Videos

TBR: “5G” Business Case Remains Elusive; Economics Questionable

by Chris Antlitz, TBR

The mobile industry continues to move toward realizing the vision of a hyper-connected, intelligent world and is at the cusp of a major inflection point. 5G, artificial intelligence (AI), cognitive analytics, virtualization, pervasive automation and other new technologies will be deployed at scale over the next decade, and this will have significant implications not only for end users but also for all stakeholders in the global economy.

The mobile industry has significant hope that the 5G era will address key challenges and will lead to revenue generation, stronger positioning against over-the-top (OTT) providers, as well as help communication service providers (CSPs) better handle data traffic growth. This hope appears to be premature, however, as the economics of 5G still do not make sense, evident in the lack of a viable business case for the technology. Said differently, it remains uncertain whether the revenue generation possibilities from 5G will be attractive enough to justify the infrastructure cost to deploy 5G.

With 5G likely several years away from starting to help CSPs address their revenue and OTT challenges, they are expected to remain vigilant in their quest to drive down costs. Herein lies the challenge for the vendor community.

Vendors, especially incumbent vendors, will face ongoing price pressure and significant disruption from new technologies and architectures in areas such as NFV/SDN (virtualization and the white-box threat), SaaS, automation, AI and analytics.

Despite all the talk and hope of what the 5G era will bring, industry trends are moving against the vendor community, with incumbent vendors, particularly hardware-centric vendors, poised to struggle the most. Leading CSPs are focused on significantly reducing the cost of network operations and capex, underscored by a desire to disaggregate the black box and commoditize the hardware layer.

Vendors also face overall lower spend as CSPs shift investments away from LTE now that those networks are pervasively deployed and focus instead on the service layer, where they aim to digitalize themselves and offer innovative services. Other trends that are moving against incumbent vendors include the open sourcing of software, evident by the slew of new open infrastructure initiatives such as the ORAN Alliance.

Incumbent vendors are susceptible to major disruption by relatively new companies that are not tied to legacy portfolios and are actively looking to align with the desires of CSPs. One example includes vRAN (virtual Radio Access Network) vendors, which were well represented at MWC2018. Incumbents will have to stay vigilant and keep a good pulse on the market to navigate appropriately.

…………………………………………………………………………………………………………………….

“The hyper-connected, ‘intelligent’ world will challenge long-held societal beliefs and will create significant moral and ethical debates, such as how hyperconnectivity will impact people’s privacy and who owns whose data. This world will also upend and challenge tried-and-true business models that have been around for decades.”

The mobile industry is increasingly pinning its hopes on 5G to address key challenges, generate new revenues, manage exploding mobile data traffic volumes and better compete against OTT providers.

“This hope appears to be premature, however, as the economics of 5G still do not make sense, evident in the lack of a viable business case for the technology. Said differently, it remains uncertain whether the revenue generation possibilities from 5G will be attractive enough to justify the infrastructure cost to deploy 5G.”

……………………………………………………………………………………………………………………….

Though use cases for 5G were myriad at MWC2018, particularly as they relate to Internet of Things (IoT), it remains to be seen how CSPs, and consequently vendors, will grow revenue from 5G. According to TBR’s 1Q18 5G Telecom Market Landscape, with the exception of fixed wireless broadband access, most of the operators that have made formal commitments to deploy 5G thus far have justified those investments by the efficiency gains that are realizable versus LTE. Said differently, the main driver of 5G investment will be the cost efficiencies the technology provides operators to remain competitive in their core business, which is offering traditional connectivity services.

In order for the business case to materialize for 5G use cases and drive revenue for CSPs, significant developmental progress must be made in deep fiber, wireless densification, edge computing and regulatory reform, among other areas. It will take years for these areas to be built up to the level required to begin delivering on the vision of some breakthrough use cases, such as hyper-connected cars and other mission-critical IoT use cases that would require 5G technology to become commercially viable.

Low latency is essential to enable commercialization of mission-critical use cases A significant reduction in latency is required to realize mission-critical uses for the network. Specifically, TBR notes that the mobile industry will have to make two variables align to see these use cases become commercialized.

First, latency must be lower than 5 milliseconds, and second, that latency must be sustained at 100% reliability. If either of these requirements is not fully met, mission-critical uses of the network will not be implemented due to a variety of considerations, including insurance and risk. For example, remote surgery will require sustained, ultralow latency for the duration of the procedure. Any lapse in connectivity, even for a millisecond, could prove disastrous from a patient outcome perspective. Insurance companies would not insure such a use case unless they are confident in the technology’s ability to perform.

TBR notes that though mission-critical uses of the network are compelling, the infrastructure cost to achieve these two foundational parameters is almost cost prohibitive. Due to the limitations of physics, spectrum and capital, many mission-critical 5G use cases will not be economically viable, at least through the next five years, according to TBR’s projections for infrastructure and ecosystem development. The most likely outcome is it will take until the mid- to late 2020s before networks are at the level of development needed to begin supporting the strict requirements of mission-critical use cases.

Where are the profit margins for vendors if everyone is open?

Vendors were nearly falling over themselves to proclaim how “open” they are and how much they are partnering with other companies. Though being open helps drive innovation, it could backfire from a business standpoint. With proprietary technology under attack from virtualization, white box, and other methods of disaggregating and open sourcing traditionally closed systems, vendors’ ability to differentiate, maintain top-line revenue and earn a profit will be significantly impacted.

TBR believes there is an existential threat on black box hardware pervading the ICT industry and that it will become more and more difficult to retain pricing power and earn a profit on proprietary hardware, which will push vendors increasingly into the software and services spheres to maintain their value-add in overall solutions. These market trends are reinforced by strong words spoken by chief technology officers (CTOs) from some of the largest operators in the world who believe the black box is dead and made that point very clear in their presentations at MWC2018.

In the digital era, value will reside in the software layer of the ICT stack, with hardware increasingly commoditized and services shifting to become more software-related in nature. Vendors, particularly incumbent vendors, that can pivot and align with these fundamental changes in the ICT market will be able to stay successful in the market.

Sophisticated telcos aim for the platform:

The world’s leading telecom operators see the value of the platform in the digital era and are steering their organizations to exploit the value of those platforms. Though connectivity will remain critical to realizing the digital era, the reality is that connectivity is increasingly viewed as a commodity, reflected in falling average revenue per user (ARPU). Conversely, the value and economic profit in the digital era will be obtainable by companies in the ecosystem that either own the platform or derive significant economic value and/or differentiation from being part of a platform.

TBR notes that more and more operators in the global ecosystem are actively looking for ways to reduce their exposure to the connectivity layer, either through business diversification or by engaging in network sharing or infrastructure spin-offs or divestitures, to redeploy capital toward other domains, such as content platforms, advertising platforms and virtual network services platforms. The topic of infrastructure handling in the digital era was discussed by several well-known presenters in various keynotes and panel discussions during MWC2018.

The car is the smartphone of the 5G era:

Many demos on the floor were related to connected transportation, particularly as it pertains to the car. Samsung put it best, stating that the car is the new smartphone. There is a lot riding on connected transportation to take off. Should there be a “killer app” for the car, much like the App Store was for iPhone and smartphones in general, it could become a key driver for 5G investment at scale because connected transportation would require significant investment in 5G infrastructure to support the latency and bandwidth requirements. Some vendors posited that the “killer app” for the car will be voice assistance. Samsung, via its Bixby platform, and other vendors aim to be the central platform residing in the brain of the car of the future. There are also industry organizations established to facilitate the development of the connected car, most notably the 5G Automotive Association (5GAA).

Regulators need to get progressive faster:

Regulatory reform remains slow, and this is stifling industry development. On one hand, regulators are trying to maintain the status quo and continue to deal with CSPs like they are utilities, while on the other hand, this stance is hindering CSPs’ ability to introduce innovation in the market and effectively compete against new competitors, such as OTT providers. Political debates aside, at the very least, regulators need to be progressive and create a more level playing field between CSPs and new entrants that compete against them, particularly OTT companies, which have come to dominate the digital economy.

Conclusion:

Business models for CSPs and other enterprises will fundamentally change during the digital era. Those companies that can navigate the landscape and align themselves with market shifts will be best able to remain profitable as their historical business models are upended by innovation. There is hope in the mobile industry that revenue growth will return, even though the actual use case(s) that will provide that growth remains elusive. In the meantime, while operators continue their search, they will remain in a sustained cost optimization phase to stay cost competitive in their traditional businesses. 5G holds some promise for a return to revenue growth, but the technology will require multiple “killer apps” to drive significant market development and deliver on the vision of a hyperconnected, intelligent world.

