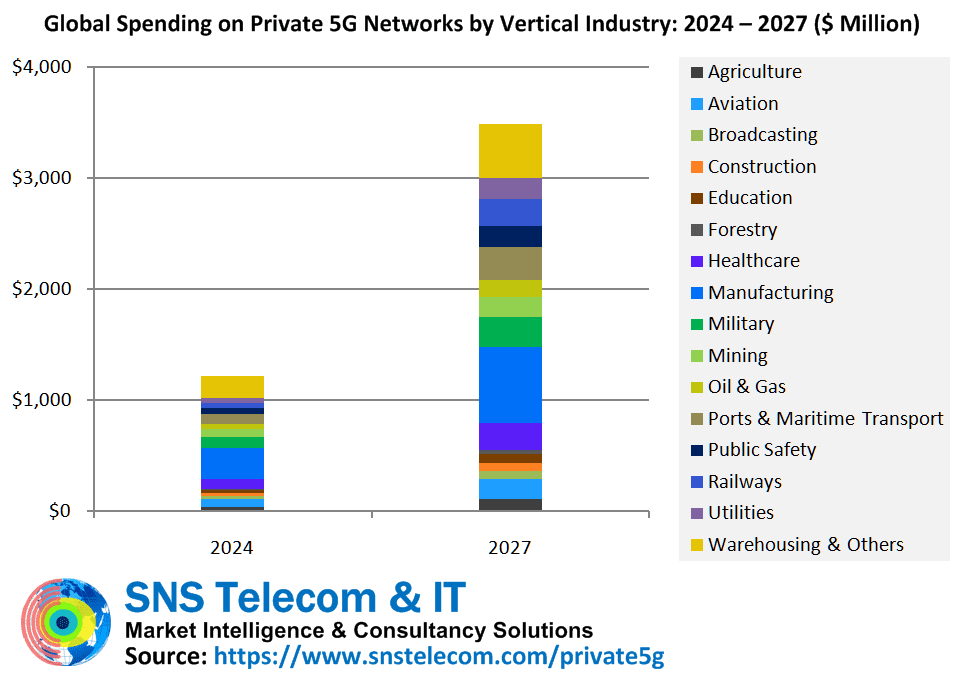

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT’s new “Private 5G Networks: 2024 – 2030” report exclusively focuses on the market for private networks built using the 3GPP-defined 5G specifications (there are no ITU-R recommendations for private 5G networks or ITU-T recommendations for 5G SA core networks). In addition to vendor consultations, it has taken us several months of end user surveys in early adopter national markets to compile the contents and key findings of this report. A major focus of the report is to highlight the practical and tangible benefits of production-grade private 5G networks in real-world settings, as well as to provide a detailed review of their applicability and realistic market size projections across 16 vertical sectors based on both supply side and demand side considerations.

The report states report that the real-world impact of private 5G networks – which are estimated to account for $3.5 Billion in annual spending by 2027 – is becoming ever more visible, with diverse practical and tangible benefits such as productivity gains through reduced dependency on unlicensed wireless and hard-wired connections in industrial facilities, allowing workers to remotely operate cranes and mining equipment from a safer distance and significant, quantifiable cost savings enabled by 5G-connected patrol robots and image analytics in Wagyu beef production.

SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Although much of this growth will be driven by highly localized 5G networks covering geographically limited areas for Industry 4.0 applications in manufacturing and process industries, sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced becomes a commercial reality. Among other features for mission-critical networks, 3GPP Release 18 – which defines the first set of 5G Advanced specifications – adds support for 5G NR equipment operating in dedicated spectrum with less than 5 MHz of bandwidth, paving the way for private 5G networks operating in sub-500 MHz, 700 MHz, 850 MHz and 900 MHz bands for public safety broadband, smart grid modernization and FRMCS (Future Railway Mobile Communication System).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Private LTE networks are a well-established market and have been around for more than a decade, albeit as a niche segment of the wider cellular infrastructure segment – iNET’s (Infrastructure Networks) 700 MHz LTE network in the Permian Basin, Tampnet’s offshore 4G infrastructure in the North Sea, Rio Tinto’s private LTE network for its Western Australia mining operations and other initial installations date back to the early 2010s. However, in most national markets, private cellular networks or NPNs (Non-Public Networks) based on the 3GPP-defined 5G specs are just beginning to move beyond PoC (Proof-of-Concept) trials and small-scale deployments to production-grade implementations of standalone 5G networks, which are laying the foundation for Industry 4.0 and advanced application scenarios.

