Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

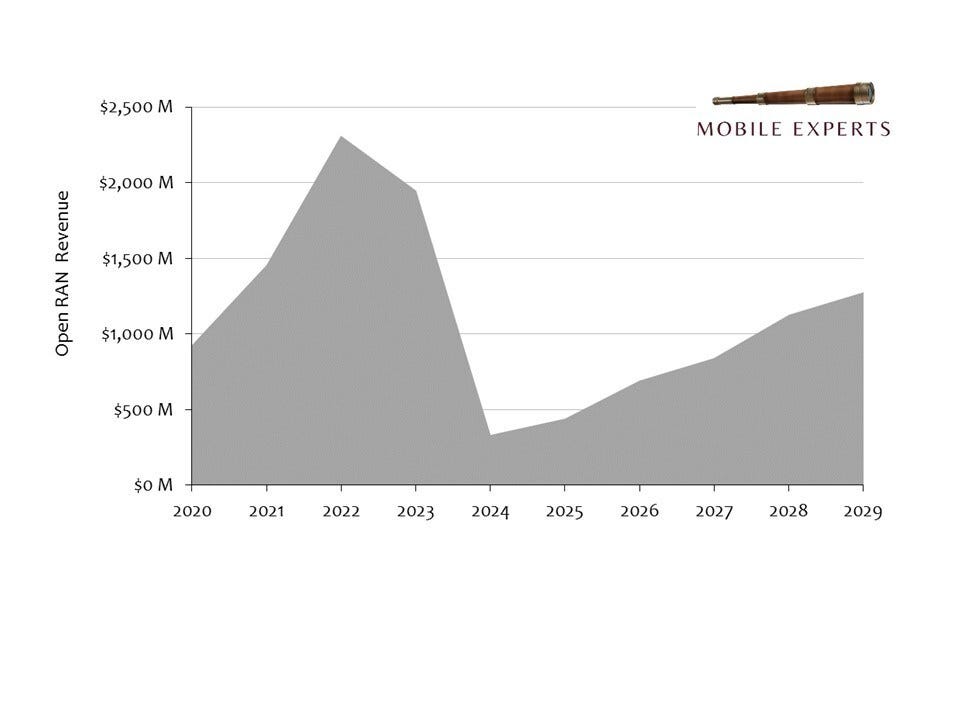

As expected, the Open RAN market ‘screeched to a halt’ during 2024. Mobile Experts released a new report on Open RAN, which it described as ‘the most bizarre market growth profile ever seen in the wireless market.’ After ‘great success’ with deployment in greenfield networks by the DISH Networks in the U.S., Rakuten in Japan and 1&1 in Germany, the market research firm is predicting a significant slump this year with a very slow recovery (see chart below).

“Our revenue chart for Open RAN looks like the Grand Canyon,” said Joe Madden, Principal Analyst at Mobile Experts. “All of the big clean-sheet O-RAN deployments have finished their major buildout phase, so now the market will transition to upgrades on legacy networks. But legacy networks will use Open RAN differently.”

“Many people don’t understand why legacy mobile operators are rejecting the original Open RAN business model and are choosing a Single Software business model instead. This report provides clear guidance on why the market is fundamentally changing.”

……………………………………………………………………………………………………………………………………

Comment and Analysis:

The original Open RAN business model called for multiple vendors to provide the equivalent of a disaggregated base station. That is why it was dubbed “Open.” However, legacy carriers prefer a closed solution, where a single vendor is the primary supplier of hardware and software for an Open RAN system. This limits the supply chain diversification that O-RAN was designed to promote and pushes out new vendors. Some examples of single vendor Open RAN solutions include:

-

AT&T and Ericsson: AT&T’s five-year, $14 billion Open RAN contract is a single vendor Open RAN deal.

- Deutsche Telekom and Nokia: Deutsche Telekom’s contract with Nokia includes the initial deployment of Fujitsu radios in Northern Germany.

- NTT DOCOMO and Nokia: NTT DOCOMO will use Nokia as its vendor to deploy Open RAN.

- Verizon and Nokia and Samsung Networks: Verizon has been using “Open RAN-capable” virtual RAN (vRAN) systems from Nokia and Samsung Networks for several years, but that is not true Open RAN as per O-RAN Alliance specs. Verizon could evolve its vRAN deployments with Samsung Networks into an Open RAN architecture, following the recent appointment of Open RAN advocate Yago Tenorio as its CTO.

