expects three new potential addressable markets to provide transformational opportunities for satellite operators in the next 2-4 years. These include Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services.

Looking at these market opportunities, a thought may arise whether satellite operators are trying to disrupt the traditional telecom market. But the reality is that telcos will continue to be the primary service provider for wireless access. Telcos are also going to benefit from partnerships with satellite operators as they will aid in providing an enhanced experience for telco customers, reinforced by ubiquitous coverage. For satellite operators though, navigating the regulatory hurdles and ensuring constant capital flow are key concerns; several players from the current herd will vanish in the next 3-5 years.

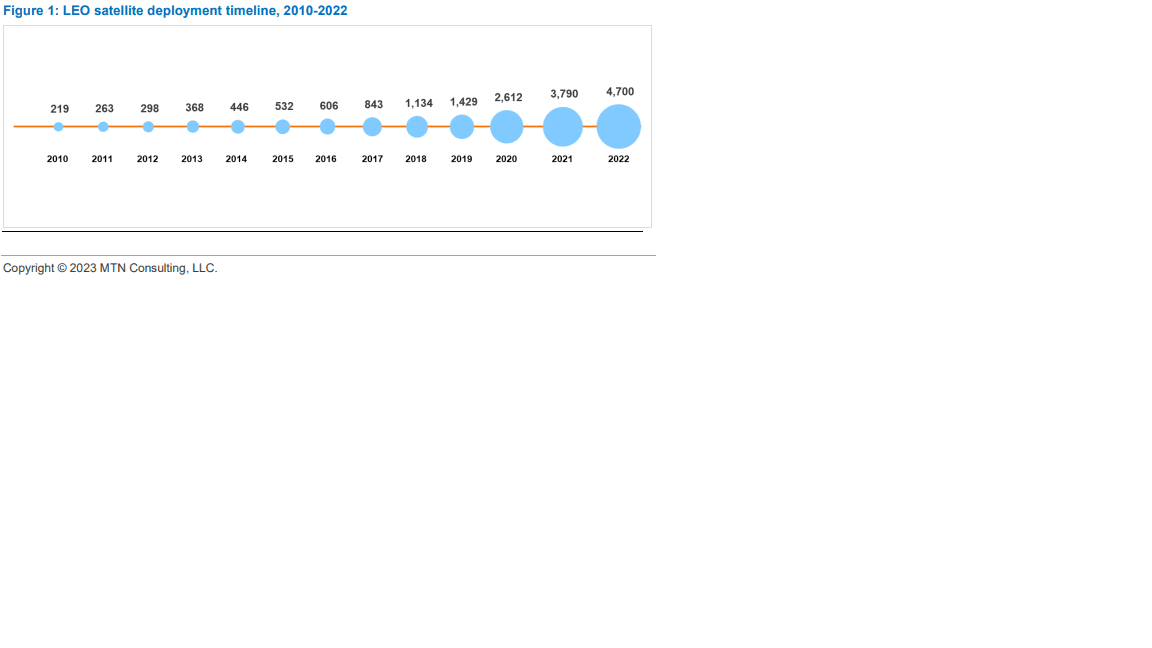

The battle for space based Internet gained momentum in the year 2022 as several satellite operators, notwithstanding their size and years of operations, shifted gears with the launch of commercial broadband internet through low earth orbit (LEO) satellites. The space rush, aided by the advancement in satellite development and large-scale manufacturing, witnessed the sudden surge in large fleets of LEO satellites being deployed in recent years, as shown in Figure 1. As of May 2022, about 4,700 active LEO satellites are girdling the planet; that’s 16x the number of active LEO satellites deployed a decade ago.

Separately, MTN found that a number of large telcos have high debt, low margins, and/or weak top line growth, and may have to curtail spending in 2023-2024 in order to cope with this reality. In particular:

- Total telco debt in 4Q22 was $1.14 trillion, 17% due in next year

- Software capex as a % of revenues was 1.9% in 2022, up a bit from 1.8% in 2021.

- Spending on acquisitions amounted to 0.5% of revenues in 2022, the lowest figure since 2012.

- At the industry level, the ratio of net debt to EBITDA in 2022 was 1.9, a bit up from 2021 but down from 2020.

- A number of large telcos face short-term debt levels over 30% of total debt

- Average margins for the industry in 2022 disappointed: free cash flow margin for the telco industry in 2022 was 11.4%, down from 12.6% in 2021; EBITDA margin was 33.7% (2021: 34.0%), and EBIT margin was 14.4% (2021: 14.9%).

References:

Satellite players bet on direct-to-device (D2D), IoT, and cloud for next big liftoff