Month: August 2013

Verizon working to buy out Vodafone stake in Verizon Wireless

Verizon Communications (VZ) is close to buying the remaining stake in Verizon Wireless (VZW) from Vodafone Group PLC it does not own for potentially $130 billion, according to people familiar with the talks, in what could be the third-biggest deal of all time. VZW is the largest U.S. mobile carrier. For months it has expressed its desire to gain full ownership of the jointly owned wireless network, which is growing fast and generating billions of dollars in free cash flow.

http://www.reuters.com/article/2013/08/29/us-vodafone-verizon-idUSBRE97S08C2013082

“Verizon Wireless is the crown jewel,” says Chris King, an analyst at Stifel Nicolaus. “It has been the best performing of all telecom assets in the US.” http://www.telegraph.co.uk/finance/9783344/Telecoms-giant-Verizon-is-conquering-America-the-world-should-take-note.html

Verizon and AT&T already dominate the U.S. telco market. They have effectively re-constructed the monopoly AT&T had before the divestiture of the Bell System.

This chart, courtesy of the Wall Street Journal, shows the changing world order for U.S. telcos:

FBR Research: Optical Upgrade Cycle Drives Demand for Ciena’s products

FBR’s Scott Thomspon:

“Ciena is arguably the world’s leader in optical communication innovation and is dependent on carrier spending on optical (think lasers) equipment. We expect Ciena’s revenue to be focused on two near-term themes that are likely to drive a strong revenue growth cycle in the optical equipment space. The near-term themes include a carrier optical network upgrade cycle and continued deployment of fiber-based Ethernet technologies for wireless backhaul.

Ciena appears to be two-plus quarters into an optical upgrade cycle that management has indicated could be longer than past cycles. While we expect Ciena will continue to post strong results on the back of relatively strong service provider spending patterns, we encourage investors to keep expectations in check as revenue recognition is often lumpy for CIEN (30%-plus of revenues are from two customers).”

Key Points:

■ Converged packet networking, software, and services combine to deliver a more balanced and prolonged upgrade cycle. Past cycles have often been driven by optical transport and a mix of switching, resulting in significant volatility throughout the upgrade cycle. We view this cycle as being different given strong and balanced growth in multiple and higher-margin categories such as packet networking, software, and services balance Ciena’s core product growth. For the July quarter, we expect growth in Ciena’s packet networking segment is likely to remain robust, potentially delivering upside to our above consensus revenue and GM estimates.

■ Margins continue to improve? We expect GMs to remain strong for Ciena for several reasons: (1) several industry participants have made comments recently about pricing pressure abating as carriers continue to deploy significant optical network upgrades, (2) component cost savings associated with WaveLogic 3 could drive additional upside to Gross Margins (GM) through CY13, and (3) Ciena is beginning to work through the initial stages of deployment where lower-margin chassis mute GM expansion. While we are always cautious with regard to GM with Ciena, we expect the July quarter GM result could come in well above our and the consensus 42.6% estimate.

■ Raising July quarter revenue estimates; tempering our enthusiastic EPS slam dunk. We are raising our revenue estimates in expectation of strong 2H13 optical spending patterns. We have revised F3Q13 revenues above the high

end of management’s guide to $549M from $534M, above Street consensus of $532M, and lowered our GM estimate to 43.4% from 44%. For FY13, we expect revenues to come in at $2.05B, up from $2.03B, against a Street consensus of

$2.04B. As a result, our $0.23 EPS estimate declines to $0.22 for F3Q13 but remains well above Street consensus of $0.15, while our FY13E EPS declines to $0.58 from $0.67 to make room for any potential non-linearity in large project

completions, which have been known to concern CIEN investors.

Q &A:

1. Will service providers, especially in the U.S., invest in an optical network upgrade cycle in 2013?

Yes. Carriers seem to invest in optical products in cycles. We expect that Verizon Communications, Inc., AT&T Inc., and Sprint are planning to make material investments in the optical layers of their networks in 2013.

2. Will Cisco s move to integrate optical transport into its routing platform pressure gross margins across the optical network equipment sector?

