Service Provider VoIP and IMS -12% YoY in 2017; VoLTE Deployments Slowing

Following are highlights from the first quarter 2018 edition of the IHS Markit Service Provider VoIP and IMS Equipment and Subscribers Market Tracker, which includes data for the quarter ended December 31, 2017. Author is IHS Markit analyst Diane Myers.

Global service provider voice over Internet Protocol (VoIP) and IP multimedia subsystem (IMS) product revenue fell to $4.5 billion in 2017, a decline of 12 percent year over year. Overall worldwide revenue is forecast to decline at a compound annual growth rate (CAGR) of 3 percent, falling to $4 billion in 2022. This decline is due to the slowing of voice over LTE (VoLTE) network deployments and overall spending falling into a steady pattern. Downward pricing — because of continued competitive factors and large deal sizes in India, China and Brazil — is also dampening growth.

“The big story over the past four years has been mobile operators and the transition to VoLTE, which has been the number-one driver of VoIP and IMS market growth, along with voice over WIFI (VoWiFi) and other mobility services,” said Diane Myers, senior research director, VoIP, UC, and IMS, IHS Markit. “However, after initial VoLTE network builds are completed, sales growth drops off, as operators launch services and fill network capacity,” she added.

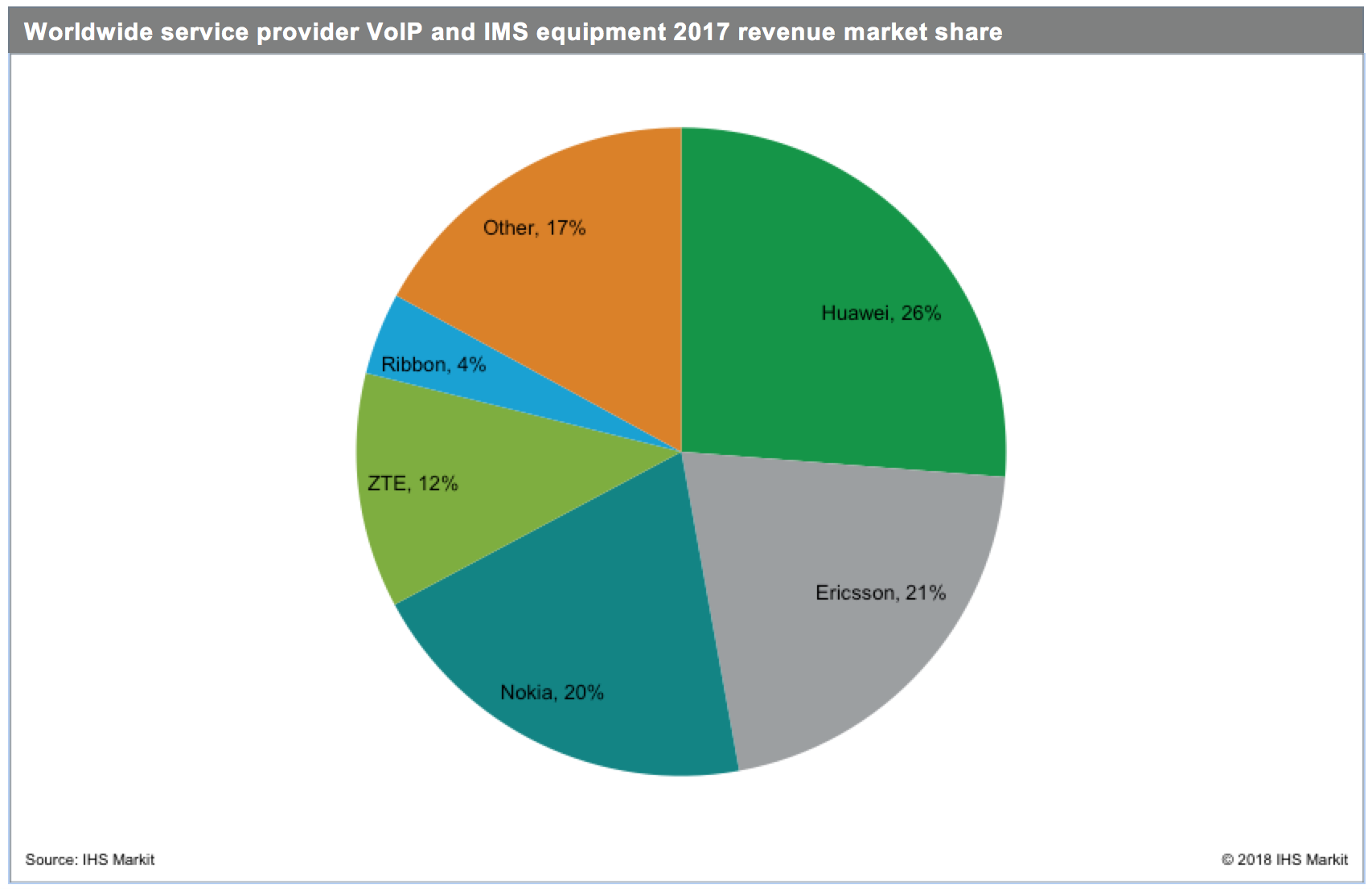

Huawei was the standout vendor in the VoIP and IMS market, with 26 percent of worldwide revenue in 2017. Ericsson ranked second, with 21 percent, followed by Nokia, ZTE and Ribbon Communications.

Service provider VoIP and IMS market highlights

- As large VoLTE projects in India and China continued to expand, the Asia-Pacific region ranked first in global revenue in 2017, accounting for 37 percent of the market. Spending from VoLTE projects in Asia-Pacific and Caribbean and Latin America continue, but it is not enough to move the worldwide market back into growth territory, primarily due to price compression in both regions.

- As of January 2018, 119 operators launched commercial VoLTE services, with more coming every year. However, new launches are slowing. Most VoLTE launches in 2017 occurred in Europe. There was also some expansion in Chinese provinces, due to growth from China Mobile; in Brazil, with Vivo; and in India, with Bharti Airtel.

Service Provider VoIP and IMS Equipment and Subscribers report synopsis

The quarterly Service Provider VoIP and IMS Equipment and Subscribers Market Tracker from IHS Markit provides worldwide and regional vendor market share, market size, forecasts through 2022, analysis and trends for trunk media gateways, SBCs, media servers, softswitches, voice application servers, HSS, CSCF and IM/presence servers.

One thought on “Service Provider VoIP and IMS -12% YoY in 2017; VoLTE Deployments Slowing”

Comments are closed.

Does voice have a role in 5G? Feb 22, 2018:

Voice over LTE (VoLTE) was created as the next-generation IP-based voice service, but it wasn’t exactly easy. Interoperability and the ability to do 911 calls are serious issues and not exactly slam-dunks. But when VoLTE works as advertised in high-def? It sounds like you’re talking to someone in the same room even when they happen to be 10 states or half a world away.

Before we get to voice’s role in 5G, it’s worth taking stock of the status of VoLTE. T-Mobile likes to boast that it was first in the U.S. to deploy VoLTE, and it now has VoLTE on 100% of its LTE network. Currently, more than 80% of all voice traffic at T-Mobile is carried over VoLTE—a global leading stat, according to the company.

Of course, Verizon has VoLTE fully deployed over its network, and 100% of its LTE sites have the capability. Verizon has deployed LTE-only sites for the last few years, so all of those have VoLTE, giving it more coverage than some older voice technologies. (For example, Alaska has only LTE towers—no legacy networks from Verizon.) The vast majority of new devices now come with VoLTE automatically activated out of the box.

AT&T’s VoLTE network now covers more than 320 million POPs, and all the smartphones it has launched since August 2016 have been VoLTE capable, a spokesperson said. The majority of its postpaid customers are on VoLTE-capable devices; its first VoLTE device was the Samsung Galaxy S4 Mini, launched in May 2014. AT&T automatically includes HD Voice for all VoLTE-capable devices for postpaid customers.

Sprint has been testing VoLTE for more than a year and is pre-seeding its customer base with VoLTE-capable devices in preparation for a commercial deployment starting this fall. Even without VoLTE, the carrier says that it offers a great HD Voice experience on a very efficient 1x platform, and its goal is to match that experience with VoLTE. Sprint expects to deploy VoLTE starting this fall.

https://www.fiercewireless.com/wireless/editor-s-corner-hear-ye-hear-ye-does-voice-have-a-role-5g?