Network Virtualization

ETSI NFV evolution, containers, kubernetes, and cloud-native virtualization initiatives

Backgrounder:

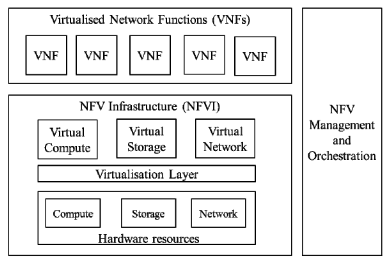

NFV, as conceived by ETSI in November, 2012, has radically changed. While the virtualization and automation concepts remain intact, the implementation envisioned is completely different. Both Virtual Network Functions (VNFs) [1.] and Management, Automation, and Network Orchestration (MANO) [2.] were not commercially successful due to telco’s move to a cloud native architecture. Moving beyond virtualization to a fully cloud-native design helps push to a new level the efficiency and agility needed to rapidly deploy innovative, differentiated offers that markets and customers demand. An important distinguishing feature of the cloud-native approach is that it uses Containers [3.] rather than VNFs implemented as VMs.

Note 1. Virtual network functions (VNFs) are software applications that deliver network functions such as directory services, routers, firewalls, load balancers, and more. They are deployed as virtual machines (VMs). VNFs are built on top of NFV infrastructure (NFVI), including a virtual infrastructure manager (VIM) like OpenStack® to allocate resources like compute, storage, and networking efficiently among the VNFs.

Note 2. Management, Automation, and Network Orchestration (MANO) is a framework for how VNFs are provisioned, their configuration, and also the deployment of the infrastructure VNFs will run on. MANO has been superseded by Kubernetes, as described below.

Note 3. Containers are units of a software application that package code and all dependencies and can be run individually and reliably from one environment to another. Some advantages of Containers are: faster deployment and much smaller footprint, factors that can help in improving the resource utilization and lowering resource consumption.

An article which compares Containers to VMs is here.

High Level NFV Framework:

Kubernetes Defined:

Each application consisted of many of these “container modules,” also called Pods, so a way to manage them was needed. Many different container orchestration systems were developed, but the one that became most popular was an open source project called Kubernetes which assumed the role of MANO. Kubernetes ensured declarative interfaces at each level and defined a set of building blocks/intents (“primitives”) in terms of API objects. These objects are representation of various resources such as Pods, Secrets, Deployments, Services. Kubernetes ensured that its design was loosely coupled, which made it easy to extend it to support the varying needs of different workloads, while still following intent-based framework.

The traditional ETSI MANO framework as defined in the context of virtual machines along with 3GPP management functions.

ETSI MANO Framework and Kubernetes and associated constructs

Source of both diagrams: Amazon Web Services

…………………………………………………………………………………………………………………………………………………………………………………………………………………………….

ETSI NFV at 2023 MWC-Shanghai Conference:

During the 2023 MWC-Shanghai conference, ETSI hosted a roundtable discussion of its NFV and cloud-native virtualization initiatives. There were presentations from China Telecom, China Mobile, China Unicom, SKT, AIS, and NTT DOCOMO. Apparently, telcos want to leverage opportunities in cloud-based microservices and network resource management, but it also has become clear that there are “challenges.”

Three reoccurring themes during the roundtable were the following:

1) the best approach to implement containerization (i.e., Virtual Machine (VM)-based containers versus bare-metal containers) which have replaced the Virtual Network Machine (VNF) concept

2) the lack of End-to-End (E2E) automation;

3) the friction and cost that is incurred from the presence of various incompatible fragmented solutions and products.

Considering the best approach to implement containerization, most attendees present suggested that having a single unified backward-compatible platform for managing both bare metal and virtualized resource pools would be advantageous. Their top three concerns for selecting between VM-based containers and bare-metal containers were performance, resource consumption, and security. The top three concerns for selecting between VM-based containers and bare-metal containers were performance, resource consumption, and security.

…………………………………………………………………………………………………………………………………………………………………………………………………………….

ETSI NFV Evolution:

While the level of achievements and real benefits of NFV might not equate among all service providers worldwide, partly due to the particular use cases and contexts where these operate. Based on the ETSI NFV architecture, service providers have been able to build ultra-largescale telco cloud infrastructures based on cross-layer and multi-vendor interoperability. For example, one of the world’s largest telco clouds based on the ETSI NFV standard architecture includes distributed infrastructure of multiple centralized regions and hundreds of edge data centers, with a total of more than 100,000 servers. In addition, some network operators have also achieved very high ratios of virtualization (i.e., amount of virtualized network functions compared to legacy ATCA-based network elements) in their targeted network systems, e.g., above 70% in the case of 4G and 5G core network systems. In addition, ETSI NFV standards are continuously providing essential value for wider-scale multivendor interoperability, also into the hyperscaler ecosystem as exemplified by recent announcements on offering support for ETSI NFV specifications in offered telco network management service solutions.

ETSI ISG NFV Release 5, initiated in 2021, had “consolidation and ecosystem” as its slogan. It aimed to address further operational issues in areas such as energy efficiency, configuration management, fault management, multi-tenancy, network connectivity, etc., and consider new use cases or technologies developed by other organizations in the ecosystem

Work on ETSI NFV Release 6 has started. It will focus on: 1) new challenges, 2) architecture evolution, and 3) additional infrastructure work items.

Key changes include:

- The broadening of virtualization technologies beyond traditional Virtual Machines (VMs) and containers (e.g., micro VM, Kata Containers, and WebAssembly)

- Creation of declarative intent-driven network operations

- Integrating heterogenous hardware, Application Programming Interfaces (APIs), and cloud platforms through a unified management framework

All changes aim for simplification and automation within the NFV architecture. The developments are preceded by recent announcements of standards-based applications by hyperscalers: Amazon Web Services (AWS) Telco Network Builder (TNB) and Microsoft Azure Operator Nexus (AON) are two new NFV-Management and Orchestration (NFV-MANO)-compliant platforms for automating deployment of network services (including the core and Radio Access Network (RAN)) through the hybrid cloud.

As more network operators and vendors are already leveraging the potential of OS container virtualization (containers) technologies for deploying telecom networks, the ETSI ISG NFV also studied how to enhance its specifications to support this trend. During this work, the community has found ways to reuse the VNF modeling and existing NFV management and orchestration (NFV-MANO) interfaces to address both OS container and VM virtualization technologies, hence ensuring that the VNF modeling embraces the cloud-native network function (CNF) concepts, which is now a term commonly referred in the industry.

This has been achieved despite OS container and VM technologies having somewhat different management logic and resource descriptions. However, diverse and quickly changing open source solutions make it hard to define unified and standardized specifications. Nevertheless, due to the fact that both kind of virtualization technologies can and will still play a major role in the future to fulfill the various and broad set of telecom network use cases, efforts to further evolve them as well as to complement them with other newer virtualization technologies (e.g., unikernels) are needed.

Furthermore, driven by new application scenarios and different workload requirements (e.g., video, Cloud RAN, etc.), new requirements for deploying diversified heterogeneous hardware resources in the NFV system are becoming a reality. For example, to meet high-performance VNFs, requirements for heterogeneous acceleration hardware resources such as DPUs, GPUs, NPU, FPGAs, and AI ASIC are being brought forward. In another example, to meet the ubiquitous deployment of edge devices in the future, other types of heterogeneous hardware resources, such as integrated edge devices and specialized access

devices, are also starting to be considered.

