Telecom Services Market

Global telecom infrastructure market outlook after a dismal 2024

Despite the telecom industry’s hopes that 2025 will usher in a turnaround for the global network equipment market, there’s no hint of that happening considering how bad 2024 was.

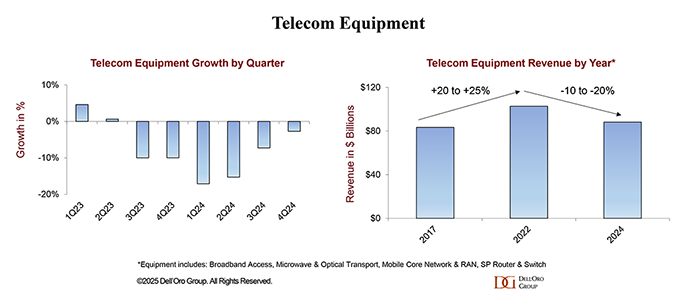

According to Dell’Oro Group, worldwide telecom equipment market revenues in 2024 dropped 11% year-over-year – marking “the steepest annual decline in more than 20 years.”

Dell’Oro VP Stefan Pongratz wrote:

“Preliminary findings suggest that worldwide telecom equipment revenues across the six telecom programs tracked at Dell’Oro Group—Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch—declined 11% year-over-year (YoY) in 2024, recording the steepest annual decline in more than 20 years (decline was >20% in 2002), propelling total equipment revenue to fall by 14% over the past two years. This remarkable output deceleration was broad-based across the telecom segments and driven by multiple factors, including excess inventory, challenging macro environment, and difficult 5G comparisons.

In 4Q24, stabilization was driven by growth in North America and EMEA, which nearly offset constrained demand in Asia Pacific (including China).

The full-year decline was uneven across the six telecom programs. Optical Transport, SP Routers, and RAN saw double-digit contractions, collectively shrinking by 14% in 2024. Microwave Transport and MCN experienced a more moderate combined decline in the low single digits, while Broadband Access revenues were fairly stable.

Similarly, regional developments were mixed in 2024. While the slowdown was felt across the five regions — North America, EMEA, Asia Pacific, China, and CALA — the deceleration was more pronounced in the broader Asia Pacific region, reflecting challenging conditions in China and Asia Pacific outside of China.

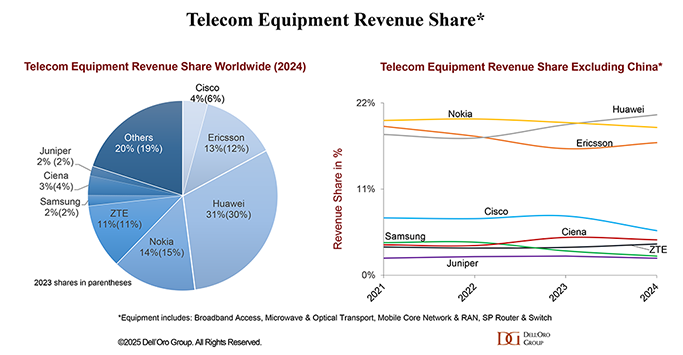

Supplier rankings were mostly unchanged globally, while revenue shares shifted slightly as both Huawei and Ericsson positions improved. Overall market concentration was stable with the 8 suppliers comprising around ~80% of the worldwide market in 2024.

Rankings changed outside of China. Initial estimates suggest Huawei passed Nokia to become the #1 supplier, followed by Nokia and Ericsson. Huawei’s revenue share outside of China was up 2 to 3 percentage points in 2024, relative to 2021, while Ericsson is down roughly two percentage points over the same period/region.

A glimmer of hope is that the Covid instigated inventory correction is over and the supply chain is starting to recover. For example, Ciena recently noted its problems with “inventory digestion” are mostly over. CEO Gary Smith said that customers are again investing in scaling their networks, specifically for the anticipated increase in cloud traffic and new AI workloads, including Managed Optical Fiber Networks opportunities with the cloud providers.

