Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground

Huawei expects to report revenue exceeding 700 billion yuan ($98.5 billion) for 2023, according to comments from rotating deputy chairman Ken Hu in an internal new year message seen by Reuters.

Mr. Hu Houkun (Ken Hu), Huawei’s deputy chairman Photo Credit: Huawei

That optimistic forecast offers further evidence that Huawei is rebounding after U.S. sanctions starting in 2019 crippled some of its business lines by restricting access to critical global technologies such as advanced chips.

“Thanks to our partners across the value chain for standing with us through thick and thin. And I’d also like to thank every member of the Huawei team for embracing the struggle – for never giving up,” Hu said.

“After years of hard work, we’ve managed to weather the storm. And now we’re pretty much back on track.”

“In 2023, we expect to wrap up the year with over 700 billion yuan [US$98.9 billion] in revenue,” he added. That would be a 9% increase on sales from 2022, when the comparable rate of global telecom revenue growth was less than 1%.

Indeed, 2023 has been a very difficult year for telecom network equipment makers such as Ericsson and Nokia. Ericsson’s revenues for the first nine months fell 7% on a constant-currency basis. Nokia’s were down 3%.

…………………………………………………………………………………………………….

What sectors might be responsible for the 9% sales growth Huawei expects this year? From the first paragraph of Ken Hu’s commentary.

“Our ICT infrastructure business has remained solid, and results from our device business surpassed expectations. Both our digital power and cloud businesses are growing steadily, and our intelligent automotive solutions have become significantly more competitive.”

Huawei’s improvement might be due to the upbeat performance of its devices business which includes smartphones and smartwatches. In 2020, the company’s consumer unit accounted for about 54% of all Huawei’s revenues, but its sales halved the following year. It was badly hurt by sanctions because smartphones have a greater need than networks do for advanced chips. Huawei was also cut off from Google software that runs on other Android smartphones. Its response to all this included the sale of Honor, a big smartphone subsidiary.

This past August, Huawei launched its Mate 60 series of smartphones, which are believed to be powered by a domestically developed chipset. The release was widely viewed as marking Huawei’s comeback into the high-end smartphone market after years of struggling under U.S. sanctions.

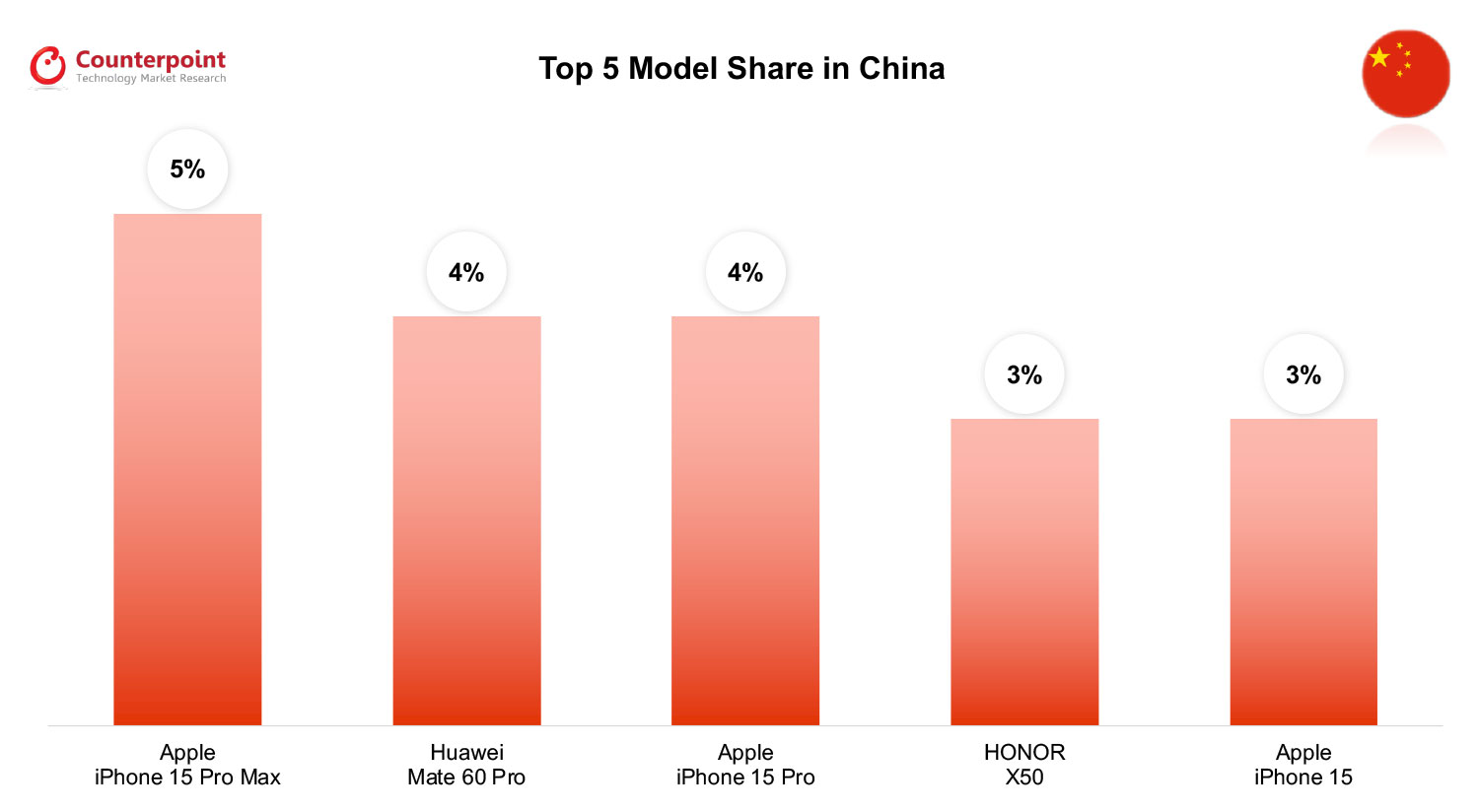

Huawei’s smartphone shipments surged 83% in October year-on-year, helping the overall Chinese smartphone market to grow 11% over the same period, according to Counterpoint Research which wrote:

Huawei’s success and climb in the rankings has been helped by the recent launch of its Mate 60 series 5G phones and popularity of its older P-series 4G devices. “The company is posting some very good growth numbers, but obviously there’s base effects happening,” notes China analyst Archie Zhang. “We expect it will grow by more than half this year, but that still doesn’t bring them close to pre-COVID levels. But it’s signalling a promising 2024.”

Huawei’s smartwatch business is doing very well. Counterpoint’s Woojin Son wrote:

“There is significant value in examining the growth drivers of the global smartwatch market in Q3 2023. Amid a global economic slowdown, most consumer device markets like smartphones are still experiencing stagnation compared to a year ago. In contrast, the smartwatch market has recorded YoY growth for two consecutive quarters in both premium and budget segments. Notably, High-level Operating System (HLOS)* smartwatches, typically featuring higher specification and price, have grown largely driven by Huawei in Q3 2023 as the company posted its highest quarterly performance ever. Most of this surge occurred in the Chinese domestic market, coupled with the launch of new Huawei 5G smartphones.”

……………………………………………………………………………………………………………………..

Looking ahead to 2024, Huawei said in the letter the device business would be one of the major business lines it would focus on for expansion. “Our device business needs to double down on its commitment to developing best-in-class products and building a high-end brand with a human touch,” the letter said.

Missing from Hu’s remarks was any reference to Huawei’s profits, which plummeted 69% last year, to just RMB35.6 billion ($1 billion).

Huawei watchers will probably have to wait until the publication of its 2023 annual report for an update. For sure, the company is cutting costs. “We will continue to streamline HQ, simplify management, and ensure consistent policy, while making adjustments where necessary,” said Huawei’s chairman.

Yet the company will likely continue to ramp up R&D spending. RMB161.5 billion ($22.8 billion) was spent on R&D in 2022, about a quarter of total revenues and a 13% year-over-year increase. Expect a similar increase for 2023 and 2024.

References:

Singles Day Growth Boosts Odds of China Market Smartphone Recovery in Q4 2023

Global Smartwatch Market Rebounds; Huawei and Fire-Boltt Hit New Peaks

One thought on “Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground”

Comments are closed.

WSJ: Huawei Readies New Chip to Challenge Nvidia, Surmounting U.S. Sanctions

Huawei Technologies is close to introducing a new chip for artificial intelligence (AI) in China, overcoming U.S. sanctions to challenge Nvidia. Chinese internet companies and telecommunications operators have been testing Huawei’s latest processor, called Ascend 910C, in recent weeks, according to people familiar with the matter. Huawei told potential clients that the new chip is comparable to Nvidia’s H100, which was introduced last year and isn’t directly available in China, the people said.