–>Meanwhile, there are still no official standards for Open RAN- only O-RAN Alliance specs.

The new report lays out the expected revenue in hardware (radios, servers, antennas) and software (vDU, vCU, RIC, xApp, rApp, and dApp) through 2029, as major operators like AT&T, Vodafone, Verizon, Telus, DoCoMo, and others begin to buy mobile infrastructure from alternative vendors.

“The US Government is pumping hundreds of millions of dollars into Open RAN,” continued Mr. Madden. “But sadly, the biggest challenge of Open RAN will not be addressed by NOFO and other government grants. Each grant will be too small to fix the fundamental economic challenge of Open RU hardware. The market will solve the problem anyway, without government help. Get our report for the details.”

Here’s a chart of Open RAN revenue by year:

Subscribers to the Open RAN 2024 report will receive:

- Full access to the 40-page Open RAN 2024 report;

- Clear breakdowns of the 5-year forecast in an Excel spreadsheet;

- Detailed technical background and architectural analysis;

- Insight into the pace of upcoming projects with legacy operators; and

- Access to the analysts behind the reports.

References:

https://www.telecoms.com/open-ran/open-ran-market-fell-83-in-2024

https://mobile-experts.net/reports/p/oran24?rq=open%20RAN

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN

Parallel Wireless deploys 1,500 Open RAN sites across Africa; partners with Hotspot Network in Nigeria

DISH Wireless Awarded $50 Million NTIA Grant for 5G Open RAN Center (ORCID)

Deutsche Telekom Network Day: Fiber, Mobile Network, Open RAN and 5G SA Launch in 2024

NTT DOCOMO OREX brand offers a pre-integrated solution for Open RAN

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

5 thoughts on “Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions”

Comments are closed.

From TelecomTV:

Other Open RAN investments are planned by operators, such as KDDI in Japan, which is working primarily with Samsung Networks for its deployment, and Deutsche Telekom, while Telefónica continues to include Open RAN in its plans, notably in Germany but also at a group level.

However, that market uptick isn’t necessarily good news for all vendors involved in the Open RAN sector, as Madden notes the growing trend towards single software vendor, rather than multivendor, deployments, which means that whatever business there is will be concentrated with just a few suppliers: AT&T’s award of a major contract to Ericsson, which is the sole provider of cloud RAN and associated management and orchestration software for the US telco’s Open RAN rollout, being a key example of that trend.

And the overall value of the market isn’t much to shout about either, with Madden expecting annual Open RAN investment levels to not even reach $1.5bn by 2029, still some way off the levels seen in 2021 until 2023, despite significant investments from the US government into Open RAN R&D – see US allocates $420m for Open RAN radio unit R&D.

While Madden’s outlook will dent the hopes of Open RAN hopefuls, such as Mavenir, Parallel Wireless and the slew of vendors developing low-cost Open RAN radio units, other industry watchers are more optimistic, with long-time mobile network sector analyst Stéphane Téral predicting the market will be worth $8bn by 2029 – see Tier 1 telcos to drive Open RAN’s second growth cycle – report.

https://www.telecomtv.com/content/open-ran/open-ran-investments-plummet-report-51566/

Teral Research:

The broader open RAN landscape is under pressure, leading to consolidation, restructuring, and even some bankruptcies. However, Samsung Networks has emerged as the front-runner in the global open vRAN market, closely followed by NEC Corporation and Fujitsu Network Communications.

Looking ahead, real acceleration is expected in 2025, when Tier 1 operators like Vodafone join AT&T with large-scale open RAN rollouts. This will usher in a new phase of adoption, positioning open RAN for broader global uptake in the coming years. As a result, we expect open RAN to account for more than 30% of global RAN sales by 2030.

https://www.linkedin.com/pulse/whats-new-t%C3%A9ral-research-t-ral-research-dlt5c/

Nvidia could succeed where open RAN has mostly failed. In the early days of the O-RAN Alliance, the technology was heralded as a way for operators to break big vendors’ lock on expensive RAN components. But today most agree that open RAN hasn’t done much to upend the global RAN order – Ericsson, Nokia, Huawei and Samsung still sit at the top of the market.

“The concept of open and interoperable interfaces will live on in some form of incarnation, but the original vision is no longer viable,” wrote Chetan Sharma, an independent analyst, on social media.

https://www.lightreading.com/ai-machine-learning/nvidia-the-vendor-that-must-not-be-named

Mavenir will stop hardware production after struggling to land contracts in a radio access network (RAN) market still dominated by Ericsson, Huawei and Nokia. “The only wrong thing we did was to bet on open RAN in a heavy way,” Mavenir CEO Pardeep Kohli said on a call with Light Reading.

Mavenir saw open RAN – which allows telcos to combine parts from different vendors more easily – as an opportunity to break into a market that generated product revenues of about $45 billion in 2022, according to data from Omdia, a Light Reading sister company. But Mavenir’s expansion into hardware was followed by a sharp downturn as telcos cut spending on RAN products by $5 billion in 2023 and another $5 billion last year, according to Omdia’s data. In that environment, telcos have largely stuck with existing suppliers and continued to buy all the products for any site from the same company.

Dell’Oro, another analyst firm, expects multivendor open RAN deployments – where an operator pairs one vendor’s RAN compute products with another supplier’s radios – to account for just 5% to 10% of total RAN revenues in 2028. Without sector growth between now and then, Mavenir could be looking at an addressable RAN compute market worth no more than $1.05 billion in sales.

“The only wrong thing we did was to bet on open RAN in a heavy way,” Mavenir CEO Pardeep Kohli said on a call with Light Reading.

The decision to exit RAN hardware will not have a massive impact on revenues at Mavenir, which generates 80% to 90% of its sales in the market for core network software. But it should make a big difference to margins, which have inevitably suffered with the push into the less profitable hardware sector.

Even so, Kohli insists most of Mavenir’s research-and-development (R$D) spending in the RAN area has gone toward software, not hardware. “We spent almost $250 million, but the hardware was a very small portion of it,” he said. “We’ve probably spent $50 million, $60 million doing the hardware. A lot of it went into doing software and breaking out the open interface.”

https://www.lightreading.com/open-ran/mavenir-boss-regrets-open-ran-bet-in-u-turn-after-financial-rescue

“No, open RAN is not dead at all,” said Tommi Uitto, the president of Nokia’s mobile networks business group, during a press conference at the Finnish company’s futuristic new research and development campus in Oulu earlier this month. “I want to say that we are fully committed to open RAN. We are fully committed to cloud RAN. There are more than Ericsson and Nokia.”

Hardly any entirely new builds, dubbed “greenfield” networks, have materialized since the birth of the O-RAN Alliance. And the biggest, owned by Echostar in the US, is to be decommissioned following the company’s multibillion-dollar sale of spectrum licenses to AT&T and SpaceX. Echostar’s move is a huge blow to Mavenir and other open RAN suppliers involved in the rollout.

The bigger problem has been the apparent lack of interest among the world’s incumbent “brownfield” operators. Nearly all have stuck with traditional vendors including Huawei, Ericsson and Nokia. Last year, data from Omdia (a Light Reading sister company) showed the RAN market share of those three companies had grown from 75.1% in 2023 to 77.4%. The world’s largest open RAN deployment by a brownfield operator is AT&T’s in the US – and it is controversial. While AT&T claims to be using products compliant with O-RAN Alliance specifications, almost all of them are provided by Ericsson.

Omdia gave Samsung a 4.8% share of the RAN market last year, making it the world’s fifth-biggest vendor by sales, behind Huawei, Ericsson, Nokia and ZTE.

Japan’s NEC and Fujitsu, the only other companies tracked by Omdia, had shares of 0.9% and 0.5% respectively.

In April, Fujitsu span off its network assets into a new business called 1FINITY and predicted that network sales would fall 17% in the current fiscal year. NEC warned in July that revenues at its telecom services unit would fall 12.6% in the current quarter and that its operating profit would drop 31%.

Both have endured the harsh RAN conditions under the protective wings of huge electronics companies generating tens of billions of dollars in annual revenues. Startups and much smaller organizations like Mavenir have not had that luxury and are not even regarded today as viable contenders by some of the biggest telcos.

“Small vendors of the ecosystem will have a role to play, but more in indoor areas and maybe some neutral host situations,” said Laurent Leboucher, the group chief technology officer of France’s Orange, at this year’s MWC Barcelona. “The really big open competition to replace and transform the existing mobile network is still with just a few players.”

https://www.lightreading.com/open-ran/nokia-mobile-boss-says-open-ran-is-not-dead-amid-duopoly-fears