However, that might take time to play out. Vendors may have to take at least 6-12 months to retool their supply chains due to tariffs, AvidThink Principal Roy Chua has said. And given the “will-they, won’t-they” situation going on with the tariffs, their ultimate impact remains to be seen.

…………………………………………………………………………………………………………………………………..

It’s been six years since 5G networks have been commercially deployed. But aside from deploying fixed wireless access (FWA), telcos have struggled to “find large use cases that require 5G speeds and features,” Deloitte said in its latest telecom industry forecast.

“Not only were there seemingly few additional use cases driving 5G adoption and monetization in 2024, but there may not be many more for 2025 or even 2026 either.” The market research/accounting firm continued:

Our outlook focuses on three of those difficult choices, and we have a full chapter on each:

- In 2025, the most discussed source of growth for many industries is generative AI, and telcos are asking how they can share in that excitement. Telcos are using gen AI to reduce costs, become more efficient, and offer new services. Some are building new gen AI data centers to sell training and inference to others. A gen AI gold rush expected over the next five years. Spending estimates range from hundreds of billions to over a trillion dollars on the physical layer required for gen AI: chips, data centers, electricity. Close to another hundred billion US dollars will likely be spent on the software and services layer.

- At the same time, telcos are roughly at the midpoint between the launch of 5G and the expected launch of 6G, and they want to confirm that they can shape 6G to be more profitable than 5G has so far been.

- Finally, after years of divesting noncore assets, telcos are getting primed to deploy M&A strategies in pursuit of growth.

Globally, the telecommunications industry is expected to have revenues of about US$1.53 trillion in 2024, up about 3% over the prior year. Both in 2024 and out to 2028, growth is expected to be higher in Asia Pacific and Europe, Middle East, and Africa, with growth in the Americas being around 1% annually. All three regions are expected to surpass half a trillion dollars in revenue each by 2027. By market cap, the sector is about US$2.6 trillion globally (Figure 1, below).

Stefan summed up: “Market conditions are expected to stabilize in 2025 on an aggregated basis, though it will still be a challenging year. The analyst team is collectively forecasting global telecom equipment revenues across the six programs to stay flat.”

References:

https://www.fierce-network.com/broadband/global-telecom-infra-faced-ultimate-pitfall-2024

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: Global telecom CAPEX declined 10% YoY in 1st half of 2024

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Highlights of Dell’Oro’s 5-year RAN forecast

US cable and telecom network operators feel the pain

According to the financial analysts at TD Cowen, prominent cable companies like Charter and Comcast collectively lost 186,000 customers in the first quarter 2024, ahead of their estimates of 141,000.

“The quarter is proving that Cable and Wireless are in the throes of market maturity, both facing a smaller pool with churn at historically low levels,” wrote TD Cowen in a recent note to investors.

“Cable has lost subscribers for a fourth consecutive quarter and [it’s] getting worse,” the analysts wrote. “The Broadband market is clearly maturing and churn is at historic lows, meaning there are less [customer] adds to go around. Therefore, even with FWA [fixed wireless access] adds trending lower, Cable will continue to struggle to grow subscribers in the near-to-mid-term.”

“During the first quarter, our Internet customer growth remained challenged by a low move and generally low activity environment, coupled with continued elevated competition at least in the short term and a small impact from fewer low income connects due to discontinued ACP availability,” explained Charter CEO Chris Winfrey during his company’s quarterly conference call, according to Seeking Alpha.

Wireless carriers AT&T, Verizon and T-Mobile collectively reported more postpaid phone growth than expected, but the TD Cowen analysts noted their gross customer additions were “light across the board.”

MoffettNathanson analysts wrote that T-Mobile’s numbers during the first quarter “were met only after adopting a dramatically sweetened free-iPhone offer in the waning days of the quarter. That offer was pulled as soon as the quarter ended. Industry growth is slowing, Cable is taking share (and threatens re-pricing the industry lower in the process), and the ever-lengthening upgrade cycles for handsets have to reverse eventually. None of that is terrifying. But it is worrying.”

Telco job cuts are continuing after many years of layoffs.

