Uncategorized

Infonetics Research: Microwave equipment mkt to hit $6 billion by 2016; Ericsson recaptures lead from NEC

Editor’s Note: Previous Infonetics Microwave Survey report is detailed here:

Overview:

Infonetics Research just released excerpts from its 2nd quarter 2012 (2Q12) Microwave Equipment vendor market share and forecast. The report analyzes TDM, Ethernet, and dual Ethernet/TDM microwave equipment by spectrum, capacity, form factor, and architecture. Mobile backhaul is clearly the main microwave market driver, especially with data traffic from many more small cells needing to be backhauled to the ISP/service provider point of presence. While nano cells permit spectrum re-use (thereby increasing throughput for a given geographical coverage area) they require more backhaul points and equipment.

In Dell’Oro Group’s recently released market report, the mobile backhaul market, including transport and routers & switches, is forecast to reach $9 billion by 2016. The traditional wireline transport segment of wireless backhaul (microwave, fiber, and copper transport) is predicted to grow at a 2 percent compounded annual growth rate to $6 billion by 2016.

MICROWAVE EQUIPMENT MARKET HIGHLIGHTS (Infonetics Research):

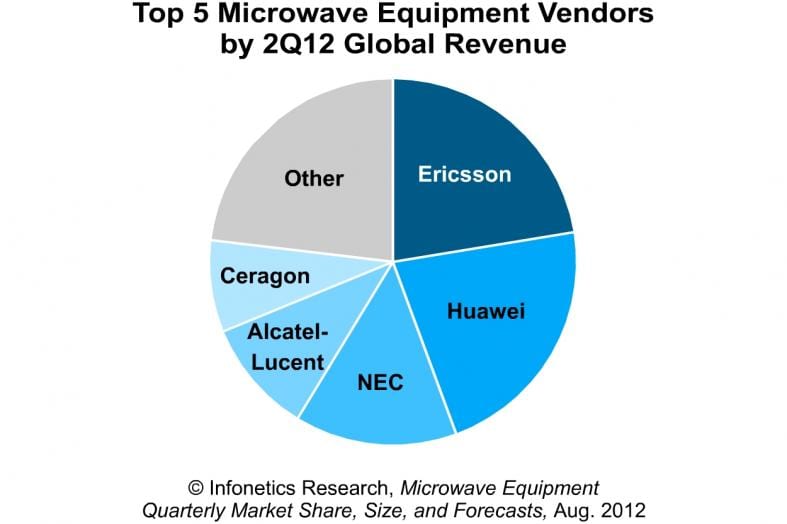

. The global microwave equipment market totaled $1.2 billion in 2Q12, up 16% from the previous quarter and down 6% from the year-ago 2nd quarter

. Ericsson regained the #1 position in the global microwave equipment market in 2Q12, edging past Huawei by a hair

. NEC, the microwave market share leader just a quarter ago, slipped to 3rd

. Regionally, EMEA (Europe, Middle East, Africa) had the strongest 2nd quarter, capturing around 50% of global

market share

ANALYST NOTE:

“The microwave equipment market rebounded nicely in the 2nd quarter thanks to strong performances from Ericsson

and Huawei,” notes Richard Webb, directing analyst for microwave at Infonetics Research. “Huawei had a huge quarter, its biggest ever for microwave equipment. The operator now counts some of the world’s major tier 1 international operators as its microwave customers and often supplies their operations across many countries.”

Webb adds: “Despite choppy performance in recent quarters, we expect the microwave equipment market to grow to $6 billion by 2016, driven by a continuing demand for increased mobile backhaul capacity and the proliferation of small cells.”

REPORT SYNOPSIS:

Infonetics’ quarterly Microwave Equipment report provides worldwide and regional market size, vendor market share,

forecasts, and analysis for Ethernet, TDM, and hybrid microwave equipment by spectrum, capacity, form factor, and architecture. Companies tracked include Alcatel-Lucent, Aviat Networks, Ceragon, DragonWave, ECI Telecom, Ericsson,

Exalt, Huawei, NEC, Nokia Siemens Networks, ZTE and others.

To buy the report, contact Infonetics sales: http://www.infonetics.com/contact.asp.

Samsung Wins Key LTE Contract in UK- company on track to be important LTE Infrastructure vendor!

And you thought Samsung Electronics was just a mobile device/smartphone/tablet vendor?

The South Korean conglomerate has been selected to provide the UK’s smallest cellco by subscribers, Hutchison 3G UK (H3G UK), with a Long Term Evolution (LTE) Radio Access Network (RAN), as well as 3G/LTE core infrastructure solutions (likely to be the LTE Evolved Packet Core (EPC)).

In a press release confirming the announcement, Samsung noted that this marks its first commercial mobile network rollout in Europe. It has confirmed that it will deploy LTE base stations, including all associated systems and network support services, across H3G UK’s existing infrastructure. The complete LTE network infrastructure solution will be trialled this year ahead of a full deployment and commercial launch in 2013.

Dave Dyson, CEO of H3G UK, which offers services under the ‘Three’ (‘3’) banner, said of the announcement: “Three’s customers will start benefitting from this investment in our core network early next year and those benefits will grow further as we deploy new spectrum … Samsung’s advanced network technology will help us to continue to deliver the most enjoyable smartphone experience. In Samsung’s home market operators are busy turning off 2G. In the UK Three is the only operator without a 2G network which means more and more consumers are choosing the network built for the internet.”

Youngky Kim, Executive Vice President and General Manager, Telecommunication Systems Business at Samsung Electronics meanwhile noted: “This contract marks a significant milestone for Samsung and further demonstrates our commitment to the European market.”

Samsung is betting that expanding sales of LTE equipment will help catapult it to the top of the industry. According to research firm Dell’Oro Group, the LTE equipment market could grow 45 percent annually over the next five years.

UK regulator Ofcom granted permission to the country’s largest cellco, Everything Everywhere, to build out LTE this year in its 1.8GHz spectrum. This is on condition it sells some of those frequencies to 3UK. Hence, Samsung is likely to expand its 3UK deployment.

Everything Everywhere welcomed the Ofcom green light, which will enable it to go live with LTE this year. “4G will drive investment, employment and innovation and we look forward to making it available later this year, delivering superfast mobile broadband to the UK,” the operator said in a statement, though it did not detail any roll-out plans at this stage.

Ofcom restated its previous position on 1.8GHz refarming, saying: “Ofcom has concluded that varying EE’s 1800MHz licences now will deliver significant benefits to consumers, and that there is no material risk that those benefits will be outweighed by a distortion of competition. Delaying doing so would therefore be to the detriment of consumers,” it said.

“The decision takes account of the forthcoming release of additional spectrum in the 800MHz and 2.6GHz bands, in an auction process set to begin later this year, which will enable other operators to launch competing 4G services from next year.”

Clearly, Samsung wants to build on its success in WiMAX by becoming a viable LTE infrastructure vendor – a goal which eluded it in 3G. The South Korean vendor has won a 4G-LTE network contract from 3UK, is one of the vendors selected for Sprint’s Network Vision (LTE) program, and has LTE deals in South Korea, Japan and the Middle East.

For more information see:

http://www.rethink-wireless.com/2012/08/28/samsung-scores-uk-carriers-cleared-lte.htm

FierceWireless http://www.fiercewireless.com/story/samsung-exec-crows-us-lte-contract-wins/2012-02-21#ixzz253Gzn7Vp

Infonetics: Huge Pop in China Boosts Global Service Provider Router & Switch Market in 2Q 2012!

Infonetics Research just released vendor market share standings and preliminary analysis from its 2nd quarter 2012 (2Q12) Service Provider (SP) Routers and Switches report. Surprisingly, China sales made the quarter positive, where without China it would’ve been negative for total sales of SP routers and switches. But the year over year results were down 9%, according to Infonetics.

“A nearly 50% increase in revenue in China propped up the global service provider router and switch market in the 2nd quarter,” notes Michael Howard, Infonetics Research’s co-founder and principal analyst for carrier networks. “China was the differentiating factor between a positive worldwide quarter and one that otherwise would have been down.”

Mr Howard adds: “While Cisco has long led the global IP edge and core router market by very comfortable margins (and whose share is steady from this time last year), Alcatel-Lucent, Juniper and Huawei have been fighting it out every quarter for the past year-and-a-half for the next three leadership positions. The race tightened considerably in the 1st half of 2012, with Huawei taking the #2 spot in the 2nd quarter.”

SERVICE PROVIDER ROUTER AND SWITCH MARKET HIGHLIGHTS:

- The global service provider router and switch market, including carrier Ethernet switches and IP edge and core routers, grew 4% in 2Q12 from the previous quarter, to $3.5 billion

- From the year-ago 2nd quarter, the overall carrier router and switch market is down 9%, as service providers generally remain cautious, particularly in North America and Europe

- Latin America is the only major world region posting an increase in carrier router and switch revenue on a year-over-year basis (up 57% in 2Q12 over 2Q11)

- ZTE posted especially strong gains in carrier Ethernet switches (CES) in 2Q12, particularly in China where CESs are being used in major mobile backhaul deployments

REPORT SYNOPSIS:

Infonetics’ quarterly Service Provider Routers and Switches report provides worldwide and regional market share, market size, forecasts, and analysis for IP edge routers, IP core routers, and CES. The report tracks the IP Edge market by application (multiservice edge, broadband remote access server, Ethernet access transport, and Ethernet service edge) and covers Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Ericsson, Extreme, Force10, Fujitsu, Hitachi Cable, Huawei, Juniper, NEC, Nokia Siemens, Orckit-Corrigent, Tellabs, ZTE, and others.

To buy the report, contact Infonetics Research at:

http://www.infonetics.com/contact.asp.

Related Articles:

http://viodi.com/2012/08/23/zte-reports-huge-drop-in-profits-telecom-death-spiral-continues/

http://www.reuters.com/article/2012/07/16/us-zte-shares-idUSBRE86F00E20120716

Pyramid & Infonetics: LTE Drives Mobile Data Growth- Better Spectral Efficiency, Lower Latency, Increased ARPU

According to Pyramid Research, the US telecom market generated $389.6bn in service revenue in 2011, a 5.2% increase over the previous year, and represents the highest growth rate since 2007. Mobile data was the single most important driver behind this trend, generating $10.1bn more revenue in 2011 than in 2010. We expect to see service revenue grow at a more subdued 2.9% CAGR over the 2012-2017 period.

There are many subcategories of mobile data that are contributing to the top line, with mobile broadband data packs for smartphones, tablets, e-readers and M2M among the most notable. Connected cars, for instance, make for an interesting opportunity within the M2M space. Sprint estimates that already 4% of cars are wirelessly connected today. Sprint expects that having at least two wireless connection streams will eventually become commonplace —one for entertainment (music, video) and one for emergency use (similar to the OnStar service today). These initiatives and others will serve to drive mobile data to become a $120.1bn market in 2017.