NFV architectures have and will continue to evolve, especially with the rise of Artificial Intelligence (AI) and Machine Learning (ML) automation. Data centers, either cloud-based or “on-premises” are becoming complex, heterogeneous environments. In addition to Central Processing Units (CPUs), complementary Graphics Processing Units (GPUs) handle parallel processing functions for accelerated computing tasks of all kinds. AI, Deep Learning (DL), and big data analytics applications are underpinned by GPUs. However, as data centers have expanded in complexity, Digital Processing Units (DPUs) have become the third member of this data-centric accelerated computing model. The DPU helps orchestrate and direct the data around the data center and other processing nodes on the network.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

Updates in ETSI NFV for Accelerating the Transition to Cloud (abiresearch.com)

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Virtual Network Function Orchestration (VNFO) Market Overview: VMs vs Containers

Virtual Network Function Orchestration (VNFO) Market Overview: VMs vs Containers

by Kaustubha Parkhi, edited by Alan J Weissberger

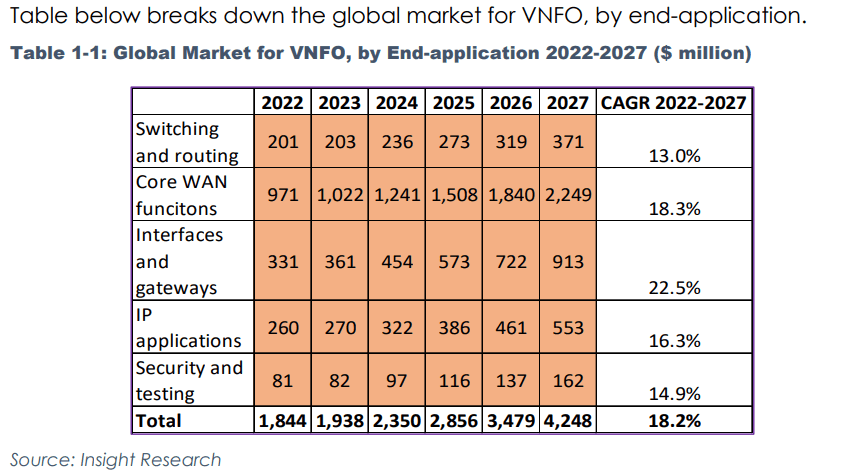

Cloud-native network functions (CNF) promise to change the dynamic of telecommunications network function engineering. The advent of 5G has added impetus to this change. Insight Research is at the cutting edge of CNF market analysis. Here are a few excerpts from our new report on the Virtualized Network Function Orchestrator (VNFO) market

Insight Research considers Virtual Machines (VMs) and Containers to be the major Virtual Network Function Orchestration (VNFO) methodologies. Network functions synthesized using VMs and Containers qualify as Virtual Network Functions (VNFs), in our opinion. That latter term has taken on much broader context since it was first introduced in the context of Network Function Virtualization (NFV) at the OpenFlow World Congress in 2012.

VNFs orchestrated by Containers are sometimes referred to as cloud-native NFs (CNFs). Insight Research has also employed this term as early as 2020. Over time however, we have observed that the usage of CNFs is neither consistent nor uniform.

Most ‘traditional’ Management and Orchestration (MANO) schemes such as ONAP, OSM and all proprietary offerings now support Containers and Kubernetes [1.]. Containers are thus one more mean towards achieving the end-objective of VNFs. As such, Insight Research finds it more appropriate to use VNF as an umbrella term and refer to VM or Container as the specific virtualization methodology.

Note 1. Kubernetes, also known as K8s, is an open-source system for automating deployment, scaling, and management of containerized applications.

The question then arises – where would we slot network functions (NFs) orchestrated by containers encapsulated in VMs? Answer is containers. Similarly, NFs orchestrated by VMs encapsulated in containers are slotted under VMs.

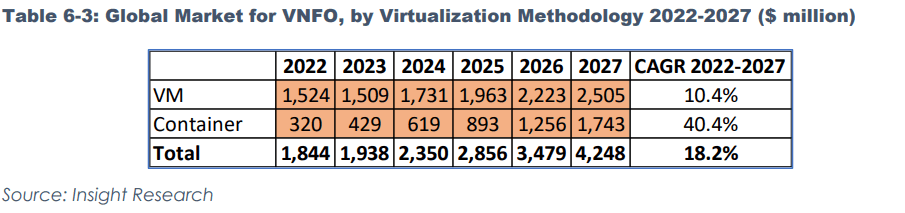

The table below breaks down the VNFO market by virtualization methodology.

We see Containers gaining major market share from VMs such that they are running away with the VNFO market. The advantages of containers over VMs are all well known. Containers are sleeker and when employed with optimal microservice granularity – considerably faster as well.

Additionally, VMs have a head start over containers and have established a solid legacy which will hold good for near to midterm future. However, barriers surrounding container adoption are gradually dissolving with differing momentums across end-applications. The greater the performance differential, the greater is the adoption potential for Containers in end-applications.

Initiatives such Nephio have placed Kubernetes in the center of the VNFO universe. In short, it’s a matter of time before Containers push VMs to be the dominant VNFO virtualization vehicle. However, many question arise.

Here are a few questions for starters:

Is the NFVO the same as service orchestrator?

Is the NFVO the same as SDN controller?

Is Kubernetes an orchestrator?

Since containers and VMs can be embedded inside one another, how do we stamp which virtualization methodology they are using?

If a proprietary MANO uses portions of open source code, should it be considered proprietary?

After picking the brains of numerous experts who were unfailingly patient in unravelling their thinking, Insight Research has been able to arrive at a set of clearcut definitions and assumptions that address the above queries and more.

To buy the report or download an executive summary, please visit:

https://www.insight-corp.com/product/vnfo-ripe-for-change/

Telco Systems and albis-elcon Partner for Service Virtualization of Telecom Networks

BATM Advanced Communications subsidiary Telco Systems, a leading provider of innovative Network Edge solutions for communications infrastructure and service management, and albis-elcon, a leading supplier of gigabit switching and routing systems for optical and mobile telecommunication networks, today jointly announced that albis-elcon has integrated Telco Systems’ virtualization technology into its recently launched uSphir solution.

uSphir is a service platform for telcos and managed service providers (MSPs) to create next generation network solutions with simplified logistics, flexible automation and continuous innovation, to transform business services operations.

By adding Telco Systems’ software virtualization technology to albis-elcon’s new service platform, uSphir now enables third party VNFs and new white box devices to be configured and fully operational within minutes. This software virtualization technology enables telcos and MSPs using uSphir to quickly deploy new VNF-based business services with centralized management and ongoing orchestration. Telco Systems’ Edge compute technology also allows uSphir to run on either Intel or Arm based devices and leverage native Cloud environments for network management and operations.

This strategic partnership between Telco Systems and albis-elcon was established as an outcome of extensive joint testing of this integrated solution according to specific market requirements and will benefit customers with the latest cutting edge Cloud Computing technologies.

“The transition towards next generation architectures with dynamic service offerings based on virtualized functions requires a network- and solution-oriented approach for which Telco Systems’ innovative virtualization technology is delivering significant value in the Cloud Computing domain,” said Werner Neubauer, CEO of albis-elcon. “Telco Systems is a world leader in its market and large vendors like ARM and CheckPoint have been using its technology insider their products for many years. Our partnership with Telco Systems accelerates the availability of new technologies, new service models for our customers.”

“The Network Edge is clearly the future of virtualized business services and we are already pursuing joint opportunities with albis-elcon at several tier 1 operators in Europe and Latin America,” stated Ariel Efrati, CEO of Telco Systems. “Our collaboration with albis-elcon will greatly expand the market footprint for both companies with stronger market presence and wider global coverage as well as empower telcos and MSPs to leverage the vast networking experience of our two companies and quickly benefit from offering new virtualized business services.”

albis-elcon “has a strong position among tier one operators in Europe and Latin America and this partnership will expand our reach into those markets. This constitutes a key aspect of our growth strategy across our business, which is to form collaborations that will accelerate the adoption of our solutions,” said BATM Chief Executive Zvi Marom.

About Telco Systems

Telco Systems is a leading provider of innovative Cloud Computing and Network Edge solutions for managing communications infrastructure and services. The company’s Cloud Edge Computing industry-leading product portfolio includes carrier Ethernet, MPLS-based demarcation and aggregation, NFV, uCPE, 5G and IoT solutions. Managed service providers and enterprises worldwide are relying on Telco Systems for networking technologies and innovations to expand the capacity of their network infrastructures and generate revenue from new connectivity services. Telco Systems is a wholly-owned subsidiary of BATM Advanced Communications (LSE: BVC) (TASE: BVC). To learn more, visit Telco Systems at www.telco.com.

About albis-elcon

albis-elcon delivers products, solutions and services that help companies, primarily communication service providers to build and operate better networks and reduce the energy needed. With 15 million installed devices in more than 40 countries, the company is well-positioned to deliver software-defined and virtualization enabling gigabit networking for Cloud computing, enterprise access, mobile backhaul and 5G Campus networks. Superior-engineered hardware, software, network management, and implementation services manage complexity and provide sustainable, secure communication. albis-elcon — power to complete networks. To learn more, visit albis-elcon at www.albis-elcon.com.

References:

LightCounting: AT&T relinquishes leadership in network virtualization

AT&T made a lot of noise about its six-year push to virtualize 75% of its network functions, a goal it claims it reached in September 2020. The debt plagued network operator earned praise for being so outspoken about its software defined network (SDN) effort earlier than its competitors.

