IHS Markit: 75% of Carriers Surveyed Have Deployed or Will Deploy SDN This Year

By Michael Howard, senior research director carrier networks, IHS Markit

Bottom Line

- Three-quarters of carriers participating in the IHS Markit software-defined networking (SDN) survey say they have already deployed or will deploy SDN in 2016; 100 percent plan to deploy the technology at some point

- The top drivers for service provider SDN investments and deployments are simplification and automation of network and service provisioning, as well as service automation

- Most operators are moving from SDN proof-of-concept (PoC) evaluations to commercial deployments in 2016 and 2017

IHS Analysis

In our fourth annual survey of carrier SDN strategies, it’s clear that service providers around the globe are investing in SDN as part of a larger move to automate their networks and transform not only their networks, but also internal processes, operations and service offerings.

Service providers believe that SDN will fundamentally change telecom network architecture and deliver benefits in service agility, time to revenue, operational efficiency and capex savings.

And these operators want SDN in most parts of their networks. Survey respondents’ top three SDN-targeted network domains for deployment by the end of 2017 are within data centers, between data centers and access for businesses.

Still, carriers are starting carefully with SDN, biting off small chunks of their networks called “contained domains” in which they will explore, trial, test and make initial deployments. Momentum is strong, but it will be many years before bigger parts of networks or entire networks are controlled by SDN—although a few operators are leading the way including AT&T, Level 3, Colt, Orange Business Systems, SK Telecom and Telefónica, among others.

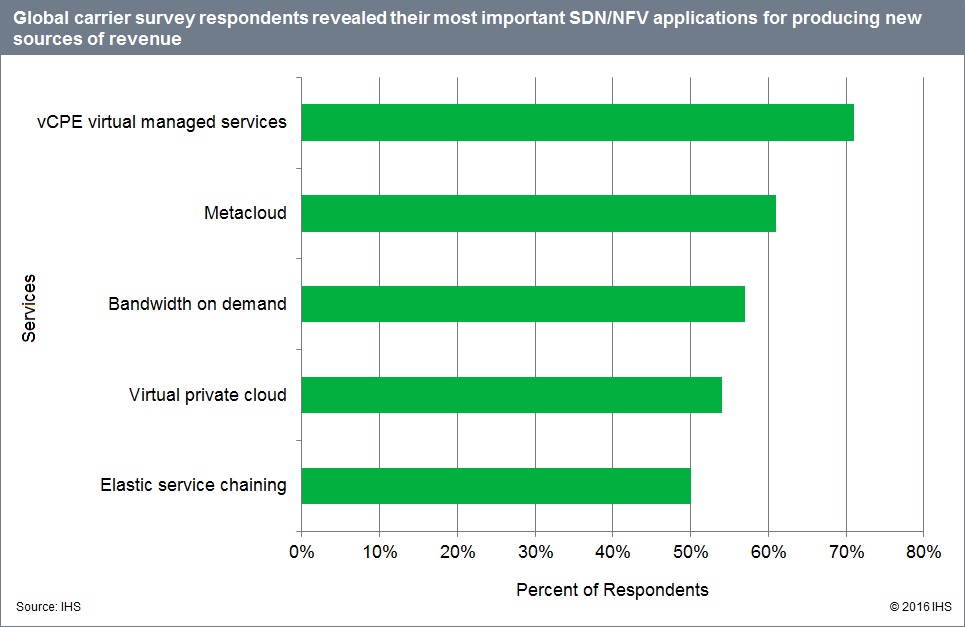

The industry is still in the early stages of a long-term transition to SDN and network functions virtualization (NFV) architected networks. Much continues to be learned as each year passes, and various barriers and drivers have become more prominent as operators inch closer to commercial deployment. In this year’s survey, for example, respondent operators indicated that their top barriers to deployment are the lack of carrier-grade products and integration of virtual networking into their existing physical networks. Nonetheless, they rated virtual customer premises equipment (vCPE) managed services as the top SDN/NFV application for producing new sources of revenue.

Carriers are learning that some avenues are not as fruitful as expected, and telecom equipment manufacturers and software suppliers may well invent new approaches that open up new applications. IHS Markit will conduct the fifth annual SDN survey in 2017, and it will be interesting to see what new issues emerge and which problems get resolved in the additional commercial deployments planned for 2016.

SDN Survey Synopsis

The 22-page IHS Markit SDN strategies survey is based on interviews with purchase-decision makers at 28 service providers around the world that control 53 percent of world’s telecom capex and are deploying or plan to deploy SDN in their networks in the future. Operators were asked about their strategies and timing for SDN, including deployment drivers and barriers, target use cases, applications and more.

How to Buy this Report

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

Previous IHS SDN Forecast Chart:

Author’s Opinion:

While there may be pockets of SDN deployed in carrier networks this year and next, we maintain it won’t present a large business opportunity for any carrier vendor/suppliers. That’s because each network (and cloud service) provider has their own version of SDN, with none compatible with any others! That in turn is due to the fragmentation of the market due to too many versions of SDN and no solid standards for multi-vendor interoperability.

We think the CORD project and mobile CORD have a much better opportunity because vendors are collaborating under various open source consortiums to disaggregate hardware of network elements, specify functional groupings and inter-module communications. IMHO, the dis-aggregation/network equipment virtualization trend is irreversible.

Here are a few references:

CORD: REINVENTING CENTRAL OFFICES FOR EFFICIENCY & AGILITY

Threat of Disaggregated Network Equipment – Part 3

CORD (Central Office Re-architected as a Datacenter): the killer app for SDN & NFV

Highlights of Light Reading’s White Box Strategies for Communications Service Providers (CSPs)

One thought on “IHS Markit: 75% of Carriers Surveyed Have Deployed or Will Deploy SDN This Year”

Comments are closed.

But what SDN model or version was implemented by these service providers? There’s the classical SDN/Open Flow model from ONF, the overlay or virtual network model, the evolutionary model, hybrid model, DevOps management model, VMWare’s two NSX versions, etc

Also, most versions of SDN use a centralized controller and NOT segment or hop by hop routing. Yet Cisco and Juniper routers can handle segment-routing traffic. Their versions of SDN are ready for segment routing, as well. Moreover, Linux has an open source implementation of segment routing, and Cumulus Networks’ Linux-based network OS also supports it.

With so many different versions of SDN, it appears that network equipment and software built for one SDN based network will not work on ANY other service provider’s SDN unless multiple SDN versions/models are supported in the same equipment/software.

References:

https://www.rcrwireless.com/20170811/three-different-sdn-models-tag27-tag99

https://searchnetworking.techtarget.com/tip/Three-models-of-SDN-explained

https://searchvmware.techtarget.com/opinion/VMwares-two-NSX-versions-are-the-future-of-SDN