We believe Cisco only makes a concerted effort to enter a market when it believes it can hold one of the top two market share positions in the category. We expect Cisco s move to integrate optical capabilities into its routing platform creates a more credible and negative threat for Ciena and its ability to maintain and grow its gross margin profile.

3. Could increasing competition from Huawei Technologies Ltd. and Infinera Corporation pressure the gross margin?

Yes, but we are cautiously optimistic that pricing pressure may have subsided a bit. Additionally, lower COGS associated with the WaveLogic 3 product could help to offset competitive margin pressures for the next several quarters. Huawei is an aggressive competitor, but we expect political pressure against Huawei in the U.S. and the EU may prove beneficial for Ciena s margins in 2013.

References (by this author):

Ciena and Research Network Partners Work to Make Carrier WAN-SDN Realizable http://viodi.com/2013/08/12/ciena-research-network-partners-work-to-make-carrier-wan-sdn-realizable/

Open Network Foundation & Other Organizations; ONF-Optical Transport WG; Ciena & SDN http://viodi.com/2013/04/24/open-network-foundation-onf-optical-transport-wg-ciena-sdn/

Sprint to Scale Core Network to 40G/100G and later 400G with Ciena’s 6500 Packet-Optical Platform https://techblog.comsoc.org/2012/06/13/sprint-to-scale-core-network-to-40g100g-and-later-400g-with-cienas-6500-packet-optical-platform

Ciena brings SDN functionality to new network architecture- OPn https://techblog.comsoc.org/2012/06/12/ciena-brings-sdn-functionality-to-new-network-architecture-opn-july-comsocscv-meeting

AT&T Opens new Innovation Center/Foundry in Atlanta, GA (#4)

Jacob Saperstein described the mission and purpose of AT&T’s Palo Alto Foundry, how it relates to AT&T’s Innovation Platform, and its role in the Silicon Valley ecosystem. In addition to its Palo Alto facility, AT&T has Foundry locations in Richardson, TX and Ra’anana, Israel (and now Atlanta, GA). At these three “Innovation Centers,” AT&T teams up with start-ups and leading edge companies to fast-track new apps, devices, software/hardware platforms and other areas of technology innovation.

SDN to be a $3.52 billion market by 2018; Cyan’s Blue Orbit for carrier based SDN and NFV applications

The software-defined networking (SDN) will be a $3.52 billion global market by 2018, according to Transparency Market Research. The market research firm’s new “Software Defined Networking (SDN) Market – Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2012 – 2018” report predicts SDN spending worldwide will grow at a compound annual growth rate of 61.5% from 2012 to 2018.

http://www.transparencymarketresearch.com/software-defined-networking-sdn-market.html

The increasing need for efficient infrastructure and mobility, as well as the popularity of cloud services, will drive this growth, according to the report. Transparency Market Research cites three main markets for SDN: enterprises, cloud services providers, and telecommunications services providers. Enterprises represented 35% of the SDN market in 2012. However, cloud service providers are expected to be the fastest growing market segment throughout the years the report covers. Transparency Research says that SDN’s ability to reduce opex and capex while enabling the delivery of new services will spearhead its use by cloud service providers.

Cloud provisioning and orchestration products currently dominate the global SDN market, the report states. SDN switching held the second largest revenue share of the SDN market in 2012. SDN products and applications also will be used to design, optimize, secure, and monitor the network, the market research firm predicts. The report segments the global SDN market into users, products (including SDN switching, SDN controllers, cloud provisioning and orchestration, and others such as security and services), and region.

North America currently is the largest market for SDN technology, thanks to a high degree of standardization and favorable regulatory initiatives. Not surprisingly, Asia Pacific is expected to be the fastest growing region during forecast period, fueled by the increasing adoption of BYOD practices in China, India, and Australia.

In this early stage, the SDN industry is fragmented, the report asserts. Multiple players have moved to address different categories including hardware providers, software developers, and service providers. Transparency Research names Cisco, IBM, NEC, Juniper Networks, Alcatel-Lucent, VMware, HP, Google, Big Switch Networks, Arista Networks, Brocade Communications Systems, Verizon Communications, and Intel among the primary players.

