Month: June 2016

Verizon, KT to work together on 5G standard; US Telecom says FCC could impede 5G Deployment

1. Verizon and KT to collaborate on 5G standard and technology:

Verizon Communications (VZ) and Korea Telecom (KT) will collaborate on development of 5G wireless technology ahead of a planned 2018 demonstration of the proposed standard.

KT Chairman Hwang Chang-gyu noted in a statement: “Global partnership for the 5G standardization is very crucial ahead of its planned commercialization in 2020.”

Up till recently, it appeared VZ didn’t agree as the US carrier had announced 5G trials before ITU-R even defined what 5G is and the specs aren’t to be finalized till the end of 2020. VZ inked a partnership with Samsung to make their 5G trials real.

Carriers and manufacturers are making their 5G speed tests public, but until a global standard is established, it is difficult to gauge the accuracy of the 5G speed tests by the companies.

The 5G service is expected to roll out by 2020, but Korea Telecom aims to be ahead of the pack and deliver 5G capabilities by 2018 during the PyeongChang Winter Olympics. The deal between KT and Verizon means that the latter will pool its efforts to push out the next generation of wireless service, which should make sure KT checks its objective. Keep in mind that Verizon was the first carrier that introduced 4G LTE service in the United States and there is a high chance to repeat the feat with 5G.

Although 5G remains a debatable subject, a tight partnership of the two large global carriers can make sure that the technical infrastructure is ready quicker than expected.

|

AT&T to use LTE, Cat-M1 & M2 for IoT Applications

AT&T is moving forward with LTE future for its cellular Internet of Things (IoT) applications, despite earlier suggestions that the network operator could consider other low-power, wide-area (LPWAN) specifications. The LTE only decision is consistent with AT&T’s existing LTE based IoT platform, which we described in an earlier article:

AT&T claims to have the largest share of the connected device market with 19.8M IoT devices or 47% of the U.S. total IoT market in 2013. There are GSM location tracking capabilities in over 100 countries with roaming access in more than 200 countries.

AT&T is a founding member of the Industrial Internet Consortium where over 100 companies are now involved. As part of that effort:

- IBM and AT&T are collorating on IoT solutions for cities, institutions, and enterprises.

- GE and AT&T are working on remotely controlled industrial machines.

“I think the decision that we have made as a company is that AT&T is going to standardize on the LTE stack as opposed to unlicensed bands,” Mobeen Khan, AVP of AT&T IoT Solutions, at AT&T Mobile and Business Solutions, told Light Reading Wednesday, June 22nd. AT&T has “many reasons” for the decision: The specialized IoT LTE technologies uses AT&T’s existing spectrum; it’s more secure and can be managed using existing infrastructure. “It has a lot of benefits for our customers,” Khan said.

AT&T is going to standardize on Cat-M1 (a.k.a. LTE-M) for devices like smart meters and wearables. Cat-M1 is optimized to offer a 1Mbit/s connection but with superior battery life compared to the typical 4G smartphone radio chipset. The operator has just approved its first modules for this specification. There will be trials in the forth quarter.

For even lower-power applications, AT&T will use Cat-M2 modules in units like smoke detectors and networked monitors. Cat-M2 is “still being specced out” but is anticipated to go to kilobits-per-second connection rates to further extend battery life, Khan said. AT&T will test Cat-M2 devices on the network in 2017 and hopes to go commercial early in 2018.

This doesn’t mean that AT&T won’t support any other types of networking for IoT. WiFi, Bluetooth and mesh networking will all be part of the mix. “We’re living in a multi-network world,” Khan said.

References:

http://www.lightreading.com/iot/iot-strategies/atandt-settles-on-lte-for-cellular-iot/d/d-id/724289

http://www.lightreading.com/iot/m2m-platforms/atandt-readies-low-power-lte-for-iot/d/d-id/720150

Energy versus security–the IoT tradeoff:

AT&T and other leading telcos are highlighting the security advantages of using cellular networks in licensed spectrum to connect IoT devices. They point to the benefits of having a SIM card authenticate the device on the network, such as being able to remotely bar devices, where necessary. Without a secure link, IoT applications may be more vulnerable to attacks, such as spoofing, where a fraudulent end device injects false data into the network or a fraudulent access point hijacks the data captured by a device.

AT&T Focus on Smart City Development (part of IoT)

An AT&T executive offered an update on the carrier’s “smart city” program, in which the company is competing against other providers in the Internet of Things space.

