IHS Markit: $3.5 Billion to be spent on Carrier Wi-Fi equipment between 2018 and 2022

by Richard Webb, IHS Markit

The carrier Wi-Fi equipment market continued to grow in 2017, driven by ongoing broadband demand and a strong role within 5G era. Revenue reached $626 million for the full-year 2017, increasing 1.3 percent from the prior year.

By 2022, the market is forecast to hit $725 million — a cumulative size of over $3.5 billion from 2018 to 2022 — based on two strong segments: standalone Wi-Fi access points (predominantly deployed by fixed-line operators and wireless ISPs) and dual mode Wi-Fi/cellular access points (deployed by mobile operators).

“The arrival of the 5G era will gradually transform network architectures, but the requirements for network density mean that Wi-Fi will continue to play a strong support role for mobile broadband end-users and for newer applications such as the Internet of Things and smart city,” said Richard Webb, director of research and analysis for service provider technology at IHS Markit. “We expect an uptick in carrier Wi-Fi investments through 2020, aligned with 5G network development.”

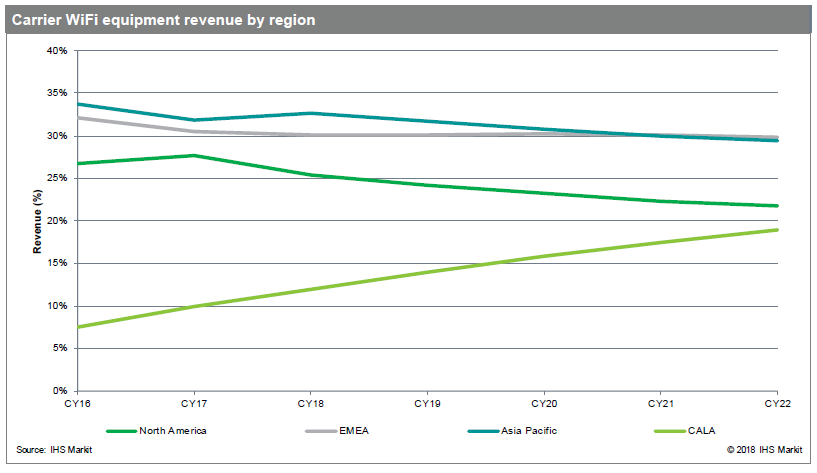

All regions are seeing strong demand for carrier Wi-Fi, demonstrating evidence of proliferation in developing countries in addition to developed markets where mobile data growth is well documented. However, the scale of requests for proposals (RFPs) from mobile operators in Asia Pacific — in particular China and Indonesia currently, with India likely to add to the groundswell closer to 2022 — means the region will be the strongest driver of growth, although all regions see continuous growth through this period.

More carrier Wi-Fi market highlights

- Dual mode 3G/Wi-Fi equipment revenue totaled just $17 million in 2017, a decline of 66.4 percent from the prior year

- Meanwhile, subscriber identity module (SIM)–based Wi-Fi access points are experiencing solid adoption growth (+21.6 percent in 2017 from 2016), driven by the desire to have closer integration between Wi-Fi and the mobile network

- Network functions virtualization (NFV) has strong potential benefits for fixed and mobile operators alike, such as opex and capex efficiencies, service flexibility and creation, reduced power usage and new service environments, including data analytics and location-based services

Carrier WiFi Equipment Market Tracker – H2 2017

This report tracks Wi-Fi equipment deployed by operators in public spaces for wireless internet access. It provides worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends for Wi-Fi hotspot controllers and carrier Wi-Fi access points.

Reference:

……………………………………………………………………………………………………………………………………………………………………………………….

In a separate report, Markets & Markets forecasts the Wi-Fi Market to be worth $15.60 Billion by 2022:

The rapid adoption of Wi-Fi technology is expected to make North America the largest region in market.

North America consists of developed economies, the US and Canada. In this region, Wi-Fi solutions and services are gaining traction within the businesses. The region’s strong financial position also enables it to invest heavily in the Wi-Fi technology. These advantages have provided North American organizations a competitive edge in the market. Moreover, the region has the presence of several major Wi-Fi vendors. Therefore, there is strong competition among the players. The number of enterprises adopting Wi-Fi solutions and services is quite high in North America as compared to the other regions.

The major vendors offering Wi-Fi solutions and services across the globe include Cisco (US), Aruba (US), Ruckus Wireless (US), Juniper Networks (US), Ericsson (Sweden), Panasonic (Japan), Huawei (China), Alcatel-Lucent Enterprise (France), Netgear (US), Aerohive Networks (US), and Riverbed Technology (US). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships, and collaborations, to enhance their position in the Wi-Fi market.