Comment: We think that the term “SDN” includes both ONF standards based (e.g. Open Flow) and vendor specific (e.g. Arista Networks) open networking solutions. We wonder how large the SDN standards based market wii be.

Cyan Inc, a leading provider of software-defined networking (SDN) and packet-optical solutions for network operators, today announced that Pica8, Inc. has joined Blue Orbit, an ecosystem of partners focused on proving real-world, multi-vendor, software-defined network (SDN) and network functions virtualization (NFV) applications.

“The addition of Pica8 to the Blue Orbit Ecosystem demonstrates the supplier community’s desire to come together and push interoperability testing and real deployments forward,” said Joe Cumello, chief marketing officer at Cyan. “As Blue Orbit continues to grow, we are gaining invaluable insight into how we can help network operators such as carriers, data center operators and cloud companies slash OpEx, launch new services, and deliver a better customer experience.”

In June 2013, Blue Orbit was formed to demonstrate interoperability among SDN and NFV solutions from an array of partners to lessen the risk network operators would otherwise face and accelerate the deployment of production SDN and NFV use cases. Blue Orbit partners provide applicable solution elements to Cyan’s California-based Blue Orbit Lab. From this facility, Cyan, Blue Orbit partners, and customers are able to test and demonstrate the deployability of SDN solutions.

http://www.cyaninc.com/en/keep-up/press-releases/2013/pica8-joins-cyan/

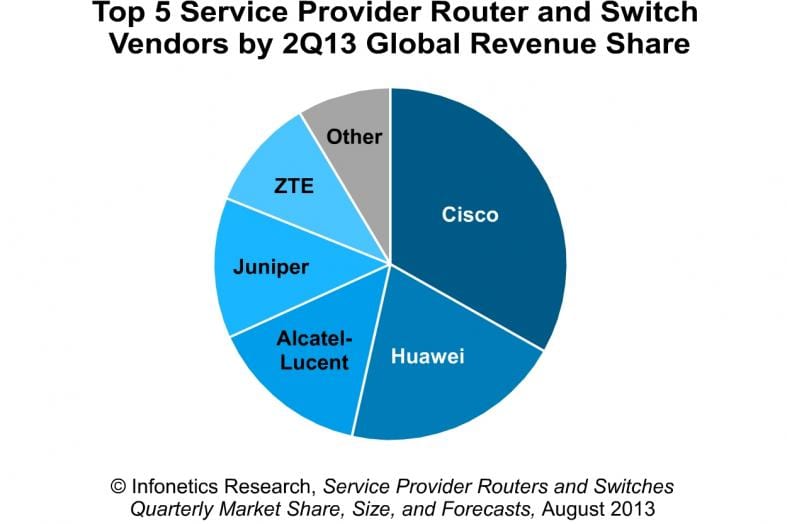

Global Carrier Router/Switch market up 27% in 2Q13 thanks to Asia Pacific region

Introduction:

Infonetics Research released vendor market share and preliminary analysis from its 2nd quarter 2013 (2Q13) Service Provider Routers and Switches report.

2Q13 CARRIER ROUTER AND SWITCH MARKET HIGHLIGHTS:

•Globally, service provider router and switch revenue is up 27% in 2Q13 from 1Q13, to $4 billion, showing that service providers are ready to spend after holding back in the previous quarter

•In the overall carrier router and switch market, Huawei gained 4 market share points in 2Q13, rising back into the #2 spot behind leader Cisco

•IP edge (edge routers and carrier Ethernet switches) revenue grew 30% sequentially in 2Q13, attributable in part to an uptick in the move to 100GE on routers and 100G in optical transport

◦Meanwhile, core routers grew the slowest quarter-over-quarter

•Alcatel-Lucent, Cisco, Huawei and Juniper together account for about 90% of total router (edge and core) revenue in 2Q13

•Over the past 2 years (4-quarter rolling average), Huawei gained the most edge and core router market share points of any vendor, up 5.6 points

Analyst Commentary:

“The 2nd quarter is usually up for carrier routers and switches, but this one is exceptional given the sluggishness of the past few years. Every major geographical region except Japan notched double-digit sequential growth and, more important, gained from the year-ago quarter,” reports Michael Howard, principal analyst for carrier networks and co-founder of Infonetics Research. “In Asia Pacific, carrier router and switch revenue jumped 45% from the previous quarter thanks in large part to Huawei’s and ZTE’s stellar performance,” Howard adds. “And even recent laggard Europe/EMEA gained nicely, possibly signaling a pitch forward.”

REPORT SYNOPSIS:

Infonetics’ quarterly router and switch report provides worldwide, regional, China, and Japan market share, market size, forecasts through 2017 and analysis for IP edge and core routers, carrier Ethernet switches, and the IP edge market by application. Vendors tracked: Alaxala, Alcatel-Lucent, Brocade, Ciena, Cisco, Ericsson, Fujitsu, Hitachi, Huawei, Juniper, NEC, Tellabs, ZTE, others.

To buy the report, contact Infonetics:

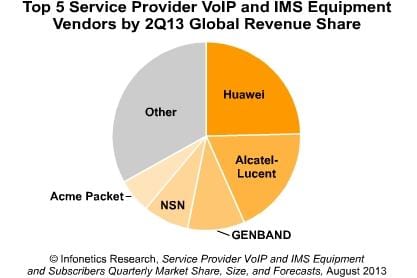

VoLTE in N America Boosts Carrier VoIP/IMS market by 30% in 2Q13

Infonetics Research released vendor market share, forecasts and preliminary analysis from its 2nd quarter 2013 (2Q13) Service Provider VoIP and IMS Equipment and Subscribers report. (Full report will be published August 29th)

2Q13 CARRIER VOIP/IMS MARKET HIGHLIGHTS:

•Typically a strong quarter, in 2Q13 the global service provider VoIP and IMS equipment market grew 30% sequentially, to $936 million

•All major geographical regions – North America, EMEA (Europe, Middle East, Africa), Asia Pacific and Latin America – posted year-over-year and quarter-over-quarter gains in 2Q13

•North America continues to be positively impacted by LTE-related activity, growing 78% year-over-year in 2Q13

•The standout vendors in 2Q13 in terms of sequential revenue growth are Alcatel-Lucent, BroadSoft, Genband, Huawei and Sonus

•Meanwhile, Huawei, Alcatel-Lucent and Genband remain atop the VoIP and IMS market share leaderboard

“IMS equipment has officially moved into an LTE and voice-over-LTE world, and there’s no going back now,” notes Diane Myers, principal analyst for VoIP, UC and IMS at Infonetics Research. “In the second quarter we saw this impact spending on session border controllers and IMS core equipment for VoLTE access and interconnection (LTE to 3G) buildouts.”

Myers adds: “Though LTE- and VoLTE-related equipment sales are growing, the market will continue to be lumpy from quarter to quarter.”

VOIP AND IMS REPORT SYNOPSIS:

Infonetics’ quarterly carrier VoIP and IMS report provides worldwide and regional market share, market size, forecasts through 2017, analysis, and trends for trunk media gateways, SBCs, media servers, softswitches, voice application servers, HSS, CSCF, BGCF, MGCF, IM/presence application servers, and subscribers. Vendors tracked: Acme Packet, Alcatel-Lucent, BroadSoft, Ericsson, Genband, Huawei, Metaswitch, NSN, Radisys, Sonus, ZTE and others.

To buy the reports, contact Infonetics: http://www.infonetics.com/contact.asp

From IBIS World:

“Voice over Internet Protocol (VoIP) experienced massive growth at the start of the past five-year period, though residential customer growth has since flattened out. Regulations and the dominance of companies like Google threaten the industry, but the expansion of mobile broadband networks will open up new avenues for growth. Cable companies able to bundle VoIP service with cable service will fare best in consumer markets in the coming five years, while businesses will slowly but surely turn to VoIP for voice needs…”

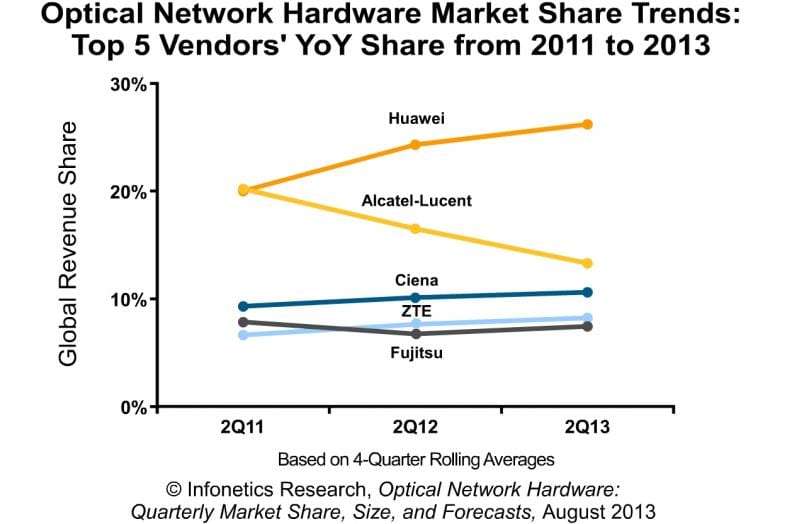

Infonetics: Top 3 Optical Nework Equipment leaders are Huawei, Alcatel-Lucent & ZTE

- The global optical network hardware market, including WDM and SONET/SDH equipment, totaled $3.3 billion in 2Q13

- EMEA (Europe, Middle East, Africa) is operating at record low levels of optical capital intensity; positive capex rumbles from tier 1 carriers have yet to translate into more optical spending

- The top 3 optical market share leaders in 2Q13 are, in rank order, Huawei, Alcatel-Lucent and ZTE

- Alcatel-Lucent continues to decline on a year-over-year basis, though optical investment is set to increase in 2013 as part of its SHIFT Plan to double down on optical and routing

- Ciena is well positioned to capture the torrent of 100G spending expected this year from AT&T and Verizon

- Infinera is the fastest-growing supplier of optical WDM gear in Europe

- Infonetics’ August Optical research brief

- 100G optical coherent systems, CDC ROADMs offer hope in stagnant WSS component

- OTN switching reaching mainstream status with service providers

- 100G optical transceiver shipments more than doubling in 2013 and 2014

- Optical transport network (OTN) market to top $13 billion by 2017

- Breakout growth ahead for OTN switching

- 10G/40G/100G Optical Transceivers Market Size and Forecasts

- 40G/100G and ROADM Strategies: Global Service Provider Survey

- Optical Equipment Vendor Leadership: Global Service Provider Survey

- Optical Network Hardware Vendor Market Share – 2Q13 Full Analysis

- The OTN Expansion: The Next Carrier Upgrade Cycle (Sept. 17: Learn more / register)

- SDNs and NFV: Why Operators Are Investing Now (View on-demand)

- Making 100G Optical Economical for the Metro (View on-demand)

- Improving Network Economics with IP over OTN (View on-demand)

Global Optical Transport Network (OTN) Equipment Industry

http://www.reportlinker.com/p01518541/Global-Optical-Transport-Network-OTN-Equipment-Industry.html#utm_source=prnewswire&utm_medium=pr&utm_campaign=Network_Equipment

This report is quite expensive at $4500 per copy. It analyzes the worldwide markets for Optical Transport Network (OTN) Equipment in US$ Million by the following Product Segments: OTN Transport Equipment, and OTN Switching Equipment. The report provides separate comprehensive analytics for the US, Canada, Europe, Asia-Pacific, Middle East, and Latin America. Annual estimates and forecasts are provided for the period 2009 through 2018. The report profiles 47 companies including many key and niche players such as ADTRAN Inc., ADVA Optical Networking SE, Alcatel-Lucent, Aliathon Technology Ltd., Ciena Corporation, Cisco Systems, Inc., ECI Telecom Ltd., Ericsson, Fujitsu Limited, Huawei Technologies, Infinera Corporation, JDS Uniphase Corporation, NEC Corporation, Tellabs, Inc., and ZTE Corporation. Market data and analytics are derived from primary and secondary research. Company profiles are primarily based on public domain information including company URLs.

Huawei Closing in on Cisco’s Dominance of Enterprise Networking Market + Infonetics Scorecard Ranks Other Vendors

Huawei Technologies Ltd (China) expects 40% growth in its enterprise-network business revenue this year to about $2.7 billion. By 2017, the company aims to increase the segment’s revenue to more than $10 billion. That’s a very steep climb from 2012, when Huawei enterprise-network equipment business generated $1.9 billion in revenue, which was only 5% of Huawei’s total revenue.

By contrast, 73% of the company’s revenue came from its telecom-gear business, while its mobile-handset business accounted for about 22%.

Huawei sees opportunities in enterprise-network equipment because the market is going through major changes, with more companies adopting cloud computing and bring-your-own-device policies. Potential growth is greater than the telecom network market, said William Xu, a Huawei senior executive in charge of the enterprise-network business.

Huawei’s enterprise-network business currently generates roughly half of its revenue outside China, and its strong overseas markets are in Europe, Latin America and Asia. Huawei is spending $600 million this year on research and development for its enterprise network equipment, up from $500 million.

Read more at: http://infotechlead.com/2013/08/08/huawei-enterprise-network-biz-revenue-to-grow-40-to-2-7-billion-in-2013/

Scott Thompson of FBR on Huawei threat to Cisco: While Huawei Technologies Co., Ltd. has been unable to gain a

foothold in North America (due to the impact of the attached stigma from the stance of the U.S. House Subcommittee on

Cybersecurity), without the EU taking a firm stand with the U.S., we expect Cisco has more revenue at risk in China than Huawei has in the U.S.”

Excerpts follow from Infonetics’ Enterprise Networking and Communication Vendor Leadership Scorecard, which profiles and ranks the top 8 vendors of enterprise networking, network security, and communication equipment/software: Alcatel-Lucent, Avaya, Brocade, Cisco, HP, Juniper, NEC and Siemens Enterprise. Note that Huawei was not included in this vendor evaluation.

According to Infonetics Marketing Director Kim Peinado, the vendor rankings are based on actual data and metrics, including direct feedback from buyers, vendor market share, share momentum, financials and solution portfolio — eliminating subjectivity.

Infonetics reports that Cisco has the highest score and leads the rest of the field by a wide margin, giving them an adequate cushion to bolster against future score fluctuations in multiple areas. Cisco has the broadest product portfolio, the highest market share, the strongest financials, and the strongest overall brand. Cisco’s key weakness is market share momentum due to a slight decline in market share in 2012.

ENTERPRISE SCORECARD HIGHLIGHTS:

. Aside from #1 Cisco, for the most part vendor scores fall into a narrow range; a notable exception is financial stability, where there is significant variability in scores

. Brocade strongly improved its ranking this year (tied with Juniper for 2nd place) due to improvements in financials, market share momentum and buyer perception

. Juniper maintained its score from last year, as improvements in solution breadth and buyer perception were offset by weaker financials

. HP ranks 2nd in 5 out of 7 criteria but slid into 4th place overall due to slowing market share momentum and weakening financials

. The core business of the other 4 vendors analyzed in the report – Alcatel-Lucent, Avaya, NEC and Siemens Enterprise – revolves around the PBX market, which has been slow to recover from the recession, limiting their financial stability and growth prospects

. That said, Alcatel-Lucent, Avaya and Siemens offer some of the most extensive product portfolios, and NEC’s early work on software-defined networking (SDN) could raise its technology innovation scores next year

ANALYST QUOTES:

“More than 100 vendors are vying for a piece of the $50 billion enterprise networking and communication infrastructure market, but only 8 have a diverse product offering and consistently capture more than 1% market share,” observes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research and lead author of the report. “Our enterprise scorecard helps buyers make accurate comparisons among vendors based on commonly-used purchase criteria and identify which vendors are most suitable for their organization’s specific requirements.”

Machowinski adds: “Cisco leads this field by a wide margin, claiming a perfect score in 6 out of the 7 criteria that we measure in our enterprise vendor scorecard. But the battle for 2nd place remains heavily contested, as witnessed by the tie this year between Brocade and Juniper.”

ABOUT THE SCORECARD:

Infonetics’ annual enterprise vendor scorecard evaluates the leading enterprise networking and communication equipment vendors using criteria that are commonly used by buyers to select vendors, demonstrate success in the marketplace, and position a vendor for success. The matrix rankings are based on 7 criteria including market share; market share momentum; financial stability; solution breadth; technology innovation; product reliability; and service and support. Companies ranked: Alcatel Lucent, Avaya, Brocade, Cisco, HP, Juniper, NEC and Siemens Enterprise.

A note on excluded vendors:

·Huawei reported over $1.8B in total enterprise revenue last year but does not break out how much of that revenue comes from enterprise networking and communication infrastructure. Once Huawei starts providing revenue break-outs and meets the threshold for inclusion, we will add Huawei to future scorecards.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

GET THE SCORECARD FREE:

Qualified businesses and service providers can download Infonetics’ 2013 Enterprise Networking and Communication Vendor Leadership Scorecard – worth $500 – free of charge for a limited time at

FBR: Analysis of Level 3 2Q13 Results; Revenue Outlook Remains Uncertain

David Dixon of FBR Capital Markets:

Level 3 Communications (http://www.level3.com/) reported weak 2Q13 earnings due to below-consensus consolidated EBITDA. Core revenues were line with consensus with growth weighted once again to Latin America and enterprise. While this was encouraging, we remain concerned that top-line trends are likely to remain weaker than expected, and the cost structure of the company may shift more than expected due to the change in the nature of content relationships which may drive a review of peering interconnections with end-user networks and the potential migration of customers to single integrated wireline/wireless providers.

While management continued to cite strong demand from enterprise customers, we reiterate our belief that this is largely for lower-margin “feeds and speeds” versus “higher-margin managed services.” Growth is consistently coming at lower price points, as North American transport and related services are commoditized.

The Internet is changing; impact of software-defined networks (SDNs) is unclear. We expect significant increases in the long-haul network utilization of major carrier networks at dramatically lower opex costs. The simplification of routing protocols and a focus on source origination and destination of application flows could increase disintermediation risk for Level 3 Communications.

New acquisition on the horizon? The company has already captured much of the initial benefits from the Global Crossing acquisition as two-thirds of the $300 million in savings having already occurred in the first six quarters after the merger (ending in 1Q13). Management reemphasized that the company has just begun to see the advantages of improved operating leverage. However, this would require the unified migration of long-haul AND metro network systems, processes, and data, which has eluded Level 3 in past transactions.

While we do not foresee Level 3 as being acquired (i.e., by Sprint to enhance its network backhaul positioning), we

believe the company may be a quarter or two from its next acquisition, given the moderating organic outlook.

References:

1. Level 3 Reports Second Quarter 2013 Results

http://level3.mediaroom.com/2013-07-31-Level-3-Reports-Second-Quarter-2013-Results

2. Level 3’s 2Q2013 earnings call replay can be accessed by dialing 1 800-633-8284 (U.S. Domestic) or 1 402-977-9140 (International), conference code 21660691

Or register to hear it on line at: http://www.media-server.com/m/p/e6feabzi

End Note:

Level 3 is one of the few competitive nationwide wireline carriers left in the U.S. The others include Century Link (which includes x-RBOC U.S. West/Qwest), Frontier, TW Telecom, XO Communications, TDS Telecom, Cogent, Zayo, Reliance Telecom, Integra Telecom, and others.

Some like Cogent and Level 3 mostly re-sell their telecom facilities to other carriers. Zayo, Reliance and Integra are mostly Business Ethernet carriers. TW Telecom and XO also are Ethernet providers, but in many locations do not own their own fiber and have to resell other carrier (e.g. AT&T) services.