Huawei is back – net profits more than doubled in 2023!

China’s Huawei Technologies said its net profit more than doubled last year, marking a stunning comeback for the company years after U.S. export controls cut it off from advanced technology.

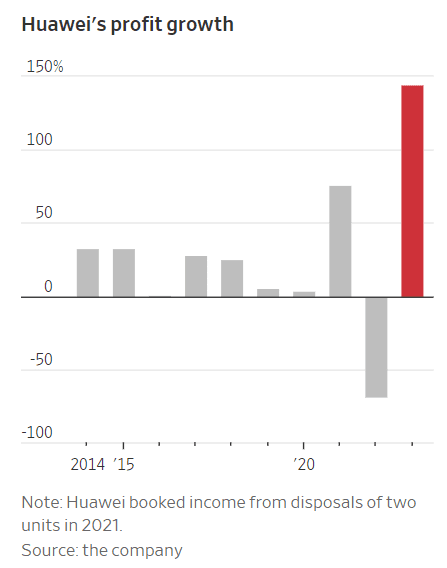

The tech giant on Friday said profit rose to 87 billion yuan, or $12 billion, a rise of more than 140% from the same period a year ago. It is the largest jump in profit for the company since it started reporting comparable figures in 2006. Revenue rose 10% to $99 billion.

It’s Huawei’s highest revenue number, and its first year of topline growth, in four years. Operating cash flow of RMB69.8 billion ($9.7 billion), up fourfold from 2022 and also the highest in four years.

In a statement, Huawei downplayed the figures, with current rotating chairman Ken Hu describing them as “in line with forecast.”

It’s a long way from the imposition of U.S. technology transfer sanctions five years ago, when Huawei executives acknowledged the company was fighting for its survival.

Huawei said growth was driven by higher sales in its consumer electronics and cloud computing offerings.

Last September, Huawei surprised U.S. authorities by releasing a new smartphone, the Mate 60 Pro, with 5G-like capabilities, running on its homegrown chips. Five years after the U.S. restricted sales of the most powerful chips and the Android operating system to Huawei, the telecom equipment and mobile phone maker has shown strong resilience.

Huawei’s core ICT infrastructure unit, comprising the legacy carrier network business and enterprise network sales, remains the biggest source of revenue. It grew 2.3% to RMB362 billion ($50.1 billion), while the cloud business was another of the big growth drivers, gaining 22%.

The company has diversified into new business lines such as cloud computing, enterprise software and automobile systems and retooled its products.

Huawei co-built Aito, one of China’s most popular EVs. There’s also the newly formed smart auto components units business, which more than doubled revenue to RMB4.7 billion ($650 million).

“We’ve been through a lot over the past few years. But through one challenge after another, we’ve managed to grow,” said Ken Hu, Huawei’s rotating chairman.

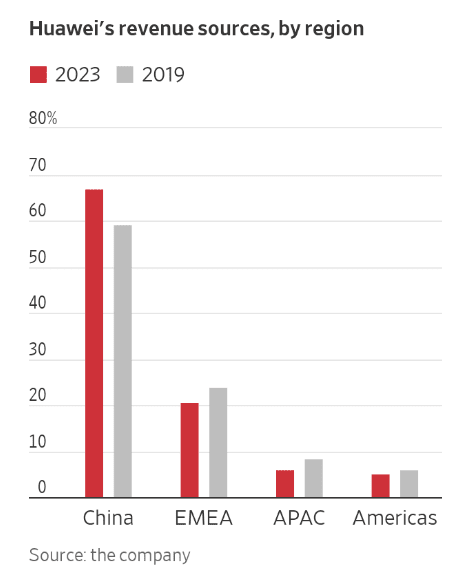

Last year nearly 70% of Huawei’s revenue came from China as its overseas presence shrunk. Five years ago, China formed about 60% of its revenue, while the rest came from Europe and emerging markets. Huawei doesn’t break out U.S. sales figures.

Revenue from its telecommunication equipment and enterprise technology business grew 2%. Sales at its consumer business group, encompassing products such as smartphones, laptops and smart wearables, rose 17%.

Huawei was the world’s largest providers of telecom equipment and among the biggest smartphone makers globally, but U.S. sanctions beginning in 2019 crushed its smartphone business and forced it to spin off its budget Honor handset brand.

U.S. authorities also blocked American carriers from buying from the Chinese company and asked allies not to use Huawei’s telecom equipment, calling the company a national security threat. Huawei said then that restricting it from doing business in the U.S. wouldn’t improve national security and would limit the country’s 5G development.

But the past few months have indicated a reversal of Huawei’s fortunes. Since the launch of the Mate 60 series, Huawei has begun to chip away at Apple’s high-end smartphone market share in China.

On Friday, Huawei said the Mate 60 Series and HarmonyOS, its own operating system for mobile phones and other smart devices, had “received wide acclaim.” The company said its consumer unit grew by “overcoming major technical barriers and diving deep into the industry’s most challenging issues.”