AT&T and Verizon have been shedding jobs/ reducing headcount for many years and wireline carrier Lumen Technologies is following:

- AT&T cut the most total number of jobs in 2023, reducing its headcount from 162,920 employees at the end of 2022, to 150,470 employees at the end of last year. That was below the nearly 40,000 jobs AT&T managed to cut in 2022.

- Verizon cut slightly fewer jobs than AT&T last year, though it was a higher overall percentage of its employee base. The #2 U.S. carrier slashed 11,700 positions in 2023, ending the year with 105,400 total employees.

- Lumen Technologies recently announced it would cut almost 1,000 positions, or 7% of its workforce, to “right-size our business through automation and AI.”

The very tough telecom market may be pushing operators to raise money or pursue M&A. “The capital markets are becoming more favorable, further opening up the possibility for M&A,” wrote the financial analysts at TD Cowens.

- Cogent is raising around $200 million with some of its IPv4 Internet addresses.

- According to Bloomberg, Uniti Group is preparing to reunite with Windstream in a $15 billion merger.

Uniti and Windstream aren’t alone. For example, Bloomberg reported that European satellite operators SES and Intelsat have also restarted merger negotiations.

Meanwhile, T-Mobile now expects to close its $1.3 billion purchase of MVNO Mint Mobile in the coming days. The company also recently inked a $1.5 billion plan to invest into fiber operator Lumos.

It’s unclear when the next big M&A transaction might arrive in the telecom industry. There are plenty of assets up for sale, including UScellular’s mobile business and Crown Castle’s fiber and small cell operations.

………………………………………………………………………………………………..

Hovering over all of this is the apparent end of the U.S. government’s Affordable Connectivity Program (ACP). That program currently provides up to $30 per month to 23 million U.S. households for their telecom services, money that ultimately runs into the coffers of network operators.

“We’re expecting that the program funding is going to end,” said T-Mobile’s Michael Katz during his company’s quarterly conference call.

Katz said T-Mobile counts “a couple hundred thousand” prepaid customers on the program. But he suggested that the end of ACP might help funnel some customers to T-Mobile’s cheaper offerings, including its new Mint Mobile brand.

Meanwhile, other US subsidies are scheduled to hit the US broadband market in the coming months and years. For example, money from the Biden administration’s $42.5 billion Broadband Equity Access and Deployment (BEAD) program is expected to begin running through U.S. states starting next year. That money will arrive in the form of grants for the construction of networks in rural areas.

It’s unclear how that shifting subsidy landscape will affect a U.S. broadband market that’s showing signs of slowing.

“We now have confidence that industry [customer] adds will land at a little more than 400,000, down from a normal pace of 700-800,000,” wrote the financial analysts at New Street Research in a note to investors following the release of Charter’s earnings. “If we annualize this, based on normal seasonality, we land at a little more than 1 million adds for the year, down from a normal pace of ~2.5 million.”

The New Street Research analysts explained that growth in the U.S. broadband market is generally keeping pace with the formation of new households, which is also slower than normal.

“The big question: have we hit saturation for the broadband market or are there temporary pressures impacting growth,” wrote the analysts. “If it is the former, then this is the new normal. If the latter, growth should reaccelerate at some point.”

……………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/finance/things-are-getting-tight-for-us-telecom-network-operators

https://techblog.comsoc.org/category/affordable-connectivity-program-acp/

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

High Tech Layoffs Explained: The End of the Free Money Party

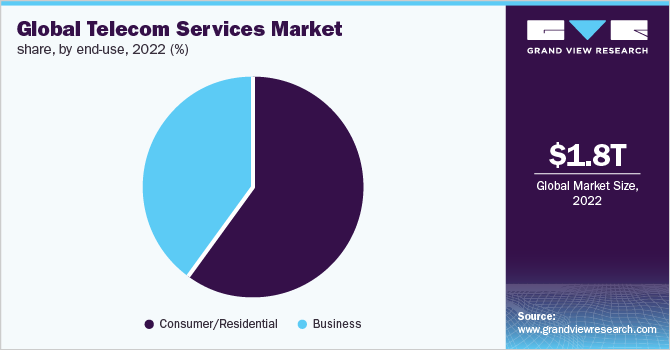

Grandview Research: global telecom services market to compound at 6.2% from 2023 to 2030

