LightCounting: AT&T relinquishes leadership in network virtualization

AT&T made a lot of noise about its six-year push to virtualize 75% of its network functions, a goal it claims it reached in September 2020. The debt plagued network operator earned praise for being so outspoken about its software defined network (SDN) effort earlier than its competitors.

However, something changed in the last few months, and signs suggest AT&T has relinquished its leadership role, according to LightCounting.

In a recent blog post, LightCounting suggests AT&T has relinquished its leadership role. First, John Donovan left AT&T in October 2019. Former CTO Chris Rice, who played a key role in AT&T’s SDN, virtualization and cloud efforts, left in August 2020. During that period, there were job losses at AT&T, but what wasn’t reported were cutbacks in research and some of the open networking projects that AT&T had initiated. And its active blog detailing its latest network transformation developments is largely about open networking developments it is involved in with other companies, rather than its own initiatives.

Could it be that AT&T set too fast a pace and the industry pack caught it up? Or is greater financial pragmatism needed to tackle its debt following its two huge media company acquisitions in recent years?

Many leading CSPs are pursuing network transformation, in addition to AT&T, but the industry has a few visionaries and AT&T until recently served this valuable role. It remains to be seen if that will continue.

“If any one operator has sort of driven the whole vision of disaggregated, that software-defined networking, virtualization, white boxes, this is something that AT&T has pushed more than any other operator, and they put it into effect as well,” Roy Rubenstein, consultant at LightCounting, told SDxCentral in a phone interview.

“Its contributions, the various open source projects they then contributed to these open source organizations has been significant,” he said, adding that AT&T was, at least until late last year, “a real trailblazer.”

Grant Lenahan, partner and principal analyst at Appledore Research, has a less complimentary view of AT&T’s stature and success on virtualization. “It’s not clear how far ahead AT&T ever were,” he wrote in response to questions.

………………………………………………………………………………………………

This author’s checks with AT&T employees (in 2019 and 2020) indicated that vendor proprietary boxes were still in AT&T Central Offices and Data Centers. They had NOT been replaced by network virtualization software running on compute servers! The big exception was AT&T’s deployment of “dis-aggregated core routers” running Israeli unicorn DriveNets network OS and Network Cloud solution software. The DriveNets software then connects into AT&T’s centralized SDN controller that optimizes the routing of traffic across the core.

“We chose DriveNets, a disruptive supplier, to provide the Network Operating System (NOS) software for this core use case,” AT&T said in a September 28, 2020 story on its website.

“We are thrilled about this opportunity to work with AT&T on the development of their next gen, software-based core network,” said Ido Susan, CEO of DriveNets. “AT&T has a rigorous certification process that challenged my engineers to their limits, and we are delighted to take the project to the next level with deployment into the production network.”

…………………………………………………………………………………………….

“There’s definitely been a change in terms of AT&T’s own vocality and in a sense the industry has lost an important evangelist of this,” Rubenstein said.

While AT&T’s 75% milestone suggests it still has another 25% to go, that math doesn’t really add up, according to Rubenstein. The operator has effectively virtualized everything it intends to operate with software in the core of its network and the remaining 25% represents network functions or services that will just be operated to the end of their life and then decommissioned, he said.

AT&T’s decision to frame its virtualization journey on a percentage basis was also an over simplification of the work involved and objectives it achieved, Lenahan explained, adding that most operators use this framework to make their results appear more flattering.

“It’s very unclear and early announcements were unlikely or unrealistic,” he added “Solid, well understood metrics would be really useful” to gain a better understanding of what exactly has been virtualized.

The biggest bottleneck on virtualization is the service life of equipment, and that’s why Appledore Research believes the virtualization journey will span roughly two decades throughout the industry, according to Lenahan. “It’s also worth pointing out that the entire idea of virtualization flies in the face of decades of [99.999% reliability] thinking and deep, precise control of all assets, and therefore is a cultural shift,” he said.

While AT&T’s 75% milestone suggests it still has another 25% to go, that math doesn’t really add up, according to Rubenstein. The operator has effectively virtualized everything it intends to operate with software in the core of its network and the remaining 25% represents network functions or services that will just be operated to the end of their life and then decommissioned, he said.

AT&T’s decision to frame its virtualization journey on a percentage basis was also an over simplification of the work involved and objectives it achieved, Lenahan explained, adding that most operators use this framework to make their results appear more flattering.

“It’s very unclear and early announcements were unlikely or unrealistic,” he added “Solid, well understood metrics would be really useful” to gain a better understanding of what exactly has been virtualized.

The biggest bottleneck on virtualization is the service life of equipment, and that’s why Appledore Research believes the virtualization journey will span roughly two decades throughout the industry, according to Lenahan. “It’s also worth pointing out that the entire idea of virtualization flies in the face of decades of [99.999% reliability] thinking and deep, precise control of all assets, and therefore is a cultural shift,” he said.

……………………………………………………………………………………

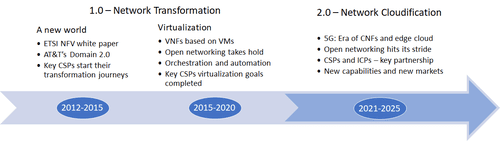

LightCounting argues that CSPs have just completed phase one of network transformation. The next phase extends the cloud to the network edge and embraces cloud-native software practices for network functions. Telcos are now moving from Network Transformation phase 1.0 to 2.0 as per this figure:

5G is the catalyst for Phase 2.0. 5G has code-based network functions and SDN built in, and it brings capabilities that will enable new services and applications, so its rollout is a natural point to introduce new technologies. The opening up of the radio access network–Open RAN–which includes 5G, embraces all the techniques associated with network transformation.

5G is the catalyst for Phase 2.0. 5G has code-based network functions and SDN built in, and it brings capabilities that will enable new services and applications, so its rollout is a natural point to introduce new technologies. The opening up of the radio access network–Open RAN–which includes 5G, embraces all the techniques associated with network transformation.

More information on the report is available at:

https://www.lightcounting.com/products/January2021_NetworkTransformation/

Resources:

https://about.att.com/story/2020/open_disaggregated_core_router.html