Huawei didn’t provide sales numbers for the phones. Ming-Chi Kuo, a supply chain analyst at TF International Securities, last September predicted that Huawei would likely deliver at least 12 million Mate 60 handsets by August.

The company said cloud computing revenue rose 22% last year. Huawei, China’s second-largest cloud computing provider, had outpaced the growth of market leader Alibaba Group and smaller rival Tencent Holdings. Last year, the company launched new cloud-based artificial-intelligence offerings for business use that are now deployed in banks and mines.

Analysts say Huawei is also set to benefit from China’s localization policy, as the company expands its offerings in areas such as semiconductors, where Beijing is seeking more self-sufficiency.

Huawei has managed to deliver AI chips that developers say match the capabilities of some of Nvidia’s top processors. Nvidia named Huawei as one of its competitors in its annual report in February.

In 2023, Huawei spent $23 billion on research and development, about 23% of its total revenue.

References:

https://www.lightreading.com/5g/huawei-profit-soars-as-it-returns-to-growth

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Kuwait stc/Huawei deploy 5G Redcap FWA in Kuwait; Huawei’s 5G core wins

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Huawei launches new network products at HNS 2023 in Mexico

Huawei and Ericsson renew global patent cross-licensing agreement

3 thoughts on “Huawei is back – net profits more than doubled in 2023!”

Comments are closed.

Huawei said its consumer business saw revenue grow by 17.3% year-on-year to 251.5 billion yuan in 2023. ICT remained by far Huawei’s biggest revenue driver with 362 billion yuan in revenue in 2023, up 2.3% from a year ago. Cloud revenue grew by nearly 22% to 55.3 billion yuan.

https://www.cnbc.com/2024/03/29/huaweis-profit-doubled-in-2023-as-smartphone-autos-business-picked-up.html

……………………………………………………………..

Last year marked the third consecutive year of growth for the company after revenue plummeted by almost a third in 2021 when the company started to exhaust chip reserves, though revenue remains below its 2020 peak of 891.3 billion yuan.

Huawei was relatively muted about its achievement, doing away with the press conference and launch event it has held every year at least since the U.S. restrictions began.

In a press release, rotating chairman Ken Hu said the results were in line with forecasts.

“We’ve been through a lot over the past few years. But through one challenge after another, we’ve managed to grow.”

At a launch event last year, Meng Wangzhou, Huawei’s CFO and the daughter of the company’s founder, announced that Huawei was no longer in crisis mode.

Net profit in 2023 rose by 144.5% to 87 billion yuan, with the net profit margin more than doubling on a year earlier to 12.35%.

Some of that came from ongoing payment from the sale of the Honor smartphone brand, which Huawei sold in November 2020, a company spokesperson said.

While the company’s core ICT infrastructure business remained stable, its cloud business grew by more than a fifth, generating revenue of 55.3 billion yuan.

Huawei’s four-year-old smart car software and components business also saw major growth albeit from a lower comparison base, up 128.1% year on year to 4.7 billion yuan.

Last year Huawei announced it would spin off the smart car unit into a new company.

Earlier this month, Richard Yu, the managing director and chairman of Huawei’s smart car solutions, announced the unit would likely turn a profit from April after losing billions of yuan in the past year, local media reported.

https://www.reuters.com/technology/chinas-huawei-continues-rebound-with-strongest-earnings-growth-since-2019-2024-03-29/

stc and Huawei Completed the MENA Region’s First-Ever Long-Haul 800G Live Network Trial

stc Group, the leading operator in the Kingdom of Saudi Arabia, partnered with Huawei to complete the MENA region’s first-ever long-haul 800G/channel trial in its live optical network. This successful live network trial with connection over 1,000 kilometers, from Riyadh to Makkah, of state-of-the-art processing and transporting capacity proves the 800G solution is ready for scale deployment across Saudi Arabia, driving the Kingdom and the MENA region’s digital transformation.

As a result of this successful trial, stc Group networks can now transport more data throughput for every wavelength deployed and extend across longer distances without generation, reducing power and transport costs, and supporting efficiency standards across stc Group’s infrastructure.

The high-performance 800G/channel optical module, empowered by a built-in high baud bandwidth modulator and super 16QAM modulation with a Channel-Matched Shaping (CMS) 2.0 algorithm, established connection over 1,000 kilometers in a live Colorless-Directionless-Contentionless (CDC) network, proving the stc systems can monitor and sustain complex link environments in real-time, optimizing network transmission performance.

stc has been committed to offering excellent experience to all customers with state-of-the-art technologies and solutions. The 800G channel trial project is the result of stc’s focus on maximizing fiber capacity and optical network efficiency, making it possible to deliver up to 64Tbps single fiber capacity to meet ever-increasing bandwidth demand from all users, and reduce the per bit power consumption by more than 50% compared with 100G channel. The trial shows that stc is strengthening its partnership with Huawei in the ultra-high-speed optical transmission field.

https://www.huawei.com/en/news/2024/3/800g-trial-with-stc

Great post! Where will Huawei get advanced semiconductors- processors and FPGAs in light of US sanctions?