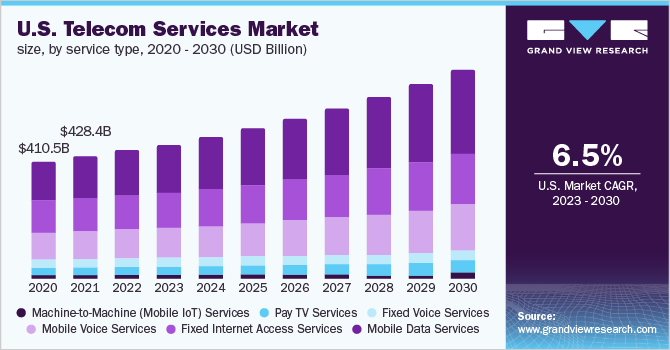

According to Grandview Research, the global telecom services market size was valued at USD 1,805.61 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030.

Rising spending on the deployment of 5G infrastructures due to the shift in customer inclination toward next-generation technologies and smartphone devices is one of the key factors driving this industry. An increasing number of mobile subscribers, soaring demand for high-speed data connectivity, and the growing demand for value-added managed services are the other potential factors fueling the market growth. The global communication network has undoubtedly been one of the prominent areas for continued technological advancements over the past few decades.

In 2022, the wireless networks accounted for a market share of more than 76.0% in the global market. The advent of cloud-computing technologies, artificial intelligence, and IoT is presumed to majorly contribute to the growth of wireless communication channels worldwide. Over the years, there has been a rapid deployment of systems for Wireless Local Area Networks (WLANs) that has enabled internet access to cellular devices in private homes, public spaces, airports, office buildings, cafeterias, and other areas. Such wireless densification to simplify work processes and automate routine test actions is presumed to prove beneficial, hence registering a robust CAGR in the forthcoming years.

In 2022, the consumer/residential segment accounted for the largest revenue share of more than 59.0% and is projected to maintain its lead over the forecast period. The significant growth is ascribed to the proliferation of smartphones worldwide. There were more than 8 billion mobile subscribers recorded globally in 2020, wherein more than 60% of the population was using smartphones. The private telecom operators account for a larger subscriber base as compared to government-owned companies. In addition, the growing demand for OTT applications is contemplating the users to subscribe to wireless internet offerings, thereby significantly contributing to the deployment of communication networks at a broader level. Additionally, the growing trend of using ultra-high-definition videos and online gaming is expected to boost the segment growth over the forecast period.

In 2022, the Asia Pacific captured more than 33.0% of share and is expected to grow at a CAGR of 7.0% from 2023 to 2030. The region is likely to attract more than half of the new mobile subscribers by 2030. The regional market is primarily driven by e-commerce and retailer buy-in platforms, smartphone ubiquity, and investments in 5G networks. China, Japan, and India have emerged as significant contributors to regional market growth. According to industry expert analysis, in February 2022, China recorded 1.02 billion internet users, which is more than three times the number of the third-placed United States, which had just over 307 million. India recorded the second highest internet users in February 2022.

Some prominent players in the global telecom services market include:

- AT&T Inc.

- Verizon Communications Inc.

- Nippon Telegraph and Telephone Corporation (NTT)

- China Mobile Ltd.

- Deutsche Telekom AG

- SoftBank Group Corp.

- China Telecom Corp Ltd.