Pyramid says the U.S. will continue to lead the world in total LTE subscriptions, making up 25.2 percent of total global Long Term Evolution (LTE) subscriptions in 2017, according to a new report titled, US: Bundling and Mobile Data Revenue Drive Telecom Market Growth.

“By 2017, LTE will be the most prevalent form of mobile cellular connectivity in the U.S., with 41.3 percent of subscriptions,” says Pyramid Research Analyst, Emily Smith. Even though there are many different forces at play that are

driving operators toward LTE, like the spectrum crunch, data QoS concerns and operational costs, Pyramid expects to continue seeing a market for older 2G and 3G technologies over the forecast period. “For the near future, investment in

these networks will continue, while 1xRTT remains the most dependable voice technology for CDMA operators like Sprint, leaving a small percentage of subscriptions as 2.5G-only through 2017,” she adds.

http://www.pyramidresearch.com/store/CIRUNITEDSTATES.htm?sc=LR081312_CIRUSA

Not to be outdone, Infonetics Research released excerpts from its 2012 LTE Deployment Strategies:

Global Service Provider Survey, for which incumbent, competitive, and mobile operators were interviewed about their Long Term Evolution (LTE) network drivers, deployment plans, challenges, and service offerings.

“Despite the global gloom, there are better days ahead for mobile operators,” notes Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research. “For the first time since we began tracking LTE in 2008, increased average revenue per user (ARPU) is among the top LTE upgrade drivers, along with spectral efficiencies that are driving down the cost per gigabyte. As a result, operators’ bottom line should improve for a change.”

LTE SURVEY HIGHLIGHTS:

. Almost 1/3 of the operators that Infonetics surveyed plan to use their 2G and 3G networks for voice services as long as possible

. TD-LTE continues to gain momentum, spearheaded by China Mobile’s participation in the LTE standards process

. Single radio voice call continuity (SRVCC) is on track to become commercially available in Fall 2012, but 84% of operators surveyed don’t expect the feature to be ready this year

. EMEA (Europe, Middle East, Africa) leads in the number of LTE deployments worldide, while North America is home to 80% of the more than 10 million global LTE subscribers

LTE SURVEY SYNOPSIS:

For this LTE Service Provider Survey, Infonetics interviewed incumbent, competitive, and mobile operators about their LTE network build-out plans, deployment migration scenarios, challenges, technical and commercial drivers, and the LTE services, features, and devices they plan to offer. Service providers surveyed together represent 31% of the world’s telecom capital expenditures (capex) and 29% of the world’s telecom carrier revenue, and come from EMEA (Europe, Middle East, Africa), North America, Asia Pacific, and Latin America. To buy the survey, contact Infonetics sales: http://www.infonetics.com/contact.asp.

Profile of Prolific Inventor & ComSoc NA Director Yigang Cai

Introduction and Overview

For the third time in four years, ComSoc NA Director Yigang Cai, PhD was honored with the 2011 Bell Labs Inventors Award in the Product and Services group category. His contributions cover Messaging, Mobile Applications and Mobile Service technology and markets. The annual Bell Labs Inventors Award recognizes and honors individuals who exemplify excellence, innovation and creativity by outstanding patent contributions across Alcatel-Lucent (ALU).

In addition to being a prolific inventor, Yigang did a splendid job as ComSoc NA Distinguished Lecture Tour (DLT) Director in 2009-2011. As ComSocSCV Chair, this author was very impressed with Dr. Cai’s dedication and strong commitment to that volunteer job. This year (2012), we’ve collaborated on several issues that improved operations of local ComSoc NA Chapters.

About Yigang Cai, PhD

Yigang Cai was an Associate Professor in Department of Mechanical Engineering at Zhejiang University before he moved to the United States in 1989. He obtained his BS, MS and PhD degrees from Zhejiang University, Hangzhou, China. Yigang joined AT&T-Bell Labs in 1995. He has worked as a systems engineer in his Lucent, and Alcatel-Lucent (ALU) career and engaged in research and development of many wire-line and wireless communication products. Dr. Cai became a Distinguished Member of Bell Labs Technical Staff in 2000.

An Inventor Par Excellence!

As of July 31, 2012, Yigang has filed 231 US patent applications, and had 145 patents granted worldwide. That’s a phenomenal total by any stretch of the imagination!

Yigang’s numerous invention submissions address a wide range of technology areas. During 2010- the most recent ALU Inventor time period- Yigang’s contributed total forty-three patent filings:

- Twenty-nine contributions address VOIP and Web Applications such as Location Based Services, Messaging, Subscriber Data Management and Profiling, Billing/Payment Systems, IMS Solutions and VoIP Infrastructure.

- Eleven contributions address Mobile/Wireless Core Networks including the Mobile Switching Center, Mobility management, the Evolved Packet Core, Handsets, 3GPP Services, and LTE.

- Two contributions address Video and Media Applications such as Multimedia Applications, and TV Video Applications.

- One contribution addresses Service Aware Networks such as Multimedia Gateways.

Many of Yigang’s contributions have been implemented in ALU products and delivered to customers such as Verizon Wireless (VZW). Others are under development so that they can be included in new ALU products that are expected to be delivered to customers, including VZW and AT&T, in the near future.

Yigang’s contributions impact ALU products that include LTE SMS GW, SMSC, MSC, 5119 BMGW, real time payment system (8610 ICC and 8620 SurePay) policy control manager (5780 DSC), Universal Message Center. Yigang continues to be one of the most prolific inventors in ALU. Yigang’s contributions are not only numerous but are also high in quality. In particular, thirty-one of Yigang’s forty-three contributions have been designated by ALU as “high quality” (i.e., internal rank 1 or 2) and are scheduled for international patent filing. Several contributions have been submitted to standards development organizations for potential adoption. Moreover, substantial contributions have been made in ALU focus areas, which include: Messaging, Subscriber Data Management and LTE. Many of those are likely to be implemented in ALU products.

