VoIP and VoLTE

Deutsche Telekom migrates IP-based voice telephony platform to the cloud

Deutsche Telekom has successfully transitioned its IP-based voice telephony platform to the cloud. Landline connections are now centrally controlled from cloud data centers in Germany. Over seventeen million customer connections have been migrated. Billions of voice minutes are now handled entirely through the NIMS platform (NIMS: Next Generation IP Multimedia Subsystem) with around 100 interconnect partners.

Thanks to disaggregation, services can be provided through an optimized solution portfolio of software modules from a wide ecosystem of industry partners. The near-complete automation of the Telco Cloud provides a more efficient process, leading to significantly more flexibility and speed in the introduction of new service features and capacity expansion.

Image credit: Deutsche Telekom

“This project is a game changer in the industry,” says Abdu Mudesir, Chief Technology Officer of Deutsche Telekom Deutschland. “It is the result of excellent cooperation with partners such as Juniper Networks, Mavenir, Microsoft, HPE, Red Hat, and Lenovo. Our common goal in this innovation project has always been to set a benchmark for excellence in the industry, for our customers. The success has spread, many network operators are now asking us specifically how we managed to achieve this.”

“The cloud isn’t just a technology, but rather an entirely new operating model that can yield tremendous agility, cost efficiencies and better user experiences. I am so proud that Juniper was able to play a role in bringing Deutsche Telekom’s visionary strategy for NIMS to life and even more thrilled to see this project, which I consider a blueprint for the rest of the telecom industry, now complete,” says Rami Rahim, CEO – Juniper Networks.

“With NIMS, Deutsche Telekom has leveraged the benefits of cloud native network functions, hyper scaler technology and extreme automation to deliver mission critical carrier grade performance; it’s a huge step forward in the Telecommunications industry,” says Yousef Khalidi CVP, Azure for Operators – Microsoft.

“Telekom´s vision was unique because it was not just a pure technology play. Its goal to change the old development paradigms, driving automation and interoperability into the very fabric of the Telco Cloud architecture. The NIMS platform offers a transformative lifecycle automation for all telco cloud and payload components and Mavenir is proud to be part of the multi-vendor ecosystem delivering this innovation,” says Bejoy Pankajakshan, EVP & Chief Technology and Strategy Officer of Mavenir.

“The platform is a key building block for ´Zero Touch operations´ where manual intervention and operations to handle network management and configuration are reduced in favor of a more advanced, software-based solution,” says David Stark, VP & GM, Telco Solutions – HPE.

Telekom has already established follow-up projects to consistently implement the successful model of cloudification, disaggregation, and complete automation in other voice applications, 5G Core and the access networks.

References:

Deutsche Telekom Network Day: Fiber, Mobile Network, Open RAN and 5G SA Launch in 2024

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

Deutsche Telekom with AWS and VMware demonstrate a global enterprise network for seamless connectivity across geographically distributed data centers

Deutsche Telekom exec: AI poses massive challenges for telecom industry

Deutsche Telekom’s fiber optic expansion in 140 of the 179 municipalities within the Gigabit region of Stuttgart

Deutsche Telekom Global Carrier Launches New Point-of-Presence (PoP) in Miami, Florida

Vodafone and Mavenir complete VoLTE call over a containerized Open RAN lab environment

Upstart network software provider Mavenir, announced today that it completed the first data and Voice over LTE (VoLTE) call across a containerized 4G small cell Open RAN solution in a Vodafone lab environment. The completed tests are the latest steps forward to delivering an open and vendor-interoperable 4G connectivity solution for small to medium-sized office locations.

Having first started work on a containerized indoor enterprise connectivity solution in January 2021, Vodafone has completed tests for an important stage of the technology roadmap. The plug-and-play small cell equipment can ensure comprehensive mobile coverage in every corner of the office. The solution will provide 4G coverage initially, making use of radio hardware from Sercomm and software from Mavenir (Open RAN). Containerization means that software can be seamlessly transferred between equipment, platforms, and applications. Wind River provided its Containers as a Service (CaaS) software, part of Wind River Studio.

This demonstration of a containerized solution is a major milestone in the evolution of connectivity equipment away from physical infrastructure to a digital cloud-based environment. Containerization provides greater flexibility for customers, but also significant benefits in terms of speed and cost of deployment.

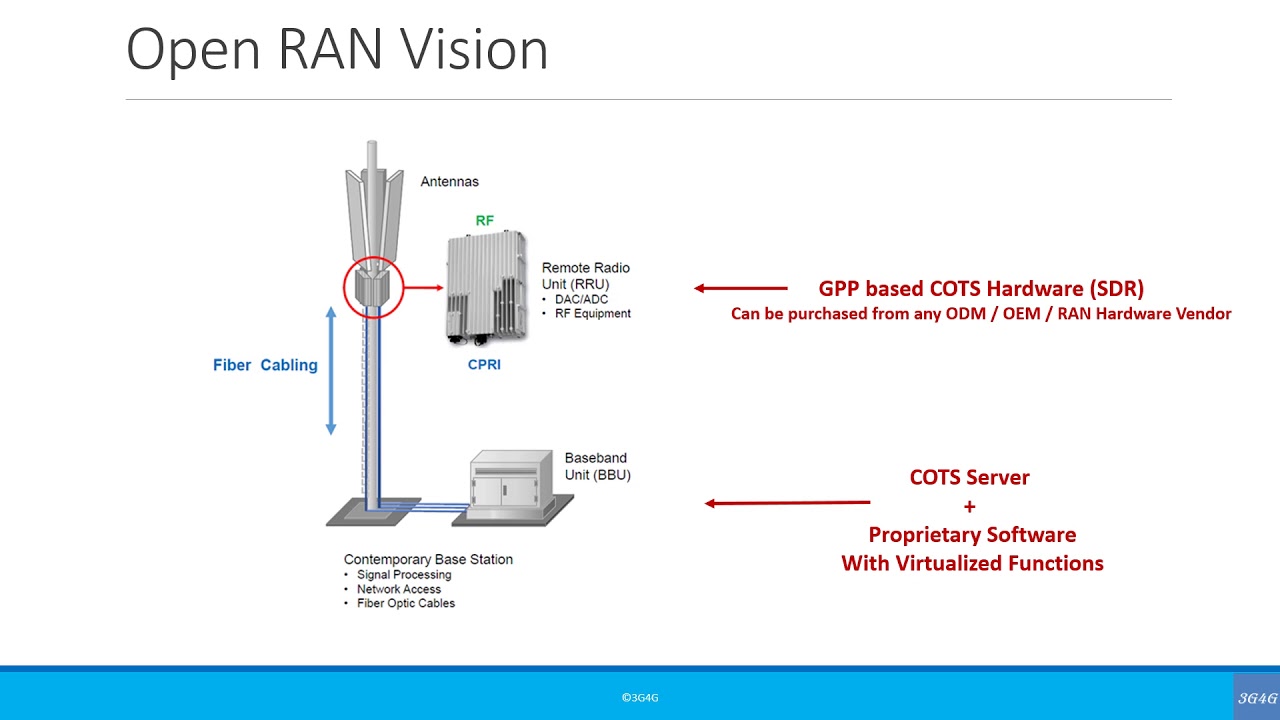

Open RAN technology separates software from hardware, meaning more flexibility for mobile operators and customers. This approach aims to see many companies providing the components that make up a mobile network site, where previously one vendor would have delivered the whole solution. The technology is controversial, but accepted by many as a potential disruptor for the telecommunications industry. Vodafone claims to be one of the industry leaders in supporting the development of the Open RAN vendor ecosystem.

Whereas much of the focus for Open RAN has been directed towards network infrastructure deployment on mobile sites throughout the UK, the technology can be implemented in an enterprise environment to support local connectivity requirements. As an interoperable and standardized (there are no standards for Open RAN!) technology, Open RAN solutions can be integrated with little disruption in a “plug and play” manner, interoperable with other Open RAN compliant vendors.

Andrea Dona, Chief Network Officer, Vodafone UK, said: “Open RAN is opening doors to simplified and intuitive connectivity solutions. For our wider network deployment strategy, Open RAN is enabling us to work with a wider pool of suppliers and to avoid vendor lock-in scenarios that might prevent us from taking advantage of the latest innovations. The same could be said for enterprise connectivity solutions.”

“From the moment Open RAN is deployed in an office environment, customers are no-longer locked into a single upgrade path. Working alongside Vodafone, customers can be more flexible in how connectivity solutions are adapted and upgraded as demands evolve in the future.”

Stefano Cantarelli, Executive Vice President and Chief Marketing Officer, Mavenir, said; “Cloud Native and Open Solutions are becoming the new reality of the mobile world, and these include Radio Access and its containerized implementation. Open vRAN is a very flexible architecture that can serve any type of segment and Mavenir is really pleased to work with Vodafone in the enterprise business and achieved another first together. It is an opportunity to show that automated and AI controlled systems will simplify life to business and industry.”

“Mavenir is delighted to partner with Vodafone in Open RAN and to work in the U.K. on their radio network transformation initiative, proving the extreme flexibility of Open vRAN,” Virtyt Koshi, SVP of Mavenir EMEA, said. “We are particularly proud in working in the field within the Vodafone commercial network and in the Newbury Open RAN Test and Verification lab, supporting the Vodafone effort to boost the ecosystem.”

Moving forward, Vodafone and Mavenir will focus on finalizing the packaging and automation of the solution before beginning trials with selected customers.

References:

Vodafone and Mavenir create indoor OpenRAN solution for business customers

Vodafone partners with Mavenir to leverage Open RAN for in-building enterprise 4G

Ericsson to acquire Vonage to create a global VoIP network and communication platform

Ericsson has agreed to buy VoIP network operator Vonage for $21 per share, for a total of $6.2 billion. The board of directors at Vonage approved the deal, which will enable Ericsson to expand its enterprise operations globally and build on its integration of Cradlepoint in September 2020.

Vonage reported revenues for the 12 months to end September of $1.4 billion, with an adjusted EBITDA margin of 14% and free cash flow of $109 million. The merger price represents a premium of 28% to Vonage’s closing share price on 19 November and 34% to the volume-weighted average share price for the three months to 19 November.

Vonage’s presence in the Communication Platform as a Service (CPaaS) segment will provide Ericsson with access to a complementary and high-growth segment, the company said. The combination will also accelerate enterprise digitization and the development of advanced APIs made possible by 5G. Over the longer term, Ericsson intends to deliver services to the full ecosystem, including telecom operators, developers, and businesses, by creating a global platform for open network innovation, built on Ericsson and Vonage’s complementary solutions.

The cloud-based Vonage Communications Platform (VCP) serves over 120,000 customers and more than one million registered developers globally. The API (Application Programming Interface) platform within VCP allows developers to embed high quality communications – including messaging, voice and video – into applications and products, without back-end infrastructure or interfaces. Vonage also provides Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) solutions as part of the Vonage Communications Platform.

VCP accounts for approximately 80% of Vonage’s current revenues and delivered revenue growth in excess of 20% in the three-year period to 2020, with adjusted EBITDA margins moving from -19% in 2018 to break-even in the 12-month period to 30 September 2021. Vonage’s management team projects annual growth of over 20% for VCP in the coming years.

Börje Ekholm, President and CEO of Ericsson, says: “The core of our strategy is to build leading mobile networks through technology leadership. This provides the foundation to build an enterprise business. The acquisition of Vonage is the next step in delivering on that strategic priority. Vonage gives us a platform to help our customers monetize the investments in the network, benefitting developers and businesses. Imagine putting the power and capabilities of 5G, the biggest global innovation platform, at the fingertips of developers. Then back it with Vonage’s advanced capabilities, in a world of 8 billion connected devices. Today we are making that possible.”

“Today Network APIs are an established market for messaging, voice and video, but with a significant potential to capitalize on new 4G and 5G capabilities. Vonage’s strong developer ecosystem will get access to 4G and 5G network APIs, exposed in a simple and globally unified way. This will allow them to develop new innovative global offerings. Communication Service Providers will be able to better monetize their investments in network infrastructure by creating new API driven revenues. Finally, businesses will benefit from the 5G performance, impacting operational performance, and share in new value coming from applications on top of the network.”

Rory Read, CEO of Vonage, says: “Ericsson and Vonage have a shared ambition to accelerate our long-term growth strategy. The convergence of the internet, mobility, the cloud and powerful 5G networks are forming the digital transformation and intelligent communications wave, which is driving a secular change in the way businesses operate. The combination of our two companies offers exciting opportunities for customers, partners, developers and team members to capture this next wave.”

“We believe joining Ericsson is in the best interests of our shareholders and is a testament to Vonage’s leadership position in business cloud communications, our innovative product portfolio, and outstanding team.”

References:

CEO and CFO presentation (pdf)

Two webcasts on November 22, 2021:

9:10 AM CET: Replay

3:30 PM CET: Replay

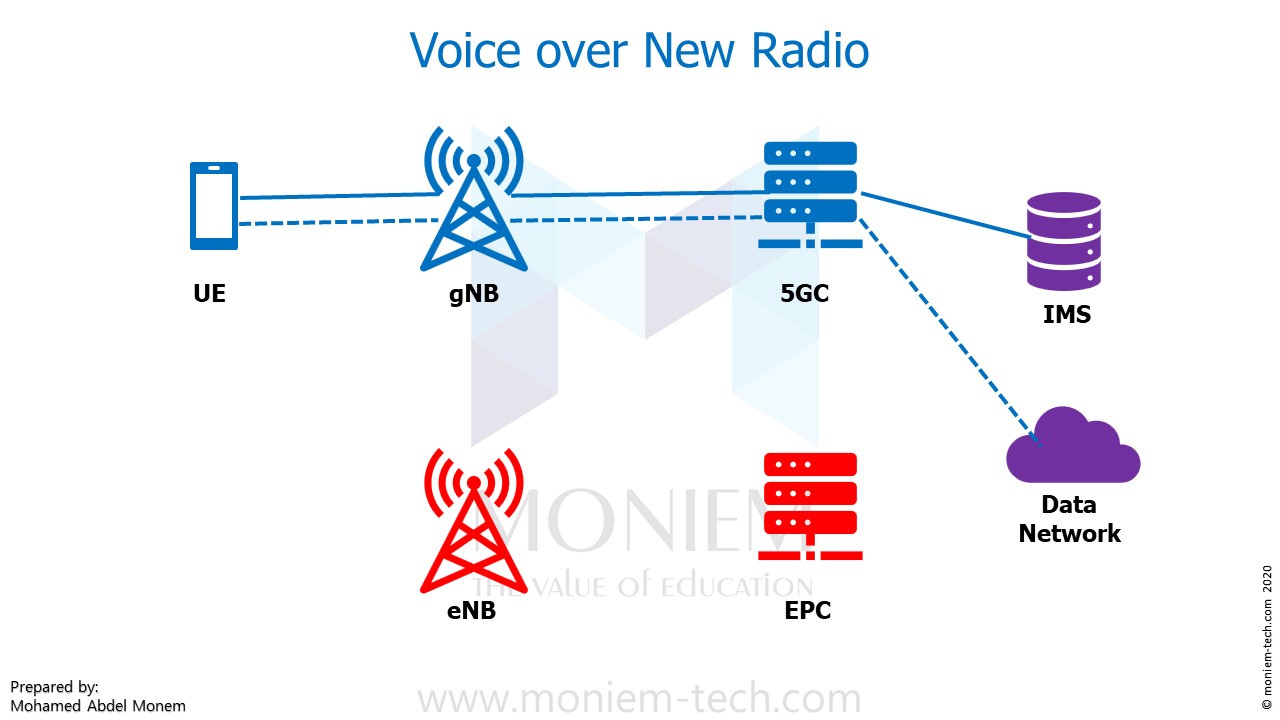

GSM: VoNR progresses, but requires 5G SA core network

5G non-standalone (5G NSA) networks, voice services were enabled by continued use of LTE and 2G/3G infrastructures, but 5G standalone networks (5G SA) – both public and private – require a new approach. They need to be able to carry QoS-guaranteed voice services (as opposed to over-the-top voice applications), but there is no legacy infrastructure to fall back on.

Voice over New Radio (VoNR) [1.] is designed to meet this challenge. VoNR is also expected to bring improvements in latency, call quality and improved integration with applications and services using 5G data at the same time. VoNR is anticipated to drive innovation in conferencing, augmented and virtual reality applications over 5G networks.

Note 1. 5G NR is the essence of standardized 5G RAN as per 3GPP Release 15, 16 and ITU-R M2150 recommendation for 5G RIT/SRIT. However, VoNR requires a 5G SA core network rather than using LTE signaling and core (EPC).

Additionally, there needs to be a mechanism for devices to use to LTE, or 2G/3G voice networks when outside the coverage of a 5G standalone network. EPS Fallback (EPS-FB) is an early introduction step to VoNR until sufficient NR low-band or low mid-band coverage has been deployed.

The Global mobile Suppliers Association (GSA) announced that 42 devices and 40 5G chipsets from four vendors have been announced supporting Voice over New Radio (VoNR) technology. This includes five discrete modems and 35 mobile processors/platforms. Of these, 36 are known to be commercially available, including four discrete modems and 32 mobile processors and platforms. Chipsets are commercially available from Mediatek, Qualcomm, Samsung and Unisoc.

In the GSA’s latest VoNR Market Report, the industry group found that numerous network operators are heavily investing in the new voice technology for their 5G standalone networks. To date, GSA has catalogued 16 operators publicly announced as investing in VoNR in some way or another. Of those, eight are evaluating/testing/trialing, three are understood to be planning to deploy, three

are deploying the technology, one has soft launched VoNR services and one is offering limited VoNR as part of a market trial of its new 5G SA network.

This past June, Deutsche Telekom (DT) and partners announced the successful completion of the world’s first 5G Voice over New Radio (VoNR) call in an end to end multi-vendor environment. T-Mobile, which is majority owned by DT, is also pursuing VoNR as per this article.

References:

GSA Market Report: Global Progress to Voice over New Radio (VoNR) – October 2021

https://www.telekom.com/en/media/media-information/archive/world-first-end-to-end-multivendor-5g-voice-over-nr-call-628746

https://www.fiercewireless.com/tech/t-mobile-chases-voice-5g-verizon-at-t-not-so-much

Session Border Controller (SBC) for Enterprises and VoIP Service Providers

by Nellie Marteen

Introduction:

If you are new to Unified Communications (UC), it could be challenging to learn its many components. Some acronyms could be confusing. For example, SBC- Session Border Controller.

SBC is a network element used to protect Session Initiation Protocol (SIP) based VoIP (most enterprises use VoIP as the telephony service over the Internet). SBC may be deployed in the enterprise/customer premises (see Figure below), the VoIP carrier network or in the cloud as discussed later in this article.

SIP is used to initiate, maintain, and pause the working of VoiP and SIP services. The primary purpose of SBC is to enhance connectivity and address safety problems. However, some companies do not use SBC despite knowing its many benefits.

……………………………………………………………………………………………………………………………………………..

SBC in the enterprise/customer premises is shown in this Figure:

…………………………………………………………………………………………………………

Advantages of using SBC:

1. Quality of Calls

Session Border Controller can enhance call quality and provide ease of use. SBC enables the IP Private Branch Exchange (PBX) to be placed on the LAN among a separate IP address. They can do significant things such as normalizing hosted PBX signaling between the PBX as well as the service provider and providing critical routing capacities.

SBCs also assure interoperability of VoIP and video gadgets, examine VoIP lines, analyze call quality, and many more to name. SBC is a must if you get complaints about dropped or missed calls, reduced call quality, or both.

2. Connectivity

The primary function of SBC is to connect a company’s communications infrastructure to the hosted PBX service providers, private vendor network, and public internet. Additionally, SBCs have various essential roles, such as maintaining and securing networks.

An organization can save time and money by using SBCs. They can easily route their phone traffic via internal IPs rather than conventional circuit switched phone networks. Organizations can route phone calls instantly without paying for individual, traditional phone lines.

3. Safety

This is the benefit that many companies do not recognize. If a SBC recognizes a potential security threat, it can instantly remove/block that problem. After spotting the threat, it will alert the host computer(s) with the threat details and the protocols applied to normalize it. Also, SBCs can send the threat date to other businesses’ branches to look out for the same security breach. IT teams can be aware and utilize the data to look out for future security threats.

4, Mitigation of DoS Attacks and Continuity of Service

SBCs use pattern recognition technology to find unusual activities like a strange traffic surge while a DoS (Denial of Service) attack [1.] is ongoing. DoS strikes can take down entire networks resulting in unexpected downtime. Firewalls are generally not sufficient to prevent DoS attacks.

SBCs decrease threats and defend business communication systems from DoS attacks. DoS strikes can interpret phone and video conferences and steal important information or infect systems with malware and viruses. And if the system gets down due to a DoS attack, the organization may have to suffer for an unknown amount of time.

You can watch a short video on how SBCs detect and defend against DoS attacks.

Note 1. A denial-of-service (DoS) attack occurs when legitimate users are unable to access information systems, devices, or other network resources due to the actions of a malicious cyber threat actor. The most common method of attack occurs when an attacker floods a network server with traffic. In this type of DoS attack, the attacker sends several requests to the target server, overloading it with traffic. These service requests are illegitimate and have fabricated return addresses, which mislead the server when it tries to authenticate the requestor. As the junk requests are processed constantly, the server is overwhelmed, which causes a DoS condition to legitimate requestors.

5. Security

Hackers and other bad actors have found new ways to interrupt business communications services and upgrade their ways to disrupt older security measures. Here, SBCs take care of the protection. It is crucial to have up-to-date methods supported. Additionally, an extra layer of security from SBCs are crucial to safely maintaining VoIP solutions.

SBC Challenges:

SBC can be a complex piece of technology – one that demands a certain amount of expertise to set up and maintain. It is not a set-and-forget technology; as additions, moves and changes of voice service occur, the SBC must be configured to recognize them. Also, the IT department must actively manage SBC devices adding to their workload.

Who controls the session border?

For the enterprise, it is obviously desirable to be able to secure network connections, so their IT department should manage the SBC. Yet the VoIP carrier — whose network is being connected to — is also concerned about such things as QoS, lawful intercept of voice traffic and management of the voice connection.

For these reasons, communications carriers who offer VoIP connectivity often want to manage the session border controller or specify the controller that the enterprise will use. This is clearly at odds with an enterprise that wants to mask its internal networks from external intrusion. SBC, from the standpoint of the carrier, breaks the end-to-end management of call completion and complicates regulatory obligations such as access to 911 services and call intercept.

SBC in two VoIP carrier networks is depicted in this diagram:

Complicating this situation is the introduction of cloud-based session control. In this scenario, the SBC functionality is provided through a cloud service. Advantages are that the enterprise can offload a great deal of the management overhead associated with SBC maintenance. The drawback is that VoIP traffic latency can increase dramatically as it transits a much larger network.

Conclusions:

We have described and detailed all the significant benefits of SBC in this article, along with the challenges an IT department must deal with to effectively use SBCs. The important topic of whether the enterprise or carrier should control the session border was discussed along with cloud based session control.

It should be crystal clear that enterprises using VoIP should integrate SBC within their business communications system – either directly or via their VoIP service provider.

………………………………………………………………………………………………………………….

References:

https://www.voip-info.org/session-border-controller/

https://ribboncommunications.com/company/get-help/glossary/session-border-controller-sbc

https://www.ir.com/guides/a-complete-guide-to-session-border-controllers

https://us-cert.cisa.gov/ncas/tips/ST04-015

https://www.ecosmob.com/session-border-controller/#1

………………………………………………………………………………………………………………………..

About Nellie Marteen:

Nellie is also a blogger who writes about a variety of topics.

Juniper Research: Telco Operator Voice Revenue to Drop 45% by 2024, Under a Growing OTT Challenge

A new study from Juniper Research has found that mobile operator voice revenue will drop to $208 billion by 2024 from $381 billion in 2019, as users continue to prefer more flexible and free OTT (Over-the-Top) services.

The new research, Mobile Voice: Emerging Opportunities for Operators & Vendors 2019-2024, forecasts that third-party OTT voice services will continue to grow; nearing 4.5 billion users by 2024. The study found that while this trend will contribute to declining voice revenue for operators, 5G proliferation will propel a number of nascent mobile voice and video services; generating fresh revenue streams for service providers.

Operator Voice Revenue Falls, as OTT managed VoIP Users Continue to Grow

The research forecasts that operator voice revenue will decline by 45% by 2024, in the face of an increase of 88% in the total number of third-party OTT mVoIP users over the next five years. The study urges operators to invest in AI-enabled communications platforms that facilitate competitive voice service delivery.

However, the research anticipates that improved 4G coverage and a growing number of capable devices will boost the number of mobile video call users; partially offsetting voice revenue losses. The study forecasts that ViLTE (Video over LTE) operator revenue will exceed $33 billion by 2024.

RTI (Real-Time-Interaction) and Vo5G (Voice Over 5G)

The report anticipates that 5G proliferation will generate new revenue streams for operators by enabling innovative use cases for VoLTE and ViLTE. The study notes that high data throughput and low latency will propel emerging services such as RTI, remote control and Vo5G, which will find wide application across a range of industries.

Additionally, the research prompts operators to accelerate VoLTE launches, in order to benefit from emerging Vo5G services. The study notes that establishing a 5G-enabled IMS (IP Multimedia Subsystem) infrastructure for VoLTE will provide a pivotal foundation for future voice services rollouts, which operators can monetise in upcoming years.

For more insights on mobile voice, download the free whitepaper: How Will 5G Evolve Mobile Voice in an AI-driven World.

……………………………………………………………………………………………..

Juniper Research provides research and analytical services to the global hi-tech communications sector, providing consultancy, analyst reports and industry commentary.

For further details please contact:

Sam Smith, Press Relations

Telephone: +44(0)1256 830002

Email: [email protected]

Dell’Oro: Worldwide Telecom Equipment market increases after 3 years of decline; VoLTE up 16% Y/Y

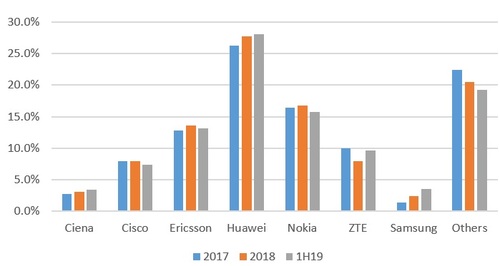

The worldwide telecom equipment market grew 6 percent year-over-year (Y/Y) in the past twelve months, according to a new Dell’Oro Group report. The majority of growth was driven by Mobile RAN and Optical Transport sales. Equipment manufacturer revenue in these two technology areas grew 10 percent and 8 percent, respectively.

The telecom equipment market shifted into a growth phase in 3Q 2018 after three years of decline. As a result, the market’s growth for the trailing four-quarter period ending 2Q 2019 was up significantly from a bottom reached in 2017. Most of the leading vendors gained revenue during this period with the highest percentage increases obtained by Samsung, ZTE, and Ciena.

Although Huawei was placed on the U.S. Entity List in late May, restricting its purchase of U.S. components without a license, the company seems to have avoided any negative impact on sales of telecom equipment. For the trailing four-quarter period (3Q18 through 2Q19), Huawei held the highest share of the telecom equipment market at 28 percent.

Nokia captured the second-highest share in the period due to its strong position in each of the seven technology segments included in the Telecom Equipment Market report. Nokia was a top vendor in each product category.

Global Telecom Equipment Market Share:

Dell’Oro’s market share rankings cover the entire telecom equipment industry and are inclusive of everything from Mobile Radio Access Network (RAN) to optical transport to routers to switches to packet cores and microwave transmission and mobile backhaul.

Huawei’s ability to grow its share through 2019 is noteworthy considering the Chinese tech giant is in the eye of the trade war between the U.S. and China, a battle that has global implications. Many (like this author) believe that the company is being used as a bargaining chip by the U.S. in that trade war. For example, President Trump banned some U.S. companies from doing business with Huawei on national security grounds, though it’s also viewed primarily as a negotiating tactic.

However, the ban may initially affect only Huawei’s smartphone business, which is #2 in the world. It relies on components from U.S. suppliers and the Android OS from Google. The company’s networking business — which includes cellular base stations, optical transport, Ethernet switches, routers and transponders– may be more insulated from the effects of the U.S. ban, given that sales cycles among global telecom service providers are much longer when compared with smartphone buyers.

Further, Huawei’s networking equipment has long been implicitly forbidden among major US telecom service providers, so the Chinese supplier has little to lose, except for sales of mobile base stations to rural U.S. carriers as per this IEEE Techblog post.

The Dell’Oro Group Advanced Research: Telecom Equipment Market Report is a compilation of the findings of seven research programs conducted by Dell’Oro Group. These research programs are:

Broadband Access and Home Networking, Carrier IP Telephony, Microwave Transmission & Mobile Backhaul, Mobile Radio Access Network, Optical Transport, Router & Carrier Ethernet Switch, and Wireless Packet Core. For more information, please contact us by email at [email protected].

…………………………………………………………………………………………..

VoLTE and Carrier Telephony:

In a separate report, Dell’Oro said that the worldwide Voice-over-LTE (VoLTE) infrastructure market revenues grew 16 percent Year-Over-Year (Y/Y) in 2Q 2019, as the Asia Pacific region took the leading role in licenses shipped, growing 62 percent Y/Y.

“It appears the tipping point of preparing 5G networks for voice with VoLTE is upon us as indicated by the growth rate we saw in 2Q 2019,” said Dave Bolan, senior analyst at Dell’Oro Group. “Licenses shipped to service providers in China and India accounted for most of the 62 percent growth in the Asia Pacific region. With 5G services expected to launch in October 2019, Chinese service providers are aggressively trying to migrate their 1.2 B LTE subscribers to VoLTE. Currently only about half are using VoLTE,” continued Bolan.

“In addition, the market in India is seeing a rapid shift to VoLTE services. For example, service provider Reliance Jio, had over 331 M VoLTE subscribers with a 54 percent Y/Y growth rate,” Bolan added.

Additional highlights from the 2Q 2019 Carrier IP Telephony report include:

- The top three ranking VoLTE vendors were Huawei, Nokia, and Ericsson

- Circuit switched core market revenues were down 21 percent Y/Y

- The IMS Core market revenues were up 13 percent Y/Y

- The Carrier IP Telephony market was up 5 percent Y/Y

The Dell’Oro Group Carrier IP Telephony Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for both wireline and wireless voice core markets. The segments include soft switches, media gateways, session border controllers, voice application servers, IMS CSCF and HSS, and legacy mobile switching centers. To purchase this report, please contact us at: [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Worldwide Telecom Equipment Market Grew 6 Percent in Past Twelve Months, According to Dell’Oro Group

Worldwide VoLTE Market Revenues Grew 16 Percent Y/Y in 2Q 2019, According to Dell’Oro Group

GSA Report: Evolution of LTE to 5G also includes NB-IoT and LTE-M

Pre-standard “5G” roll outs continue and the latest Evolution of LTE to 5G report from GSA identifies 884 operators actively investing in LTE, with 769 operational LTE networks in 225 countries, 194 VoLTE capable networks and 296 operators in 100 countries investing in 5G with 39 – 3GPP Release 15 (5G NR NSA) compliant 5G networks launched – some with limited service.

High end devices are also growing in popularity with more CAT-12 and above devices coming to market and 100 5G devices now announced. GSA expects 5G to be deployed much faster than 4G which took 7 years to reach 100 million subscriptions. We expect 5G to reach 100 million subscriptions in less than 5 years.

GSA Market Research Findings:

• 884 operators actively investing in LTE, including those evaluating/ testing and trialling LTE and those paying for suitable spectrum licences (excludes those using technology neutral licences exclusively for 2G or 3G services).

• 769 operators running LTE networks providing mobile and/or FWA services in 225 countries worldwide.

• 194 commercial VoLTE networks in 91 countries and a total of 262 operators investing in VoLTE in 120 countries.

• 304 launched or launched (limited availability) LTE-Advanced networks in 134 countries. Overall, 335 operators are investing in LTE-Advanced technology in 141 countries.

• Ten launched networks that support user equipment (UE) at Cat-18 DL speeds within limited geographic areas, and one supporting Cat-19 (in a limited area).

• 228 operators with TDD licences and at least 164 operators with launched LTE-TDD networks.

• 151 operators investing in NB-IoT in 72 countries; of these, 98 NB-IoT networks are deployed/launched in 53 countries. 62 operators are investing in LTE-M/Cat-M1 in 36 countries; of these, 38 LTE-M/Cat-M1 networks are deployed/commercially launched in 26 countries. • 296 operators in 100 countries have launched with limited availability, deployed, demonstrated, are testing or trialling, or have been licensed to conduct field trials of mobile 5G or FWA 5G.

• 56 operators in 32 countries have announced the deployment of 5G within their live network.

• 39 operators have announced 3GPP 5G service launches (or limited service launches).

LTE deployments:

The drivers of LTE, LTE-Advanced, LTE-Advanced Pro and increasingly 5G, for operators are more capacity, enhanced performance and improved efficiencies to lower delivery cost. Compared with 3G, LTE offered a big step up in the user experience, enhancing demanding apps such as interactive TV, video blogging, advanced gaming and professional services. Deployment of LTE-Advanced technologies – and particularly carrier aggregation – takes performance to a new level and is a major current focus of the industry. Interest in LTE-Advanced Pro is high too, bringing with it new, globally standardised LPWA solutions – LTE Cat-M1 (LTE-M, eMTC) and Cat-NB1 (NB-IoT) – and new business opportunities. And while LTE-Advanced and LTE-Advanced Pro solutions have yet to be deployed by the majority of operators, vendors and network operators are already looking towards 5G and its potential to meet future capacity, connectivity and service requirements.

Spectrum for LTE deployments:

Pressure for spectrum is high and operators need to deploy the most efficient technologies available. LTE, LTE-Advanced and LTE-Advanced Pro services can be deployed in dozens of spectrum bands starting at 450 MHz and rising to nearly 6 GHz. The most-used bands in commercial LTE networks are 1800 MHz (Band 3), which is a mainstream choice for LTE in most regions; 800 MHz (Band 20 and regional variations) for extending coverage and improving in-building services; 2.6 GHz (FDD Band 7) as a major capacity band; and 700 MHz (with variations in spectrum allocated around the world) again for coverage improvement. The now-completed LTE standards enable the possibility to extend the benefits of LTE-Advanced to unlicensed and shared spectrum.

There are several options for deploying LTE in unlicensed spectrum. The GSA report LTE in Unlicensed and Shared Spectrum: Trials, Deployments and Devices gives details of market progress in the use of LAA, eLAA, LTE-U, LWA and activity in the CBRS band.

Many recent allocations/auctions of spectrum have focused on licensing unused spectrum – including pockets of spectrum in the 2 to 4 GHz range, but also at lower frequencies – for LTE and future 5G services. This spectrum is sometimes dedicated to LTE, sometimes to 5G and sometimes allocated on a technology-neutral basis.

VoLTE global status:

In total GSA has identified 262 operators investing in VoLTE in 120 countries, including 194 operators that have launched VoLTE voice services in 91 countries. There have been recent launches in India, Hungary, Iran, Maldives, Kenya, Mexico, Tuvalu, Ireland, New Zealand and Nieu.

GSA is aware of at least 30 operators deploying VoLTE and nearly 40 other operators planning VoLTE or are testing/trialling the technology. The GSA report VoLTE and ViLTE: Global Market Update, published in August 2019, gives more detail.

LTE-Advanced global status:

Investment in LTE-Advanced networks continues to grow. By July 2019, there were 304 commercially launched LTE-Advanced networks in 134 countries. Overall, 335 operators are investing in LTE-Advanced (in the form of tests, trials, deployments or commercial service provision) in 141 countries.

Many operators with LTE-Advanced networks are looking to extend their capabilities by adding 3GPP Release 13 or Release 14 LTE-Advanced Pro features, e.g. those making use of carrier aggregation of large numbers of channels, or carriers across TDD and FDD modes, LAA, massive MIMO, Mission-Critical Push-to-Talk, LTE Cat-NB1/NB-IoT or LTE-M/Cat-M1.

The GSA report LTE in Unlicensed and Shared Spectrum: Trials, Deployments and Devices tracks the progress of LAA/eLAA, LWA and LTE-U. By July 2019, there were 37 operators investing in LAA (including eight deployed/launched networks), 11 operators investing in LTE-U (including three launched/deployed networks) and three investing in LWA (including one launched network). One operator had undertaken trials of eLAA.

Carrier aggregation has been the dominant feature of LTE-Advanced networks. Varying numbers of carriers and varying amounts of total bandwidth have been aggregated in trials and demos, but in commercial networks, the greatest number of carriers aggregated (where we have data) is five. Some trials and demos have also aggregated up to ten carriers, for instance SK Telecom’s trial in South Korea.

Pre-standard 5G global status:

GSA has identified 296 operators in 100 countries that have launched (limited availability or non-3GPP networks), demonstrated, are testing or trialling, or have been licensed to conduct field trials of 5G-enabling and candidate technologies (up from 235 operators in May 2019).

Detailed analysis of speeds and spectrum used for 5G trials to date is available in the report Global Progress to 5G – Trials, Deployments and Launches on the GSA website. Operators continue to provide clarity about their intentions in terms of launch timetables for 5G or pre-standards 5G. GSA has identified 56 operators in 32 countries that have stated that they have activated one or more 5G sites within their live commercial network (excludes those that have only deployed test sites).

The number that have announced the launch of commercial services remains much lower however, as operators have had to await the availability of 5G devices. These have now started to appear, removing the market blockage.

GSA has identified 100 announced devices (excluding regional variants and prototypes) and a handful of these are now available for customers to buy and use. See GSA’s report 5G Device Ecosystem, published monthly, for more details.

GSA knows of 39 operators who have (as of 6 August 2019) announced 3GPP compatible 5G service launches (either mobile or FWA, some with limited availability): we understand there are ten operators with FWA-only services, 15 with mobile-only services, and 14 with both mobile and FWA services. All services are initially restricted in terms of either geographic availability, devices availability, or the types and numbers of customers being provided with services.

Among recent service launches (or limited service launches) are those by three operators in Kuwait (Viva, Zain and Ooredoo), Batelco in Bahrain, T-Mobile and Vodafone in Germany, Vodafone in the UK, Digi Mobile in Romania, Monaco Telecom and Dhiraagu in the Maldives.

Cellular LPWANs for IoT:

The start of 2019 has continued to see strong growth in the number of cellular IoT networks based on NB-IoT and LTE-M. By July 2019, there were 151 operators investing in NB IoT in 72 countries, up from 148 operators in 71 countries in May 2019. The number of deployed/launched NB-IoT networks was 98 in 53 countries, up from 78 operators in 45 countries in January 2019. There are 62 operators investing in LTE-M networks in 36 countries, up from 57 operators in 34 countries in January 2019. Thirty-eight operators have deployed/launched LTE-M networks in 26 countries, up from 30 operators in January 2019. Orange Spain launched its LTE-M network in June 2019.

Altogether 55 countries now have at least either a launched NB-IoT network or a launched LTE-M network and 24 of those countries have both network types.

…………………………………………………………………………………………………….

GSA will continue tracking the progress of 5G deployments worldwide. GSA reports are compiled from data stored in the GSA Analyser for Mobile Broadband Devices/Data (GAMBoD) database, which is a GSA Member and Associate benefit.

Much of the GSA activity is working on spectrum and the upcoming WRC-19 conference in October/November. If you would like to meet up with GSA in Sharm el-Sheikh, Egypt at the conference, please email [email protected]

IHS Markit: Service Provider VoIP and IMS revenue fell 8% in 2018; More declines expected

By Diane Myers, senior research director, IHS Markit

Global service provider voice over Internet Protocol (VoIP) and IP multimedia subsystem (IMS) product revenue fell to $4 billion in 2018, a year-over-year decline of 8 percent. Overall worldwide revenue is forecast to decline at a compound annual growth rate (CAGR) of 2 percent from 2018, falling to $3.6 billion in 2022. This decline is caused mainly by slowing voice over long-term evolution (VoLTE) network deployments and competitive factors leading to lower prices. Big sales volumes continue in India and China, but pricing in those two countries is lower, which is stunting growth.

Huawei was the leading vendor in 2018 with 27 percent share of global revenue. Huawei was followed by Nokia with 23 percent and Ericsson with 20 percent. ZTE and Ribbon Communications rounded out the top five. For the full year, Nokia and Metaswitch were two noteworthy vendors posting revenue growth.

Service provider VoIP and IMS Market Highlights

- North America was the only global region to post year-over-year growth in 2018, with VoLTE expansion and new rollouts, most notably by Sprint and Shaw. Sales in the region grew 7 percent in 2018, following a 7 percent decline in 2017.

- As of November 2018, 137 operators had launched commercial VoLTE services, with more coming every year, but launches have slowed. Europe Middle-East and Africa launched 80 services, followed by Asia-Pacific with 35, North America, with 15 and Caribbean and Latin America with 7.

Service Provider VoIP and IMS Equipment and Subscribers Market Tracker

Each quarter, the “Service Provider VoIP and IMS Equipment and Subscribers Market Tracker” from IHS Markit provides worldwide and regional vendor market share, market size, forecasts through 2023, analysis and trends for trunk media gateways, SBCs, media servers, softswitches, voice application servers, HSS, and CSCF.

,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,,

IMS Backgrounder:

IMS began as a 3GPP technology for 3G mobile networks, but has been adopted as a broader standard. It is in the development and early testing phase, and its impact remains to be seen. IMS builds on the SIP protocol.

IP Multimedia Subsystem (IMS) is a generic architecture for offering multimedia and voice over IP services, defined by 3rd Generation Partnership Project (3GPP). IMS is access independent as it supports multiple access types including GSM, WCDMA, CDMA2000, WLAN, Wireline broadband and other packet data applications. IMS will make Internet technologies, such as web browsing, e-mail, instant messaging and video conferencing available to everyone from any location. It is also intended to allow operators to introduce new services, such as web browsing, WAP and MMS, at the top level of their packet-switched networks.

IMS Release 7 is also the basis for the CableLabs PacketCable 2.0 standard which is currently under development. This is an architecture specific to service delivery over broadband cable networks which covers VoIP, cellular integration and enhanced telephony.

Some of the possible applications where IMS can be used are:

- Service Convergence (Caller-ID on TV, click to call from TV or web)

- Presence services

- Full Duplex Video Telephony

- Instant messaging

- Unified messaging

- Multimedia advertising

- Multiparty gaming

- Videostreaming

- Web/Audio/Video Conferencing

- Push-to services, such as push-to-talk, push-to-view, push-to-video

Service Provider VoIP and IMS -12% YoY in 2017; VoLTE Deployments Slowing

Following are highlights from the first quarter 2018 edition of the IHS Markit Service Provider VoIP and IMS Equipment and Subscribers Market Tracker, which includes data for the quarter ended December 31, 2017. Author is IHS Markit analyst Diane Myers.

Global service provider voice over Internet Protocol (VoIP) and IP multimedia subsystem (IMS) product revenue fell to $4.5 billion in 2017, a decline of 12 percent year over year. Overall worldwide revenue is forecast to decline at a compound annual growth rate (CAGR) of 3 percent, falling to $4 billion in 2022. This decline is due to the slowing of voice over LTE (VoLTE) network deployments and overall spending falling into a steady pattern. Downward pricing — because of continued competitive factors and large deal sizes in India, China and Brazil — is also dampening growth.

“The big story over the past four years has been mobile operators and the transition to VoLTE, which has been the number-one driver of VoIP and IMS market growth, along with voice over WIFI (VoWiFi) and other mobility services,” said Diane Myers, senior research director, VoIP, UC, and IMS, IHS Markit. “However, after initial VoLTE network builds are completed, sales growth drops off, as operators launch services and fill network capacity,” she added.

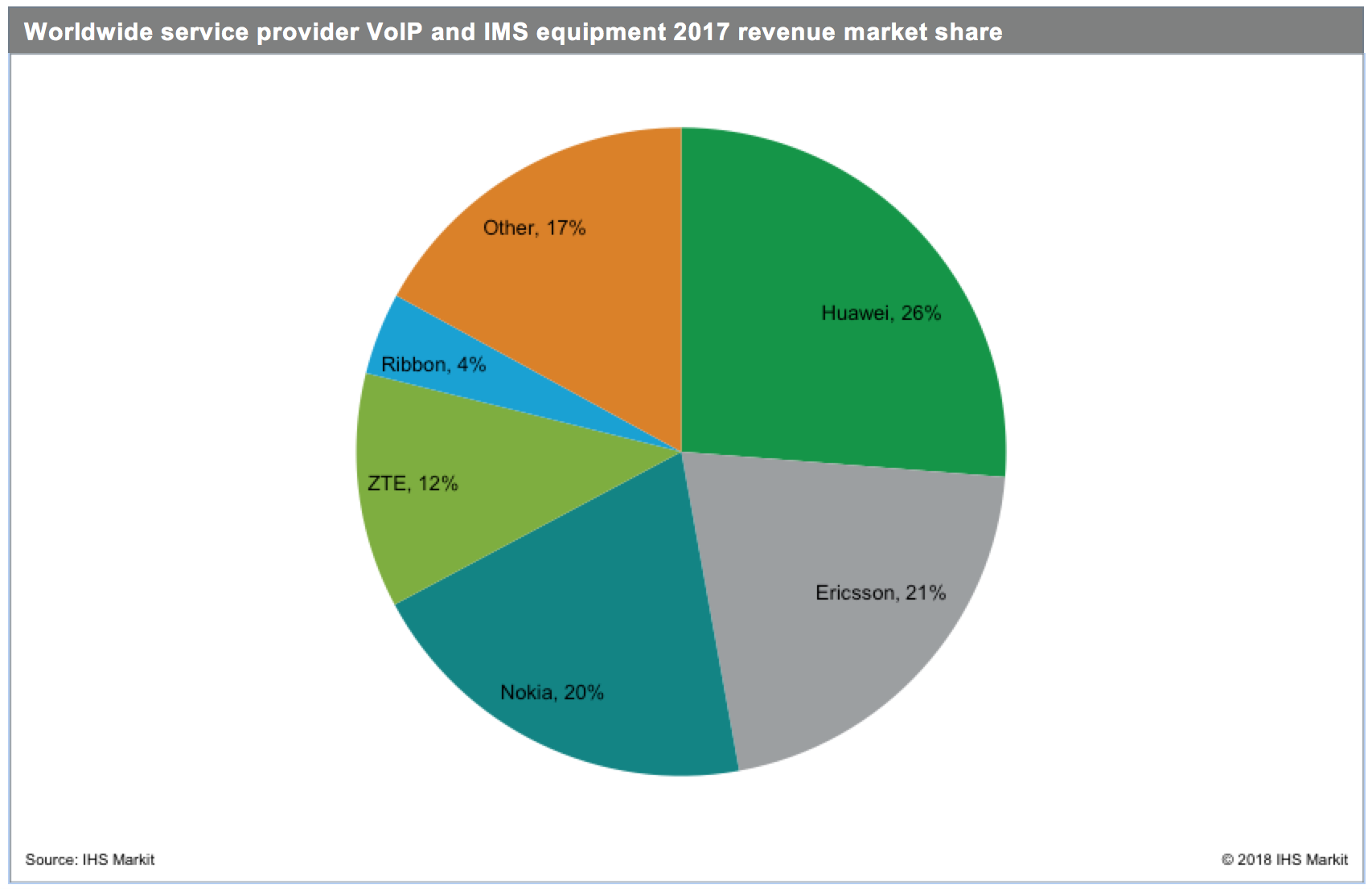

Huawei was the standout vendor in the VoIP and IMS market, with 26 percent of worldwide revenue in 2017. Ericsson ranked second, with 21 percent, followed by Nokia, ZTE and Ribbon Communications.

Service provider VoIP and IMS market highlights

- As large VoLTE projects in India and China continued to expand, the Asia-Pacific region ranked first in global revenue in 2017, accounting for 37 percent of the market. Spending from VoLTE projects in Asia-Pacific and Caribbean and Latin America continue, but it is not enough to move the worldwide market back into growth territory, primarily due to price compression in both regions.

- As of January 2018, 119 operators launched commercial VoLTE services, with more coming every year. However, new launches are slowing. Most VoLTE launches in 2017 occurred in Europe. There was also some expansion in Chinese provinces, due to growth from China Mobile; in Brazil, with Vivo; and in India, with Bharti Airtel.

Service Provider VoIP and IMS Equipment and Subscribers report synopsis

The quarterly Service Provider VoIP and IMS Equipment and Subscribers Market Tracker from IHS Markit provides worldwide and regional vendor market share, market size, forecasts through 2022, analysis and trends for trunk media gateways, SBCs, media servers, softswitches, voice application servers, HSS, CSCF and IM/presence servers.