Huawei to Invest more in Europe; Wants to be Perceived as a European Company

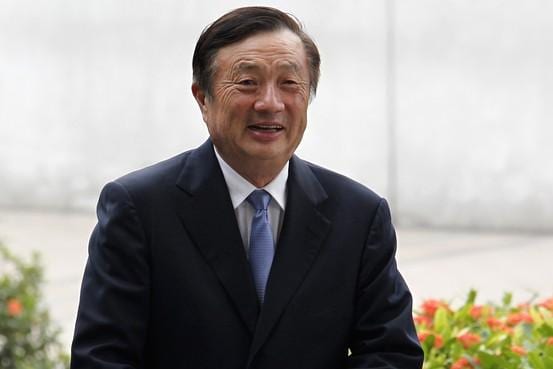

Huawei Technologies Co.’s chief executive Ren Zhengfei told reporters in London that the Chinese telecommunications-equipment maker plans to increase investment and hiring in Europe as part of an effort to change perceptions of a company he acknowledged has been seen as “mysterious.” Huawei wants to be perceived as more of a “European” company. As part of that directive, Huawei will increase investment in European research and development, and will extend an employee incentive plan to all key non-Chinese employees this year in order to attract and keep top talent, Mr. Ren said.

Ren said: “Right now we should not be expending too much effort in the United States as it might take 10 or 20 years for them to know that Huawei is a company with integrity. We will accelerate efforts in countries that have accepted us.”

Huawei CEO Ren Zhengfei (above) told Reuters:

“Our idea is to make people perceive Huawei as a European company.”

Ren started Huawei in 1987 after retiring from the Chinese military in 1983. Since then, he has built the company into the world’s largest maker of equipment for telecom networks behind Ericsson AB (ERICB), even without access to the U.S. telecommunications market, where Huawei has battled claims the company’s gear may provide opportunity for Chinese intelligence services to tamper with networks for spying. The closely held company has repeatedly denied those allegations, and doesn’t see a public listing as a way of building trust, Ren said.

Huawei has faced allegations in the U.S. that it is a security risk, as well as the threat of an European Union investigation into allegations that China is dumping or subsidizing products pertaining to mobile-telecommunications networks.

“My reluctance to meet with the media has been used as a reason to label Huawei as a mysterious company,” Mr. Ren said through a translator during an interview with Reuters. In a few years, “our idea is to make people perceive Huawei as a European company,” he said.

“By increasing our level of transparency, we still may not be able to address the U.S. government’s concerns,” Ren said. “The reality is that shareholders are greedy and want to squeeze every bit out of the company. Not listing on the stock market is one of the reasons we have overtaken our peers.” By contrast, Huawei’s employee-owned structure, he said, is “part of the reason Huawei could catch up and overtake some of our peers in our industry.”

Huawei grabbed nearly 22% of mobile-network infrastructure spending in Europe, the Middle East and Africa last year, up from just 12% in 2010, according to market-research firm Infonetics. By contrast, in North America, Huawei had only a 2.8% share of that market in 2013—prompting the company to pull back from investments there.

Even as Huawei fights cybersecurity concerns that have restricted access for its network equipment in the U.S. and Australia, the company said last month its sales will rise 77 percent to $70 billion by 2018, from $39.5 billion last year. Ren said the company would continue to increase its research spending, which rose last year to roughly $5 billion, at average 2013 exchange rates, compared with Ericsson’s $4.9 billion.

To reach its revenue target, Huawei is broadening its portfolio with smartphones, tablets and business-computing products, and cloud services. Ericsson, which divested its mobile-device business to focus on network equipment, has reported stalling revenue for two consecutive years. Ren acknowledges that Huawei faces a challenge to convince customers to buy its smartphones amid intense competition.

“There is no way to imitate the growth of Apple and Samsung,” he said. “We will have to work out the way for ourselves. We need to take a step-by-step approach.”

The approach has begun to pay off. Worldwide, the company sold more smartphones last year than any company aside from Samsung Electronics Co. and Apple Inc, as it boosted its share of the global market to 4.9 percent, from 4 percent in 2012, researcher International Data Corp. reported in January. The success has been possible as the company has faced fewer headwinds with consumer products than for its equipment that run mobile networks.

References:

http://www.bloomberg.com/news/2014-05-02/huawei-s-ren-plots-future-outsi…

http://online.wsj.com/news/articles/SB1000142405270230367840457953760327…?