Yigang is one ALU employee who surely does not work in a silo. While several contributions are solo efforts, many are collaborative efforts with a variety of different inventive teams, with other co-inventors of individual inventive teams being located in China, Europe, the United States, or all three continents. For many of these border-crossing collaborative invention teams, Yigang is the lead US-based co-inventor.

An ALU employee that worked with Yigang and drafted several of his patent applications said, “I find him extremely collegial, always willing to share his expertise so that the best end-product/result is achieved. He is responsive throughout the patent process, responding faithfully and timely despite other, enormous demands on his time.”

That’s a very powerful testimonial! ComSoc is most fortunate to have Yigang Cai as our NA Director. If you have the opportunity to work with him, you are most fortunate!

Appendix: Yigang’s top 10 patents in 2010 (the most recent ALU time frame)

In the considered ALU time frame, Yigang contributed to forty-three positive filing decisions. Ten contributions currently considered of most commercial import follow:

1. Message Delivery over LTE Networks (3GPP Services).

Contribution embodiment/s address LTE messaging strategy, architecture and methods and are the basis for a brand new ALU product LTE SMS GW which will be deployed to VZW network in 2010.

2. Sequential Message Delivery for FDA Processing and Store-and-Forward Processing (Messaging).

Contribution embodiment/s propose a key evolution with a FDA/MDA configuration of SMS/MMS network, were built into ALU’s SMSC release 11.0 and deployed to the VZW network beginning in November of 2009 when VZW began a network upgrade from the current single SMSC to a FDA/MDA configuration. ALU has 58 pair of SMSC (~50 sites) in the VZW network and the configuration of most will be upgraded. ALU revenue confirmed from VZW will be ~$40 million in 2010-11 for 4 geo-sites. The complete network upgrade is expected to take at least 5 years and while ALU does not have VZW’s commitment yet, the upgrade’s revenue impact is conservatively estimated at ~$120 million.

3. Voice Notification to the Destination of a Text Message That is Engaged in a Voice Call (Messaging).

Contribution embodiment/s create a ‘whispering’ SMS when an end user is in a voice session. ‘Whispering SMS’ is expected to be a great application in the near future.

4. SIP Response Encapsulation for SMS Delivery over IP Network (Messaging).

Contribution embodiment/s provide a new method in SIP messaging so that SMS can be delivered over IP networks, eliminating unnecessary delivery acknowledgement/ report messaging and handling. The method can be used for other SIP applications and standards evolution. Its first application will be in the VZW network.

5. Messaging Waiting Notification to External Message Center (Mobile Switching Center).

Contribution embodiment/s were a key MSC feature for the Verizon Wireless (VZW) network. FDA/MDA evolution. Embodiments were implemented in ALU MSC and delivered to VZW.

6. SMS Message Delivery over Broadband Data Networks (Evolved Packet Core or EPC).

Contribution embodiments provide a new direct SMS delivery over EVDO (3G) network when bypassing MSC and SMSC. Embodiments were implemented in a new ALU product 5119 BMGW and deployed in VZW network in November of 2009. Similar embodiments were deployed for AT&T in 2011.

7. A Method for Delivering Dynamic Policy Rules to an End User, According on Subscribers Account Balance and Service Subscription Level (Billing).

Contribution embodiment/s provide a new method for interactions between OCS and PCRF in 3GPP policy and charging control (PCC) for mobile broadband services, IPTV and other applications. The contribution is an ALU value position to enhance the PCC capability on the real time payment system (8610 ICC and 8620 SurePay) and the policy control manager (5780 DSC).

8. Text Messaging over an eHRPD Network (Messaging).

Contribution embodiment/s provide a SMS/MMS message deliver over LTE/eHRPD networks. The contribution is in a road map and will be implemented in a new ALU product Universal Message Center for North America and other regions’ customers.

9. Charging Method Selection for Service Data Flows Based on the Data Services Being Requested (Billing).

Contribution embodiment/s allow LTE gateways and the PCEF to consult charging rules to the PCRF when providing flow and service data to the PCRF, during establishing and updating IP-CAN. The contribution will significantly enhance 8610 ICC and 8620 SurePay by involving LTE/EPC network charging.

10. Registration Notification for SMS over LTE (Mobile Management/ Evolved Packet Core).

Contribution embodiment/s provide a method for subscriber databases (HSS and/or AAA) to push a registration notification to IP-SM-GW when subscriber registers/ deregisters to LTE/EPC networks. The contribution will be built in a roadmap into HSS/AAA and a new ALU product Universal Message Center.

Yigang with ALU CEO Ben Verwaayen:

AT&T Acquiring & Shifting 2G Wireless Spectrum to Support LTE Network Buildout

AT&T has taken two major steps to gather additional wireless spectrum to build out its Long Term Evolution (LTE) network over the next five years. AT&T has repeatedly stated that it will soon run out of the necessary airwaves to adequately meet the wireless demands of its customers if it doesn’t get more spectrum. The company made two announcements last week to gain more spectrum.

1. On Aug. 2, AT&T agreed to acquire NextWave Wireless, a failing carrier with spectrum that the Federal Communications Commission has been trying to repurpose for years.