However, something changed in the last few months, and signs suggest AT&T has relinquished its leadership role, according to LightCounting.

In a recent blog post, LightCounting suggests AT&T has relinquished its leadership role. First, John Donovan left AT&T in October 2019. Former CTO Chris Rice, who played a key role in AT&T’s SDN, virtualization and cloud efforts, left in August 2020. During that period, there were job losses at AT&T, but what wasn’t reported were cutbacks in research and some of the open networking projects that AT&T had initiated. And its active blog detailing its latest network transformation developments is largely about open networking developments it is involved in with other companies, rather than its own initiatives.

Could it be that AT&T set too fast a pace and the industry pack caught it up? Or is greater financial pragmatism needed to tackle its debt following its two huge media company acquisitions in recent years?

Many leading CSPs are pursuing network transformation, in addition to AT&T, but the industry has a few visionaries and AT&T until recently served this valuable role. It remains to be seen if that will continue.

“If any one operator has sort of driven the whole vision of disaggregated, that software-defined networking, virtualization, white boxes, this is something that AT&T has pushed more than any other operator, and they put it into effect as well,” Roy Rubenstein, consultant at LightCounting, told SDxCentral in a phone interview.

“Its contributions, the various open source projects they then contributed to these open source organizations has been significant,” he said, adding that AT&T was, at least until late last year, “a real trailblazer.”

Grant Lenahan, partner and principal analyst at Appledore Research, has a less complimentary view of AT&T’s stature and success on virtualization. “It’s not clear how far ahead AT&T ever were,” he wrote in response to questions.

………………………………………………………………………………………………

This author’s checks with AT&T employees (in 2019 and 2020) indicated that vendor proprietary boxes were still in AT&T Central Offices and Data Centers. They had NOT been replaced by network virtualization software running on compute servers! The big exception was AT&T’s deployment of “dis-aggregated core routers” running Israeli unicorn DriveNets network OS and Network Cloud solution software. The DriveNets software then connects into AT&T’s centralized SDN controller that optimizes the routing of traffic across the core.

“We chose DriveNets, a disruptive supplier, to provide the Network Operating System (NOS) software for this core use case,” AT&T said in a September 28, 2020 story on its website.

“We are thrilled about this opportunity to work with AT&T on the development of their next gen, software-based core network,” said Ido Susan, CEO of DriveNets. “AT&T has a rigorous certification process that challenged my engineers to their limits, and we are delighted to take the project to the next level with deployment into the production network.”

…………………………………………………………………………………………….

“There’s definitely been a change in terms of AT&T’s own vocality and in a sense the industry has lost an important evangelist of this,” Rubenstein said.

While AT&T’s 75% milestone suggests it still has another 25% to go, that math doesn’t really add up, according to Rubenstein. The operator has effectively virtualized everything it intends to operate with software in the core of its network and the remaining 25% represents network functions or services that will just be operated to the end of their life and then decommissioned, he said.

AT&T’s decision to frame its virtualization journey on a percentage basis was also an over simplification of the work involved and objectives it achieved, Lenahan explained, adding that most operators use this framework to make their results appear more flattering.

“It’s very unclear and early announcements were unlikely or unrealistic,” he added “Solid, well understood metrics would be really useful” to gain a better understanding of what exactly has been virtualized.

The biggest bottleneck on virtualization is the service life of equipment, and that’s why Appledore Research believes the virtualization journey will span roughly two decades throughout the industry, according to Lenahan. “It’s also worth pointing out that the entire idea of virtualization flies in the face of decades of [99.999% reliability] thinking and deep, precise control of all assets, and therefore is a cultural shift,” he said.

While AT&T’s 75% milestone suggests it still has another 25% to go, that math doesn’t really add up, according to Rubenstein. The operator has effectively virtualized everything it intends to operate with software in the core of its network and the remaining 25% represents network functions or services that will just be operated to the end of their life and then decommissioned, he said.

AT&T’s decision to frame its virtualization journey on a percentage basis was also an over simplification of the work involved and objectives it achieved, Lenahan explained, adding that most operators use this framework to make their results appear more flattering.

“It’s very unclear and early announcements were unlikely or unrealistic,” he added “Solid, well understood metrics would be really useful” to gain a better understanding of what exactly has been virtualized.

The biggest bottleneck on virtualization is the service life of equipment, and that’s why Appledore Research believes the virtualization journey will span roughly two decades throughout the industry, according to Lenahan. “It’s also worth pointing out that the entire idea of virtualization flies in the face of decades of [99.999% reliability] thinking and deep, precise control of all assets, and therefore is a cultural shift,” he said.

……………………………………………………………………………………

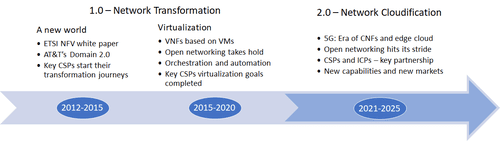

LightCounting argues that CSPs have just completed phase one of network transformation. The next phase extends the cloud to the network edge and embraces cloud-native software practices for network functions. Telcos are now moving from Network Transformation phase 1.0 to 2.0 as per this figure:

5G is the catalyst for Phase 2.0. 5G has code-based network functions and SDN built in, and it brings capabilities that will enable new services and applications, so its rollout is a natural point to introduce new technologies. The opening up of the radio access network–Open RAN–which includes 5G, embraces all the techniques associated with network transformation.

5G is the catalyst for Phase 2.0. 5G has code-based network functions and SDN built in, and it brings capabilities that will enable new services and applications, so its rollout is a natural point to introduce new technologies. The opening up of the radio access network–Open RAN–which includes 5G, embraces all the techniques associated with network transformation.

More information on the report is available at:

https://www.lightcounting.com/products/January2021_NetworkTransformation/

Resources:

