Cable Labs

Dell’Oro: Broadband Access Equipment Revenue -15% YoY; Radical Change Coming

A new report by the Dell’Oro Group found that total global revenue for wireline Broadband Access equipment (=Cable, DSL, and PON equipment) dropped to $2.5 B, down 15 percent year-over-year (YoY) from 1Q 2019. The first quarter activity, which is seasonally slow to begin with, was hurt by supply chain disruptions throughout Asia-Pacific as a result of the COVID-19 pandemic.

“The first half of 2020 will give way to a sustained rebound in broadband equipment spending in the second half of the year,” said Jeff Heynen, Senior Research Director, Broadband Access and Home Networking. “The need to expand residential broadband speeds and availability will ultimately win out over the current macroeconomic slowdown,” explained Heynen.

Following are additional highlights from the 1Q 2020 Broadband Access Quarterly Report:

- Total cable access concentrator revenue decreased 22 percent YoY to $211 M, driven by a slowdown in CCAP license purchases in North America.

- Total DOCSIS 3.1 CPE shipments remained strong and increased to 5.8 M, representing 67 percent of total Cable CPE shipments. It’s forecast to reach 70 percent of shipments by the end of 2020.

- Total PON ONT (passive optical network/optical network terminal) unit shipments decreased 15 percent YoY, as new installations were limited by the pandemic.

Heynen also expects cable access revenues to rebound a bit in the second quarter as cable operators boost upstream capacity by purchasing additional channel capacity on traditional CCAPs and move ahead with mid-split and high-split projects that expand the amount of spectrum dedicated for the cable network upstream.

Cable remote PHY deployments remain slow today but could pick up as operators begin to touch amplifiers and other parts of the network for future expansions of the cable network upstream. In those cases, “you’re almost required to upgrade to remote PHY at some point,” explains Heynen.

Q1 didn’t produce a major swing in cable access market share among CommScope/Arris, Casa Systems and Cisco Systems. Harmonic, meanwhile, has already warned that some cable network virtualization projects have been pushed out a bit as cable operators reassessed their near-term network-facing priorities during the pandemic.

Regarding the fiber-to-the-premises (FTTP) market, Dell’Oro found that total PON ONT (optical network terminal) unit shipments dropped 15% year-over-year as new installations were hindered by the pandemic. However, OLT (optical line terminal) ports were relatively flat over that period, indicating that there is sustained investment being placed in FTTP infrastructure in regions such as Europe, says Heynen.

Heynen expects that activity centered on the Rural Digital Opportunity Fund (RDOF) could provide some lift to the FTTP sector in the US next year.

The Dell’Oro Group Broadband Access and Home Networking Quarterly Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for Cable, DSL, and PON equipment. Covered equipment includes Converged Cable Access Platforms (CCAP) and Distributed Access Architectures (DAA); Digital Subscriber Line Access Multiplexers ([DSLAMs] by technology ADSL/ADSL2+, G.SHDSL, VDSL, VDSL Profile 35b, and G.FAST); PON Optical Line Terminals (OLTs), Cable, DSL, and PON CPE (Customer Premises Equipment); and SOHO WLAN Equipment, including Mesh Routers. For more information about the report, please contact [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

………………………………………………………………………………………………………………………………………………………

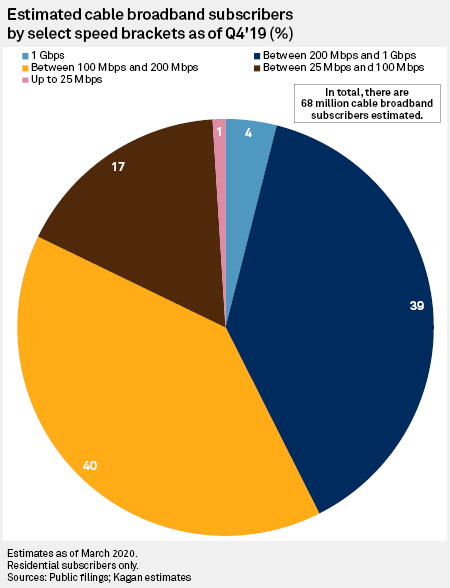

Source: S&P Global

………………………………………………………………………………………………………………………….

References:

………………………………………………………………………………………………………………………….

Addendum: Cable network undergoing a ‘radical transformation’

Belal Hamzeh, CTO and SVP at CableLabs, told a Light Reading virtual audience that the evolution of the network and a rethinking of HFC are necessary to prepare the cable industry to support a wave of new requirements for a broader set of high-capacity, low-latency applications. These next-gen applications will span everything from augmented and virtual reality and remote healthcare to mobile backhaul and edge computing and others that are still being thought of.

“The requirements of the network are becoming quite diverse,” he said. “For us to efficiently and effectively handle that, we have to look at entirely new perspectives … Rather than looking at the platform as a connectivity platform, we need to start looking at the platform as a connectivity and compute platform.”

Virtualization, Hamzeh added, is a “huge enabler for this transformation.” To address that critical piece, CableLabs has teamed with partners, including Altran, on an open source project nicknamed “Adrenaline” that aims to provide a centrally managed distributed and heterogeneous computing platform that supports the deployment of workloads across the operator’s infrastructure.

“It’s a cable-first initiative, but this is also a general purpose platform,” said Shamik Mishra, VP of research and innovation at Altran, a company that’s primarily focused on engineering and R&D services for multiple industries, including the telecom sector.

“We’re not trying to constrain what use cases there are [for Adrenaline],” added Randy Levensalor, principal architect with CableLabs’s future infrastructure group in the office of the CTO.