5G private networks

Verizon partners with Nokia to deploy large private 5G network in the UK

Nokia and Verizon Business are collaborating to deploy a private 5G network across the Thames Freeport, a major UK industrial cluster including the Port of Tilbury and Ford Dagenham. This project is one of the UK’s largest private 5G deployments. It aims to modernize operations, boost efficiency, and drive economic growth in the region. The Thames Freeport, a 34 km-wide economic corridor, is the site of the deployment. This includes major industrial sites like the Port of Tilbury, Ford Dagenham, and DP World London Gateway. The deployment will cover 1,700 acres across multiple industrial sites within the Freeport.

Nokia will be the sole hardware and software provider, utilizing its Digital Automation Cloud (DAC) and MX Industrial Edge (MXIE) solutions.

This private 5G network will enable advanced use cases like AI-driven data analytics, predictive maintenance, process automation, autonomous vehicle control, and real-time logistics orchestration, according to Telecoms Tech News. The network is expected to modernize port operations, improve cargo handling, and enhance overall efficiency in the Freeport. The project also aims to boost the local economy, support job creation and training, and foster innovation and R&D collaborations.

Verizon and Nokia win a Thames Freeport private 5G deal. (Art by midJourney for Fierce Network)

“Band 77 in the U.K. is available at low cost on a local-area licensed basis — enterprises can readily get access to exclusive use mid-band spectrum in the 3.8-4.2 GHz range. The U.K. regulator, Ofcom, has pioneered this model globally,” said Heavy Reading Senior Principal Analyst for Mobile Networks Gabriel Brown in an email to Fierce Network. Brown noted that though it is based in the U.S., Verizon has an established smart ports business in the U.K., with the Port of Southhampton one of its private 5G network clients. He added the operator also has an ongoing relationship with Nokia around private 5G. “This new win shows advanced wireless technologies can scale to support nationally critical infrastructure with diverse stakeholders and use cases,” Brown said.

“To date, over 530 licenses have been issued to more than 90 licensees in this frequency range,” said SNS Telecom & IT 5G research director Asad Khan.

Verizon Business has been working on building its ports business for a while now, having already scored the aforementioned Southampton deal in April 2021. And its efforts appear to be paying off.

“I know there’s been chatter about how Verizon Business was able to outbid domestic carriers,” AvidThink Principal Roy Chua stated. “It’s likely some combination of demonstrated expertise in rolling out similar deployments and favorable financial terms. Definitely a win for Verizon Business (and Nokia) for sure.”

References:

https://www.fierce-network.com/wireless/verizon-and-nokia-win-one-largest-private-5g-projects-uk

Pente Networks, MosoLabs and Alliance Corp collaborate for Private Cellular Network in a Box

Pente Networks, a private wireless network core, orchestration and management software company; MosoLabs, a global company building solutions for LTE and 5G private and neutral host networks; are collaborating with Alliance Corporation to deliver a complete Private Cellular Network in a Box. It’s a pre-built, plug and play kit with multiple options available (see below) to cater to different use cases, such as surveillance, fixed wireless access and point of sale.

By including already provisioned devices, customers can use their own highly secure and robust private cellular network almost immediately. The solution speeds up and simplifies private network deployment for integrators, IT departments and small businesses; even those with little to no private wireless experience.

Alliance’s Network in a Box is a pre-configured bundle designed with everything needed to deploy and then operate an end-to-end private wireless 4G LTE or 5G wireless network. Alliance’s professional services team uses the Pente HyperCore platform to pre-integrate with MosoLabs’ Canopy indoor and outdoor radios and provision selected end-user devices, SIMs and eSIMs. Alliance then assembles an enclosure that houses all the network equipment, including the HyperCore EdgeMini, a full Evolved Packet Core (EPC) and 5G Core in one. The pre-built kits and radios are ready for simple installation at the desired location. Once connected, the network is immediately up and running, with the devices instantly recognized by the network. No additional programming or configuration is needed.

Three ready made bundles are:

- Network in a Box with Fixed Wireless Access WiFi

- Network in a Box with Video Surveillance

- Network in a Box with Point of Sale

Each bundle includes the Pente HyperCore EdgeMini, Moso Canopy Small Cell Radios, and select devices all preconfigured to work together instantly.

“Our goal is to make private networks accessible to everyone,” says Dan Ortega, Senior Sales Engineer, Alliance Corporation. “With Pente and MosoLabs, we can pre-configure an out-of-the-box functional kit so that all our customers, regardless of their size or use case, can take advantage of everything private networks have to offer.”

Alliance support is available for any questions, and they offer additional services needed such as RF planning, SAS registration, and network monitoring and management. Alliance can also support customers who want to scale their network to support additional services, applications, and IoT devices.

Alliance Corporation distributes equipment for wireless network infrastructure, in-building signal enhancement solutions, cellular broadband systems, next-generation 5G networks, fixed wireless and private enterprise networks, as well as cellular solutions that connect the Internet of Things. Alliance provides pre and post-sale technical support, engineering, radio configuration, and training services. Alliance serves telecommunication carriers, fixed wireless broadband service providers, OEMs, systems integrators, resellers, and contractors in education, enterprise, federal government, military, healthcare, industrial, municipal government, oil and gas, mining, public safety, security, utilities, and transportation industries.

Alliance US Holding, LP owns Alliance Corporation, GetWireless, TESSCO Technologies, and DiscountCell and is owned by entities affiliated with Lee Equity Partners and Twin Point Capital

About Pente:

Pente provides the world’s most advanced LTE & 5G SA mobile core and network management solution supporting operators and enterprises with both fully virtualized mobile core networks and private cellular network solutions. With over 1000 APIs, Pente’s mobile core and network orchestration platform, enables the fastest implementation and integration available on the market today. Pente currently manages millions of IT-grade SIMs for customers around the globe on networks serving corporate enterprise, industrial, healthcare, education, the public sector and military applications. Pente has strategic customers and partnerships with leading MNOs, MVNOs, enterprises, device manufacturers, managed service providers and system integrators.

Visit pentenetworks.com or call 1-888-821-4797.

About MosoLabs:

MosoLabs is focused on building world-class 4G and 5G hardware with a unified network management platform and an innovative application software suite for private wireless and neutral hosts networks. Our mission is to simplify the entire private network experience – from planning to deployment to management – and create products to support new use cases. We develop fully integrated products that simplify time-to-market and deployment complexity for global enterprises and managed service providers. Learn more at www.mosolabs.com.

References:

https://www.pentenetworks.com/networkinabox

Tata Consultancy Services: Critical role of Gen AI in 5G; 5G private networks and enterprise use cases

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

HPE Aruba Launches “Cloud Native” Private 5G Network with 4G/5G Small Cell Radios

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

BT and Ericsson in partnership to provide commercial 5G private networks in the UK

Tata Consultancy Services: Critical role of Gen AI in 5G; 5G private networks and enterprise use cases

“In the realm of network management, Generative AI could play a critical role in predicting 5G data flow patterns and optimizing performance, ultimately improving the customer experience. Similarly, in the area of security, Gen AI could be pivotal in identifying and predicting threats before they occur, strengthening overall network security,” Mayank Gupta, Global Head (Sales and Strategy Network Solutions and Services) at Tata Consultancy Services (TCS), told the Economic Times of India.

5G adoption has been happening in stages he said. When asked about the 5G monetization challenges, Gupta opined that one of the main challenges has been fully understanding the business case or use case required by the industry. “It is not the traditional ‘design, deploy and get paid’ model. Instead, you have to engage with the industry, collaborate with various stakeholders and take an ecosystem approach. It is essential to understand the specific business needs, define the problem and then build solutions around that,” Gupta said.

“Two years ago, 5G was moving at a very slow pace, but it has gained significant momentum. Globally, the U.S. and Canada are leading the way, while countries like South Korea and Brazil are accelerating their adoption, largely due to the liberalization of their spectrum. From a deployment standpoint, mobile private networks are among the first areas seeing significant progress, with deployments growing rapidly. “The focus is shifting from just connectivity to a broader transformation of operational technology,” he added.

Over 50% of 5G mobile data is now coming from the enterprise sector, which has become a major focus. Different countries prioritize different use cases based on their needs.

Watch the video interview here:

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Tata Communications launches global, cloud-based 5G Roaming Lab

5G Made in India: Bharti Airtel and Tata Group partner to implement 5G in India

LightCounting & TÉRAL RESEARCH: India RAN market is buoyant with 5G rolling out at a fast pace

Reliance Jio in talks with Tesla to deploy private 5G network for the latter’s manufacturing plant in India

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India to set up 100 labs for developing 5G apps, business models and use-cases

Adani Group to launch private 5G network services in India this year

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

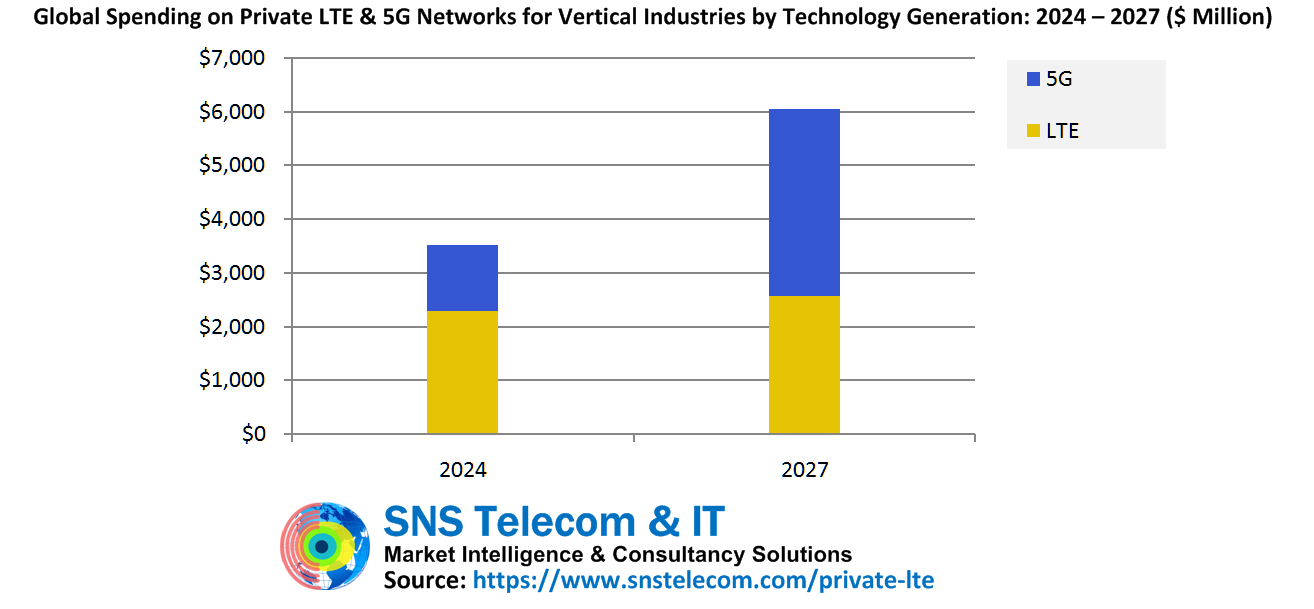

SNS Telecom & IT’s latest research report estimates that the private LTE and 5G network market revenues will be $6 Billion by the end of 2027. It’s one of the few bright spots in the otherwise gloomy wireless telecommunications industry, which is marked by a slowdown in public mobile network infrastructure spending and service providers struggling to monetize their existing 5G investments, particularly in the consumer segment.

Historically a niche segment of the wider wireless telecommunications industry, private 4G-LTE and 5G networks – also referred to as NPNs (Non-Public Networks) in 3GPP terminology – have rapidly gained popularity in recent years due to privacy, security, reliability and performance advantages over public mobile networks and competing wireless technologies as well as their potential to replace hardwired connections with non-obstructive wireless links.

Their expanding influence is evident from the recent use of rapidly deployable private cellular network-in-a-box systems for professional TV broadcasting, enhanced fan engagement and gameplay operations at major sports events, including Paris 2024 Olympics, 2024 UEFA European Football Championship, North West 200 Motorcycle Race, 2024 World Rowing Cup III, New York Sail Grand Prix, 2024 PGA Championship, 2024 UFL Championship Game and 2024 NFL International Games, as well as the Republican and Democratic national conventions in the run up to the 2024 United States presidential election.

Other examples of high-impact private LTE/5G engagements include but are not limited to multi-site, multi-national private cellular deployments at the industrial facilities of Airbus, BMW, Chevron, John Deere, LG Electronics, Midea, Tesla, Toyota, Volkswagen, Walmart and several other household brand names; Aramco’s 450 MHz 3GPP network project in Saudi Arabia and ADNOCS’ 11,000-square kilometer private 5G network for connecting thousands of remote wells and pipelines in the UAE; defense sector 5G programs for the adoption of tactical cellular systems and permanent private 5G networks at military bases in the United States, Germany, Spain, Norway, Japan and South Korea; service territory-wide private wireless projects of 450connect, Ameren, CPFL Energia, ESB Networks, Evergy, Neoenergia, PGE (Polish Energy Group), SDG&E (San Diego Gas & Electric), Tampa Electric, Xcel Energy and other utility companies; and the recent implementation of a private 5G network at Belgium’s Nobelwind offshore wind farm as part of a broader European effort to secure critical infrastructure in the North Sea.

There has also been a surge in the adoption of private wireless small cells as a cost-effective alternative to DAS (Distributed Antenna Systems) for delivering neutral host public cellular coverage in carpeted enterprise spaces, public venues, hospitals, hotels, higher education campuses and schools. This trend is particularly prevalent in the United States due to the open accessibility of the license-exempt GAA (General Authorized Access) tier of 3.5 GHz CBRS spectrum. Some examples of private network deployments supporting neutral host connectivity to one or more national mobile operators include Meta’s corporate offices, City of Hope Hospital, SHC (Stanford Health Care), Sound Hotel, Gale South Beach Hotel, Nobu Hotel, ASU (Arizona State University), Cal Poly (California Polytechnic State University), University of Virginia, Duke University and Parkside Elementary School.

SNS Telecom & IT estimates that global spending on private LTE and 5G network infrastructure for vertical industries will grow at a CAGR of approximately 20% between 2024 and 2027, eventually accounting for more than $6 Billion by the end of 2027. Close to 60% of these investments – an estimated $3.5 Billion – will be directed towards the buildout of standalone private 5G networks, which will become the predominant wireless communications medium to support the ongoing Industry 4.0 revolution for the digitization and automation of manufacturing and process industries. This unprecedented level of growth is likely to transform private LTE and 5G networks into an almost parallel equipment ecosystem to public mobile operator infrastructure in terms of market size by the late 2020s. By 2030, private networks could account for as much as a fifth of all mobile network infrastructure spending.

The “Private LTE & 5G Network Ecosystem: 2024 – 2030 – Opportunities, Challenges, Strategies, Industry Verticals & Forecasts” report presents an in-depth assessment of the private LTE and 5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, two technology generations, four spectrum licensing models, 16 vertical industries and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 7,300 global private LTE/5G engagements – as of Q4’2024.

The report will be of value to current and future potential investors into the private LTE and 5G market, as well as LTE/5G equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “Private LTE & 5G Network Ecosystem: 2024 – 2030 – Opportunities, Challenges, Strategies, Industry Verticals & Forecasts” please visit: https://www.snstelecom.com/private-lte

About SNS Telecom & IT:

SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 6G, 5G, LTE, Open RAN, vRAN (Virtualized RAN), small cells, mobile core, xHaul (Fronthaul, Midhaul & Backhaul) transport, network automation, mobile operator services, FWA (Fixed Wireless Access), neutral host networks, private 4G/5G cellular networks, public safety broadband, critical communications, MCX (Mission-Critical PTT, Video & Data), IIoT (Industrial IoT), V2X (Vehicle-to-Everything) communications and vertical applications.

References:

https://www.snstelecom.com/private-lte

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Wipro and Cisco Launch Managed Private 5G Network-as-a-Service Solution

Nokia’s 760 global private networking contracts are mostly 4G-LTE Advanced

Backgrounder:

Private Wireless Radio Access Network (RAN) revenue growth slowed in the fourth quarter of 2023 on a year-over-year basis. However, full-year revenues accelerated by approximately 40% in 2023, propelling private wireless to comprise around 2% of the overall RAN market.

“Private wireless RANs are now growing at a formidable pace, in contrast to public RAN and enterprise WLAN – both segments are projected to contract in 2024,” said Stefan Pongratz, Vice President at Dell’Oro Group in April.

The top 3 Private Wireless RAN suppliers in 2023 were Huawei, Nokia, and Ericsson. Excluding China, they were Nokia, Ericsson, and Samsung.

……………………………………………………………………………………………………………………………………………..

Nokia leads in Private RANs:

Nokia recently told Fierce Network that it signed 30 new private networking contracts in the second quarter of 2024. Nokia has said that it has signed more than 760 private network contracts around the world. NGIC, Sigma Lithium and Solis are some of the most recent names it has signed.

Nokia said that 78% of its private network business is based on 4G LTE-Advanced [1.], compared to 18% being 5G only, and the remaining 4% combining the two broadband cellular technologies.

Note 1. In October 2010, LTE-Advanced successfully passed the ITU-R’s evaluation process and was found to meet or exceed IMT-Advanced requirements. It was standardized a “IMT Advanced,” which support low to high mobility applications and a wide range of data rates in accordance with user and service demands in multiple user environments. IMT Advanced also has capabilities for high quality multimedia applications within a wide range of services and platforms, providing a significant improvement in performance and quality of service.

Image courtesy of Research Gate

…………………………………………………………………………………………………………………………………………….

David de Lancellotti, VP of enterprise campus edge business at Nokia talked to Fierce about Nokia’s performance in the private networking space. “Thirty in Q2, and roughly 50 — a little more than 50 — in the first half,” he said of contracts signed.

“We kind of jumped into this a bit earlier than anybody else,” Nokia’s de Lancellotti explained. “I think we’ve always taken a real service provider approach in terms of quality, in terms of feature set [and] in terms of roadmap,” while noting Nokia’s “real drive to pick up the enterprise space.”

Industry verticals – transportation, energy and manufacturing – continue to “lead the way” for private networking contracts in Q2. “When we talk about transportation, I think that’s the port side of business, which continues to be strong for us,” David said.

References:

https://www.fierce-network.com/wireless/nokia

Private Wireless RAN Revenues up ~40 Percent in 2023, According to Dell’Oro Group

https://en.wikipedia.org/wiki/LTE_Advanced

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-adv/Pages/default.aspx

https://www.researchgate.net/figure/Network-architecture-of-LTE-Advanced_fig1_333886291

UScellular adds NetCloud from Cradlepoint to its 5G private network offerings; Buyout coming soon?

UScellular has added NetCloud Private Networks from Cradlepoint (part of Ericsson) to expand its portfolio of private cellular solutions. The company now offers Ericsson Private 5G and Ericsson’s Mission Critical Networks to its customers. By building on these capabilities, UScellular is able to support even more customers across varying areas of business.

Some existing private cellular network ecosystems are pulled together piece by piece from different providers, which requires additional training and agreements. This makes it difficult for enterprise IT teams to have seamless visibility across the entire network. NetCloud Private Networks is an end-to-end private cellular network solution that removes these complexities to simplify building and operating 5G private networks.

“With the addition of NetCloud Private Networks to our portfolio, we can better address business challenges for customers of all sizes to connect business, industry and mission critical applications,” said Kim Kerr, senior vice president, enterprise sales and operations for UScellular. “The agility, flexibility and scalability of NetCloud Private Networks helps improve coverage, security, mobility, and reliability for applications where Wi-Fi may not be enough.”

NetCloud Private Networks supports enterprises who need more scalable, reliable and secure connectivity than they are getting today with traditional Wi-Fi solutions. There is significant opportunity in warehouses, logistics facilities, outdoor storage yards, manufacturing and retail operations environments to provide more connectivity. This will alleviate manual work, improve safety, and provide increased visibility.

“UScellular is a leader in this space by showing how a public carrier enhances the value of private network solutions,” said Manish Tiwari, head of private cellular networks, Cradlepoint and Ericsson Enterprise Wireless Networks.

“By adding NetCloud Private Networks to their portfolio of Ericsson private networks solutions, UScellular unlocks new opportunities for organizations to have local network coverage and address their reliability and security challenges. With solutions available to cater to both OT and IT in industrial and business environments, their customers have a choice in adopting the right private network solution for their use-cases with secure, policy-based wireless connectivity at scale.”

………………………………………………………………………………………………………………………..

Separately, The Wall Street Journal reported Thursday that T-Mobile is seeking to buy $2 billion worth of UScellular and take over some operations and wireless spectrum licenses. A deal could be announced this month, according to people familiar with the matter.

Meanwhile, Verizon is considering a deal for some of the rest of the company which is 80% owned by Telephone & Data Systems (TDS). Last year, TDS put the wireless company’s operations up for sale, as it struggled with competition from national wireless telco rivals and cable-broadband providers.

Verizon is the biggest U.S. cellphone carrier by subscribers, while T-Mobile became the second largest soon after it bought rival Sprint. T-Mobile gained more customers this month after it completed its purchase of Mint Mobile, an upstart brand.

The rising value of wireless licenses is a driving force behind the deal. U.S. Cellular’s spectrum portfolio touches 30 states and covers about 51 million people, according to regulatory filings.

U.S. companies have spent more than $100 billion in recent years to secure airwaves to carry high-speed fifth-generation, or 5G, signals and are hunting for more. But the Federal Communications Commission has lacked the legal authority to auction new spectrum for more than a year. The drought has driven up the price of spectrum licenses at companies that already hold them.

The U.S. wireless business has also matured: Carriers have sold a smartphone subscription to most adults and many children, which leaves less room for expansion as the country’s population growth slows. AT&T and Verizon have meanwhile retreated from expensive bets on the media business to focus on their core cellphone and home-internet customers.

A once-crowded field of small, midsize and nationwide cellphone carriers in the U.S. is now split among Verizon, T-Mobile and AT&T, leaving few players left to take over. As one of the last pieces left on the board, U.S. Cellular has long been an attractive takeover target. For many years, the home of the Chicago White Sox has been UScellular field.

………………………………………………………………………………………………………………………..

About UScellular:

UScellular offers wireless service to more than four million mostly rural customers across 21 states from Oregon to North Carolina. It also owns more than 4,000 cellular towers that weren’t part of the latest sale talks. The company has a market value of about $3 billion.

UScellular provides a range of solutions from public/private hybrid networks, MVNO models, localized data (aka CUPS) and custom VPN approaches. Private 5G offers unparalleled reliability, security and speed, enabling seamless communication and automation. For more information:

https://business.uscellular.com/products/private-cellular-networks/

References:

https://www.wsj.com/business/telecom/t-mobile-verizon-in-talks-to-carve-up-u-s-cellular-46d1e5e6

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT’s new “Private 5G Networks: 2024 – 2030” report exclusively focuses on the market for private networks built using the 3GPP-defined 5G specifications (there are no ITU-R recommendations for private 5G networks or ITU-T recommendations for 5G SA core networks). In addition to vendor consultations, it has taken us several months of end user surveys in early adopter national markets to compile the contents and key findings of this report. A major focus of the report is to highlight the practical and tangible benefits of production-grade private 5G networks in real-world settings, as well as to provide a detailed review of their applicability and realistic market size projections across 16 vertical sectors based on both supply side and demand side considerations.

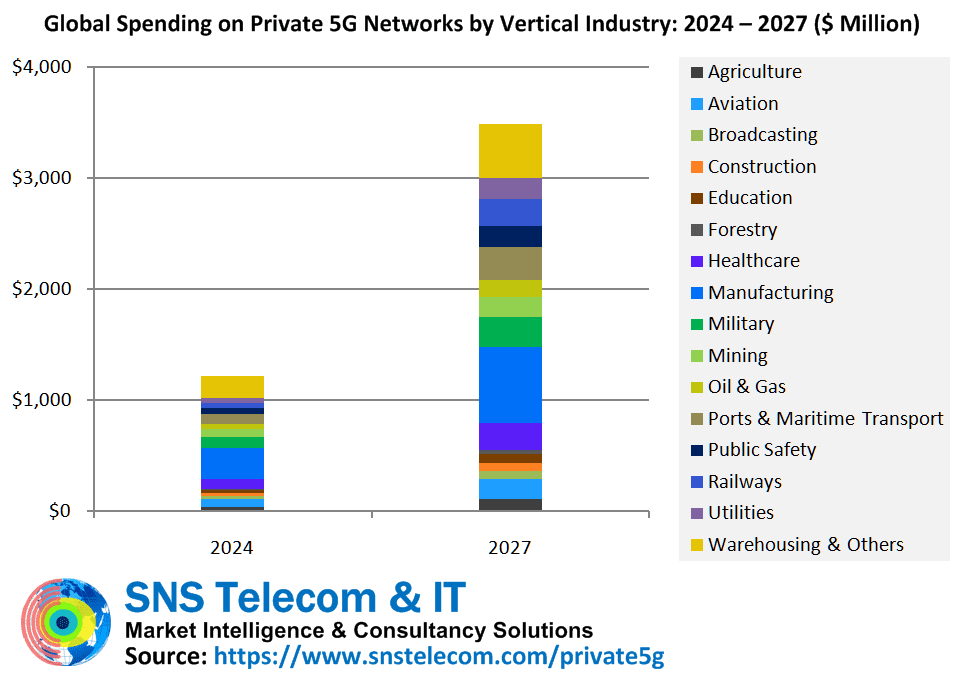

The report states report that the real-world impact of private 5G networks – which are estimated to account for $3.5 Billion in annual spending by 2027 – is becoming ever more visible, with diverse practical and tangible benefits such as productivity gains through reduced dependency on unlicensed wireless and hard-wired connections in industrial facilities, allowing workers to remotely operate cranes and mining equipment from a safer distance and significant, quantifiable cost savings enabled by 5G-connected patrol robots and image analytics in Wagyu beef production.

SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Although much of this growth will be driven by highly localized 5G networks covering geographically limited areas for Industry 4.0 applications in manufacturing and process industries, sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced becomes a commercial reality. Among other features for mission-critical networks, 3GPP Release 18 – which defines the first set of 5G Advanced specifications – adds support for 5G NR equipment operating in dedicated spectrum with less than 5 MHz of bandwidth, paving the way for private 5G networks operating in sub-500 MHz, 700 MHz, 850 MHz and 900 MHz bands for public safety broadband, smart grid modernization and FRMCS (Future Railway Mobile Communication System).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Private LTE networks are a well-established market and have been around for more than a decade, albeit as a niche segment of the wider cellular infrastructure segment – iNET’s (Infrastructure Networks) 700 MHz LTE network in the Permian Basin, Tampnet’s offshore 4G infrastructure in the North Sea, Rio Tinto’s private LTE network for its Western Australia mining operations and other initial installations date back to the early 2010s. However, in most national markets, private cellular networks or NPNs (Non-Public Networks) based on the 3GPP-defined 5G specs are just beginning to move beyond PoC (Proof-of-Concept) trials and small-scale deployments to production-grade implementations of standalone 5G networks, which are laying the foundation for Industry 4.0 and advanced application scenarios.

Compared to LTE technology, private 5G networks – also referred to as 5G MPNs (Mobile Private Networks), 5G campus networks, local 5G or e-Um 5G systems depending on geography – can address far more demanding performance requirements in terms of throughput, latency, reliability, availability and connection density. In particular, 5G’s URLLC (Ultra-Reliable, Low-Latency Communications) and mMTC (Massive Machine-Type Communications) capabilities, along with a future-proof transition path to 6G networks in the 2030s, have positioned it as a viable alternative to physically wired connections for industrial-grade communications between machines, robots and control systems. Furthermore, despite its relatively higher cost of ownership, 5G’s wider coverage radius per radio node, scalability, determinism, security features and mobility support have stirred strong interest in its potential as a replacement for interference-prone unlicensed wireless technologies in IIoT (Industrial IoT) environments, where the number of connected sensors and other endpoints is expected to increase significantly over the coming years.

It is worth noting that China is an outlier and the most mature national market thanks to state-funded directives aimed at accelerating the adoption of 5G connectivity in industrial settings such as factories, warehouses, mines, power plants, substations, oil and gas facilities and ports. To provide some context, the largest private 5G installations in China can comprise hundreds to even thousands of dedicated RAN (Radio Access Network) nodes supported by on-premise or edge cloud-based core network functions depending on specific latency, reliability and security requirements. For example, home appliance manufacturer Midea’s Jingzhou industrial park hosts 2,500 indoor and outdoor 5G NR access points to connect workers, machines, robots and vehicles across an area of approximately 104 acres, steelmaker WISCO (Wuhan Iron & Steel Corporation) has installed a dual-layer private 5G network – spanning 85 multi-sector macrocells and 100 small cells – to remotely operate heavy machinery at its steel plant in Wuhan (Hubei), and Fujian-based manufacturer Wanhua Chemical has recently built a customized wireless network that will serve upwards of 8,000 5G RedCap (Reduced Capability) devices, primarily surveillance cameras and IoT sensors.

As end user organizations in the United States, Germany, France, Japan, South Korea, Taiwan and other countries ramp up their digitization and automation initiatives, private 5G networks are progressively being implemented to support use cases as diverse as wirelessly connected machinery for the rapid reconfiguration of production lines, distributed PLC (Programmable Logic Controller) environments, AMRs (Autonomous Mobile Robots) and AGVs (Automated Guided Vehicles) for intralogistics, AR (Augmented Reality)-assisted guidance and troubleshooting, machine vision-based quality control, wireless software flashing of manufactured vehicles, remote-controlled cranes, unmanned mining equipment, BVLOS (Beyond Visual Line-of-Sight) operation of drones, digital twin models of complex industrial systems, ATO (Automatic Train Operation), video analytics for railway crossing and station platform safety, remote visual inspections of aircraft engine parts, real-time collaboration for flight line maintenance operations, XR (Extended Reality)-based military training, virtual visits for parents to see their infants in NICUs (Neonatal Intensive Care Units), live broadcast production in locations not easily accessible by traditional solutions, operations-critical communications during major sporting events, and optimization of cattle fattening and breeding for Wagyu beef production.

Despite prolonged teething problems in the form of a lack of variety of non-smartphone devices, high 5G IoT module costs due to low shipment volumes, limited competence of end user organizations in cellular wireless systems and conservatism with regards to new technology, early adopters are affirming their faith in the long-term potential of private 5G by investing in networks built independently using new shared and local area licensed spectrum options, in collaboration with private network specialists or via traditional mobile operators. Some private 5G installations have progressed to a stage where practical and tangible benefits – particularly efficiency gains, cost savings and worker safety – are becoming increasingly evident. Notable examples include but are not limited to:

- Tesla’s private 5G implementation on the shop floor of its Giga-factory Berlin-Brandenburg plant in Brandenburg, Germany, has helped in overcoming up to 90 percent of the overcycle issues for a particular process in the factory’s GA (General Assembly) shop. The electric automaker is integrating private 5G network infrastructure to address high-impact use cases in production, intralogistics and quality operations across its global manufacturing facilities.

- John Deere is steadily progressing with its goal of reducing dependency on wired Ethernet connections from 70% to 10% over the next five years by deploying private 5G networks at its industrial facilities in the United States, South America and Europe. In a similar effort, automotive aluminum die-castings supplier IKD has replaced 6 miles of cables connecting 600 pieces of machinery with a private 5G network, thereby reducing cable maintenance costs to near zero and increasing the product yield rate by ten percent.

- Lufthansa Technik’s 5G campus network at its Hamburg facility has removed the need for its civil aviation customers to physically attend servicing by providing reliable, high-resolution video access for virtual parts inspections and borescope examinations at both of its engine overhaul workshops. Previous attempts to implement virtual inspections using unlicensed Wi-Fi technology proved ineffective due to the presence of large metal structures.

- The EWG (East-West Gate) Intermodal Terminal’s private 5G network has increased productivity from 23-25 containers per hour to 32-35 per hour and reduced the facility’s personnel-related operating expenses by 40 percent while eliminating the possibility of crane operator injury due to remote-controlled operation with a latency of less than 20 milliseconds.

- The Liverpool 5G Create network in the inner city area of Kensington has demonstrated significant cost savings potential for digital health, education and social care services, including an astonishing $10,000 drop in yearly expenditure per care home resident through a 5G-connected fall prevention system and a $2,600 reduction in WAN (Wide Area Network) connectivity charges per GP (General Practitioner) surgery – which represents $220,000 in annual savings for the United Kingdom’s NHS (National Health Service) when applied to 86 surgeries in Liverpool.

- NEC Corporation has improved production efficiency by 30 percent through the introduction of a local 5G-enabled autonomous transport system for intralogistics at its new factory in Kakegawa (Shizuoka Prefecture), Japan. The manufacturing facility’s on-premise 5G network has also resulted in an elevated degree of freedom in terms of the factory floor layout, thereby allowing NEC to flexibly respond to changing customer needs, market demand fluctuations and production adjustments.

- A local 5G installation at Ushino Nakayama’s Osumi farm in Kanoya (Kagoshima Prefecture), Japan, has enabled the Wagyu beef producer to achieve labor cost savings of more than 10 percent through reductions in accident rates, feed loss, and administrative costs. The 5G network provides wireless connectivity for AI (Artificial Intelligence)-based image analytics and autonomous patrol robots.

- CJ Logistics has achieved a 20 percent productivity increase at its Ichiri center in Icheon (Gyeonggi), South Korea, following the adoption of a private 5G network to replace the 40,000 square meter warehouse facility’s 300 Wi-Fi access points for Industry 4.0 applications, which experienced repeated outages and coverage issues.

- Delta Electronics – which has installed private 5G networks for industrial wireless communications at its plants in Taiwan and Thailand – estimates that productivity per direct labor and output per square meter have increased by 69% and 75% respectively following the implementation of 5G-connected smart production lines.

- An Open RAN-compliant standalone private 5G network in Taiwan’s Pingtung County has facilitated a 30 percent reduction in pest-related agricultural losses and a 15 percent boost in the overall revenue of local farms through the use of 5G-equipped UAVs (Unmanned Aerial Vehicles), mobile robots, smart glasses and AI-enabled image recognition.

- JD Logistics – the supply chain and logistics arm of online retailer JD.com – has achieved near-zero packet loss and reduced the likelihood of connection timeouts by an impressive 70 percent since migrating AGV communications from unlicensed Wi-Fi systems to private 5G networks at its logistics parks in Beijing and Changsha (Hunan), China.

- Baosteel – a business unit of the world’s largest steelmaker China Baowu Steel Group – credits its 43-site private 5G deployment at two neighboring factories with reducing manual quality inspections by 50 percent and achieving a steel defect detection rate of more than 90 percent, which equates to $7 Million in annual cost savings by reducing lost production capacity from 9,000 tons to 700 tons.

- Dongyi Group Coal Gasification Company ascribes a 50 percent reduction in manpower requirements and a 10 percent increase in production efficiency – which translates to more than $1 Million in annual cost savings – at its Xinyan coal mine in Lvliang (Shanxi), China, to private 5G-enabled digitization and automation of underground mining operations.

- Sinopec’s (China Petroleum & Chemical Corporation) explosion-proof 5G network at its Guangzhou oil refinery in Guangdong, China, has reduced accidents and harmful gas emissions by 20% and 30% respectively, resulting in an annual economic benefit of more than $4 Million. The solution is being replicated across more than 30 refineries of the energy giant.

- Since adopting a hybrid public-private 5G network to enhance the safety and efficiency of urban rail transit operations, the Guangzhou Metro rapid transit system has reduced its maintenance costs by approximately 20 percent using 5G-enabled digital perception applications for the real-time identification of water logging and other hazards along railway tracks.

Some of the most technically advanced features of 5G Advanced – 5G’s next evolutionarily phase – are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For instance, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

The “Private 5G Networks: 2024 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the private 5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, two technology generations, 16 vertical industries and five regional markets. The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 7,000 global private cellular engagements – including more than 2,200 private 5G installations – as of Q2’2024.

The key findings of the report include:

- SNS Telecom & IT estimates that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 42% between 2024 and 2027, eventually accounting for nearly $3.5 Billion by the end of 2027. Much of this growth will be driven by highly localized 5G networks covering geographically limited areas for high-throughput and low-latency Industry 4.0 applications in manufacturing and process industries.

- Sub-1 GHz wide area critical communications networks for public safety, utilities and railway communications are also anticipated to begin their transition from LTE, GSM-R and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G Advanced – 5G’s next evolutionarily phase – becomes a commercial reality.

- As end user organizations ramp up their digitization and automation initiatives, some private 5G installations have progressed to a stage where practical and tangible benefits are becoming increasingly evident. Notably, private 5G networks have resulted in productivity and efficiency gains for specific manufacturing, quality control and intralogistics processes in the range of 20 to 90%, cost savings of up to 40% at an intermodal terminal, reduction of worker accidents and harmful gas emissions by 20% and 30% respectively at an oil refinery, and a 50% decrease in manpower requirements for underground mining operations.

- Some of the most technically advanced features of 5G Advanced are also being trialed over private wireless installations. Among other examples, Chinese automaker Great Wall Motor is using an indoor 5G Advanced network for time-critical industrial control within a car roof production line as part of an effort to prevent wire abrasion in mobile application scenarios, which results in production interruptions with an average downtime of 60 hours a year.

In addition, against the backdrop of geopolitical trade tensions and sanctions that have restricted established telecommunications equipment suppliers from operating in specific countries, private 5G networks have emerged as a means to test domestically produced 5G network infrastructure products in controlled environments prior to large-scale deployments or vendor swaps across national or regional public mobile networks. For example, Russian steelmaker NLMK Group is trialing a private 5G network in a pilot zone within its Lipetsk production site, using indigenously built 5G equipment operating in Band n79 (4.8-4.9 GHz) spectrum.

To capitalize on the long-term potential of private 5G, a number of new alternative suppliers have also developed 5G infrastructure offerings tailored to the specific needs of industrial applications. For example, satellite communications company Globalstar has launched a 3GPP Release 16-compliant multipoint terrestrial RAN system that is optimized for dense private wireless deployments in Industry 4.0 automation environments while German engineering conglomerate Siemens has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers.

Spectrum liberalization initiatives – particularly shared and local spectrum licensing frameworks – are playing a pivotal role in accelerating the adoption of private 5G networks. Telecommunications regulators in multiple national markets – including the United States, Canada, United Kingdom, Germany, France, Spain, Netherlands, Switzerland, Finland, Sweden, Norway, Poland, Slovenia, Bahrain, Japan, South Korea, Taiwan, Hong Kong, Australia and Brazil – have released or are in the process of granting access to shared and local area licensed spectrum.

By capitalizing on their extensive licensed spectrum holdings, infrastructure assets and cellular networking expertise, national mobile operators have continued to retain a significant presence in the private 5G network market, even in countries where shared and local area licensed spectrum is available. With an expanded focus on vertical B2B (Business-to-Business) opportunities in the 5G era, mobile operators are actively involved in diverse projects extending from localized 5G networks for secure and reliable wireless connectivity in industrial and enterprise environments to sliced hybrid public-private networks that integrate on-premise 5G infrastructure with a dedicated slice of public mobile network resources for wide area coverage.

New classes of private network service providers have also found success in the market. Notable examples include but are not limited to Celona, Federated Wireless, Betacom, InfiniG, Ataya, Smart Mobile Labs, MUGLER, Alsatis, Telent, Logicalis, Telet Research, Citymesh, Netmore, RADTONICS, Combitech, Grape One, NS Solutions, OPTAGE, Wave-In Communication, LG CNS, SEJONG Telecom, CJ OliveNetworks, Megazone Cloud, Nable Communications, Qubicom, NewGens and Comsol, and the private 5G business units of neutral host infrastructure providers such as Boldyn Networks, American Tower, Boingo Wireless, Crown Castle, Freshwave and Digita.

NTT, Kyndryl, Accenture, Capgemini, EY (Ernst & Young), Deloitte, KPMG and other global system integrators have been quick to seize the private cellular opportunity with strategic technology alliances. Meanwhile, hyperscalers – most notably AWS (Amazon Web Services), Google and Microsoft – are offering managed private 5G services by leveraging their cloud and edge platforms.

Although greater vendor diversity is beginning to be reflected in infrastructure sales, larger players are continuing to invest in strategic acquisitions as highlighted by HPE’s (Hewlett Packard Enterprise) acquisition of Italian mobile core technology provider Athonet.

The service provider segment is not immune to consolidation either. For example, Boldyn Networks has recently acquired Cellnex’s private networks business unit, which largely includes Edzcom – a private 4G/5G specialist with installations in Finland, France, Germany, Spain, Sweden and the United Kingdom.

Among other examples, specialist fiber and network solutions provider Vocus has acquired Challenge Networks – an Australian pioneer in private LTE and 5G networks, while mobile operator Telstra – through its Telstra Purple division – has acquired industrial private wireless solutions provider Aqura Technologies.

The report will be of value to current and future potential investors into the private 5G network market, as well as 5G equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 5G, LTE, Open RAN, private cellular networks, IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies and vertical applications.

References:

https://www.snstelecom.com/private5g

What is 5G Advanced and is it ready for deployment any time soon?

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

https://www.kyndryl.com/us/en/about-us/news/2024/02/it-ot-convergence-in-manufacturing

India Telcos say private networks will kill their 5G business

WSJ: China Leads the Way With Private 5G Networks at Industrial Facilities

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

Ericsson and ACES partner to revolutionize indoor 5G connectivity in Saudi Arabia

Ericsson and Advanced Communications and Electronics Systems (ACES) [1.] have signed a strategic three-year Neutral Host Provider (NHP) agreement, to address the surging demand for indoor 5G connectivity and 5G technology. This agreement aims to create a neutral host ecosystem, allowing service providers to share infrastructure and deliver high-performance 5G connectivity in high-traffic indoor locations in Saudi Arabia.

Note 1. Advanced Communications & Electronic Systems Company (ACES) is a leading international neutral host operator and a digital infrastructure company based in Saudi Arabia. Established in early 1990s, ACES is specialized in implementing total solutions and turn-key projects in wireless communication, network monitoring & testing and information technology systems.

……………………………………………………………………………………………………………….

Using multi-operator infrastructure sharing to address rising demand for indoor connectivity will significantly improve user experience. With the rise of high-attraction landmarks and the need for network densification, it has become crucial to provide reliable and high-performing indoor solutions for portability, agility and flexibility.

The NHP agreement allows ACES to provide Ericsson indoor 5G products to service providers, enabling them to share the same infrastructure, and ensure cost-effective coverage expansion and efficient utilization of resources.

This agreement will establish a neutral host ecosystem, supporting CSPs in enhancing their indoor 5G coverage with flexibility and ease of operation and maintenance. It will contribute to the footprint expansion of indoor 5G networks across the Kingdom.

Image Credit: Ericsson

By deploying Ericsson’s Radio Dot System, CSPs can deliver high-performing 5G connectivity to users in large locations such as airports, hotels, hospitals, stadiums, and shopping malls.

One of the key activations as a result of this agreement is enhancing the 5G indoor connectivity at an international airport in the Kingdom that welcomes millions of visitors regularly. The agreement paves the way for a resilient infrastructure in high-density locations.

Akram Aburas, Chief Executive Officer of ACES, says: “At ACES, we seek to empower businesses and individuals with a transformative digital experience, and our agreement with Ericsson is a momentous step towards that. With Ericsson’s cutting-edge indoor 5G solutions, we aim to create a neutral host ecosystem that offers seamless and high-performance connectivity in high-traffic indoor locations across the Kingdom. Our agreement with Ericsson will support and meet the surging demand for indoor connectivity across Saudi Arabia and unlock unparalleled opportunities for telecom operators to enrich their offerings and deliver exceptional user experiences.”

Ericsson’s indoor 5G solutions, powered by the Radio Dot System, will enable faster and more reliable network performance in indoor environments and will cater to the increasing need for seamless connectivity.

Håkan Cervell, Vice President and Head of Ericsson Saudi Arabia and Egypt at Ericsson Middle East and Africa, says: “By fostering a neutral host ecosystem, we are enabling communications service providers to embrace unprecedented flexibility and cost efficiency in their network expansion. Our indoor 5G solutions, powered by the Radio Dot System, will enhance how businesses and individuals experience seamless connectivity within indoor environments. We look forward to this agreement with ACES, which will ensure robust indoor 5G connectivity across the Kingdom, in line with Saudi Vision 2030, while setting new benchmarks for network performance that propel Saudi Arabia to the forefront of the global 5G revolution.”

To date, the Ericsson Radio Dot System has been deployed in more than 115 countries around the world in high-traffic indoor venues.

References:

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

Ericsson and IIT Kharagpur partner for joint research in AI and 6G

Ericsson expects continuing network equipment sales challenges in 2024

Recon Analytics (x-China) survey reveals that Ericsson, Nokia and Samsung are the top RAN vendors

T-Mobile US, Ericsson, and Qualcomm test 5G carrier aggregation with 6 component carriers

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN

Ligado Networks and Ubiik to offer private LTE network using Band 54 spectrum at 1670-1675 MHz

U.S. satellite communications service provider Ligado Networks plans to offer a private LTE network using advanced metering infrastructure (AMI) from Taiwan based Ubiik. Using Band 54 spectrum at 1670-1675 MHz, the private LTE network is intended for the utilities sector and other mission-critical customers. Band 54 is standardized for 3GPP-based cellular technologies; it is available contiguously across the US.

Ubiik gained considerable success in Taiwan, including a $17 million tender from Taiwan Power Company (Taipower) at the start of 2023. The company has developed a private LTE base station for Band 54 spectrum, under the brand goRAN; the 5MHz chunk at 1670-1675 MHz, affording time-division (rather than frequency division) duplexing (TDD), is presented as a useful private network addition for low-power IoT projects.

On October 6th, Ubiik partnered with Electricity Canada with the aim of contributing to Canada’s clean energy future through developments in wireless connectivity. Ubiik will collaborate with Electricity Canada’s members and partners to deliver pLTE networks for utilities in Canada, using its innovative goRAN™ LTE Base Station and LTE-M end devices that support the 1.8GHz, 900MHz, and 1.4GHz spectrum.

The goRAN™ base station integrates a full-software 3GPP Release 15 Radio Access Network (RAN) optimized for private networks, with multi-carrier standalone NB-IoT support as well as standalone LTE-M in 1.4MHz, 3MHz and 5MHz bandwidths, including VoLTE. It can operate as a Base Station connecting to an external Evolved Packet Core (EPC) via the S1 interface, as well as an Access Point with its built-in EPC and integrated HSS (external HSS via S6a is also supported).

…………………………………………………………………………………………………………………………….

It is a “golden opportunity” for critical industries, said Ubiik. TDD separates the uplink and downlink signals by allocating different time slots in the same frequency band, allowing for asymmetric flow for uplink and downlink transmission. Ligado Networks said: “[It] equips utility users with significant flexibility, as different ratios of uplink versus downlink slots may be used to address requirements of mission-critical applications.”

A news release said: “The Band 54 goRAN™ LTE Base Station will be particularly useful for utilities deploying private networks which is why the companies plan to showcase a demonstration version of the device during the 2023 Utility Broadband Alliance (UBBA) Summit & Plugfest Event in Minneapolis next week from October 10-12, 2023.”

Sachin Chhibber, chief technology officer at Ligado Networks emphasized how the announcement represents another building block in the expansion of the ecosystem which utilizes Band 54 frequencies. He stated: “Ubiik’s goRAN base station is a significant enhancement to the opportunities the band affords to the critical infrastructure industry – especially utility and other enterprise organisations planning private networks… By eliminating the requirement to pair channels for uplink and downlink, we will be able to offer partners the flexibility to use the spectrum exactly how they need, and with greater efficiencies.”

Chhibber reiterated how specific attributes of Band 54 – particularly its Time Division Duplex (TDD) capabilities – equip utility users with significant flexibility, as different ratios of uplink versus downlink slots may be used to address requirements of mission-critical applications. “By eliminating the requirement to pair channels for uplink and downlink, we will be able to offer our partners the flexibility necessary to use the spectrum exactly how they need, and with greater efficiencies,” Chhibber noted. He added that uplink-heavy users such as utilities – for monitoring purposes, as an example – will be able to deploy tailormade networks to achieve their priorities.

Tienhaw Peng, chief executive at Ubiik, said: “Given the scarcity of spectrum, being able to secure an optimal 5 MHz slice to build out a private network is a golden opportunity for critical infrastructure customers. Our goRAN base station offers the perfect mix of affordability and ease of deployment combined with the spectral efficiency, interoperability and security brought by LTE. With Ligado, we look forward to providing a solution-in-a-box for building an LTE network – by either utilising a user’s specified core network or one directly built into the base station.”

Peng also explained that the goRAN™ Base Station will integrate with chipsets supporting Band 54 and with a utility-hardened LTE endpoint module currently in development. Ubiik’s recent acquisition of utility networks provider Mimomax Wireless will provide North American utilities with additional expertise in the deployment of multiple large-scale wireless networks.

Ubiik’s recent acquisition of utility networks provider Mimomax Wireless will provide North American utilities with additional expertise in the deployment of multiple large-scale wireless networks, the company said.

References:

Ligado Networks teams up with Ubiik to offer US utilities Band-54 private LTE at 1670-1675 MHz

New VMware Private Mobile Network Service to be delivered by Federated Wireless

Federated Wireless, a shared spectrum and private wireless network operator, today announced it will deliver private 4G and 5G networks-as-a-service for enterprises in the form of the new VMware Private Mobile Network Service. Federated Wireless will build and operate private 4G and 5G radio access network (RAN) infrastructure to be deployed on customers’ premises. VMware will provide its Private Mobile Network Orchestrator to manage the end-to-end network and integrate it with existing IT environments.

The streamlined solution provides the performance, coverage, and security benefits of private cellular networks without the complexity of building and operating standalone infrastructure.

Key features and benefits of the joint solution include:

- Streamlined deployment of private 4G/5G RAN at enterprise locations

- Simplified private mobile core integrated with existing IT management platforms

- Centralized orchestration and automation of the end-to-end networks

- Enhanced security and more optimized connectivity for business- and mission-critical applications

- Carrier-grade performance with SLAs tailored to enterprise requirements

- Ability to leverage CBRS shared spectrum as well as privately licensed spectrum

“Enterprises are looking to private cellular networks to enable business transformation, but need solutions that integrate with their existing infrastructure,” said Kevin McCartney, Vice President of Alliances at Federated Wireless. “Through the strength of our combined solutioning with VMware, we’re giving customers in difficult-to-cover environments an easy on-ramp to private 4G and 5G with the performance and scale they require.”

“VMware is committed to helping customers modernize their networks through innovative software solutions,” said Saadat Malik, Vice President and General Manager, Edge Computing at VMware. “With Federated Wireless and a growing partner ecosystem, we’re making it simpler for enterprises to deploy and run private networks in a model that aligns with their business needs.”

The solution will be delivered by Federated Wireless as part of its private wireless managed service and will be available to both direct customers and channel partners.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

VMware today is also introducing new and enhanced orchestration capabilities for the edge. VMware Edge Cloud Orchestrator (formerly VMware SASE Orchestrator) will provide unified management for VMware SASE and the VMware Edge Compute Stack—an industry-first offering to bridge the gap between edge networking and edge compute. Enhancements to the orchestrator will help customers plan, deploy, run, visualize, and manage their edge environments in a friction-free manner—allowing them to run edge-native applications focused on business outcomes. The VMware Edge Cloud Orchestrator (VECO) will deliver holistic edge management by providing a single console to manage edge compute infrastructure, networking, and security.

VMware defines the software-defined edge as a distributed digital Infrastructure that runs workloads across a number of locations, close to endpoints that are producing and consuming data. It extends to where the users and devices are—whether they are in the office, on the road or on the factory floor. Enterprises need solutions to connect these elements more securely and reliably to the larger enterprise network in a scalable manner. VMware Edge Cloud Orchestrator is key to enabling a software-defined edge approach. VMware’s approach to the software-defined edge features right-sized infrastructure (shrinking the stack to the smallest possible footprint); pull-based orchestration (security and administrative updates are “pulled” by the workload); and network programmability (defined by APIs and code).

“Audi wants to take factory automation to the next level and benefit from a scalable edge infrastructure at its factories worldwide,” said Jörg Spindler, Global Head of Manufacturing Engineering, Audi. “Audi’s Edge Cloud 4 Production will be the key component of this digital transformation, replacing individual PCs and hardware on the shop floor. Ultimately, it will increase factory uptime, agility, and the speed of rolling out new applications and tools across the production line. VMware Edge Compute Stack (ECS) and the VMware Edge Cloud Orchestrator (VECO) will offer a scalable way for Audi to operate a distributed edge infrastructure, manage resources more efficiently, and lower its operations costs.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

VMware also announced that the VMware Private Mobile Network, a managed connectivity service to accelerate edge digital transformation, will become initially available in the current quarter (FY24 Q3). VMware partners with wireless service providers to help remove the complexity associated with private mobile networks and enable enterprises to focus on their strategic business outcomes. Built on VMware Edge Compute Stack, VMware Private Mobile Network offers service providers trusted VMware technology, seamlessly integrated into existing IT management platforms. This enables rapid deployment and effortless management and orchestration. VMware is also pleased to announce that it is working with Betacom, Boingo Wireless, and Federated Wireless as the initial beta wireless service provider partners for this new offering.

Supporting Diverse Use Cases at the Edge:

VMware offers enterprises the right edge solution to address diverse use cases at the right price. It is collaborating with customers to successfully address the following edge use cases:

- Manufacturing – Support for autonomous vehicles, digital twin, inventory management, safety, and security;

- Retail – Support for loss prevention, inventory management, safety, security, and computer vision;

- Energy – Enable increased production visibility and efficiency, reduced unplanned downtime, maintain regulatory compliance; and,

- Healthcare – Support for IoT wearables, smart utilities, and surgical robotics.

End Quote:

“Boingo is collaborating with VMware to enhance our managed private 5G networks that connect mobile and IoT devices at airports, stadiums and large venues. VMware’s Private Mobile Network simplifies network integration and management, helping us accelerate deployments.” – Dr. Derek Peterson, chief technology officer, Boingo

References:

https://www.federatedwireless.com/products/private-wireless/

https://go.federatedwireless.com/l/940493/2023-06-12/3pj9f/940493/1686554112NWvEuSUE/WhyFederatedWireless_SolutionBrief.pdf