Optical network market poised for growth in 2013, especially in EMEA region

1. Market research firm Infonetics Research just released vendor market share and preliminary analysis from its 4th quarter 2012 (4Q12) and year-end Optical Network Hardware report. The full report will be published Feb. 27th.

OPTICAL NETWORK MARKET HIGHLIGHTS :

. The global optical network hardware market rose 2% in 4Q12 from 3Q12, but was down 13% from the year-ago 4thQ

. For the full year 2012, total optical equipment spending was down 10% worldwide

. The SONET/SDH optical segment fared much worse, essentially dealt a death blow in 2012 as global legacy capex fell 30%

. After posting its lowest-ever optical revenue results a quarter ago, Alcatel-Lucent bounced back in 4Q12, up 29% on the tide of the EMEA capex surge; still, ALU’s WDM revenue is down from a year ago

. Ciena’s optical revenue was down sequentially and year-over-year, but grew shipments of its 40G and 100G equipment and is ramping production of a new single-carrier 100G solution

. Infinera had another strong quarter, thanks to a surge in sales of its new DTN-X OTN switching platform

“After ending 2012 on a flat note, things are looking up for the optical market in 2013,” notes Andrew Schmitt, principal analyst for optical at Infonetics Research. “Our conversations with equipment providers continue to trend positive, particularly in North America where 100G spending is about to ramp. The general consensus remains that an optical cycle for equipment in the core is emerging, what we call the ‘optical reboot.'”

“Meanwhile, there are positive rumbles in the EMEA region, where 2012 ended with a spending flourish and carriers are cutting dividends to plow capital into general capex,” Schmitt adds. “And we are looking forward to our visits with carriers in Beijing this spring to get a good read on the year, but the preliminary indication is it will be a huge year for 100G. China is about half of the global 40G WDM market, and 2013 will be the peak year for 40G worldwide.”

In an earlier report, Mr Schmitt was quite positive about the OTN Switching market. Andrew wrote, “Though OTN switching currently makes up only a small portion of the overall OTN market and deployments have been centered mostly in China, we anticipate breakout growth for this segment as operators in EMEA and North America adopt integrated WDM+OTN switching as part of the roll out of 100G coherent technology in regional and core networks. We’re forecasting the OTN switching segment to grow at a 5-year compound annual growth rate of 28% from 2012 to 2016.”

OPTICAL HARDWARE REPORT SYNOPSIS:

Infonetics’ quarterly optical hardware report provides worldwide and regional market size, market share, analysis, forecasts, and trends for metro and long haul SONET/SDH and WDM equipment, Ethernet optical ports, SONET/SDH/ POS ports, and WDM ports. Companies tracked include Adtran, ADVA, Alcatel-Lucent, Ciena, Cisco, ECI Telecom, Ericsson, Fujitsu, Huawei, Infinera, NEC, Nokia Siemens Networks, Tellabs, Transmode, Tyco Telecom, ZTE, and others. To buy the report, contact Infonetics:

http://www.infonetics.com/contact.asp

2. TechNavio’s report, the Optical Network Hardware Market in the EMEA Region 2011-2015, has been prepared based on an in-depth market analysis with inputs from industry experts. The report focuses on the EMEA region; it also covers the Optical Network Hardware market landscape and its growth prospects in the coming years. The report also includes a discussion of the key vendors operating in this market.

TechNavio’s analysts forecast the Optical Network Hardware market in the EMEA region to grow at a CAGR of 2.93 percent over the period 2011-2015. One of the key factors contributing to this market growth is the increased bandwidth requirements. The Optical Network Hardware market in the EMEA region has also been witnessing strong growth prospects in Central and Eastern Europe. However, the high initial investment could pose a challenge to the growth of this market.

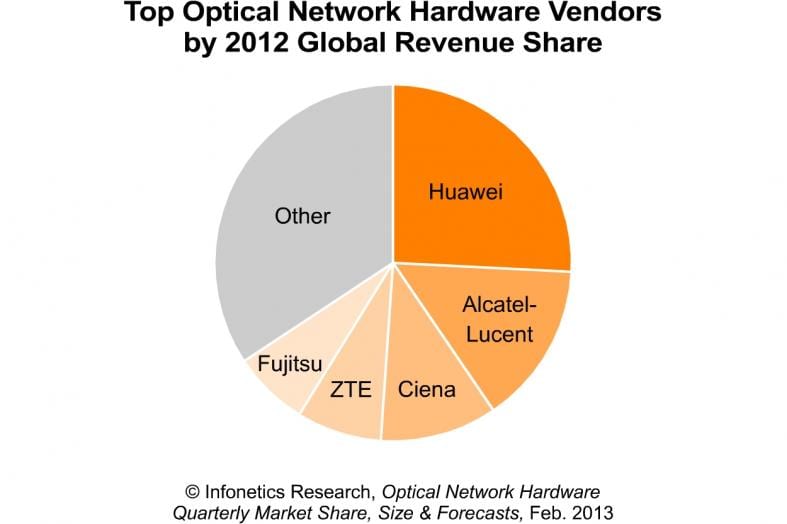

The key vendors dominating the optical network hardware space are Alcatel-Lucent, Ciena Corp., Huawei Technologies Co. Ltd., and ZTE Corp. The other vendors mentioned in the report are Fujitsu Ltd., Cisco Systems Inc., Ericsson Inc., NEC Corp., Nokia Siemens Networks, and Tellabs Inc.

To buy this report: http://www.researchmoz.us/optical-network-hardware-market-in-the-emea-region-2011-2015-report.html

3. 100G OPTICS WEBINAR:

Join Infonetics analyst Andrew Schmitt, Cisco, Cyan and Oclaro on March 5 for 100G Optics: Why Operators Are Upgrading Now, a free live webinar examining coherent 100G deployment activity to date and solutions for adding 100G to the network. Learn more or register at:

http://w.on24.com/r.htm?e=564650&s=1&k=D516668CBFFF7CD6D45545BA350F0373