‘Secure connectivity’ is the common thread in smart city technologies

Matt Foreman, lead product marketing manager for the smart cities business unit, discussed the differences between selling to governments and enterprises, noting that cities are especially wary of introducing new technologies that could prove risky or insecure. Foreman said:

“AT&T is super excited about this space. Really, secure connectivity is the common thread woven through any smart city technology,” which can range from smart electric and water meters to connected garbage cans, street lights, irrigation systems and even acoustic leak detection.

“All of those are anchored on secure connectivity whether that be LTE, whether that be fiber,” or satellite, Foreman said. “We want to make sure we’re the connectivity provider of choice, taking our best in breed practices and capabilities to help cities solve problems for their citizens.”

He emphasized that, when dealing with government, derisking a deployment is key. “The technology that’s influencing and changing the direction of how cities can operate, interact with their citizens and create that compelling place to live is tried, true and proven. There’s a huge startup ecosystem that we want to solve for and bring into that fold, but at the same time we don’t want cities to think these are new technologies.”

Foreman also highlighted the differences between selling to government and selling to the enterprise. “”When you think about the enterprise side versus government, there’s different sales cycles and different procurement considerations. When you think about some of these account teams and relationships that are out there…AT&T is really well positioned to come in and help bubble up decision making and strategy out of the individual departments to a higher level so you get incremental, exponential value.”

More, including video clip, at: http://industrialiot5g.com/20160617/channels/news/att-smart-city-tag17

Separately, AT&T vowed to appeal a Federal court decision to uphold the FCC’s network neutrality rules

“We have always expected this issue to be decided by the Supreme Court, and we look forward to participating in that appeal,” AT&T Senior Executive Vice President and General Counsel David McAtee said in a statement.

“Today’s ruling is a victory for consumers and innovators who deserve unfettered access to the entire web, and it ensures the internet remains a platform for unparalleled innovation, free expression and economic growth,” FCC Chairman Tom Wheeler said in a statement. “After a decade of debate and legal battles, today’s ruling affirms the Commission’s ability to enforce the strongest possible internet protections – both on fixed and mobile networks – that will ensure the internet remains open, now and in the future.”

Highlights of Ericsson Mobility Report

The latest Ericsson Mobility Report covers the period to 2021. Ericsson has forecast significant growth in a wide range of factors. Some of the highlight figures include:

- Mobile broadband subscriptions: CAGR of 15%

- LTE subscriptions: CAGR of 25%

- Data traffic per smartphone: CAGR of 35%

- Total mobile data traffic: CAGR of 45%

Video to dominate mobile traffic growth:

Ericsson expects video to continue to play a large part in the data traffic growth mainly due to teenagers streaming video.. In 2015 video was some 40–55% of the total mobile data traffic depending on the device type and is forecast to have a CAGR of 55% to 2021. By 2021 Ericsson forecasts that video will account for some 70% of mobile data traffic. As the report notes: “Today’s teens… have no experience of a world without online video streaming.”

To meet such growth, LTE continues to provide fast speeds with current deployments providing up to 600Mbps (Cat 11), which will grow to 1Gbps LTE (Cat 16) with deployments in in 2016 according to Ericsson.

5G to start in 2020:

Looking beyond 4G and the massive growth, Ericsson forecasts that 5G services will commence in 2020 based on ITU IMT2020 standards, and that there will be 150 million 5G subscribers by 2021 led by rollouts in South Korea, Japan, China and the US.

IoT endpoints to overtake mobile phones:

In one of the most eye-catching predictions, Ericsson suggests that the number of IoT connected end points — such as cars, machines, smart meters and consumer tech — will overtake the number of mobile phones in 2018. IoT devices are forecast to grow at a CAGR of 23% over the period, and what is worth noting is the connectivity types including non-cellular IoT connectivity and the various low-power wide-area (LPWA) proprietary systems like SIGFOX, LoRa and Ingenu. Ericsson forecasts non-cellular IoT to be almost 10 times the cellular IoT by 2021.

VoLTE growth:

Voice over LTE (VoLTE) also features in the report. Ericsson forecasts that the 100 million VoLTE subscriptions at the end of 2015 will increase to 2.3 billion by 2021 — representing over 50% of all LTE subscriptions. In the US, Canada, South Korea and Japan this figure rises to over 80%.

The article on managing user experience describes how high traffic load in less than a tenth of the mobile radio cells in metropolitan areas can affect more than half of the user activity over the course of 24 hours.

In the last article, Ericcson discusses the need for global spectrum harmonization to secure early 5G deployments.