https://about.att.com/story/2020/open_disaggregated_core_router.html

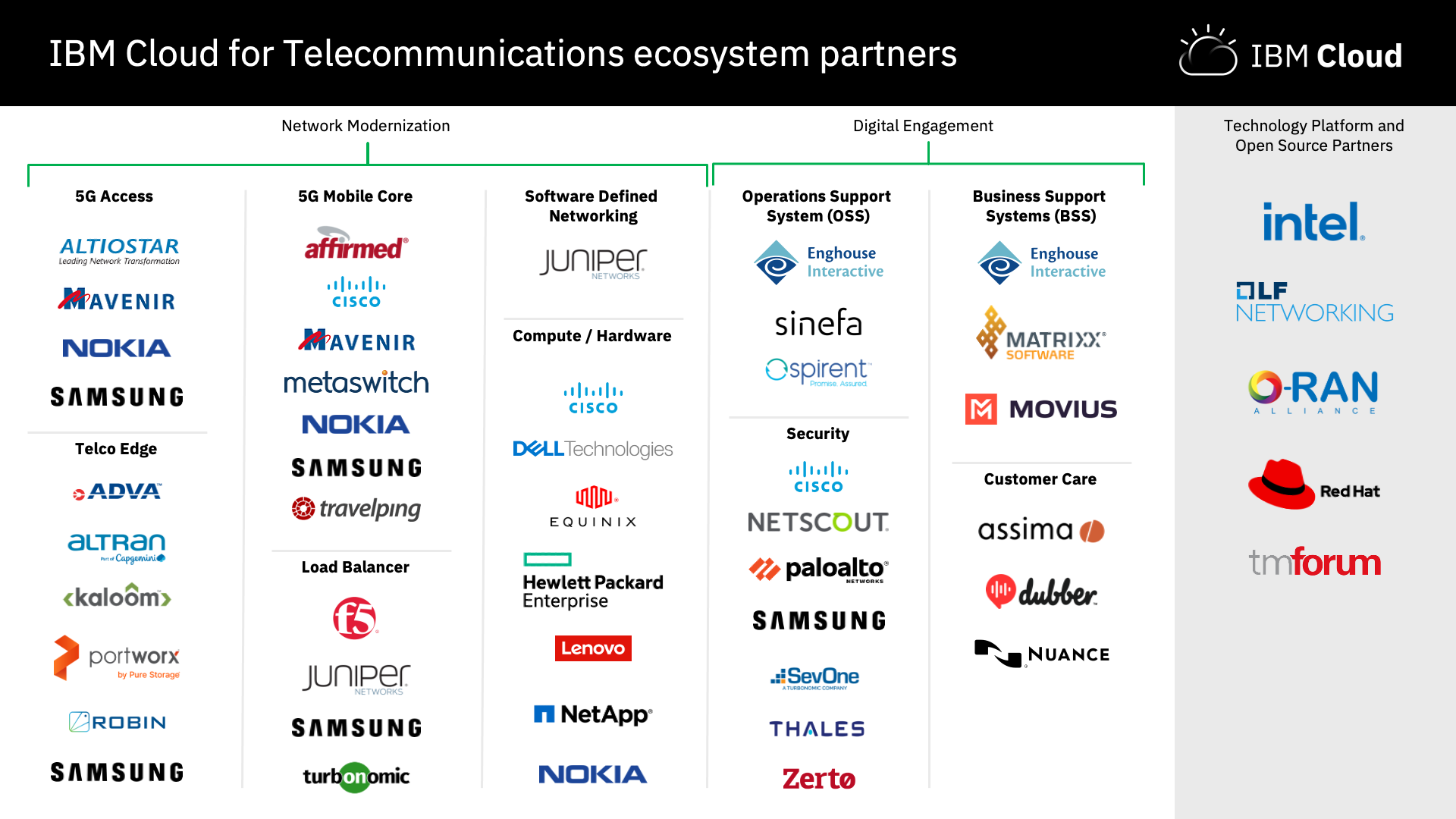

IBM Telco Cloud has 35+ Partners to Help Virtualize Carrier Networks

“IBM Cloud® for Telecommunications provides the first high trust, unified hybrid architecture to address the fundamental transformation challenges facing telecommunications operators today.”

“We are excited to launch the IBM Cloud for Telecommunications – an open, hybrid cloud architecture designed to help telecommunications providers address the specific challenges of the highly-regulated industry: accelerating business transformation, enhancing digital client engagement and improving agility as they modernize their enterprise applications and infrastructure to unlock the power of 5G and edge,” IBM’s Howard Boville wrote in a blog post.

IBM is expanding its presence in the telecom market with a new ecosystem of 35+ partners to help communication service providers virtualize their networks. Companies such as Nokia, Samsung, Juniper Networks and Intel have agreed to help operators take advantage of the new IBM Cloud Satellite platform based on Red Hat OpenShift and deploy the IBM Cloud for Telecommunications services in the cloud, on premises or at the edge.

According to a recent IBV study, 60% of Communications Service Provider (CSP) leaders surveyed agree that they must virtualize their entire network across edge locations, but only half of them are prepared to virtualize in a cloud-native environment. Built on IBM Cloud Satellite, currently in beta, and leveraging Red Hat OpenShift, clients can deploy IBM Cloud services anywhere: on the cloud, on premises or at the edge, while addressing industry-specific requirements and data protection.

The IBM Telco Cloud platform integrates and extends IBM Edge Application Manager and IBM Telco Network Cloud Manager to help reduce network-related infrastructure costs, increase automation, speed deployment of next gen services, and deliver new consumer and enterprise value. The holistic hybrid cloud offering will be complemented by our ecosystem partners’ software and technology, and enable mission critical workloads to be managed consistently from the network core to the edge to position telecom providers to extract more value from their data while they drive innovation for their customers.

Ecosystems fuel platforms, and because the IBM Cloud for Telecommunications is built on an open architecture, a large ecosystem of partners can enhance it with their own solutions in addition to providing services for it – and this is an important distinction. In order for clients to get our best technology with the most scale and flexibility at the start, we’ve built the IBM Cloud for Telecommunications using Red Hat OpenShift, and this strategy positions partners as the engine to drive a multitude of possibilities for clients.

The partners spans numerous categories, including network equipment providers, independent software vendors, software-as-a-service providers and hardware partners. Partners include Cisco, Adva, Enghouse, Dell, Equinix, Palo Alto Networks, Spirent, Altiostar and Affirmed Networks.

………………………………………………………………………………………………………………………………………………………………………………………………………….

“We are happy to team up with IBM to develop 5G solutions at the telecom edge, with Red Hat OpenShift. We believe that our service provider customers will benefit greatly from having an additional choice to quickly and efficiently deploy private 5G networks,” said Jane Rygaard, Head of Edge Cloud, Nokia. “The transition to 5G will be a key step for industries to deliver on their digital transformation plans. Having multiple options of cloud-based solutions will help our industry build this path forward.”

“Samsung is committed to helping enterprises tackle the unique challenges of today’s market by utilizing the latest mobile innovations and advanced network solutions,” said KC Choi, EVP and Head of Global Mobile B2B Team, Mobile Communications Business, Samsung Electronics. “We are excited to work with IBM and Red Hat to develop new user experiences for business based on transformative technologies like 5G, IoT and AI to help drive efficiency and streamline operations.”

“Cisco is excited to bring our industry leading compute, security, and Service Provider solutions to the IBM Cloud for Telecommunications,” said Keith Dyer, VP for IBM Strategic Alliance. “We are delighted to expand our 20+ year partnership with IBM and bring the power of our joint solutions to our mutual customers.”

IBM says their partner ecosystem will provide customers with a wide range of ways to leverage the platform to enable them to deliver next generation 5G and Edge services, deploy and manage new cloud capabilities, and enrich relationships through AI-driven engagement. Those committing to join our growing ecosystem are listed below alongside descriptions about how they are helping customers today, or how we expect to collaborate on IBM Cloud for Telecommunications:

- ADVA Optical Networking SE is contributing low latency 5G access and transport solutions, optical backbones, Network Function Virtualization (NFV), sync and timing, and disaggregated cell site gateways.

- Affirmed Networks, Inc. enables operators to transform the economics of deploying and scaling mobile networks with its complete portfolio of open, cloud-native, 5G solutions.

- Altiostar will provide 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the radio access baseband functions to build a disaggregated multi-vendor, web-scale, cloud-based mobile network.

- Altran, Part of Capgemini, provides 5G solutions (vRAN, Core, Transport, Edge platform & marketplace), advanced Edge applications for industries and deep 5G System Integration & Network Engineering expertise.

- Assima delivers powerful applications training at scale, leveraging its patented cloning technology to create immersive learner experiences.

- Cisco is providing security, compute and Service Provider solutions.

- Dell Technologies. An essential technology company in the data era, Dell Technologies is enabling Telecom network operators to extend their capabilities, moving beyond today’s connectivity to offer new enterprise services that will ignite broad industry innovations and create new revenue streams.

- Dubber’s Voice Intelligence Cloud plans to integrate and be interoperable with IBM Cloud for Telecommunications, to help enable providers to deliver next generation Unified Call Recording and Voice AI Services on one cloud platform.

- Enghouse Networks. Through IBM Cloud, Enghouse Networks offers Telecommunications service providers the ability to Plan, Design, Engineer, Provision, Operate, Monitor, Protect and simplify network complexity in a vendor-agnostic, hybrid cloud network environment.

- Equinix, Inc. plans to host the IBM Cloud for Telecommunications solution on its globally distributed automated bare metal platform.

- F5 Networks Inc. contributes traffic management, security for layers 2-7 and Kubernetes ingress control along with other virtual infrastructure solutions to enhance and support application services in the telco network cloud.

- Hewlett Packard Enterprise delivers a leading, comprehensive portfolio of cloud-enabled software, carrier-grade services, and open, secure infrastructure offerings to accelerate innovation for telco cloud and edge solutions.

- Intel brings a broad ecosystem, enabling new use cases and usage models from the edge to the cloud. Emphasizing an open-based and innovative approach helps to accelerate deployments that are built on Intel technologies with performance and security in mind.

- Juniper Networks Inc. Contrail is an end-to-end software-based network architecture delivering secure, consistent policy to applications regardless of their location and the physical underlay.

- Kaloom offers a fully programmable and automated cloud networking solution that is disrupting how edge and data center networks are built, managed and operated.

- Lenovo’s purpose-built edge servers and storage along with Lenovo’s infrastructure automation software (LOC-A) have been validated with IBM edge application manager to provide easy to consume edge infrastructure.

- Linux Foundation Networking (LFN) facilitates collaboration and operational excellence across open source networking projects

- MATRIXX Software provides a highly performant network application for charging and monetization of network resources.

- Mavenir helps wireless service providers with comprehensive end to end software applications that transforms their networks to run on the cloud.

- Metaswitch, a Microsoft company, provides cloud native IP Multimedia Subsystem (IMS) network functions that help enable the deployment of highly scalable rich communication services on Red Hat OpenShift.

- Movius provides mobile-unified communication software that enables frontline employees to securely communicate with their clients across compliant digital voice and messaging channels.