IHS Operator Survey: Smart Central Offices in 85% of Service Provider Networks in 2018

By Michael Howard, executive director, research and analysis, carrier networks, IHS Markit, and Heidi Adams, senior research director, IP and optical networks, IHS Markit

Highlights:

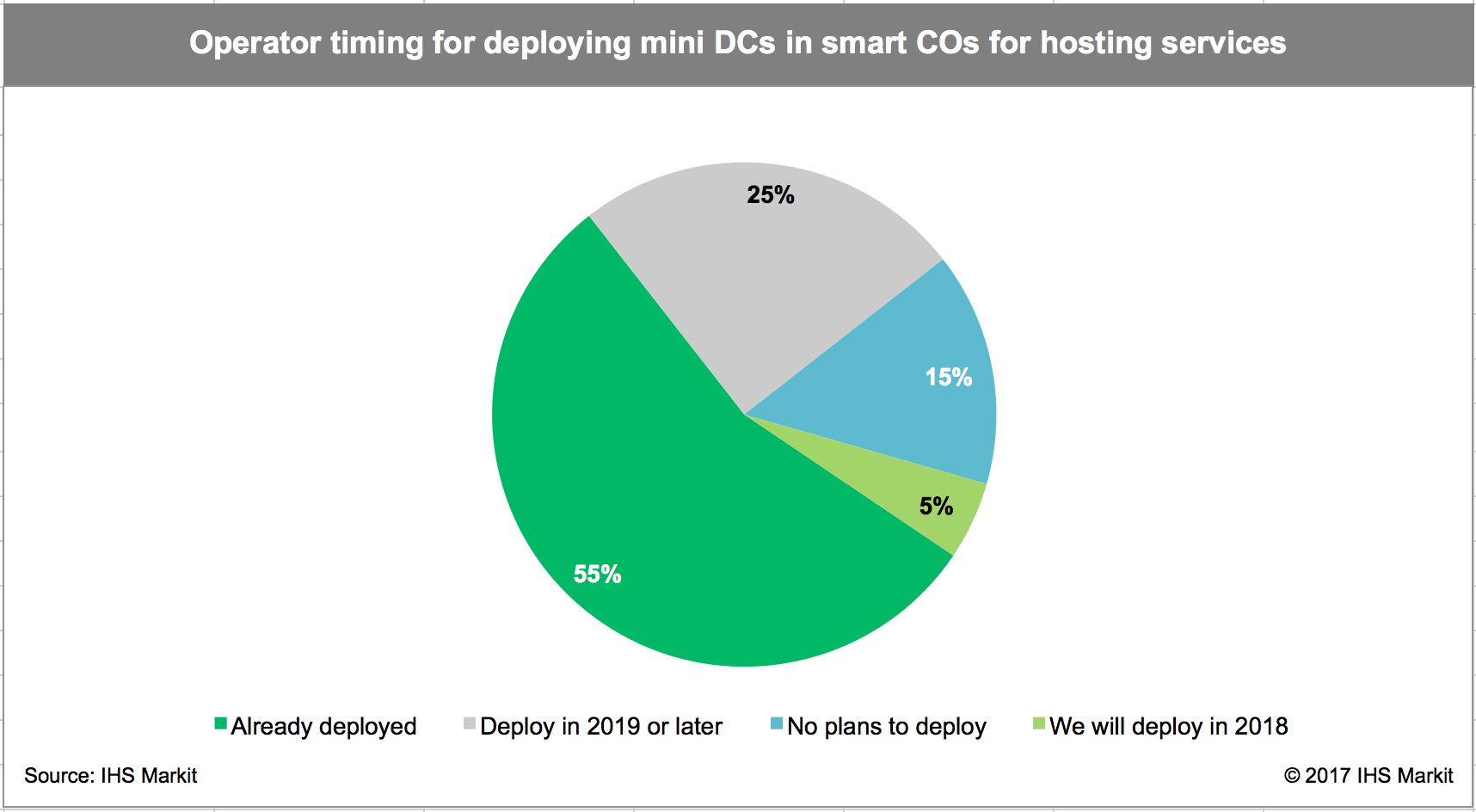

- In 2018, 85% of operator respondents to an IHS-Markit survey plan to create, or will have already deployed, smart central offices — that is, installing servers, storage and switching to create mini data centers in selected central offices. These mini data centers are used to offer cloud services, and as the network functions virtualization (NFV) infrastructure on which to run virtualized network functions (VNFs) such as vRouter, firewall, CG-NAT and IP/MPLS VPNs.

