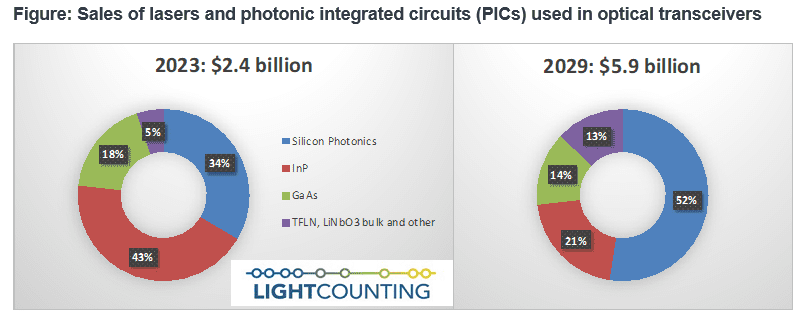

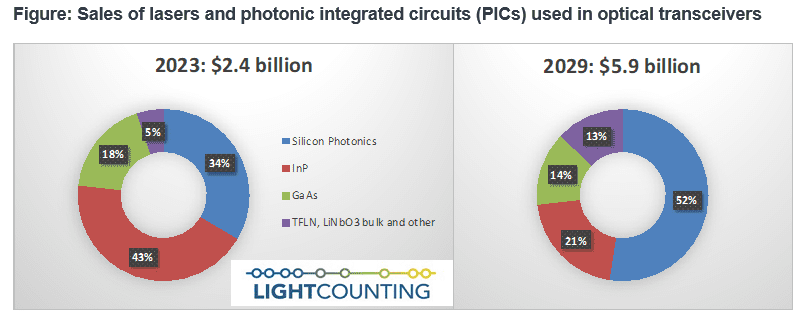

LightCounting: Silicon Photonics chip market to hit $3 billion in 2029

Sales of silicon photonics chips will increase from $0.8 billion in 2023 to just above $3 billion in 2029. Sales of PICs with TFLN modulators will grow from almost zero now to $0.75 billion by 2029. Sales of bulk LiNbo3 modulators used in legacy DWDM transceivers will continue to decline, becoming negligible by 2029.

Surging demand for optical connectivity in AI Clusters has reversed a decline in market share of GaAs VCSELs. Nvidia purchased close to 2 million 400G SR4 and 800G SR8 transceivers and plans to buy 4 million more this year. These modules use 100G VCSELs, which many experts expected not to be reliable enough for deployment. It is a true comeback story for VCSELs, but it will not last. Nvidia is prioritizing silicon photonics technology for its next generation transceivers.

The Figure below shows sales data of lasers and photonic integrated circuits (PICs) used in optical transceivers, sorted by technology.

LightCounting expect gradual declines in market shares of GaAs and InP based transceivers, while silicon photonics (SiP) and Thin Film Lithium Niobate (TFLN) PICs will gain share. Adoption of LPO and CPO will also contribute to the market share growth of SiP and possibly even TFLN devices.

Companies manufacturing TFLN products are joining forces in accelerating supply chain development. Advanced Fiber Resources (AFR), HyperLight, Fujitsu Optical Components (FOC), Liobate and Ori-Chip as well as their partners organized a special workshop on TFLN at OFC 2024, which was very well attended. We expect more companies to invest into an infrastructure needed to scale up production of TFLN wafers and PICs.

Silicon photonics will provide an integration platform for TFLN. If we include TFLN in a broader definition of silicon photonic PICs, sales of these products will reach close to $3.8 billion by 2029.

About the Author:

Vladimir Kozlov, Founder and CEO of LIGHTCOUNTING, an optical communications market research company.

References: