IHS: Sales of Branded Bare Metal Switches Hit $23 Million in 1st Half of 2016

By Cliff Grossner, Ph.D., senior research director, data center, cloud and SDN, IHS Markit

Highlights:

- Open networking using branded bare metal switching continues to make steady progress in the enterprise, with revenue growing 125 percent in the first half of 2016 (H1 2016) from the second half of 2015 (H2 2015)

- Dell launched the branded bare metal switching segment around two years ago and in H1 2016 claimed just over half of revenue market share

- Software-defined enterprise wide area network (SD-WAN) is gaining momentum thanks to the emergence of tier-1 service providers that have partnered with SD-WAN vendors to deploy over-the-top solutions

IHS Analysis:

The global data center and enterprise software-defined networking (SDN) market—including in-use Ethernet switches, SDN controllers and SD-WAN—totaled $1.1 billion in H1 2016. This was an increase of 42 percent from H2 2015, reflecting a ramp in customer deployments. All major geographical regions were up from H2 2015 for data center and enterprise SDN hardware and software.

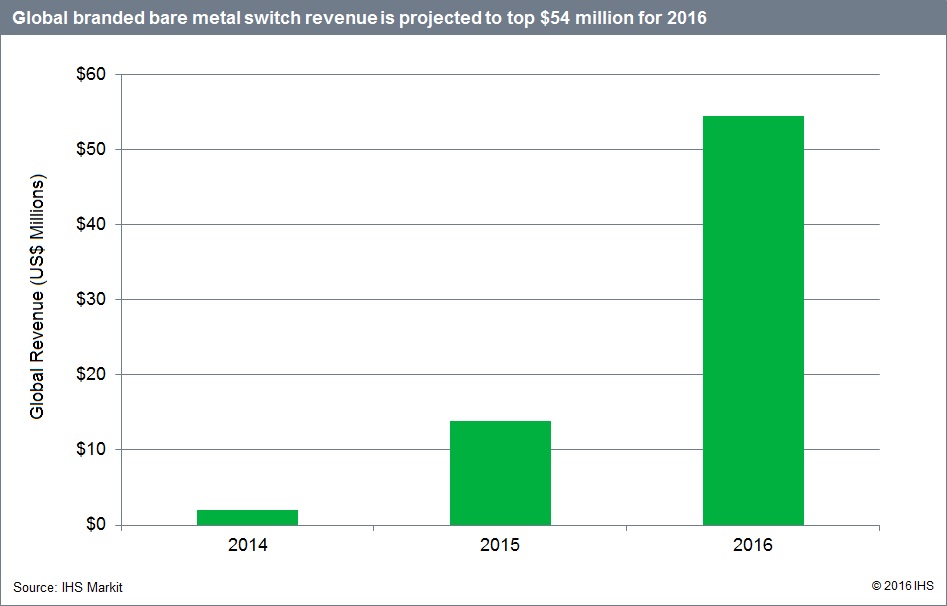

Branded bare metal switch revenue reached $23 million worldwide in H1 2016 and is projected to top $50 million for the full-year 2016, driven by tier-2 operator and enterprise deployments.

While this segment is tiny compared to the approximately $8 billion in annual data center Ethernet switch revenue, it’s in line with expectations given the market was launched by Dell just over two years ago. The hype surrounding branded bare metal switches has overshadowed reality, but the segment is rolling along at a respectable clip. Now that a good selection of branded bare metal switches and maturing switch OS software are available, the next efforts should be focused on priming the channel to enterprises.

The SD-WAN segment is still small—$33 million worldwide in H1 2016—but it continues to gain momentum with the recent entry of tier-1 service providers including AT&T, Verizon, CenturyLink, BT, SingTel and Sprint. It has been aided as well by a string of announcements from tier-2 operators such as Vonage, EarthLink, MetTel and TelePacific. SD-WAN is poised to accelerate, growing above 90 percent per year to 2020.

The market share leaders in the SDN market serving the data center and enterprise LAN market continue to solidify their positions as SDN “crosses the chasm.” Based on in-use SDN revenue, white box vendors are number one with 19 percent of revenue in H1 2016, while Cisco and VMware round out the top three.

Data Center and Enterprise SDN Report Synopsis:

The IHS Markit data center and enterprise SDN report provides market size, market share, forecasts, analysis and trends for SDN controllers; SDN-capable bare metal Ethernet switches and branded Ethernet switches; and SD-WAN appliances and control and management.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]