- NetApp, Inc. helps customers simplify the adoption and readiness of 5G by providing advanced data services to enable hybrid cloud environments that extend to the Edge, and by integrating these data services with container orchestration platforms such as OpenShift and IBM Cloud Pak solutions.

- NETSCOUT Systems provides visibility of digital services to prevent or resolve performance and security problems regardless of the technologies involved. We call it Visibility without Borders.

- Nokia and IBM plan to deploy a fully functioning cloud-based 5G network on the IBM Cloud infrastructure, designed to help service providers to quickly deploy and deliver private 5G solutions to their Enterprise customers

- Nuance Communications, Inc.’s enterprise solutions power over 31 billion intelligent customer interactions annually with cloud-native, AI-powered customer engagement technology to deliver industry-best digital, voice, and biometric security innovations.

- O-RAN ALLIANCE. As a member of the O-RAN ALLIANCE, IBM Cloud for Telecommunication will help to transform the radio access networks towards open, intelligent, virtualized and fully interoperable RAN.

- Palo Alto Networks, Inc. for Zero Trust 5G Security.

- Portworx by Pure Storage will provide a platform of complementary data services for data rich applications running on OpenShift on IBM Satellite, including high availability, data protection, data security, multi-cloud mobility and automated capacity management required to run enterprise applications in production.

- Red Hat will help enable the IBM Cloud for Telecommunication Ecosystem partners to run their solutions on Red Hat OpenShift and Red Hat OpenStack Platform.

- Robin.io’s cloud-native solution for Telco provides end-to-end automation for the deployment, scaling, and lifecycle management of any data- or network-intensive applications – all the way from RAN, Core, Edge, and OSS/BSS on Kubernetes.

- Samsung, IBM, and Red Hat are collaborating to bring AI-driven solutions for clients transforming to Industry 4.0 and beyond by leveraging the power of secure 5G devices, cloud-native 5G networks, and advanced edge computing platforms.

- SevOne, a Turbonomic Company, delivers network performance management solutions with modern monitoring and analytics.

- Sinefa plans to provide Digital Experience Monitoring for remote workers and SD-WAN by leveraging the IBM Telco Cloud.

- Spirent delivers automated test and assurance solutions to accelerate the design, development and deployment of 5G, cloud and virtualized networks.

- THALES Cloud Licensing and Protection helps organizations protect their most sensitive data and software, secure the cloud and achieve compliance through advanced encryption, access management and software licensing solutions.

- TM Forum will be working with IBM Cloud for Telecommunication to help unlock the possibilities of 5G by enabling the industry to build self-sustaining networks

- Travelping accelerates the provision of mobile 2G to 5G Networks, the turnkey solutions to the Telecommunications, Automotive, IoT, Manufacturing, Energy, Financial Services, and Hospitality businesses.

- Turbonomic Application Resource Management (ARM) helps automatically assure applications get the resources they need to perform, no matter where they run or how they are architected.

- Zerto will integrate with IBM Cloud Satellite as an embedded solution providing data protection, disaster recovery and mobility solutions.

- Wipro will launch a solution suite built with IBM Edge Application Manager to help clients leverage 5G and Edge for enterprise use cases.

- HCL’s IBM Ecosystem Unit will help clients, including those in regulated industries such as telecommunications, to develop digital and cloud-native solutions with IBM Cloud Paks.

………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecompaper.com/news/ibm-signs-up-partners-for-telco-hybrid-cloud-platform–1360709

Opinion: How virtualization and open source are upending the entire telecom industry

Article below written by Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research

[Note that the IEEE Techblog content manager (since April 2009) does not agree with the theme of this article. We believe that the only really big customers of virtualization and open source hardware/software are the largest tier 1 telcos (like AT&T, Telefonica, etc) and the big cloud companies (like Amazon, Google, Microsoft, Facebook, Alibaba, Tencent, etc).

- One of the big problems with network virtualization is that you have a single point of failure (the server running virtual network functions) and also a much larger attack surface for cyber attacks.

- The biggest obstacles to using open source hardware and software are systems integration, multi-vendor interoperability and compatibility and tech support, especially related to failure isolation and recovery. Other issues with deploying open source include performance (vs purpose built hardware/firmware/software) and OPEX associated with integrating and maintaining hardware/software from multiple vendors.

However, we like to present different views and provide balanced coverage of telecom tech topics like open networking and open source hardware/software. So please enjoy the below article and comment in the Comment box below it.]

………………………………………………………………………………………………………………………………………………..

Posted by: Anasia D’mello. Article written by Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research.

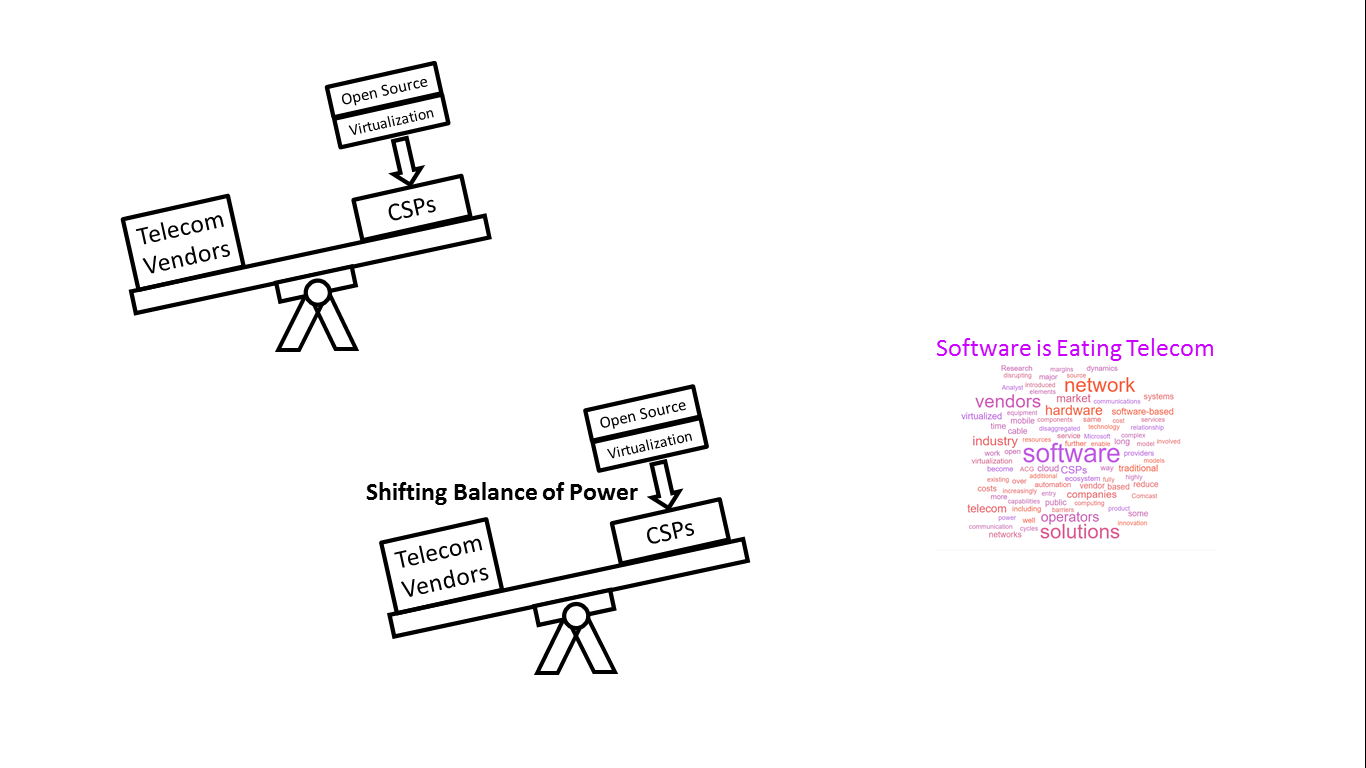

Until recently, network technology vendors to communication service providers (CSPs) had a well-established competitive market position with brand loyalty, long-standing customer relationships, and well entrenched proprietary solutions. However, an inexorable move to software-based (virtualised) solutions, combined with the increasing prevalence of open-source resources, is disrupting the market dynamics and will have profound implications for the industry structure.

Traditionally, telecom network technology vendors supplied bespoke solutions, typically consisting of hardware racks populated with purpose-built circuit boards that performed highly specialised tasks, complemented by highly customised software, with complex back office systems to manage these systems and the applications that run on them. These solutions were supplemented by extensive professional services resources, and typically involved regular software upgrades, and, less frequently hardware ones.