Compared to LTE technology, private 5G networks – also referred to as 5G MPNs (Mobile Private Networks), 5G campus networks, local 5G or e-Um 5G systems depending on geography – can address far more demanding performance requirements in terms of throughput, latency, reliability, availability and connection density. In particular, 5G’s URLLC (Ultra-Reliable, Low-Latency Communications) and mMTC (Massive Machine-Type Communications) capabilities, along with a future-proof transition path to 6G networks in the 2030s, have positioned it as a viable alternative to physically wired connections for industrial-grade communications between machines, robots and control systems. Furthermore, despite its relatively higher cost of ownership, 5G’s wider coverage radius per radio node, scalability, determinism, security features and mobility support have stirred strong interest in its potential as a replacement for interference-prone unlicensed wireless technologies in IIoT (Industrial IoT) environments, where the number of connected sensors and other endpoints is expected to increase significantly over the coming years.

It is worth noting that China is an outlier and the most mature national market thanks to state-funded directives aimed at accelerating the adoption of 5G connectivity in industrial settings such as factories, warehouses, mines, power plants, substations, oil and gas facilities and ports. To provide some context, the largest private 5G installations in China can comprise hundreds to even thousands of dedicated RAN (Radio Access Network) nodes supported by on-premise or edge cloud-based core network functions depending on specific latency, reliability and security requirements. For example, home appliance manufacturer Midea’s Jingzhou industrial park hosts 2,500 indoor and outdoor 5G NR access points to connect workers, machines, robots and vehicles across an area of approximately 104 acres, steelmaker WISCO (Wuhan Iron & Steel Corporation) has installed a dual-layer private 5G network – spanning 85 multi-sector macrocells and 100 small cells – to remotely operate heavy machinery at its steel plant in Wuhan (Hubei), and Fujian-based manufacturer Wanhua Chemical has recently built a customized wireless network that will serve upwards of 8,000 5G RedCap (Reduced Capability) devices, primarily surveillance cameras and IoT sensors.

As end user organizations in the United States, Germany, France, Japan, South Korea, Taiwan and other countries ramp up their digitization and automation initiatives, private 5G networks are progressively being implemented to support use cases as diverse as wirelessly connected machinery for the rapid reconfiguration of production lines, distributed PLC (Programmable Logic Controller) environments, AMRs (Autonomous Mobile Robots) and AGVs (Automated Guided Vehicles) for intralogistics, AR (Augmented Reality)-assisted guidance and troubleshooting, machine vision-based quality control, wireless software flashing of manufactured vehicles, remote-controlled cranes, unmanned mining equipment, BVLOS (Beyond Visual Line-of-Sight) operation of drones, digital twin models of complex industrial systems, ATO (Automatic Train Operation), video analytics for railway crossing and station platform safety, remote visual inspections of aircraft engine parts, real-time collaboration for flight line maintenance operations, XR (Extended Reality)-based military training, virtual visits for parents to see their infants in NICUs (Neonatal Intensive Care Units), live broadcast production in locations not easily accessible by traditional solutions, operations-critical communications during major sporting events, and optimization of cattle fattening and breeding for Wagyu beef production.

Despite prolonged teething problems in the form of a lack of variety of non-smartphone devices, high 5G IoT module costs due to low shipment volumes, limited competence of end user organizations in cellular wireless systems and conservatism with regards to new technology, early adopters are affirming their faith in the long-term potential of private 5G by investing in networks built independently using new shared and local area licensed spectrum options, in collaboration with private network specialists or via traditional mobile operators. Some private 5G installations have progressed to a stage where practical and tangible benefits – particularly efficiency gains, cost savings and worker safety – are becoming increasingly evident. Notable examples include but are not limited to:

- Tesla’s private 5G implementation on the shop floor of its Giga-factory Berlin-Brandenburg plant in Brandenburg, Germany, has helped in overcoming up to 90 percent of the overcycle issues for a particular process in the factory’s GA (General Assembly) shop. The electric automaker is integrating private 5G network infrastructure to address high-impact use cases in production, intralogistics and quality operations across its global manufacturing facilities.

- John Deere is steadily progressing with its goal of reducing dependency on wired Ethernet connections from 70% to 10% over the next five years by deploying private 5G networks at its industrial facilities in the United States, South America and Europe. In a similar effort, automotive aluminum die-castings supplier IKD has replaced 6 miles of cables connecting 600 pieces of machinery with a private 5G network, thereby reducing cable maintenance costs to near zero and increasing the product yield rate by ten percent.

- Lufthansa Technik’s 5G campus network at its Hamburg facility has removed the need for its civil aviation customers to physically attend servicing by providing reliable, high-resolution video access for virtual parts inspections and borescope examinations at both of its engine overhaul workshops. Previous attempts to implement virtual inspections using unlicensed Wi-Fi technology proved ineffective due to the presence of large metal structures.

- The EWG (East-West Gate) Intermodal Terminal’s private 5G network has increased productivity from 23-25 containers per hour to 32-35 per hour and reduced the facility’s personnel-related operating expenses by 40 percent while eliminating the possibility of crane operator injury due to remote-controlled operation with a latency of less than 20 milliseconds.

- The Liverpool 5G Create network in the inner city area of Kensington has demonstrated significant cost savings potential for digital health, education and social care services, including an astonishing $10,000 drop in yearly expenditure per care home resident through a 5G-connected fall prevention system and a $2,600 reduction in WAN (Wide Area Network) connectivity charges per GP (General Practitioner) surgery – which represents $220,000 in annual savings for the United Kingdom’s NHS (National Health Service) when applied to 86 surgeries in Liverpool.

- NEC Corporation has improved production efficiency by 30 percent through the introduction of a local 5G-enabled autonomous transport system for intralogistics at its new factory in Kakegawa (Shizuoka Prefecture), Japan. The manufacturing facility’s on-premise 5G network has also resulted in an elevated degree of freedom in terms of the factory floor layout, thereby allowing NEC to flexibly respond to changing customer needs, market demand fluctuations and production adjustments.

- A local 5G installation at Ushino Nakayama’s Osumi farm in Kanoya (Kagoshima Prefecture), Japan, has enabled the Wagyu beef producer to achieve labor cost savings of more than 10 percent through reductions in accident rates, feed loss, and administrative costs. The 5G network provides wireless connectivity for AI (Artificial Intelligence)-based image analytics and autonomous patrol robots.

- CJ Logistics has achieved a 20 percent productivity increase at its Ichiri center in Icheon (Gyeonggi), South Korea, following the adoption of a private 5G network to replace the 40,000 square meter warehouse facility’s 300 Wi-Fi access points for Industry 4.0 applications, which experienced repeated outages and coverage issues.

- Delta Electronics – which has installed private 5G networks for industrial wireless communications at its plants in Taiwan and Thailand – estimates that productivity per direct labor and output per square meter have increased by 69% and 75% respectively following the implementation of 5G-connected smart production lines.

- An Open RAN-compliant standalone private 5G network in Taiwan’s Pingtung County has facilitated a 30 percent reduction in pest-related agricultural losses and a 15 percent boost in the overall revenue of local farms through the use of 5G-equipped UAVs (Unmanned Aerial Vehicles), mobile robots, smart glasses and AI-enabled image recognition.

- JD Logistics – the supply chain and logistics arm of online retailer JD.com – has achieved near-zero packet loss and reduced the likelihood of connection timeouts by an impressive 70 percent since migrating AGV communications from unlicensed Wi-Fi systems to private 5G networks at its logistics parks in Beijing and Changsha (Hunan), China.

- Baosteel – a business unit of the world’s largest steelmaker China Baowu Steel Group – credits its 43-site private 5G deployment at two neighboring factories with reducing manual quality inspections by 50 percent and achieving a steel defect detection rate of more than 90 percent, which equates to $7 Million in annual cost savings by reducing lost production capacity from 9,000 tons to 700 tons.

- Dongyi Group Coal Gasification Company ascribes a 50 percent reduction in manpower requirements and a 10 percent increase in production efficiency – which translates to more than $1 Million in annual cost savings – at its Xinyan coal mine in Lvliang (Shanxi), China, to private 5G-enabled digitization and automation of underground mining operations.

- Sinopec’s (China Petroleum & Chemical Corporation) explosion-proof 5G network at its Guangzhou oil refinery in Guangdong, China, has reduced accidents and harmful gas emissions by 20% and 30% respectively, resulting in an annual economic benefit of more than $4 Million. The solution is being replicated across more than 30 refineries of the energy giant.

- Since adopting a hybrid public-private 5G network to enhance the safety and efficiency of urban rail transit operations, the Guangzhou Metro rapid transit system has reduced its maintenance costs by approximately 20 percent using 5G-enabled digital perception applications for the real-time identification of water logging and other hazards along railway tracks.

