Infonetics: Cloud is Top Priority for N. America Enterprise Network Spending

Infonetics Research released excerpts from its 2014 Network Equipment Spending and Vendor Leadership: North American Enterprise Survey, which explores businesses’ top networking initiatives, budget priorities and growth, investment drivers and barriers, and vendor preferences.

NETWORK EQUIPMENT SPENDING SURVEY HIGHLIGHTS:

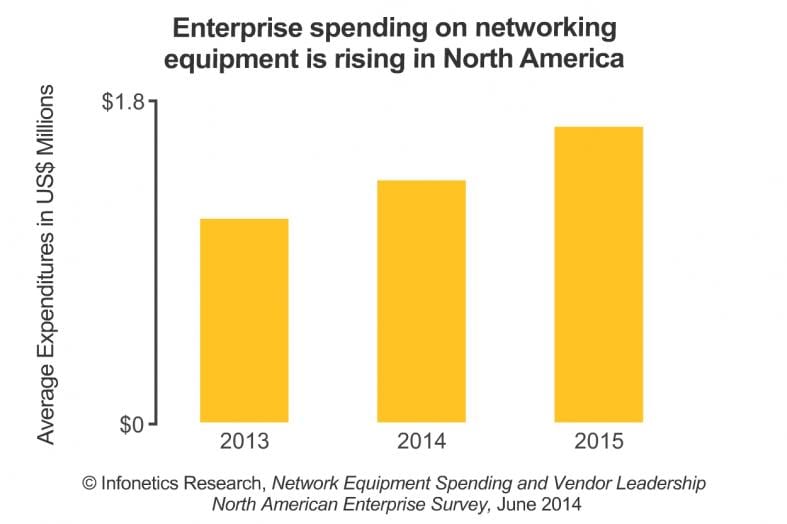

. Respondent companies spent, on average, over $1.1 million on networking equipment in 2013, and they expect to increase spending by 19% this year

. Wireless LAN (WLAN) budget allocations are on the rise among those surveyed, becoming the #2 investment area for 2014

. The economic outlook for North America is positive and companies are looking to capitalize on new opportunities, leading to an expenditure shift from headquarters to branch offices

. Around 3/4 of respondents consider Cisco the top network equipment vendor, an even better showing than in Infonetics survey last year

. Juniper has made major gains from last year, moving up 3 positions in respondent ratings

ANALYST NOTE:

“Our just-finished survey on network equipment spending indicates the outlook for network equipment is healthy. Enterprises are expecting double-digit growth in their expenditures this year and next. How they are spending their budgets is changing, and allocations towards wireless LAN, network monitoring, and switches are growing. Greater spending on branch office infrastructure is also anticipated, a sign of confidence in continued economic expansion,” notes Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research.

Machowinski adds: “One of the most interesting findings is that cloud has emerged as the number-1 networking initiative over the next 12 months. Companies are embracing the cloud in a services model as well as building their own cloud-architected data centers, and this means upgrades to network infrastructure.”

Author NOTE:

For several years, the issue of a standardized cloud network interface and architecture has been neglected. The alternatives includes: public Internet, private line [to cloud service providers (CSP) Point of Presence (PoP)], IP MPLS VPN, Ethernet for Private Cloud (a MEF initiative) and hybrid/combinations of the above. Each CSP offers a different set of alternative interfaces and architectures- often via third parties. It’s amazing that this issue hasn’t drawn more attention from the official standards bodies (IEEE started an initiative in this area in 2011, had 1 meeting and then it went dark- with no notice given to the meeting attendees, including this author.).

ABOUT THE SURVEY:

For its 27-page network equipment spending survey, Infonetics interviewed 207 North American organizations that have at least 100 employees about their networking equipment, plans, and purchase considerations over the next two years. The survey provides insights into networking initiatives, budget priorities and growth, investment drivers and barriers, and vendor preferences.

Vendors named in the survey include Alcatel-Lucent, Apple, Aruba, Avaya, Brocade, Cisco, D-Link, Dell, Extreme/Enterasys, HP, Huawei, IBM, Juniper, Linksys, Microsoft, Motorola, Oracle, Netgear, others.

To buy the report, contact Infonetics: www.infonetics.com/contact.asp

More info at: http://www.infonetics.com/pr/2014/Enterprise-Network-Equipment-Spending-Survey-Highlights.asp

Public Cloud Services growing at 23%:

Separately, gllobal spending on public cloud services reached US$45.7 billion last year and will experience a 23 percent compound annual growth rate through 2018, according to analyst firm IDC.

Some 86 percent of the 2013 total came from cloud software, which encompasses both SaaS (software as a service) applications and PaaS (platform as a service) offerings, with the remaining 14 percent generated by cloud infrastructure, IDC said on July 7th.

IDC ranked Amazon.com first in the PaaS market, with Salesforce.com and Microsoft tied for second place, followed by GXS and Google. Amazon was also No. 1 in the infrastructure category, followed by Rackspace, IBM, CenturyLink and Microsoft.

Geographically, the U.S. accounts for 68 percent of the overall public cloud market, but this figure will fall to 59 percent by 2018 as Western Europe’s take rises from 19 percent to 23 percent and growth picks up in emerging markets, IDC said.

“We are at a pivotal time in the battle for leadership and innovation in the cloud. IDC’s Public Cloud Services Tracker shows very rapid growth in customer cloud service spending across 19 product categories and within eight geographic regions. Not coincidentally, we see vendors introducing many new cloud offerings and slashing cloud pricing in order to capture market share. Market share leadership will certainly be up for grabs over the next 2-3 years,” said Frank Gens, Senior Vice President and Chief Analyst at IDC.

The SaaS market – accounting for 72% of the total public cloud services market and forecast to grow at a 20% CAGR over the forecast period – is dominated by Enterprise Applications cloud solutions such as enterprise resource management (ERM) and customer relationship management (CRM), followed by Collaborative applications. System Infrastructure Software cloud solutions – the other major part of the SaaS market, including Security, Systems Management, and Storage Management cloud services – drove 21% of the 2013 SaaS market. From a competitive perspective, the SaaS service provider ecosystem is largely led by Salesforce.com followed by ADP and Intuit. Traditional software vendors Oracle and Microsoft hold the 4th and 5th positions, respectively.

The PaaS market – accounting for 14% of the market in 2013 with a forecast CAGR of 27% – is composed of a wide variety of highly strategic cloud app development, deployment, and management services. In 2013 and 2014, PaaS spending has been largely driven by Integration and Process Automation solutions, Data Management solutions, and Application Server Middleware services. From a market share standpoint, the 2013 PaaS market was led by Amazon.com, followed by Salesforce.com and Microsoft (both share the number 2 position). GXS and Google hold the 4th and 5th positions, respectively.

More info at: http://www.idc.com/getdoc.jsp?containerId=prUS24977214