Illustrations:

Mobile subscriptions

State of the networks

In analyzing the report, John Okas of Real Wireless wrote:

One of the key conclusions from the report is that managing the user experience is key for network operators and infrastructure providers – and all of the trends highlighted above are making that an increasingly complex challenge. As such, Data analytics are increasingly being applied to find the relationship between user experience and network performance statistics. Such an understanding is vital for operators to prioritise network investment as well as keep churn low. As the data from the report shows, operators face many calls on capex and opex as new technology combined with new use cases (and hopefully more spectrum), gives operators new opportunities and as well new challenges.

Of course, vendors put time and effort in to these reports to bring these challenges into sharp focus for the operators along with whatever solutions the vendor may have to offer. Real Wireless provides deep independent expertise in all of the areas and topics covered in such vendor reports including LTE, 5G and IoT. We’re involved in the business, technology, regulation and markets, working with all parts of the ecosystem including vendors, operators, regulators and end users. We help bring clarity and understanding to the challenges as well as the opportunities in the wireless world — without bias.

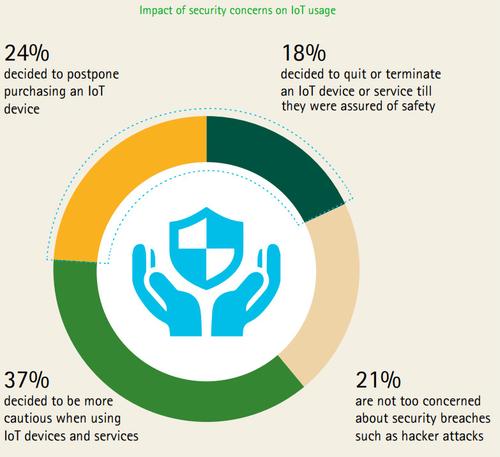

Accenture Survey: 47% of consumers see security as IoT adoption barrier

Analyzing Sprint’s Small Cell Strategy with Lower CAPEX Guidance

Sprint is working with Mobilitie LLC, a Newport Beach, Calif., company to build small cellular antenna systems from California to Massachusetts. The company wants to install low-power cellular antennas in public rights of way, land typically holding utility poles, street lamps and fire hydrants. In places where it can’t strap antennas to existing poles, it wants to erect new poles.

However, the new antenna on poles rollout has been delayed as communities confront what some consider unsightly installations and authorities wrestle with new regulatory questions. Sprint recently slashed its capital spending plans for the year as it waits for zoning approvals. Mobilitie says it has about 1,000 permits approved and will start large-scale installations once more are in hand.

Caption: One of the wireless antennas being installed on light poles in cities around the country for Sprint and other carriers to increase cellphone service quality at lower cost than much-larger tower antennas. Pole above is in Los Angeles. PHOTO: CELLTOWERPHOTOS.COM

In the past, wireless carriers built towers of 200 feet or more that could send signals over large areas to cover as many customers as possible. Now that more people use smartphones to stream videos and surf the Web, carriers want to put lower-power antennas closer to the ground so that fewer people will connect to each one—resulting in less network congestion.

“It’s not a new concept,” said John Saw, Sprint’s chief technology officer. “All carriers are trying to ‘densify’ their networks.” But Sprint’s goal is to be “cheaper and faster and more innovative” than its rivals, he said.

Mounting antennas on existing utility poles is something most carriers are hoping to do. But cash-strapped Sprint aims to take the concept further than rivals: It is hoping to install as many as 70,000 antennas in the public right of way over the next few years. By comparison, it has 40,000 traditional antenna sites on towers or rooftops.

It is a central piece of a strategy devised in early 2015 by Sprint Chairman Masayoshi Sonto improve service while keeping costs down. Companies can negotiate with a city for one deal that includes various permits. Mobilitie Chief Executive Gary Jabara says building and operating these so-called small cells costs about $190,000 over 10 years, whereas a traditional tower costs $732,000 because of real estate rents, power and other costs.

The spectrum Sprint owns are ideally suited for this design because their high frequency prevents them from traveling long distances. Rather than string fiber-optic cables to each antenna, Sprint hopes to link them via wireless connections, further bringing down costs and speeding deployment.

“We’re not surprised that sometimes you will run into opposition in certain jurisdictions,” Mr. Saw says. “ ‘Not in my backyard’ has been around for a very long time.”