This, combined with the long cycles involved in introducing new solutions, or in upgrading existing ones due to long testing cycles, created a relatively closed ecosystem with high barriers to entry and high switching costs. It also drove costs up, as it increased the bargaining power of suppliers; it limited the number of competitors and stifled innovation because younger companies with fewer resources found it difficult to penetrate the ecosystem.

The disruptive nature of virtualization

The inexorable migration to software-based, virtualized solutions is disrupting this ecosystem, with profound long-term consequences. Increasingly, telecom operators are introducing virtualized software solutions in their operating environments. Their long-term goal is of a fully software-driven ecosystem with software-only network elements running on commodity off-the-shelf servers (COTS) or open source hardware, hosted in local offices, in distributed data centres or in a cloud-compute environment.

The software-based systems are not less complex, and the incumbent vendors are rushing to either port their existing solutions on COTS or redeveloping parts of those systems to become software based. It also allows new software vendors to enter the market without the long design, manufacturing, and logistics supply chains of traditional hardware.

At the same time, the CSP traditional development/deployment paradigm, which was largely based on the waterfall model and involved protracted cycles, is slowly making way to an agile framework, based on the Continuous Integration/Continuous Deployment model where incremental changes are introduced on an on-going basis, enabled by a microservices-based, modularised architecture.

This paradigm allows minimally viable products to be introduced and then rapidly enhanced, reducing the entrenched foothold of existing suppliers and opening the way for new entrants, further transforming the market dynamics.

By reducing the barriers to entry, virtualization is adding new vendors and new delivery mechanisms that bypass the traditional supply chains: New virtual network software companies, public cloud companies, and the network operators themselves.

- New virtual network software companies: New software-centric companies have entered the market over the last several years. Examples include Affirmed Networks, Altiostar and Parallel Wireless that offer a software-based mobile core solution, Etiya that provides a nearly fully virtualised mobile solution (running on an AWS public cloud infrastructure), and Metaswitch that offers a wide range of mobile and fixed network software-based network technologies. Other traditional software vendors to operators, such as HPE, are also entering the virtualised network equipment market.

- Public cloud companies: Cloud providers are increasingly tapping into the convergence of cloud and communication networks. Recently, Microsoft bought Affirmed Networks, which offers fully virtualized, cloud-native mobile network solutions for telecom operators. This acquisition will enable Microsoft to become a major telecom vendor in the mobile and nascent private 5G markets. In days past, communication service providers (CSP) used to build their own data centres, but virtualisation technologies enable cloud providers, such as Microsoft, to offer the same capabilities, mostly as services, on their public computing and storage infrastructure at much lower initial cost and with more flexibility.

- DIY: Some CSPs are hiring software developers in droves and are beginning to develop their own solutions. Not only that, but some operators are also transforming themselves into vendors, offering their solutions to their peer operators. A case in point is Comcast Corp. The company’s mantra has become “software eats the world.” Its newly opened Comcast Technology Center serves as “the dedicated home for our company’s growing workforce of more than 4,000 technologists, engineers and software architects.” Comcast has developed its Xfinity X1 entertainment service in-house; it is also syndicating it to cable operators, including Cox and Shaw and Rogers of Canada. At the same time, the company has developed a software-defined platform (ActiveCore) to power its business services, and it is not unfathomable that it would look to syndicate it at some point in the future.

Others CSPs are expanding their software capabilities for internal, and external, use. Reliance Jio’s parent company, Reliance Industries, bought Radisys, a US-based provider of open telecom solutions, while AT&T’s expansion of its software capabilities is well-known in the industry.

The role of open-source collaboration

Most operators do not have the capacity nor the ability to undertake massive development efforts, particularly because some of the solutions they need are highly complex. However, open-source hardware and software and disaggregated network elements go a long way to alleviate the need to undertake end to end developments.

Recent disaggregated network element (DNE) projects, some including open-source hardware and software, have been created by CSPs throughout the various telecom equipment domains, from radio backhaul to the core networks, optical access and transport equipment, and edge computing environments, among many others. DNEs are essentially public open source Lego-like building blocks that run on standard computing and storage hardware or programmable ASICs that standardise designs and that can be used to create solutions. They enable CSPs to select the best combination of commoditised hardware and specialised software components. DNEs are designed to reduce vendor lock-ins and further lower the barriers to entry for new vendors, increasing competition in sales and support.

The operator–vendor new relationship framework

New engagement models are emerging. The traditional supplier/customer relationship is making way to a cooperative engagement model, where the operator and the vendor work hand in hand on developing solutions. Furthermore, unlike traditional models where the vendor is paid upfront and is further compensated for on-going support, new frameworks are emerging where the vendor is compensated based on the success of the operator. One such arrangement was the Infinite Broadband Unlocked that Cisco introduced in 2018 where it charged cable operators based on broadband consumption over their networks, rather than upfront licenses. Such arrangements are facilitated by software-based solutions and are likely to become more prevalent over time, further disrupting market dynamics.

Toward the future

The commoditisation of the hardware components of the network will reduce the vendors’ margins and potentially reduce overall CSPs’ costs. However, the CSPs will have to bear the additional costs of testing multivendor arrangements, configuring, and managing the larger number of network components, as well as securing the entire network.

These additional costs will eat into the potential savings and are expected to require a hefty dose of automation. Such automation will come from vendors, systems integrators, as well as from additional open-source initiatives such as the ONAP program, the open-source version of the AT&T ECOMP home-grown system that seeks to provide real-time, policy-driven software automation of AT&T’s network management functions.

It is too early in the game to scope the full impact of this unfolding transformation. It is likely that it will increase the speed of innovation and improve the cost structure for operators. At the same time, intense competition may reduce vendors’ margins, decreasing their ability to invest in R&D. However, an increasingly symbiotic relationship between operators and vendors will improve industry dynamics, overall, as it will lead to better targeted solutions, more cost efficiency and improved customer experience.

Conclusion

Technological changes and industry realignment are enabling CSPs to gain greater market control and to reap larger efficiencies by replacing monolithic hardware and software solutions from major vendors with disaggregated networking elements with open-source software on commoditised, standardised hardware, and by adopting co-development models. This will reduce the pricing power of major vendors and compress their margins but may lead to greater innovation in the industry.

The authors are Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research.

Liliane Offredo-Zreik

Dr. Mark H Mortensen

About the authors

Liliane Offredo-Zreik ([email protected] @offredo) is a principal analyst with ACG Research. Her areas of coverage include the cable industry, SD-WAN, and communications service provider digital transformation. Prior to her analyst work, she held senior roles in major telecom and cable companies, including Verizon and Time Warner Cable (now Charter) as well as with industry vendors and has been an industry advisor in areas including marketing, strategy, product development and M&A due diligence.

Dr. Mark H Mortensen ([email protected] @DrMarkHM) is an acknowledged industry expert in communications software for the TMT sector, with over 40 years of experience in OSS and BSS specifications, network operations, software architecture, product marketing, and sales enablement. His work has spanned the gamut of technical work at Bell Labs, strategic product evolution at Telcordia, CMO positions at several software vendors, and as a research director at Analysys Mason. He is currently the Communications Software Principal Analyst at ACG Research focusing on network and business automation.

……………………………………………………………………………………………………………………………………………….

Gartner: Enterprise Data Network Services Market Moves to Transformational Technologies

Market Overview

Gartner forecasts that the market for enterprise data networking services in 2020 will be $157.5 billion, broadly unchanged from 2019 (see “Forecast: Enterprise Communications Services, Worldwide, 2017-2023, 4Q19 Update”).

The number of global NSPs included in this Gartner research has increased as more providers have met our revised inclusion criteria. In addition to large global providers, enterprises are increasingly willing to consider smaller providers, including managed service providers with little or no network infrastructure of their own (such as those featured in the “Market Guide for Managed SD-WAN Services”). Alternatively, enterprises may choose a combination of multiple regional providers.

Sourcing Trends

Providers are increasingly focused on providing the managed service platform (e.g., managed SD-WAN and NFV/vCPE); however, they are also more open to “bring your own access” and other flexible sourcing approaches for the network transport components.

The global network service market continues to move toward a more software-driven, as-a-service model, with increasing levels of visibility and self-service via portals and APIs available to enterprise customers.

However, this means providers are reluctant to allow deviations from their standard offerings, because that will require deployment of a custom solution at a higher cost that could rapidly become obsolete in this fast-moving market.