Some of the most technically advanced features of 5G Advanced – 5G’s next evolutionarily phase – are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For instance, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

The “Private 5G Networks: 2024 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the private 5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, two technology generations, 16 vertical industries and five regional markets. The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 7,000 global private cellular engagements – including more than 2,200 private 5G installations – as of Q2’2024.

The key findings of the report include:

- SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Much of this growth will be driven by highly localized 5G networks covering geographically limited areas for high-throughput and low-latency Industry 4.0 applications in manufacturing and process industries.

- Sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced – 5G’s next evolutionarily phase – becomes a commercial reality.

- As end user organizations ramp up their digitization and automation initiatives, some private 5G installations have progressed to a stage where practical and tangible benefits are becoming increasingly evident. Notably, private 5G networks have resulted in productivity and efficiency gains for specific manufacturing, quality control and intralogistics processes in the range of 20 to 90%, cost savings of up to 40% at an intermodal terminal, reduction of worker accidents and harmful gas emissions by 20% and 30% respectively at an oil refinery, and a 50% decrease in manpower requirements for underground mining operations.

- Some of the most technically advanced features of 5G Advanced are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For example, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

Spectrum liberalization initiatives – particularly shared and local spectrum licensing frameworks – are playing a pivotal role in accelerating the adoption of private 5G networks. Telecommunications regulators in multiple national markets – including the United States, Canada, United Kingdom, Germany, France, Spain, Netherlands, Switzerland, Finland, Sweden, Norway, Poland, Slovenia, Bahrain, Japan, South Korea, Taiwan, Hong Kong, Australia and Brazil – have released or are in the process of granting access to shared and local area licensed spectrum.

By capitalizing on their extensive licensed spectrum holdings, infrastructure assets and cellular networking expertise, national mobile operators have continued to retain a significant presence in the private 5G network market, even in countries where shared and local area licensed spectrum is available. With an expanded focus on vertical B2B (Business-to-Business) opportunities in the 5G era, mobile operators are actively involved in diverse projects extending from localized 5G networks for secure and reliable wireless connectivity in industrial and enterprise environments to sliced hybrid public-private networks that integrate on-premise 5G infrastructure with a dedicated slice of public mobile network resources for wide area coverage.

New classes of private network service providers have also found success in the market. Notable examples include but are not limited to Celona, Federated Wireless, Betacom, InfiniG, Ataya, Smart Mobile Labs, MUGLER, Alsatis, Telent, Logicalis, Telet Research, Citymesh, Netmore, RADTONICS, Combitech, Grape One, NS Solutions, OPTAGE, Wave-In Communication, LG CNS, SEJONG Telecom, CJ OliveNetworks, Megazone Cloud, Nable Communications, Qubicom, NewGens and Comsol, and the private 5G business units of neutral host infrastructure providers such as Boldyn Networks, American Tower, Boingo Wireless, Crown Castle, Freshwave and Digita.

NTT, Kyndryl, Accenture, Capgemini, EY (Ernst & Young), Deloitte, KPMG and other global system integrators have been quick to seize the private cellular opportunity with strategic technology alliances. Meanwhile, hyperscalers – most notably AWS (Amazon Web Services), Google and Microsoft – are offering managed private 5G services by leveraging their cloud and edge platforms.

Although greater vendor diversity is beginning to be reflected in infrastructure sales, larger players are continuing to invest in strategic acquisitions as highlighted by HPE’s (Hewlett Packard Enterprise) acquisition of Italian mobile core technology provider Athonet.

The service provider segment is not immune to consolidation either. For example, Boldyn Networks has recently acquired Cellnex’s private networks business unit, which largely includes Edzcom – a private 4G/5G specialist with installations in Finland, France, Germany, Spain, Sweden and the United Kingdom.

Among other examples, specialist fiber and network solutions provider Vocus has acquired Challenge Networks – an Australian pioneer in private LTE and 5G networks, while mobile operator Telstra – through its Telstra Purple division – has acquired industrial private wireless solutions provider Aqura Technologies.

The report will be of value to current and future potential investors into the private 5G network market, as well as 5G equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 5G, LTE, Open RAN, private cellular networks, IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies and vertical applications.

References:

https://www.snstelecom.com/private5g

What is 5G Advanced and is it ready for deployment any time soon?

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

https://www.kyndryl.com/us/en/about-us/news/2024/02/it-ot-convergence-in-manufacturing

India Telcos say private networks will kill their 5G business

WSJ: China Leads the Way With Private 5G Networks at Industrial Facilities

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

Great article. So many use cases and examples of real-world deployments of private 5G.