Sprint’s CFO, Tarek Robbiati, explained to J.P. Morgan analyst Phil Cusick at the bank’s tech conference last month that Sprint envisions using multiple small cells — radios with short range, which can be deployed on lamp-posts and other areas that don’t cost high rents — as a way to make Sprint’s network have better coverage:

There’s not enough towers in the country to do what we intend to do to densify the Sprint network, period. So, you’ve got to think differently. And really, there is great benefit around this, because the cost of deployment of cell sites is a fraction of the cost of the deployment of a tower site. So, whatever number you pick up for a tower site, it’s probably $200,000, thereabout, including all-in costs, labor and equipment. Small cell sites are a fraction of that, 60%, 70% lower.

Sprint’s strategy is sound, says David Dixon of FBR &Co:

While Sprint’s lower capex guidance is raising eyebrows across the industry and early execution challenges are

evident, we believe Sprint’s plan to use low-cost commodized small cells and CPE solutions leveraging its vast 2.5 GHz spectrum portfolio will allow it to close the multi-faceted performance gap with competitors in the coming years and achieve positive Free Cash Flow (FCF) while staying within the confines of lower capex guidance. If well executed, Sprint has the potential to become the lowest cost and fastest data network among the national carriers that are migrating to greater dependency on low-cost densification for coverage and capacity using commodity hardware solutions and new (shared) spectrum bands.

Majority owner Softbank is highly levered, and investors fear it will be challenged going forward to support its majority investment in Sprint. However, Sprint is benefiting from a change in the technology cycle, leveraging the cloud to nextgen deployment options to spend much less than expected in capital to help generate positive FCF […] There is a general lack of understanding on how Sprint can achieve a 10x increase in downlink network speed at less than half the expected cost and achieve a 30% improvement in network coverage from increasing the maximum power levels in devices, which drives a 30% decrease in cost. Bottom line, existing spectrum in the 2.5 GHz frequency band should sustain Sprint’s improved performance for the next six-plus years […] 2.5 GHz spectrum is the basis of Sprint s LTE Plus network and makes up the bulk of Sprint’s spectrum portfolio. Sprint controls approximately 120 MHz of 2.5 GHz spectrum in 90% of the top 100 U.S. markets. If Softbank can create low-cost Pico and CPE solutions using 2.5 GHz spectrum to densify its network, Sprint will have the potential to become the lowest-cost and fastest data network among the national carriers that are migrating to a greater dependency on low-cost WiFi spectrum ahead of a migration to low-cost, shared LTE spectrum in the 3.5 GHz band and beyond.

However, other analysts are concerned about Sprint lowering Capex Spending as per this article

http://www.androidheadlines.com/2016/05/sprints-network-strategy-fire.html

Also see:

https://www.reddit.com/r/Sprint/comments/4ikm3q/so_with_sprint_lowering_its_capex_from_45b_to_3b/

AT&T and Verizon Articulate Their Vision for "5G" Deployments; Ericsson’s 5G book

In a new video clip, AT&T’s AVP Dave Wolter told Light Reading’s Carol Wilson that 5G represents a fundamental change. Not just more and faster data, but massive IoT based deployment for a variety of industries. Many new frequency bands are being considered for 5G. However, there is still a lot of work to be done to bring 5G to market. Wolter said that work is well underway, starting with test bed activity this summer.

The core network must be upgraded to support the diverse IoT requirements, Wolter added. SDN and NFV will be key to create “network slices” to particular applications and serves their needs.

Meanwhile, Verizon CEO Lowell McAdam said that the huge wireless network operator sees 5G as a potential cable/DSL replacement for delivering high-speed data to the home. That implies 5G might initially be used for wireless fixed line triple play services.

McAdam said Verizon has now tested its initial 28GHz “5G testbed” at 1.8 Gbit/s in Basking Ridge, New Jersey. Verizon plans a fixed wireless pilot in 2017 but McAdam envisages a broader deployment in the US over time. “I don’t know why there would be any limitation on where we would take it,” McAdam says. (See Verizon Will Pilot 5G Fixed Wireless in 2017.)

Verizon needs is enough fiber close enough to the 5G radios to make it viable, McAdam noted. “Close is to be defined,” he added. “That’s why we bought XO Communications,” McAdam said. “Because they have 45 of the top 50 markets they have metro fiber rings that gives you the ability to be out into those markets and then you just run your extensions off of them.”

“5G as a mobile network standard is probably more of a 2020 proposition,” McAdam acknowledged (what every reader of this blog knows already).

Finally, Ericsson has cooperated with academia to produce a comprehensive book about 5G titled,