- More than half of operators (55%) surveyed plan to move each of 10 different router functions from physical edge routers to VNFs running on commercial servers in mini data centers in smart central offices, including customer edge (CE) router, route reflector (RR) and others.

- Seven out of 10 respondents plan to deploy central office rearchitected as a data center (CORD) in smart central offices.

- Operators expect 44% of their central offices will have mini data centers (or smart central offices) by 2023, and deploy CORD (Central Office Re-architected as a Data center) in half of those central offices.

IHS-Markit Analysis:

SDN and NFV are spurring fundamental changes in network architecture, network operations and how carriers are organized, which is illustrated by the purchasing decisions of operators worldwide. Nearly every operator around the world is undertaking major efforts.

More importantly, the move to SDN and NFV is changing the way operators make equipment purchase decisions, placing a greater focus on software. Although hardware will always be required, its functions will be refined, and software will drive services and operational agility.

A basic architectural change in motion is the deployment of new functions in large central offices that are closer to end customers. These also serve as locations for distributed broadband network gateways (BNGs), content delivery networks (CDNs), mini data centers and other new functions. Mini data centers (i.e., servers and storage) are used to deliver cloud services within a metropolitan area and house applications including augmented and virtual reality and gaming, to give users better response time as well as provide a place for NFV and VNFs, including vRouters, which run on servers. These central offices with mini data centers are known as “cloud central offices” or “smart central offices.”

Cloud services for business, and internet usage in general, have caused carrier network traffic patterns to change dramatically in and out of data centers. This is true not only for the hyperscale data centers of Google, Apple, Facebook, Amazon, Microsoft, Baidu, Alibaba and Tencent, but also for their smaller metro and regional megascale data centers, and large enterprises, as well as smaller data centers used by enterprises and government.

In a large metropolitan area, there might be 10 or more smart central offices aggregating traffic from smaller end offices. Based on our discussions with operators around the world, a common long-range plan is to identify 10 percent to 25 percent of central offices as smart central office locations — all candidates for CORD. The smart central office is the new location of the IP edge, which is creating a need for a new class of optical transport equipment and a new class of routers designed for data center interconnect (DCI) applications.

Routing, NFV and Packet-Optical Survey Synopsis

The 30-page 2017 IHS Markit routing, NFV and packet-optical strategies survey is based on interviews with router/CES purchase decision-makers at 20 global service providers that control a third of worldwide telecom capex and 27 percent of revenue. The survey covers hot and emerging topics in the carrier Ethernet, routing and switching space, with a focus on the IP edge. It looks at deployment plans, strategies and locations, router bypass, 100GE port mix, price per port and more.

…………………………………………………………………………………………………………………………………………

Notes & Clarifications:

- Smart central offices are simply central offices containing mini data centers that have servers, storage, and switching. Mini data centers can offer cloud services and typically include NFV infrastructure that supports virtualized network functions (VNFs) including vRouter, firewalls, carrier grade network address translation (CG-NAT), and IP/MPLS VPNs.

- IHS concluded that the reason more operators are leaning this direction is that deploying these functions in central offices brings them close to the end-user. This is part of the greater push by operators and service providers to focus on software to drive services, while refining hardware functions.

- If network operators re-architect their networks by distributing the core network, it would be closer to the end user. Virtualization allows operators to quickly deploy a core anywhere and to scale it at will. Edge computing could be deployed closer to the user without breaking the network topology. This is a major advantage that the telcos have over the cloud players – but they have not been able to capitalize on it. By pushing the core closer to the edge, and through virtualization of the network, operators could capitalize on this advantage.

- As operators push away from hardware into software, the smart central office is a new IP edge, and thus requires a class of routers for data center interconnect (DCI) applications and optical transport equipment.