Huawei’s ability to keep advancing in chips is the latest sign of how the company has managed to break through U.S. erected obstacles and develop Chinese alternatives to products made by the U.S. and its allies. Aided by billions of dollars in state support, it has become a national champion in areas including AI and a key part of Beijing’s endeavor to “delete” American technologies.

Still, Huawei has run into production delays in its current chips, according to the people. It faces the prospect of further U.S. restrictions that could deprive it of machine components and the latest memory chips used in AI hardware.

Companies including TikTok parent ByteDance, search-engine giant Baidu and state-owned telecommunications carrier China Mobile are in early discussions about obtaining the 910C, the people said. Initial negotiations between Huawei and potential customers indicate that orders are likely to surpass 70,000 chips, with a total value of around $2 billion, they said.

Huawei aims to start shipping as soon as October, the people said. They cautioned that final purchases may differ from initial plans and the delivery schedule may change. A Huawei representative declined to comment.

China is stepping up support for semiconductor manufacturing and in May raised $48 billion in the third installment of a national investment fund for the industry.

Huawei’s new AI chip seeks to fill a void left by Nvidia after U.S. export controls beginning 2022 effectively prevented the Santa Clara, Calif.-based company from offering its most advanced chips to Chinese customers. Nvidia continues to create less-powerful variants for China that comply with the export rules, although some in China have found ways to obtain its more powerful chips through other means.

Chinese customers buying from Nvidia have to make do with the H20, a downgraded version of its AI chips, which Nvidia designed to clear Washington’s rules for selling to China and introduced this spring.

In the U.S., by contrast, Nvidia clients such as OpenAI, Amazon and Google will soon have access to the company’s latest Blackwell chips and the GB200 line of hardware powered by them, which Nvidia has described as several times more powerful than its existing hardware.

Nvidia is working on another China-oriented chip called B20, but the design might have trouble getting U.S. approval for China export if the White House tightens its rules, said people familiar with the matter.

Dylan Patel, an analyst at industry research firm SemiAnalysis, said he viewed Huawei’s 910C as an advance that could perform better than Nvidia’s B20. If Huawei can produce its new chip successfully and Nvidia is still blocked from offering advanced chips to Chinese customers, he said, “Nvidia would lose market share rapidly in China.” SemiAnalysis says Huawei could produce 1.3 million to 1.4 million 910C chips next year if it doesn’t face additional U.S. restrictions.

Initially Chinese customers weren’t enthusiastic about Nvidia’s H20 because they weren’t sure it was significantly better than Huawei’s latest offering, The Wall Street Journal reported. However, some clients ramped up H20 orders after tests of bigger H20 clusters produced favorable performance results and Nvidia cut prices, people familiar with the matter said. Huawei’s production bottlenecks also played a role.

SemiAnalysis estimated in July that Nvidia would sell over one million H20 chips in China this year, valued at some $12 billion. The number of chips sold would be almost twice as many as Huawei is expected to sell of its 910B, SemiAnalysis said.

The U.S. sanctions are behind some delays this year in shipments of the Ascend 910B, currently Huawei’s most advanced AI processor, people familiar with the matter said.

In recent weeks, Huawei has started stockpiling high-bandwidth memory chips, used for state-of-the-art AI processors, in response to potential U.S. curbs on China’s access to such chips, the people said. The U.S. Commerce Department frequently updates sanctions and export controls, and people in the industry expect further action this year.

Huawei has told its local contract manufacturer and suppliers to store more machine components, anticipating that production workarounds might shorten the life of some parts and it might have a harder time sourcing parts, the people said.

At a semiconductor industry conference in June, a Huawei executive said nearly half of China’s large language models were trained with Huawei’s chips. He said 910B’s performance has surpassed Nvidia’s A100 in training models.

A June analysis by the Center for Security and Emerging Technology, a Georgetown University policy research body, said the 910 series was competitive with the A100 but also faced significant problems including limited manufacturing capacity and low yield. It said the 910B chip has fewer active AI cores—key components for computation—compared with Huawei’s previous version, so it wasn’t a big improvement.

https://www.wsj.com/tech/ai/huawei-readies-new-chip-to-challenge-nvidia-surmounting-u-s-sanctions-e108187a