The plans for the NexWave LTE spectrum are also a ways off. While NextWave is in dire financial straits, the use of its spectrum for LTE data services has yet to be approved by the FCC. However, the owner of the adjacent spectrum, Sirius XM and AT&T filed a joint proposal that would clear up a number of engineering issues and as a result would open the 2.3GHz Wireless Communications Service (WCS) to use as an LTE data band. The FCC filing outlined a number of limitations on WCS operations that would prevent AT&T’s WCS operations from interfering with Sirius XM’s audio services.

AT&T bought NextWave at the bargain-basement price of $25 million, plus a contingent payment of about $25 million plus cash and other assets to pay off NextWave’s debt, for a total of $600 million. NextWave originally bought the WCS spectrum in 1997, but was involved in a protracted legal battle with the FCC after NextWave declared bankruptcy and defaulted on its payment for the spectrum. NextWave got the rights to the spectrum in 2004, but has been unable to use the spectrum because of the potential for interference with Sirius XM.

2. In an Aug. 3 FCC filing, AT&T announced that it would phase out its 2G data network by the beginning of 2017. This will enable the company to free up spectrum for added capacity on its 3G and LTE mobile Internet network.

“Throughout this multi-year upgrade process, we will work proactively with our customers to manage the process of moving to 3G and 4G devices, which will help minimize customer churn,” the company said in the filing.

As of June 30th, roughly 12 percent of AT&Ts contract customers were still on its 2G network, which is primarily designed for voice and text messages, with relatively low data speeds. An AT&T spokesperson told eWEEK that AT&T will be working with customers who are still using 2G services to provide options that will meet their needs. AT&T has relatively few customers who currently depend on 2G data, and that number is expected to diminish through attrition by 2017. AT&T no longer sells 2G devices. By freeing up 2G spectrum, AT&T will have more space available for LTE, in much the same way that Sprint is phasing out its iDEN spectrum so it has room for LTE. Currently, it’s unclear which of its services AT&T considers 2G and plans to shut down. ( eWEEK questions to the AT&T spokesperson did not provide details as to what services in AT&T’s spectrum are planned for shutdown when support for 2G ends.)

GSM, which is what AT&T uses for its voice technology is the international standard and is used throughout the world, is technically a 2G standard, but the 2G data standard that AT&T uses is General Packet Radio Service (GPRS), which is not widely used although it is widely available on the AT&T network.

For more information, please see this eWEEK article:

Comment & Analysis

Mr. Téral adds: “The prophecies of doom for mobile operators’ SMS/MMS cash cow are being overplayed. Despite the popularity of over-the-top messaging applications like Apple’s iMessage and WhatsApp, our data shows SMS growing every year from 2012 to 2016, delivering a cumulative $1 trillion in operator revenue during those 5 years. And over that same period, voice revenue will decline only slightly, still making up a sizable chunk of operator revenues.”

Another issue with the spectrum swap from 2G to 3G/4G is timing. Won’t AT&T need a lot more spectrum for 3G/4G and even LTE Advanced before 2017?

IEEE 802.16 Wireless MAN (WiMAX) Session #80 (July 2012) Meeting Report

IEEE 802.16’s Session #80 was held on 16-19 July 2012 in San Diego, California, USA. This was an IEEE 802 LMSC Plenary Session and co-located with sessions of the other IEEE 802 Working Groups and Technical Advisory Groups. The attendance was 32 (Editors Note: attendance was way down from previous sessions for obvious reasons).

HetNet Study Group

The new IEEE 802.16 WG Study Group (SG) on the WirelessMAN Radio Interface in Heterogeneous Networks (HetNet Study Group) met for the second time. The IEEE 802 EC renewed the Study Group though Session #82. Following activities during the session, the HetNet SG is now proceeding with three separate topics:

Work toward an “OmniRAN” project using an Open Mobile Network Interface (OMNI) was advanced by presentation of an IEEE 802 Tutorial on OmniRAN the evening of 16 July.

The HetNet SG issued a Call for Contributions:

OmniRAN Standard for an IEEE 802 HetNet, which includes a Call for Comments on draft text toward an OmniRAN Project Authorization Request (PAR).

Following comment resolution, the Study Group’s PAR P802.16q, on a Multi-Tier amendment to IEEE Std 802.16, was concluded and then forwarded by the 802.16 WG and the IEEE 802 Executive Committee (EC). It is on the 29 August

NesCom agenda and could be authorized by the IEEE-SA Standards Board on 30 August. The SG issued a Call for

Contributions on the topic.

In response to contributions, the SG issued a Call for Contributions: Small-Cell Backhaul (SCB) Enhancements to WirelessMAN-OFDMA soliciting input with an intent to develop a PAR and Five Criteria at Session #81.

Metrology Study Group

The IEEE 802.16 WG Study Group on Broadband Wireless Access Metrology (Metrology Study Group) met for the second time. Following comment resolution, the Study Group’s PAR P802.16.3 on Mobile Broadband Network Performance Measurements was forwarded by the 802.16 Working Group and the IEEE 802 EC. PAR P802.16.3 is on the 29 August NesCom agenda and could be authorized by the IEEE-SA Standards Board on 30 August. The IEEE 802 EC renewed the Study Group though Session #82, and it remains open to investigation of other possible projects as well. The SG issued a Call for Contributions on Broadband Network Performance Measurements and drafted a second such Call for Contributions, withholding release pending action of the IEEE-SA Standards Board regarding the PAR. The SG summarized its work in a closing report and minutes.

GRIDMAN Task Group

The Working Group’s GRIDMAN Task Group resolved comments received during the second recirculations of WG Letter Ballot #37 and WG Letter Ballot #38, in which drafts P802.16n and IEEE P802.16.1a are under review. In each

case, a 15-day confirmation ballot will run from 27 July through 11 August. Based on conditional approval granted by the 802 EC, both drafts may proceed to Sponsor Ballot, closing prior to Session #81, dependent on successful recirculation. The TG issued a closing report and minutes.

Machine-to-Machine Task Group

The Machine-to-Machine (M2M) Task Group did not meet at Session #80. The 802.16 WG approved comment resolutions agreed by the TG at an earlier teleconference and agreed to initiate a third Sponsor Ballot recirculation. The

802 EC granted conditional approval to forward both M2M drafts (P802.16p and P802.16.1b) to RevCom. Both have been submitted for the 29 August RevCom agenda, pending successful recirculation, and could be authorized by the IEEE-SA Standards Board on 30 August. The TG Chair issued a closing report.

Maintenance Task Group

The P802.16Rev3/D6 and P802.16.1/D6 drafts were approved as, respectively, IEEE Std 802.16-2012 and IEEE Std 802.16.1, on 8 June. The Maintenance Task Group met informally to review a pre-publication editor’s draft of IEEE Std 802.16-2012. Volunteers are invited to participate in a similar exercise regarding IEEE Std 802.16.1. Publication of both standards is expected this summer. The TG Chair issued a closing report and minutes.

ITU-R Liaison Group

The ITU-R Liaison Group drafted contributions to ITU-R Working Party 5D (WP 5D) regarding IMT-2000 and IMT-Advanced updates. The two drafts were approved by the 802.16 Working Group, the 802.16 Radio Regulatory TAG, and

the IEEE 802 EC. The ITU-R Liaison Group also completed liaison statements to its partner organizations regarding the IMT-2000 and IMT-Advanced activities.

One of these statements (802.16-12-0515) solicits input regarding IMT-Advanced sharing parameters prior to Session #81, in response to an invitation from WP 5D to address activity in preparation for the 2015 World Radiocommunications Conference. The Liaison Group will meet at Session #81 to prepare the resultant contribution to WP 5D. For more details,

see the closing report.

Project Planning Committee

The WG’s Project Planning Committee met for one period during Session #80. It confirmed the IEEE 802.16 Ballot Schedules. The committee began review of two input contributions on direct mobile communication for proximity-based

applications. The Committee issued a closing report.

Session #81 will take place on 17-20 September 2012 in Indian Wells, CA, USA in conjunction with the IEEE 802 Wireless Interim. The GRIDMAN TG, HetNet Study Group, Metrology Study Group, ITU-R Liaison Group, and Project Planning Committee will meet.

Session #82 will take place on 12-15 Nov 2012 in San Antonio, TX, USA in conjunction with the IEEE 802 Plenary

Session #83 will take place on 14-17 Jan 2013 in Vancouver, BC, Canada in conjunction with the IEEE 802 Wireless Interim.

Complete report with links to meeting reports and minutes is at:

http://ieee802.org/16/meetings/mtg80/report.html

Session #84 will take place on 18-21 Mar 2013 in Orlando, FL, USA in conjunction with the IEEE 802 Plenary Session.

Huawei gaining on Ericsson for leadership in network infrastructure equipment sales

FT: Huawei is challenging Ericsson to become the world’s largest telecom equipment vendor by sales following a decade-long push by the Chinese company to shake up the industry. Huawei said on Tuesday its revenue in the first six months was Rmb102.7bn ($16.1bn), up 5.1 per cent compared with the same period in 2011.

Close to a quarter of all sales at the Huawei are through consumer businesses such as handsets. However, while revenues have continued to build for Huawei, the company said operating profit in the first six months fell 22 per cent from last year to Rmb8.79bn. The company, which is not listed, did not announce net earnings but said it “maintained robust growth momentum although the global economic situation and telecom equipmentmarket remains a significant challenge”

Ericsson last week reported a drop in first-half revenue to SK106.3bn ($15.2bn) from SK107.7bn a year earlier. The company saw net income drop 63 per cent year on year in the second quarter, was the latest telecom equipment vendor to suffer from weak growth in the industry. Just days before, Alcatel-Lucent had warned of a €40m operating loss in the second quarter, andZTE, Huawei’s smaller Chinese peer, said it expected first-half earnings to plummet 60 to80 per cent from Rmb769.3m a year ago.“We are relatively optimistic about our operating performance and profitability for theremainder of 2012,” said Meng Wanzhou, chief financial officer.Ericsson is the clear leader in a number of market segments such as mobile networkinfrastructure and telecom services, but analysts said that Huawei was likely to continue to gain ground.

http://www.ft.com/intl/cms/s/0/c7b672fa-d57e-11e1-b306-00144feabdc0.html#axzz21fkGAVYT

Reuters: Huawei Technologies Co Ltd HWT.UL, the world’s No.2 telecommunications gear maker, posted a 22 percent fall in first-half operating profit, citing the “significant challenge” of the global economy and the telecoms equipment market.

The Chinese company, whose expansion plans have been met with some suspicion in the United States and Australia over concerns about cyber security, said revenues rose just 5 percent although it expressed confidence it would achieve its full-year target of boosting sales 15-20 percent.

The drop in operating profits comes after rival Ericsson (ERICb.ST) reported below-forecast profits and competitors Franco-American Alcatel-Lucent (ALUA.PA) and China’s ZTE Corp (0763.HK) 000063.SZ issued profit warnings, largely reflecting sluggish telecom spending during the global economic downturn. However, Huawei and ZTE may fare better than their western competitors in the second half of 2012 because spending on Chinese mobile networks is expected to pick up, analysts said.

“The second-half outlook will be better for Chinese companies such as Huawei and ZTE because Chinese telecom carriers will pick up the slack in spending in the second half,” said Michael Li, a Hong Kong-based analyst with Everbright Securities. Tenders by mobile carriers to upgrade networks were delayed in the first half and the government is keen for them to meet their spending plans for the year.

Shenzhen-based Huawei, also the world’s sixth-biggest handset maker, is unlisted and provides few figures about its corporate performance. In a seven paragraph statement, it said operating profit of 8.79 billion yuan ($1.4 billion) for January to June was lower than a year earlier but up 20.3 percent compared with the second half of 2011. First-half revenues rose 5.1 percent from a year earlier to 102.7 billion yuan.

“The telecom industry is seeing sluggish growth in 2012 owing to the global economic downturn, which has caused customers to reduce investments while the competition in this industry remains fierce,” company spokesman Scott Sykes said. Li reckoned revenue growth would pick up to at least 10 percent for the full year, although Sykes said Huawei was confident it could meet its 15-20 percent target. Huawei did not provide first-half figures on net profit or its gross profit margin.

“Huawei continues to maintain robust growth momentum although the global economic situation and telecom equipment market remains a significant challenge,” it said in the statement.

CONCERNS

Huawei, founded by CEO Ren Zhengfei in 1987 after he was made redundant by China’s military, has diversified into consumer devices and enterprise networking equipment as growth in its core telecoms gear market has stalled. The firm is close to taking over market leader Ericsson as the No.1 telecom equipment vendor globally, although securing that top slot will be tough if it fails to gain business with U.S. telecom carriers.

The U.S. government has been suspicious of Chinese companies such as Huawei and ZTE selling telecom gear to its carriers on concerns over possible cyber security and reports that they had sold U.S. computer equipment to Iran. Both companies have said they had curtailed their business in Iran.

Huawei was blocked in March from an Australian broadband tender. The attorney general cited the need to ensure the “security” of critical infrastructure. However, both Huawei and ZTE have had considerable success in selling mobile phones globally, including to the U.S. market, where their prices are generally cheaper compared with larger rivals such as Apple Inc (AAPL.O) and Samsung Electronics Co Ltd (005930.KS).

Huawei plans to spend $200 million on advertising this year to help boost sales, Shao Yang, the chief marketing officer of Huawei Device, the division that sells handsets, tablets and dongles, said in June. However, Jefferies brokerage said the company’s 2012 handset sales targets were under threat by the global slowdown. In a client report, it said Huawei’s executives had told the brokerage that Europe and North America were seeing a slowdown in smartphone demand, lower subsidies and a longer replacement cycle.

“In China, there is also slowing demand across the board including tier 2 and 3 cities. China’s total telco handset subsidies are expected to remain stable, however, subsidies/handset may decline as prices of smartphones decline,” Jefferies said.

With demand weakening in some markets, Jefferies said Huawei’s full-year 2012 smartphone shipments might be in the range of 35-40 million, lower than the initial company target of 60 million.

http://www.reuters.com/article/2012/07/24/us-huawei-results-idUSBRE86N0SI20120724

Huawei VIDEO: Chinese vendor Huawei is eyeing dominance of a global LTE network market that it expects to grow to more than 140 commercial operator deployments by the end of this year. In a video interview with Mobile World Live,

Ying Wei Min, President of GSM, UMTS and LTE networks at Huawei, noted that this rapid growth will build on the “more than 80 [LTE] networks launched globally” to date, fuelled by booming demand for mobile broadband services.

Weak Global Econcomy & Slow Business in China Has Negative Impact on Alcatel-Lucent and ZTE

Alcatel-Lucent underlined the bleak outlook for itself and much of the telecoms equipment sector by disclosing second-quarter operating losses of €40m and abandoning yearly profit targets. The company cited a “slower than expected business mix improvement”. Alcatel-Lucent also said that while it expects the second half of the year to be better than the first, it will not now meet its previously-announced adjusted operating margin guidance for 2012. It noted a “difficult macro-economic environment”.

According to Odon de Laporte, an analyst at Credit Agricole Cheuvreux cited by Bloomberg, the company has also been impacted by slow business in China. During the first quarter, the company noted “extremely weak” sales of GSM equipment in China, due to the timings of the sales cycle.

Financial Times offerered an even bleaker assessment for Alcatel-Lucent prospects this year:

http://www.ft.com/intl/cms/s/3/40dd8db6-d008-11e1-bcaa-00144feabdc0.html#axzz212LYe1kO

Update on Alcatel-Lucent– 26 July 2012:

Alcatel-Lucent reported a net loss for its second quarter and announced that it is planning to reduce its headcount by 5,000 in an effort to further cut costs. The results make it the latest infrastructure vendor to suffer at the hands of the economic downturn, along with Ericsson and Huawei.

The company reported a net loss of EUR254 million for the second quarter on the back of revenue of EUR3.55 billion. The loss was particularly severe when the previous quarter’s EUR398 million net profit is taken into account.

Revenue was down 7.1 percent from EUR3.82 billion reported in Q2 2011 but up 10.6 percent from the previous quarter’s EUR3.21 billion.

Revenue for the wireless network business was EUR877 million, up 11.3 percent from the previous quarter’s EUR788 million but down 18.7 percent compared to EUR1.08 billion for the same quarter in 2011. The decline in wireless revenue over the past year was attributed to “moderate or delayed spending of service providers” on 2G and 3G technologies. However, the company’s LTE business more than tripled its revenue during the course of the year.

North America and Europe provided the bulk of the company’s total revenue during the period but have declined 8.3 percent and 15.6 percent respectively compared to a year ago. The only region to have increased revenue in the past 12 months is the rest of the world with Central and Latin America recording a seventh consecutive quarter of double digit growth. All geographies were up compared to the previous quarter.

Alcatel-Lucent CEO Ben Verwaayen said the second quarter performance confirms the company’s strong position in “many attractive market segments” such as IP, next-generation opticss and broadband access, but also the effects of the global economic situation. Verwaayen’s ommision of ‘mobile’ from the company’s list of strong markets reflects how Alcatel-Lucent is facing serious competition in the wireless sector.

Verwaayen added: “It is clear from the deteriorating macro environment and the competitive pricing environment in certain regions challenging profitability that we must embark on a more aggressive transformation.” To that end, the infrastructure vendor has launched “The Performance Program” to achieve a further EUR750 million cost reduction to bring total savings to EUR1.25 billion by the end of 2013. The plan includes the reduction of 5,000 roles in the organisation and the exit or restructuring of unprofitable managed services contracts and markets. “These times demand firm actions,” Verwaayen said.

The company has previously reduced costs through rationalising its product portfolio, co-sourcing, reducing cost structure and managing working capital more effectively. The company is targeting a strong positive net cash position by the end of 2012. http://www.mobilebusinessbriefing.com/articles/alcalu-swings-to-q2-loss-announces-5-000-job-cuts/24737?elq=b0087be5d8994e1ea01991708af665c9

LightReading: “These times demand firm actions,” stated CEO Ben Verwaayen in today’s earnings press release.

In addition to cutting jobs, AlcaLu intends to exit or renegotiate unprofitable managed services deals and quit unprofitable geographic markets. No mention was made of winding down or selling off product lines.

As part of the program AlcaLu is also looking to capitalize on its intellectual property and is setting up its patent portfolio as an independent profit center.

The cost-cutting plan wasn’t enough to appease investors, as AlcaLu’s share price on the Paris exchange fell by 5.4 percent in early trading Thursday morning to €0.83, giving the company a market value of just €1.9 billion ($2.3 billion).

http://www.lightreading.com/document.asp?doc_id=223302&f_src=lrweeklynewsletter

And now let’s look at ZTE, whose Shenzhen-listed shares closed down sharply after its recent earnings report. The Shenzhen-based firm said late Friday that its net profit would total 154 million to 308 million yuan ($24.4 million to $48.9 milliion) in the first half of 2012, dropping 60 to 80 percent year-on-year from 769 million yuan in 2011.

ZTE attributed the profit decline to considerable investment returns in the first half of 2011, foreign exchange losses and order postponement by domestic telecom operators.

“Our performance in major businesses is better in 2012 than the previous year,” Dai Shu, spokesperson of ZTE China, told the Global Times Tuesday. “If we deduct the 900 million yuan earnings by selling Nationz Technologies Inc’s shares in 2011 and 150 to 200 million yuan foreign exchange losses resulting from the eurozone crisis.”

ZTE would grow faster than the average growth of the industry in 2012, Dai projected, noting that the company would release its semiannual report in August. However, the firm has to face worsening market environment and industrial bottlenecks, analysts said. Dragged by the global economic downturn, telecom operators around the world postponed their projects and investments, and the trend is unlikely to reverse in the short term, said analyst Chen Yunhong from Sinolink Securities.

Technology research firm Gartner predicted that the global telecom sector would see 2 percent expansion in 2012.

Media reports said many ZTE staff have been recalled from overseas postings since early this year and further job cuts would be announced within the year.

http://www.globaltimes.cn/content/721664.shtml

Gartner: Robust growth for telecom equipment spending, tepid growth for telco services, PC sales flat

Telecom equipment spending could rise 10.8 percent to $377 billion this year, according Gartner Inc. The prestigious market researct firm forecasts that growth will continue throughout 2013 when spending will increase by 8.3 percent to $408 billion.

“While the challenges facing global economic growth persist—the eurozone crisis, weaker U.S. recovery, a slowdown in China—the outlook has at least stabilized. There has been little change in either business confidence or consumer sentiment in the past quarter, so the short-term outlook is for continued caution in IT spending,” said Richard Gordon, research vice president at Gartner.

However, telecom services spending will not fare nearly as well, according to Gartner. 2012 telco service growth will only be 1.4% this year to $1,686B. And 2013 growth will still be paltry at 2.3% to $1,725B. The global telecom services market continues to be the largest IT spending market. Telecom services growth is expected to come not only from net connections, especially in emerging markets, but also in mature markets from the uptake of multiple connected devices, such as media tablets, gaming and other consumer electronics devices.

Telcos could also reap some benefits as more businesses and govenment agencies start to adopt cloud computing services. Gartner predicts that enterprise spending on public cloud services will grow from $91 billion worldwide in 2011 to $109 billion in 2012 to reach $207 billion in 2016. That’s somewhat surprising since other market research firms predict more robust growth for private cloud services, due to concerns about performance, security and failure recovery.

For more info please see the press release:

Atleast telecom spending on equipment and services is doing better than PC spending. Worldwide PC sales remained virtually flat in the second quarter, according to a new Gartner report.

Gartner principal analyst Mikako Kitagawa said in a statement that the PC market in Q2 “suffered through its seventh consecutive quarter of flat to single-digit growth.” Kitagawa attributed the key reasons for this sales performance to economic uncertainty in some regions and a dropping interest on the part of consumers for PCs.