Operational Trends

The network buying discussion is gradually moving away from technologies toward outcomes and service levels. Providers continue to improve their SLAs with more-realistic objectives and more-meaningful penalties for failing to meet those objectives, increasingly including the right to cancel the service in the event of chronic breach. Installation lead times — a pain point for many enterprises with global networks — are starting to be covered by standard SLAs, and providers are striving to improve delivery times, although they remain frustrated by third-party/local access providers. The increasing speeds of cellular services are making this technology more useful as a rapid deployment (interim) solution. In addition, it provides a truly diverse backup option. However, the hype around 5G cellular replacing fixed connectivity should be treated with caution, due to maturity issues — especially coverage limitations.

Electronic quoting and ordering are increasingly widespread, with electronic bonding between the global providers and their local access providers. Self-service ordaining and/or provisioning, as well as the increased visibility of the service being delivered via portals continue to gain momentum. This is blurring the lines between managed services and self-management, to create a spectrum of co-management possibilities.

However, global networks are also becoming more complex, because transport becomes a hybrid of MPLS, internet and Ethernet; cloud endpoints are added; and SD-WAN and NFV technology are added. In addition, the internet, especially using broadband or cellular access, is an inherently less predictable service than MPLS. Visibility capabilities, sometimes referred to as performance analytics, can help by enabling enterprises see the actual performance of their applications.

Thanks to the continual investment in enhancing the customer experience, customer satisfaction with global NSPs is improving.

Network Architectures

New global network proposals are predominantly for managed SD-WAN services based on a hybrid mix of MPLS and internet transport, with different applications using the most appropriate link type. Most providers support a small portfolio of SD-WAN vendors, because the market is more fragmented and differentiated than the router market it is replacing. Some providers offer network-based SD-WAN gateways, allowing traffic to use the internet for access, but use the providers’ higher-quality, long-haul backbones.

Enterprises’ adoption of cloud IT service delivery remains key to transforming their WAN architectures. Fortunately for enterprises, global NSPs have deployed a range of capabilities to address enterprises’ cloud connectivity needs (see “Five Key Factors to Prepare Your WAN for Multicloud Connectivity”).

The providers in this research offer carrier-based cloud interconnect from their MPLS and Ethernet networks to leading CSPs, such as Amazon, Microsoft and Google. Most offer connection to additional cloud providers as well. The key differentiators are the specific cloud providers and the cities connected, and the ability to add virtualized services (e.g., security) into the cloud connection points.

Managed SD-WAN services typically offer the option of local internet access (split tunneling) from every site, which is especially useful for access to SaaS applications, such as Microsoft Office 365. Perimeter security can be provided on-site or as a cloud-based service. An option for managed SD-WAN services is for the provider to deploy network-based SD-WAN gateways to facilitate interconnection between SD-WAN and non-SD-WAN networks, improve scalability and avoid the need for traffic to traverse long distances over the internet. Alternatively enhanced internet backbone services may be available to improve the performance of cloud service access over the internet and to improve end-to-end performance, when using the internet as a transport link.

An increasing number of global WANs incorporate managed application visibility and/or WAN optimization, with some providers now offering application-level visibility by default. SD-WAN services, which operate based on application-level policies, also typically offer inherently higher levels of application visibility.

Network functions, such as edge routing, SD-WAN, security, WAN optimization and visibility, can be delivered as on-site appliances. However, many providers prefer to offer these as VNFs, running in NFV service nodes in their POPs or in uCPEs, which are essentially industry-standard servers, deployed at the customers locations, supporting one or more virtual functions. This makes it easy to rapidly change the functions deployed in the network and is also usually consumed on an “as a service” basis with a monthly subscription fee for each function.

Ethernet WAN services (virtual private line and virtual private LAN services) remain more niche. They are principally used for data center interconnection; high-performance connections, including extranets (such as trading networks); or for sites that are geographically close (i.e., Metro Ethernet). Different combinations of these services can be used to obtain different service levels appropriate to each enterprise location.

Providers are starting to offer NoD services, where bandwidth can be adjusted via a portal or APIs. Some of these services support multiple services (e.g., MPLS and internet) on a single access line, and also allow dynamic control of cloud connectivity.

Access Options

WAN access is evolving, with traditional leased-line access, such as T1 or E1 lines, no longer proposed in new deals, except when no other form of access is available, such as in rural locations or some emerging markets.

Pricing for these legacy service types is typically increasing, and, in some cases, the services are reaching the end of their life.

Traditional access lines have largely been replaced by optical Ethernet access at 10 Mbps, 100 Mbps, 1 Gbps or 10 Gbps. The scale economics of Ethernet access are very good, with each tenfold increase in speed, typically increasing cost by only two to three times. As a result, in developed markets, enterprises now tend to purchase access lines with much higher speeds than they initially require, with the port capacity limited to their current needs. This allows them to easily and quickly upgrade capacity in response to changing requirements.

For smaller, less critical or remote locations, broadband (increasingly, “superfast broadband,” such as very-high-speed DSL [VDSL], cable modem or passive optical network [PON]) is the access technology of choice, despite having no SLAs or poorer SLAs than Ethernet access. When enterprises require large numbers of broadband connections, they can sometimes find that they are able to get better pricing than that offered by global service providers by sourcing broadband access directly or from aggregators. Many providers now support “bring your own broadband.” This refers to the service provider delivering managed services over broadband sourced by the enterprise.

Finally, cellular connectivity (4G) and, in the future, 5G, is increasingly being used for backup, rapid deployment or temporary locations, although it does not offer SLAs. As with broadband, enterprises may be able to get attractive deals for data-only mobile services themselves, which will then be managed by their global provider.

Managed Services

Most global WANs are delivered on a managed service basis, with the on-site devices, such as routers, security appliances and WAN optimizers, provided and managed by the service provider. Transport links are usually sourced from the managed service provider, but might also be sourced by the enterprise, who would then give the managed service provider operational responsibility for them. Although more U.S.-headquartered multinationals are moving to managed network services, a significant number still manage their networks in-house and only source transport links from their global providers.

As more network functions, such as SD-WAN application policies or NoD bandwidth, are controllable via the providers’ portals and APIs, networks are moving more to a co-managed reality. In this case, responsibilities for various network management functions are divided between the provider and the enterprise.

Pricing Trends

Downward pressure on global network service prices is relentless (e.g., global MPLS services are undergoing unit price declines averaging 10% per year, although with strong regional variance). Gartner has produced research summarizing and predicting pricing trends for different services and geographies (see “Network Service Price Trends: What You Need to Know to Save Money on Your Next Contract Negotiation”). The response from providers varies, with some focusing on extending their own networks, while others are relying heavily on network-to-network interface (NNI) connections to partners to improve their regional coverage. Most providers are increasingly using carrier-neutral communications hubs, such as those operated by Equinix, to allow them to cost-effectively interconnect with multiple access, backbone and cloud providers.

These hubs, particularly when combined with NFV and/or SD-WAN, have dramatically reduced the level of investment required to be competitive in the global network service market. This has allowed smaller providers, including some of the more recent entrants to this Magic Quadrant, to offer solutions competitive with those of the largest providers. However, maintaining a consistent set of service features and user experiences across these different elements remains a challenge.

Change Underway:

The network service market is undergoing a major transformation, with new generations of software-based network technologies enabling new services and new business models that are less focused on large-scale infrastructure. To reflect these trends, this Magic Quadrant focuses on transformational technologies and/or approaches that address the future needs of end users, as well as today’s market.

Gartner defines the global network service market as the provision of fixed corporate networking services with worldwide coverage.

Current global network services evaluated in this Magic Quadrant include:

- WAN Transport Services — These include Multiprotocol Label Switching (MPLS) service, Ethernet services and internet services, such as dedicated internet access (DIA), broadband and cellular.

- Carrier-Based Cloud Interconnect (CBCI) — This is a direct connection between a service provider’s enterprise network services, such as MPLS and/or Ethernet services, and the private connection option of one or more cloud service providers (CSPs). CBCI can be established directly between the network service provider (NSP) and the cloud provider or via a cloud exchange, such as Equinix Cloud Exchange.

- Managed WAN Services — These include managed software-defined WAN (SD-WAN). Although a minority of enterprises are renewing their managed router networks, most new managed global network deployments in 2019 were managed SD-WAN networks using a mix of MPLS and internet transport. This is a trend Gartner expects to continue. An option for managed SD-WAN services is for the provider to deploy network-based SD-WAN gateways to facilitate interconnection between SD-WAN and non-SD-WAN networks, improve scalability and avoid the need for traffic to traverse long distances over the internet.

