Enterprise IoT and the Transformation of UK Telecom Business Models – Part 1

By Afnan Khan (ML Engineer) and Raabia Riaz (Data Scientist)

In 2026, the Internet of Things (IoT) is fundamentally changing the UK telecom sector by enabling new business models rather than simply driving incremental network upgrades.

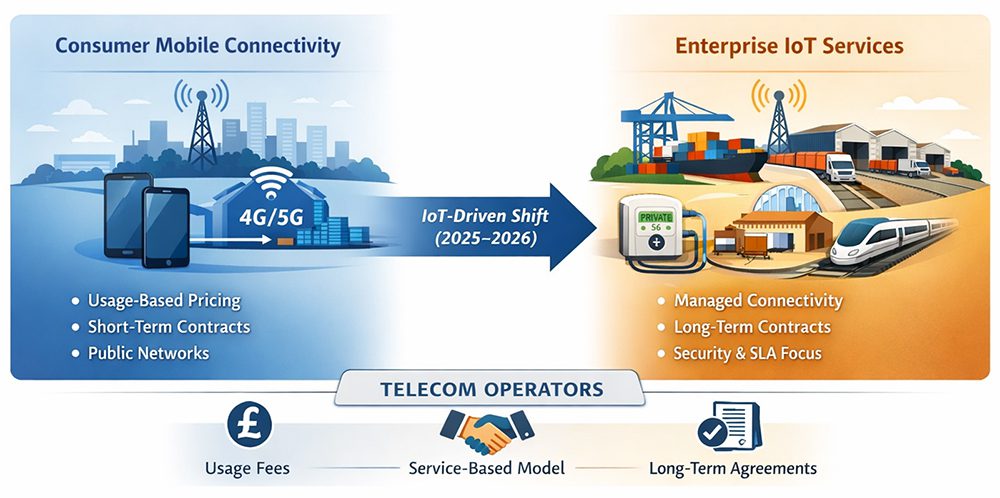

As consumer mobile markets show limited YoY growth between 2025 and 2026, telecom operators have prioritised IoT-led enterprise services as a source of new revenue (Ofcom, 2025; GSMA, 2024). Investment has shifted away from consumer facing upgrades towards private networks, managed connectivity and long-term service contracts for industry and infrastructure. This change reflects a broader move from usage-based connectivity towards service-based delivery.

IoT and Enterprise Connectivity through Private 5G

Figure 1: Transition from consumer mobile connectivity to enterprise IoT services in the UK telecom sector, highlighting the shift towards managed connectivity and long-term service contracts.

The growth of private 5G and managed enterprise networks represents one of the clearest IoT driven business shifts. Industrial customers increasingly require predictable performance, low latency and enhanced security, which are not consistently available through public mobile networks. 5G Standalone architecture enables features such as network slicing and low latency communication, allowing operators to sell connectivity as a managed service rather than a commodity product (Mobile UK, 2024).

In the UK, this model is visible in projects such as the Port of Felixstowe private 5G trials supporting automated port operations and asset tracking (BT Group, 2023), the Liverpool City Region 5G programme focused on connected logistics (DCMS, 2022), the West Midlands 5G transport and connected vehicle projects (WM5G, 2023) and Network Rail 5G rail monitoring trials supporting safety and asset management (Network Rail, 2024). These deployments are typically delivered through long term enterprise contracts.

Together, these projects illustrate how connectivity is increasingly sold as a managed operational capability embedded within enterprise workflows rather than them being priced through consumer-style data usage as illustrated in figure 1.

IoT and Long-Term Infrastructure Revenue

IoT enables telecom operators to participate in long-term infrastructure-based revenue models. The UK national smart meter programme illustrates this shift. By the third quarter of 2025, more than 40 million smart and advanced meters had been installed across Great Britain, with around 70% operating in smart mode (Department for Energy Security and Net Zero, 2025).

These systems rely on continuous, secure connectivity over long lifecycles. The Data Communications Company network processes billions of encrypted messages each month, creating sustained demand for resilient connectivity (DCC, 2024). Ofcom has linked the growth of such systems to increased regulatory focus on network resilience where connectivity underpins critical national infrastructure, while the National Cyber Security Centre has highlighted security risks associated with large IoT deployments (Ofcom, 2025; NCSC, 2024).

For telecom operators, these deployments favour long-term service contracts and regulated infrastructure partnerships over short-term retail revenue models.

Conclusion

In 2026, IoT is transforming the UK telecom sector primarily by reshaping how connectivity is monetised rather than by driving incremental network upgrades. As consumer mobile markets show limited growth, telecom operators have increasingly aligned investment with enterprise IoT demand through private 5G deployments and long-term infrastructure connectivity. These models prioritise predictable performance, security and service continuity over mass-market scale. Private 5G projects across ports, transport networks and logistics hubs demonstrate how IoT demand has accelerated the commercial adoption of 5G Standalone capabilities, allowing operators to sell connectivity as a managed operational service embedded within enterprise workflows (Mobile UK, 2024). At the same time, national smart infrastructure programmes such as smart metering illustrate how IoT supports long-duration connectivity contracts that favour regulated partnerships and resilient network design over short-term retail revenue (Department for Energy Security and Net Zero, 2025; DCC, 2024). Taken together, these developments indicate that IoT is no longer an adjunct to UK telecom networks. Instead, it has become a central driver of enterprise-led, service-based business models that align network investment with stable, long-term revenue streams and critical infrastructure requirements.

References

BT Group. (2023). BT and Hutchison Ports trial private 5G at the Port of Felixstowe.

https://www.bt.com/about/news/2023/bt-hutchison-ports-5g-felixstowe

Data Communications Company. (2024). Annual report and accounts 2023–24.

https://www.smartdcc.co.uk/our-company/our-performance/annual-reports/

Department for Digital, Culture, Media and Sport. (2022). Liverpool City Region 5G Testbeds and Trials Programme.

https://www.gov.uk/government/publications/5g-testbeds-and-trials-programme

Department for Energy Security and Net Zero. (2025). Smart meter statistics in Great Britain Q3 2025.

https://www.gov.uk/government/collections/smart-meters-statistics

GSMA. (2024). The Mobile Economy Europe.

https://www.gsma.com/mobileeconomy/europe/

Mobile UK. (2024). Unleashing the power of 5G Standalone.

https://www.mobileuk.org

National Cyber Security Centre. (2024). Cyber security principles for connected places.

https://www.ncsc.gov.uk

Network Rail. (2024). 5G on the railway connectivity trials.

https://www.networkrail.co.uk

Ofcom. (2025). Connected Nations UK report.

https://www.ofcom.org.uk