IHS-Markit: China’s Mobile Infrastructure Mkt Declines Led by LTE CAPEX -16% Fall

By Stéphane Téral, senior research director and advisor, mobile infrastructure and carrier economics, IHS Markit

Highlights

- In China, the 2G, 3G and LTE (Long Term Evolution) mobile infrastructure market decreased 9 percent in 2016 from 2015, to US$12 billion

- A network sharing deal between China Unicom and China Telecom drove LTE capex down 16 percent year-over-year in 2016

- The Chinese mobile infrastructure macro hardware market is forecast to decline at a -34 percent CAGR (compound annual growth rate) from 2016 to 2021

Our Analysis

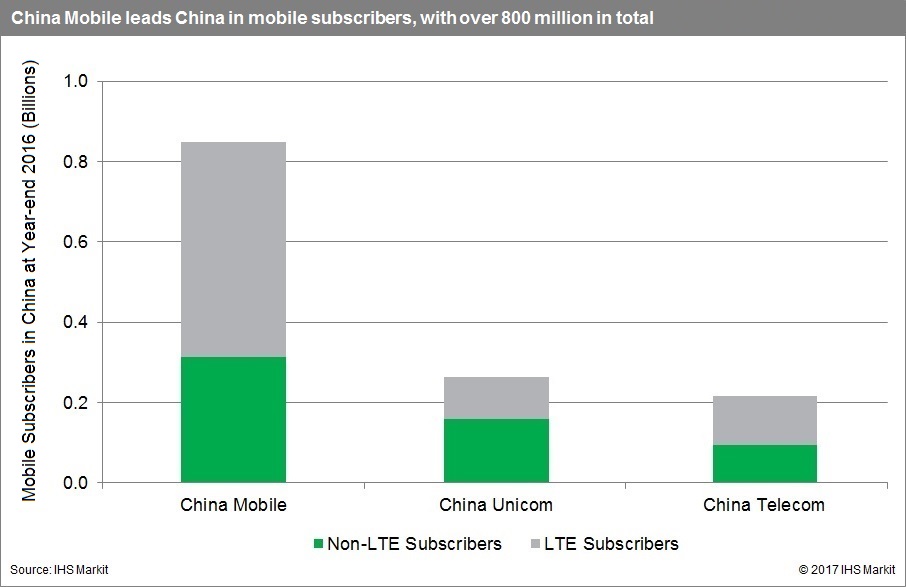

China, the world’s largest mobile subscriber base, had a total of 1.3 billion subscribers in 2016, 64 percent of them on China Mobile’s GSM/TD-SCDMA/LTE network. Fifty-eight percent of China’s mobile subscribers are now on LTE, up from 32 percent in 2015.

In 2016, a network sharing deal between China Unicom and China Telecom drove LTE capex down 16 percent year-over-year. However, the combination of both companies’ addition of FD-LTE (frequency division LTE) eNodeBs and China Mobile’s moderate TD-LTE (time division LTE) rollouts led to a combined total of 1,020,000 eNodeBs deployed—the same number as in 2015.

The overall 2G/3G/LTE mobile infrastructure market came to US$12 billion in 2016, falling 9 percent year-over-year at a time when China Unicom and China Telecom were building their nationwide FD-LTE rollout.

LTE revenue declined to about US$10 billion (-4 percent year-over-year) in 2016, sustained by flat eNodeB rollouts, and leaving combined 2G and 3G revenue at less than US$2 billion.

IHS expects the mobile infrastructure macro hardware market in China to continue to go south, with a double-digit decline anticipated in 2017 due to the end of massive LTE rollouts. In the long run, we forecast the Chinese RAN and packet core infrastructure market to slow down further to US$2 billion in 2021, a -34 percent 2016–2021 CAGR.

Chinese Mobile Report Synopsis

Based on the IHS Markit worldwide Mobile Infrastructure Quarterly Market Tracker, the country-specific Mobile Infrastructure: China Annual Market Tracker focuses on 2G GSM, 3G CDMA2000 (TD-SCDMA, W-CDMA) and 4G LTE (E-UTRAN, EPC) mobile network equipment and subscribers in China. It provides market size, vendor market share, forecasts through 2021, analysis and trends.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

One thought on “IHS-Markit: China’s Mobile Infrastructure Mkt Declines Led by LTE CAPEX -16% Fall”

Comments are closed.

FCC may ban China Mobile from US market

Federal Communications Commission (FCC) chairman Ajit Pai has released a statement urging his fellow FCC executives to vote for an order that would deny China Mobile’s application during the scheduled vote at its May 2019 Open Meeting.

“Safeguarding our communications networks is critical to our national security. After reviewing the evidence in this proceeding, including the input provided by other federal agencies, it is clear that China Mobile’s application to provide telecommunications services in our country raises substantial and serious national security and law enforcement risks,” Pai’s statement reads.

“Therefore, I do not believe that approving it would be in the public interest. I hope that my colleagues will join me in voting to reject China Mobile’s application. ”

The draft order proposed by Pai would stipulate that China Mobile has not demonstrated that its application is in the public interest, but more importantly it would assert that “China Mobile is vulnerable to exploitation, influence, and control by the Chinese government.”

China Mobile first applied back in September 2011 for a license to provide facilities based and resale telecommunications services between the US and overseas destinations.

After a long review of the application, agencies within the US government’s Executive Branch recommended in July 2018 that China Mobile deny that application, citing “substantial national security and law enforcement risks that cannot be resolved through a voluntary mitigation agreement.”

The proposed objection comes the month after Chinese vendor Huawei revealed it was taking the US government to court over an order banning federal agencies from buying its products due to national security fears.

https://docs.fcc.gov/public/attachments/DOC-357062A1.pdf