- Telefonica SA

- Vodafone Group

- KT Corporation

- Bharati Airtel Limited

- Reliance Jio Infocomm Limited

- KDDI Corporation

- Orange SA

- BT Group plc

- Comcast Corporation

Telecom Services Market Report Scope

| Report Attribute | Details |

| Market size value in 2023 | USD 1,885.41 billion |

| Revenue forecast in 2030 | USD 2,874.76 billion |

| Growth Rate | CAGR of 6.2% from 2023 to 2030 |

| Base year for estimation | 2022 |

| Historical period | 2017 – 2021 |

| Forecast period | 2023 – 2030 |

| Quantitative units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Service type, transmission, end-use, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Mexico |

| Key companies profiled | AT&T Inc.; Verizon Communications Inc.; NTT; China Mobile Ltd.; Deutsche Telekom AG; SoftBank Group Corp.; China Telecom Corp Ltd.; Telefonica SA; Vodafone Group; KT Corporation; Bharati Airtel Limited; Reliance Jio Infocomm Limited; KDDI Corporation; Orange SA; BT Group plc; Comcast Corporation |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

References:

https://www.grandviewresearch.com/industry-analysis/global-telecom-services-market

Technavio: APAC region leads global telecom services market with 33% growth

Canalys: Global cloud infrastructure services spending up 16% in Q3-2023

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”

MTN Consulting’s Mid Year Update:

There are three different types of network operators: telecom operators (telcos), webscale network operators (webscalers), and carrier-neutral operators (CNNOs). In 2022, these three groups accounted for $4.1 trillion (T) in revenues, $559 billion (B) in capex, and 8.87 million employees. The report provides 2011-22 actuals and projections through 2027, and includes projections from past forecasts for reference.

Review of the 3 Market Segments:

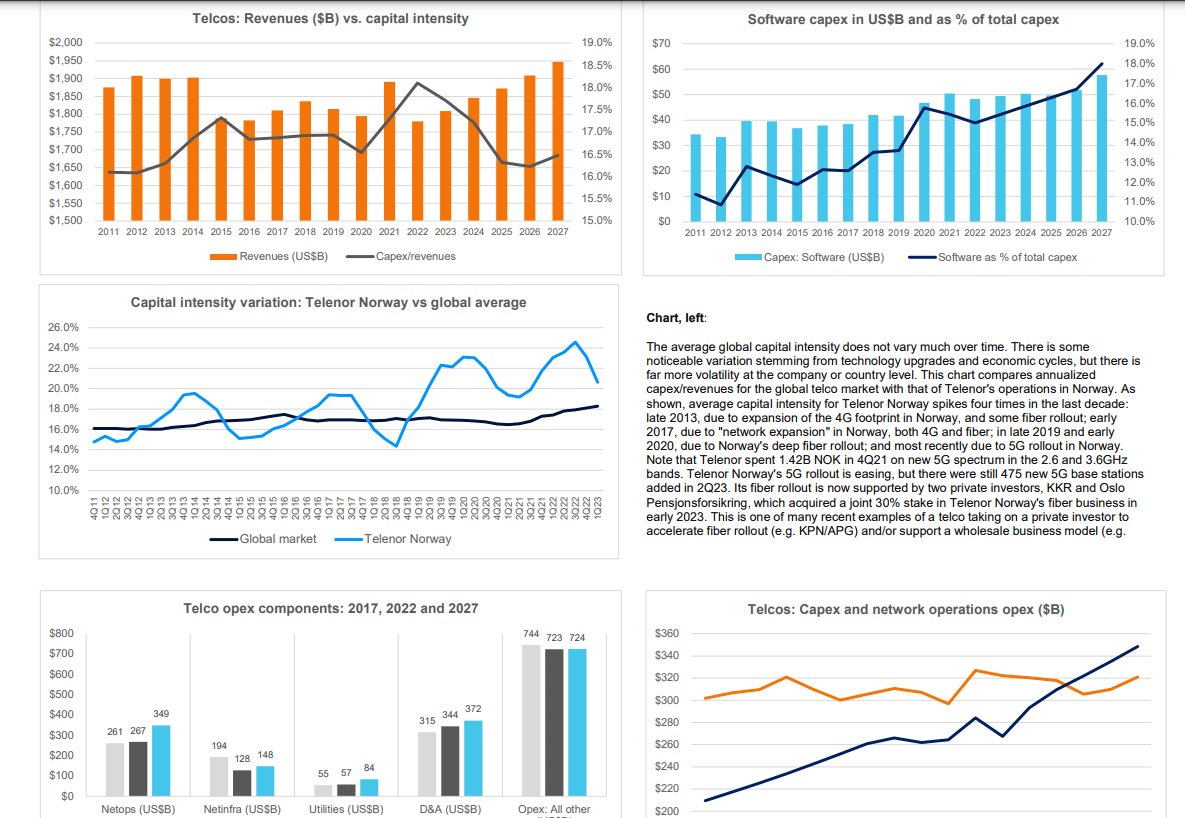

1. Telco: Telecom is essentially a zero-growth industry. Specific countries and companies do grow from time to time, in part from market share shifts, the different timing of growth cycles, or M&A. But global telco revenues have hovered in a narrow range ($1.7-$1.9 trillion) since 2011, and this will likely remain true through 2027. In 2022, revenues were $1.78T, and will grow an average annual rate of 1.8% to reach $1.95T by 2027.

Capex continues to vary with technology upgrade cycles (e.g. 5G) and government actions (e.g. newly issued spectrum, or rural fiber subsidies). In 2022, capex totaled $322B, or 18.1% of revenues; that’s an all-time high capital intensity, for coverage timeframe (2011-present). Capex will decline slightly through 2025, though, and then rise modestly again to reach $321B in 2027, which would be a 16.5% capital intensity. US capex surged in 2022, but will drop dramatically in 2023; we already expected this, though, so the current forecast is not significantly different. Software capex is growing more slowly than expected, and now likely to remain under 20% of total capex for the forecast period.

Headcount in telecom is declining faster than expected, and now likely to fall below 4.2 million in 2027, from just under 4.6 million in 2022. Labor costs per head will revert to a growth trajectory in 2023, as telcos develop a more IT/software-centric workforce.

2. Webscalers: growth from webscale has lifted the overall network operator market over the last decade. Webscalers surged during COVID, by all measures – revenues, capex, employment. Demand for data center chips and related gear also surged. Now, parts of the sector are cutting back slightly.

In 2022, revenues were $2.23 trillion, up just 4% YoY, far less than the average growth of 12% per year from 2011-22. We expect revenues to grow at a ~6% CAGR through 2027. Webscale capex was $203B in 2022, a healthy increase from 2021; due in part to generative AI interest, capex will grow again in 2023 and 2024, dip for a couple years of capacity absorption, and then end 2027 at around $231B. A larger portion of this capex will be for Network/IT/software investments: around 46%, from 44% in 2022. R&D spending by webscalers will remain high but fall from the record-breaking level of 2022 (12.0% of revenues), to about 10% in 2027. As topline growth gets harder for webscalers, they will become more cost conscious and short-term oriented.

3. CNNOs: the carrier-neutral sector remains tiny, with just $95B in 2022 revenues, but will grow to about $132B by 2027. Webscalers and telcos alike will both rely more on CNNOs over time for expansion of their data center, tower and fiber footprints.

Telcos will continue to spin out portions of their infrastructure to third-parties – both traditional CNNOs, and joint ventures like Gigapower, the AT&T-Blackrock partnership. Total CNNO capex for 2022 was $34B, and will grow to about $45B by 2027; a large chunk of the CNNO sector’s expansion will be inorganic, though, via acquisition of existing assets from other sectors. By 2027, the CNNO sector will have under its management approximately 3.7 million cell towers (2022: 3.3M), 1,607 data centers (2022: 1,224), and 1.1M route miles of fiber (2022: 960K).

Source: MTN Consulting

……………………………………………………………………………………………………………………………………………………………

Market drivers, constraints and risk factors:

This forecast represents only a modest revision from the edition published in December 2022. Most of the realities facing the operator market today were anticipated by our last forecast. For instance, we already expected that service revenues were not growing for telcos, and that 5G device sales distorted the market; an MTN Consulting report published in 2Q23 confirmed this fact, and supports a more cautious outlook for telco spending. We also thought that open RAN was overhyped, and was not likely to change the capex calculus for most established mobile operators. The 2023 dip in US telco capex was baked into our old forecast. The one big sector-specific change from the last forecast to this one is, the recent spike in interest in generative AI. This is a plus for the webscale market’s capex outlook, even if new revenue models are unclear and government regulations will slow adoption.

