Infonetics: 25GE & 50GE to transform Data Center network architectures; 2 SDN models to converge

Infonetics Research, now part of IHS Inc. (NYSE: IHS), today released excerpts from its 3Q14 Data Center Network Equipment report, which tracks data center Ethernet switches, Ethernet switches sold in bundles, application delivery controllers (ADCs) and WAN optimization products.

3Q14 DATA CENTER MARKET HIGHLIGHTS:

. The global data center Ethernet switch market put in a good showing in 3Q14, up 5 percent sequentially to $2.2 billion; positive forces include the U.S. public sector and cloud service providers

. Though worldwide application delivery controller revenue is down 2 percent in 3Q14 from 2Q14, the ADC market has grown consistently on a year-over-year basis for the last six quarters

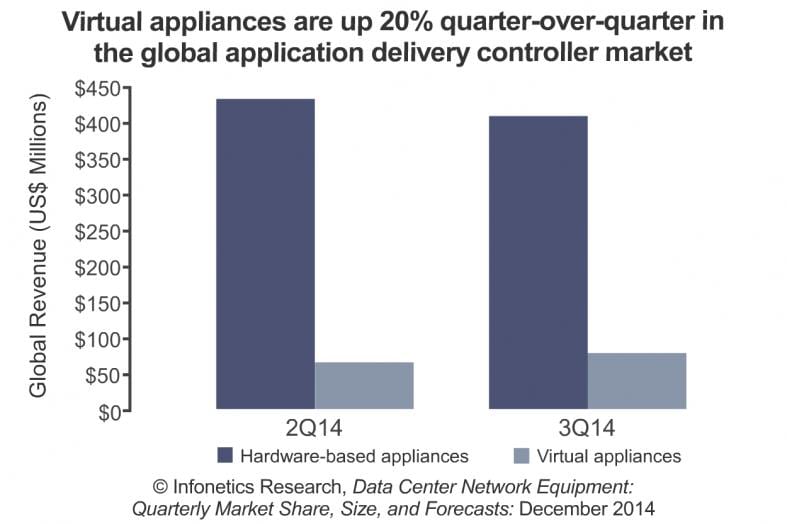

. Virtual Application Delivery Controller (ADC) appliances are up 20 percent from the previous quarter

. Globally, WAN optimization revenue is up 9 percent sequentially in 3Q14, but down 1 percent from the year-ago third quarter

. There are more new entrants in the WAN optimization space with Siaras and Viptela jumping in, but the market has yet to return to long-term growth

“The data center switching market is poised for another transformation with 25GE and 50GE enabling new data center network architectures targeting large cloud service providers looking to migrate from 10GE switching and server connectivity to 100GE switching and 25GE server connectivity,” said Cliff Grossner, Ph.D., directing analyst for data center, cloud and SDN at Infonetics Research.

Grossner added: “A new generation of Broadcom switching silicon will add 25GE and 50GE to the mix of port speeds in the data center for 2015.”

References:

1. Overview of 25G & 50G Ethernet Specification, Draft 1.4 from a consortium (NOT an IEEE 802.3 standard yet)

http://25gethernet.org/sites/default/files/25G%20and%2050G%20Specificati…

2. Ethernet Switch Market: 40G growth; 2.5G and 25G Ethernet coming, but not IEEE 802.3 standards yet

3. A new video discussing beyond 25Gigabit Ethernet from Ethernet Alliance 2014 Rate Debate

DATA CENTER REPORT SYNOPSIS:

Infonetics’ quarterly data center equipment report provides worldwide and regional market size, vendor market share, forecasts, analysis and trends for data center network equipment, including data center Ethernet switches, ADCs, WAN optimization appliances, and Ethernet switches sold in bundles. Vendors tracked: A10, Alcatel Lucent, Arista, Array Networks, Aryaka, Barracuda, Blue Coat, Brocade, CloudGenix, Cisco, Citrix, Dell, Exinda, F5, HP, Huawei, IBM, Ipanema, Juniper, Kemp, NEC, Radware, Riverbed, Siaras, Silver Peak, Talari, VeloCloud, Viptela and others.

To purchase the report: www.infonetics.com/contact.asp

In a long phone conversation with Cliff, I asked him to comment on the four SDN architectural models for the data center. There are (at least) 4 architectural models with many variations of each/different protocols used:

- Centralized SDN controller supporting many data forwarding plane (“packet engines”) distributed throughout the network. Strict separation of Control and Data planes with Open Flow v1.3 as the southbound API from Control Plane to Data Plane(s).

- Network Virtualization/overlay of a logical network over a smaller physical network. Often, there is a L2 over L3 tunneling protocol (e.g. VxLAN) used to effectively create VLANs over a physical WAN

- Network equipment vendor, e.g. Cisco offering programmable interface for more control over its switch/router, e.g. configuration, re-routing decisions, policy, monitoring, troubleshooting,etc. That largely replaces CLI commands.

- Network operator/provider, (e.g. AT&T Netbond) offering a SDN WAN with proprietary routing protocol and other programmable features. Only the suppliers/vendors chosen are privy to the network operator’s spec, which when implemented in equipment, won’t work on any other provider’s network.

After considering the above, Cliff wrote in an email: “If you relax the Openflow constraint, then I think models 1&3 are the same. This is what I refer to as the underlay model.” Of course, that implies that the vendor specific approach to SDN totally separates the Control and Data Planes, which are implemented in different boxes.

We didn’t discuss the role of the new speed Ethernet specs for the data center. Those were covered in this article:

Ethernet Switch Market: 40G growth; 2.5G and 25G Ethernet coming, but not IEEE 802.3 standards yet

https://techblog.comsoc.org/2014/12/11/ethernet-switch-market…