Emerging global network services that will be evaluated include:

- Network On Demand (NoD) — NoD services from NSPs enable enterprises to make real-time changes to access/port bandwidth, change the WAN service types delivered over a network port and, in some cases, add and remove endpoints (e.g., connections to cloud providers). This occurs under software control, via the provider’s web portal or APIs.

- Network Function Virtualization (NFV) — NFV is an architecture to deliver multiple network functions, including routing, firewall, SD-WAN, WAN optimization, visibility and voice as software, termed virtual network functions (VNFs). NFV enables enterprises to rapidly (in minutes) deploy network functionality to locations where it is required. This functionality is the replacement for purpose-built hardware devices, such as routers, security devices or WAN optimizers. NFV can be implemented on universal customer premises equipment (uCPE; see below) or in NFV service nodes, located in the provider’s network, or in colocation facilities. NFV enables network functions to be activated on demand (and deactivated when no longer required) and consumed on an “as a service” basis. This can improve the agility and cost-effectiveness of the enterprise WAN.

- Virtual Customer Premises Equipment (vCPE) — This is the use of industry-standard x86 devices (uCPE), rather than function-specific appliances, to deliver enterprise network edge functions, including WAN edge routing, SD-WAN, WAN optimization, visibility and security functions (e.g., firewalls).

In addition, it is highly desirable for providers to offer related network services, including managed WAN optimization, managed application visibility, and managed, network-related security services. Integrators, virtual operators and carriers may be included, but only if they will bid for stand-alone WAN deals and provide and manage offerings that include the WAN connectivity.

During the past 12 months, Gartner has seen continued changes in enterprise requirements and buying criteria for global networks. Enterprises are placing an ever-growing emphasis on their need for greater agility and especially enabling their organization’s adoption of cloud services and the Internet of Things (IoT). They are increasingly willing to consider smaller providers and innovative services, particularly those that can be consumed on an as-a-service basis. Therefore, they are placing less emphasis on supplier size, network scale and the availability of large numbers of provider staff to deliver customized capabilities.

NSPs are taking advantage of the marketplaces created by carrier hubs, such as those provided by Equinix and Digital Reality. This enables them to source access that’s distance-insensitive, at the national or even regional level, reducing the need to deploy large numbers of network points of presence (POPs). POPs are increasingly acting as gateways between access and backbone network services of various types, and cloud providers. In addition, they are serving as locations where virtualized network services, such as security, can be applied.

Internet services, including broadband, DIA and cellular, are growing in importance as transport options, alongside the continued use of MPLS and Ethernet services. New services such as managed SD-WAN, NoD services, NFV and vCPE, which transform the enterprise networking market, are being deployed to improve the agility of providers’ network solutions. Many of these services require a platform-based approach to delivering services, increasing the trend to move away from customized solutions, toward standard, off-the-shelf managed services, consumed on an as-a-service basis.

We are seeing a distinct split in providers’ attitudes toward NFV and vCPE. Some providers are “doubling down” on the technology, making it their default edge device offering. Others are still focusing on appliances at the network edge, frequently accompanied by network-based NFV, especially for services such as security.

Although delivering against a strong technological roadmap is important, it is equally important that services be delivered with good operational performance to implement and sustain them.

The inclusion and exclusion criteria for this year’s Magic Quadrant (see Figure 1), although similar to prior years, have been adjusted to reflect these trends.

Figure 1. Magic Quadrant for Network Services

Source: Gartner (February 2020)

………………………………………………………………………………………………….

Digital business initiatives are placing increasing demands on the enterprise network, increasing the needs for bandwidth (between 20% and 30% annually), reliability and performance. Video, live and stored, is driving significant increases in bandwidth, whereas IoT typically requires greater reliability.

A growing proportion of enterprise applications are being delivered as cloud services — infrastructure as a service (IaaS), platform as a service (PaaS) and SaaS. This requires incorporation of cloud endpoints into the network and a burgeoning need for data center-to-cloud and cloud-to-cloud connectivity.

Above all, digital business requires that enterprise networks become significantly more agile, to allow the rapid accommodation of new endpoints, new applications and new network capabilities. However, enterprises continually need to do all of this, while optimizing their WAN expenditure.

To address these requirements service providers are deploying a range of new networking technologies. SD-WAN is now the default offering for new network deployments and major refreshes, while the virtualization of network edge functions, using NFV and vCPE, is gradually becoming more common. CBCI is also mainstream, complemented by emerging NoD services.

Growing use of the internet as a network transport option, together with cloud endpoints, is resulting in performance uncertainty, and is driving significant demand for application visibility services.

Fortunately, enterprises can choose from a wide selection of solution providers, most operating across multiple geographies. This breadth is allowing enterprises to choose between one, two or many providers to find the best solution for their specific needs. These decisions will be based on geographic requirements, the specific service required and the preferred sourcing approach (i.e., the enterprise’s desire to manage multiple networks from multiple providers). Competition continues to drive down unit prices for global networking services. However, in a market in which there are no meaningful price lists, enterprises still need to use competitive procurement practices and strong negotiations to obtain the best prices.

AT&T FlexWare and Cybersecurity power Exide’s Digital Transformation

AT&T is powering Exide’s digital transformation with its FlexWare network virtualization solution. AT&T FlexWare is one of AT&T’s core software-centric services from the company’s “edge solutions portfolio.” AT&T says its near real-time service cuts long set up times and complex processes.

FlexWare enables businesses to launch virtual network functions (VNFs) to improve productivity and communication across its geographically dispersed physical sites. With FlexWare, AT&T can move the VNFs, such as firewall or security VNFs, to devices on a company’s network.

“Our technology will give Exide the support it needs to continue operating at high standards and to prepare for new opportunities in a 5G world,” said John Vladimir Slamecka, AT&T Region President for Europe, the Middle East and Africa. “We’re building a platform that is ready for new data hungry apps made possible with the arrival of 5G; such as AR and VR. That’s why we are moving compute resources closer to the network edge, opening the door to new experiences and opportunities.”

AT&T’s FlexWare, for virtualized network edge services, is now in place across Exide’s global locations, including throughout Europe, North America and Asia Pacific. FlexWare at the edge allows Exide to use both highly secure MPLS and internet access services for its network needs. Starting with network routing, Exide is able to access all wide area network components utilizing high bandwidth capabilities to help provide greater flexibility as the needs of each change over time. AT&T FlexWare also allows Exide to fulfill its centralized IT requests without needing local site support.

……………………………………………………………………………………………………….

Exide is a battery and energy storage company which was founded 130 years ago. It manufactures and recycles batteries for a broad range of industrial and transportation applications including cars, boats, forklifts and uninterrupted power units. The company has more than 10,000 employees located across 80 countries.

“Our global presence in today’s fast paced technology environment presents the unique challenge of blending reliable legacy platforms with emerging digital solutions. This requires a data transport infrastructure that supports a broad number of traditional and disruptive applications,” said Brian Woodworth, Exide Chief Information Officer. “AT&T is leading the way as a trusted and visionary provider of network edge solutions, so naturally we turned to AT&T to collaborate with us on our digital journey to become the preferred supplier to our customers across the globe,” he added.

Exide is also using managed network security services from AT&T Cybersecurity. From an AT&T report on this vital topic:

The security landscape is growing increasingly treacherous as hackers of every type continue to evolve their attack strategies to evade detection while maximizing profit from their time and effort. It doesn’t matter if it’s an organized criminal gang looking to make money from ransomware schemes, covert state-sponsored groups attempting to steal data and disrupt operations, or just malevolent individuals trying to impress others in the hacker community—every bad actor is smarter than they were last year, and better equipped to wreak havoc.

However, we wonder if AT&T takes cybersecurity seriously for its own customers, like this author who has experienced two AT&T account unexplained security breaches in the last few months?

…………………………………………………………………………………………………………………..

AT&T says it is “offering customers like Exide unrivaled visibility and security through people, process and technology allowing them to better protect their global business.” This author certainly hopes that happens!

…………………………………………………………………………………………………………

References:

https://about.att.com/story/2019/att_powers_exide_digital_transformation.html

For more information about AT&T FlexWare (nice video): https://www.business.att.com/solutions/Service/network-services/sdn-nfv/virtual-network-functions/

For more information about AT&T Cybersecurity: https://att.com/security

https://www.business.att.com/learn/cybersecurity-report-volume-8-5.html