What about the macroeconomic climate? Wars, economic growth, inflation, interest rates, climate change, etc. Russia’s war on Ukraine remains ongoing, but hasn’t expanded to new countries. China has not invaded Taiwan as of yet, although this is a serious risk over the 5-year forecast horizon. Global economic growth is weaker than historic averages – about 3% this year and next, per the IMF – but inflation is easing, and the IMF’s GDP growth outlook improved slightly from April to July 2023. Interest rates continue to rise; the US federal funds rate has risen from 3.83% to 5.08% between 12/22 and 7/23, and further increases seem likely. Rising interest rates were already assumed to modestly depress 2023-24 capex, though.

Climate change is the one macro area that is quite a bit different than 8 months ago. The news gets worse each week. Government action continues to be gradual and consensus is hard to achieve. Increasingly the pressure will be on private companies to make voluntary, verifiable changes in how they operate. This doesn’t impact the forecast directly, but will impact how operators spend their tech budgets, as we have discussed in separate reports. Energy, sustainability and climate change will continue to be key themes in MTN Consulting research.

References:

Technavio: APAC region leads global telecom services market with 33% growth

According to a new report by Technavio, the telecom services market is forecast to grow by $625.5 billion from 2022 to 2027, progressing at a CAGR of 6.13% during the forecast period. APAC is estimated to contribute 33% market growth (more details below). The report offers an up-to-date analysis regarding the current global market scenario, the latest trends and drivers, and the overall market environment.

Increased demand for broadband is the key factor driving the growth of the global telecom services market. The demand for high-speed broadband connections has increased due to the rise in the number of internet users globally. As a result, the companies are providing faster speeds and higher bandwidths by upgrading their network infrastructure. The world is becoming connected through the internet so the demand for telecom services is growing rapidly. Furthermore, people and businesses require fast and reliable connectivity to access information and services, stay connected with each other, and conduct their daily activities. Hence, these factors will boost the growth of the telecom services market during the forecast period.

Telecom service is provided by a telecommunication provider or a specified set of user-information transfer capabilities provided to a group of users by a telecommunication system. Telecom services include all forms of voice telephony and data transmission as well as leasing of circuit capacity.

Market Drivers:

- Increased demand for broadband

- Mergers and acquisitions

- Increase in global mobile data traffic

- Technological advancements

- Adoption of 5g technology

- High investment by vendors

Challenges:

- Regulatory compliance

- Increasing competition among vendors

- Growing concerns for environment

APAC region leading:

- APAC dominated the global telecom services market with the largest market share in 2022.

- APAC is the world’s most populous continent, and its population is increasing rapidly.

- As the population grows, so does the demand for telecom services, such as mobile phones and Internet access.

- Many APAC countries are experiencing rapid economic development, which is increasing the demand for telecom services.

- As people become more affluent, they are more likely to want access to mobile phones and high-speed Internet. APAC is experiencing a significant shift from rural to urban living.

- As people move to cities, they require more advanced telecom services to stay connected and conduct business.

- The rapid pace of technological change is transforming the way people live, work, and communicate.

- In APAC, there is a strong focus on digital transformation, which is driving the demand for telecom services.

- Thus, due to population growth, economic development, urbanization, and digital transformation, the demand for telecom services is booming in APAC, which may positively impact the growth of the global telecom services market during the forecast period.In 2020, the COVID-19 pandemic increased the demand for telecom services as more people work, learn, and socialize from home.

- As a result, there has been a surge in the demand for high-speed Internet, video conferencing, and online entertainment services.

- The increased demand for telecom services has also led to network congestion in some areas.

- With more people using the Internet simultaneously, network speeds can slow down, making it difficult for people to work and communicate effectively.

- The pandemic has disrupted global supply chains, which has impacted the availability of telecom equipment and devices.

- This has led to delays in the rollout of new infrastructure and has impacted the supply of mobile devices.

- However, in late 2020, the initiation of large-scale vaccination programs led to the lifting of lockdown restrictions and the resumption of industrial operations, which increased the demand for telecom services in commercial end-users as many people started going to offices.

References: