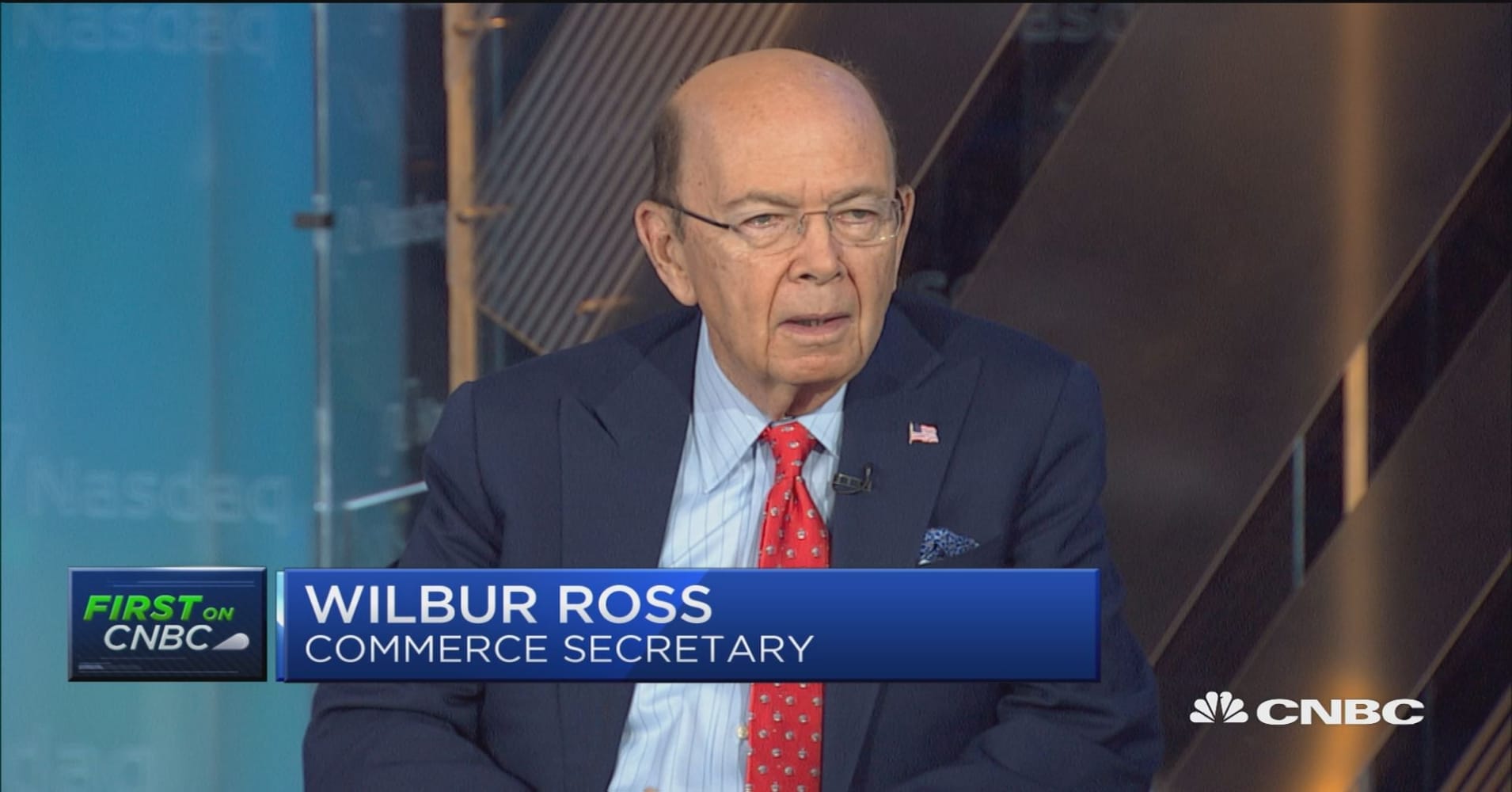

U.S. Commerce Secretary Talks Up 5G Implying T-Mobile/Sprint Merger Would Accelerate 5G Deployments in U.S.

The Trump administration is placing a high priority on building 5G mobile networks, Commerce Secretary Wilbur Ross told CNBC in a discussion of T-Mobile’s proposed merger with Sprint. According to a CNBC provided transcript of the interview, Ross said:

“You never know who is really ahead or behind (in 5G) until it is truly perfected. Nobody has 5G totally perfected yet. I think the pitch that Sprint and T-Mobile are making is an interesting one that their merger would propel Verizon and AT&T into more active pursuit of 5G. Whoever pursues it, whoever does it, we’re very much in support of 5G. We need it. We need it for defense purposes. We need it for commercial purposes. We (the U.S.) really need to be the player in 5G.”

A video of the interview can be watched here.

……………………………………………………………………………………………………………………………………………………………………………………….

The Federal Communications Commission (FCC) said in February it planned new auctions of high-band spectrum starting later this year to speed the launch of next-generation 5G networks. Carriers have spent billions of dollars acquiring spectrum and are beginning to develop and test 5G networks, which are expected to be at least 100 times faster than current 4G networks and cut latency, or delays, to less than one-thousandth of a second from one-hundredth of a second in 4G, the FCC has said.

Policymakers and mobile phone companies have said the next generation of wireless signals needs to be much faster and far more responsive to allow advanced technologies like virtual surgery or controlling machines remotely. T-Mobile Chief Executive John Legere met with two FCC commissioners in Washington on Tuesday to discuss the merits of the deal.

………………………………………………………………………………………………………………………………………………………………………………………..

Sprint is beginning to train its employees on what to say regarding the merger.

A memo has leaked out, courtesy of XDA-Developers, that shows the talking points that Sprint wants its customers to focus on. According to the document, Sprint employees are supposed to say that the company is very excited that the two companies have agreed to merge. And add that “this is terrific news for customers.” As well as assuring customers that the new T-Mobile will have “a faster, more reliable network at lower prices and with better value.” Which is basically what Sprint and T-Mobile said on Sunday and on Monday during their press tour with different news sites and TV networks.

Columnist Alexander Maxham wrote: “It is definitely important for Sprint to begin training its employees on what to say to customers regarding this merger, as there are bound to be a ton of questions regarding the merger in the coming weeks and months. T-Mobile is likely also training its employees on what to say about the merger – and many of the talking points are likely very similar if not exactly the same. Though T-Mobile’s memo has not leaked just yet. The two companies believe that merging together, they’ll be able to provide the best 5G network in the US, and also be able to better compete with AT&T and Verizon, both of which are more than twice the size of T-Mobile, and almost three times the size of Sprint.”

6 thoughts on “U.S. Commerce Secretary Talks Up 5G Implying T-Mobile/Sprint Merger Would Accelerate 5G Deployments in U.S.”

Comments are closed.

Verizon CEO couldn’t care less about T-Mobile and Sprint’s $26B merger. Lowell McAdam is skeptical the tie-up will lead to a more competitive market for high-speed 5G wireless broadband access.

T-Mobile’s plan to merge with wireless rival Sprint doesn’t even rate a blip on Verizon’s radar.

That was Verizon CEO Lowell McAdam’s reaction Wednesday when asked his opinion about the $26 billion deal between the third- and fourth-largest US wireless carriers.

“We don’t care, is the answer to that,” McAdam told GeekWire, facetiously alluding to past attempts by T-Mobile to merge with Sprint and AT&T. “Maybe the fourth time is the charm here, I don’t know.”

The deal, announced Sunday, comes amid intense competition among US carriers to win customers, leading to freebies like access to Netflix, as well as a renewed eagerness to court smartphone users with unlimited data. Sprint is still giving away a year of service for free. Those competitive pressures have driven T-Mobile and Sprint together.

McAdam expressed skepticism that the deal would make the US more competitive in the emerging market for high-speed 5G wireless broadband access.

“In the areas like 5G, we’ve been pushing forward with that strategy,” he said. “I don’t think that merger matters from a 5G perspective. We’re going to do it regardless and we’re way ahead of everybody. We’ve made all the investments that are required in fiber and millimeter wave spectrum and those sorts of things.”

https://www.cnet.com/news/verizon-ceo-couldnt-care-less-about-t-mobile-and-sprints-26b-merger/

Thanks for your unique perspective and separating hype and spin from reality

Us Commerce Secretary Wilbur Ross says we need 5G but he doesn’t say why or what 5G is.

It seems every wireless carrier has a different definition and a different spec none of which are compatible with any others

Very informative article with just the right to keep you wanting to read more on whether US govt will approve the Sprint-T Mobile merger. Well done!!

T-Mobile CTO at MWCA: Sprint merger will accelerate 5G

5G access will arrive faster and be broader under a Sprint-T-Mobile merger, according to CTO Neville Ray, who also said talks with the FCC and Department of Justice have been ‘very positive’ on the transaction.

https://www.zdnet.com/article/t-mobile-cto-at-mwca-sprint-merger-will-accelerate-5g/

U.S. Lags China in the Next Big Technological Advance in Cellphone Networks. Here’s Why it Doesn’t Matter

David H. Freedman, 10 May 2019 Newsweek Global Edition

Copyright © 2019 Newsweek LLC All Rights Reserved.

At the end of March, mobile phone carrier China Unicom broadcast a 360-degree, 3D view of the Chongqing International Marathon that put viewers smack in the middle of the 30,000-strong scrum of runners. The images were four times sharper than the highest-resolution content available from Netflix.

The live stream—billions of digital bits of data per second—was 20 times faster than current cellphone networks built with 4G technology can manage. China Unicom was demonstrating 5G technology, the next big leap for mobile networks, built by Huawei, the Chinese telecom giant that President Donald Trump loves to hate.

5G technology is arriving in the U.S. too—but not on networks built by Huawei, the world’s largest manufacturer of 5G network equipment. The White House is pushing hard to keep Huawei from grabbing an insurmountable lead in wiring up the world with 5G, which is expected to usher in a new technological age of driverless cars, smart objects, remote medical procedures, new forms of advertising and other things nobody has yet dreamed up. “The race to 5G is on, and America must win,” said Trump in mid-April. It’s no secret that he is focused on China, led by Huawei.

But which 5G race can the U.S. hope to win? There are really three different races: one to provide the equipment on which the new networks are built; one to roll out the services widely; and another to develop the whole package—the software, devices, services and business processes that take advantage of 5G’s blinding speed and near-instant responsiveness. The distinction is critical, because the U.S. has already lost the first race and may lose the second.

But the U.S. could still win the third race—and reap the main economic benefits of 5G. “The real race between the U.S. and China is to digitalize their economies,” says Bengt Nordstrom, CEO of international telecom consultancy Northstream in Stockholm. “The rest is hype.”

You won’t hear these distinctions in the Trump administration’s policies. The U.S. has already banned Chinese companies from building “essential” U.S. network infrastructure and threatened to ban Huawei components from all U.S. networks. The restrictions are pegged to suspicions that Huawei would give Chinese-government hackers “back doors” into its equipment.

Huawei denies any intent to build spyware, and there’s no public evidence it ever has. But many experts agree that Huawei-built networks pose a big security risk. “U.S. tech companies have the right to refuse to cooperate with government requests to spy, to sue if they’re being pressured and to disclose any spying to the media,” says Timothy Heath, a senior international defense researcher at the Rand Corp. in Washington, D.C. “Chinese companies don’t have those options. They’re obligated by law to be amenable to exploitation by the Chinese government.”

The Trump administration wields that argument to push the rest of the world into eschewing Huawei 5G equipment; it has threatened to sever intelligence ties with any nation that resists. So far that threat hasn’t stuck. German Chancellor Angela Merkel is defiant. British Prime Minister Theresa May gave an official thumbs-up to Huawei 5G equipment (except for certain critical components). Most of Asia, Africa and Latin America have welcomed Huawei with open arms. Only Australia and New Zealand have cooperated with the U.S.; Japan decided to ban Huawei on its own.

Huawei, already far ahead on the technology, is undercutting rivals on price. Its equipment costs as much as 40 percent less than Nokia’s and Ericsson’s—its only competitors—and neither company can match Huawei’s generous financing terms. Huawei’s market share is now more than Nokia’s and Ericsson’s combined. The U.S. isn’t even on the map: Not one U.S. company offers 5G network products or has announced plans to do so. And it’s too late anyway: The market would be saturated before a new entrant could get products out the door.

What about the race to build 5G networks? On the surface, the U.S. appears to be neck and neck with China and tech-savvy South Korea. Carriers in all three countries (plus one in Switzerland) claim to have introduced early 5G services to a limited number of mobile customers, and Japan is expected to launch 5G mobile service soon. But the U.S. networks, offered by Verizon in 22 cities, have been derided for spotty coverage. U.S. mobile carriers, hampered by the ban on Huawei, show no signs of offering nationwide 5G coverage before 2021.

China is a year or two ahead on a 5G network rollout, experts believe. “The Chinese government can mandate it as a priority, and it has the financial resources to make sure it succeeds,” says Gordon Smith, CEO of Sagent, a telecom company.

Once 5G networks are finally in place, however, the advantage is expected to shift. The U.S. maintains a strong lead in finding innovative ways to put Big Data to work for businesses and consumers, thanks both to tech giants like Google and Amazon, which spend billions on research, and a thriving tech-startup ecosystem. Leveraging 5G would create a digital world that reaches new levels of immersiveness, interactivity and realism and that is sensitive to every twitch of input from people and the environment. It would touch on video games and other entertainment; educational and advertising content; and the refrigerators, watches, buildings, store shelves and so on that cheaply zip sensor data to distant servers running artificial intelligence apps.

The economic impact of these services would be far more significant than building equipment and installing networks. The applications of 5G are expected to generate $4 trillion globally in the first two years alone, according to Wilson Chow, head of technology and telecommunications consulting at PwC China in Hong Kong. By contrast, the projected total worldwide market for installing 5G networks over four years is a mere $57 billion, according to industry research company IDC.

Perhaps more important, maintaining dominance in applications will allow the U.S. to remain the world’s leading technology influencer. “Think of what the U.S. gained economically, politically and militarily from being the first to master internet technologies and how China had to struggle to catch up,” says the Rand Corp.’s Heath. “5G is likely to play out in a similar way.”

If it does, Trump, should he still be president, may end up thanking China and Huawei for laying the pipes that made it possible.

Newsweek LLC