IHS Markit: Optical Network Equipment Market off to slow start in 2018

By Heidi Adams, senior research director, IP and optical networks, IHS Markit

Highlights

- Global optical network hardware revenue totaled $3.1 billion in the first quarter of 2018 (Q1 2018), declining 25 percent sequentially and remaining flat on a year-over-year basis.

- The global Q1 2018 optical equipment market net of China was down 2 percent year over year. China itself was up 7 percent year over year, and continues to be a key market for optical transport equipment.

- Huawei remained the overall optical equipment market leader in Q1 2018, with 26 percent market share.

Our analysis

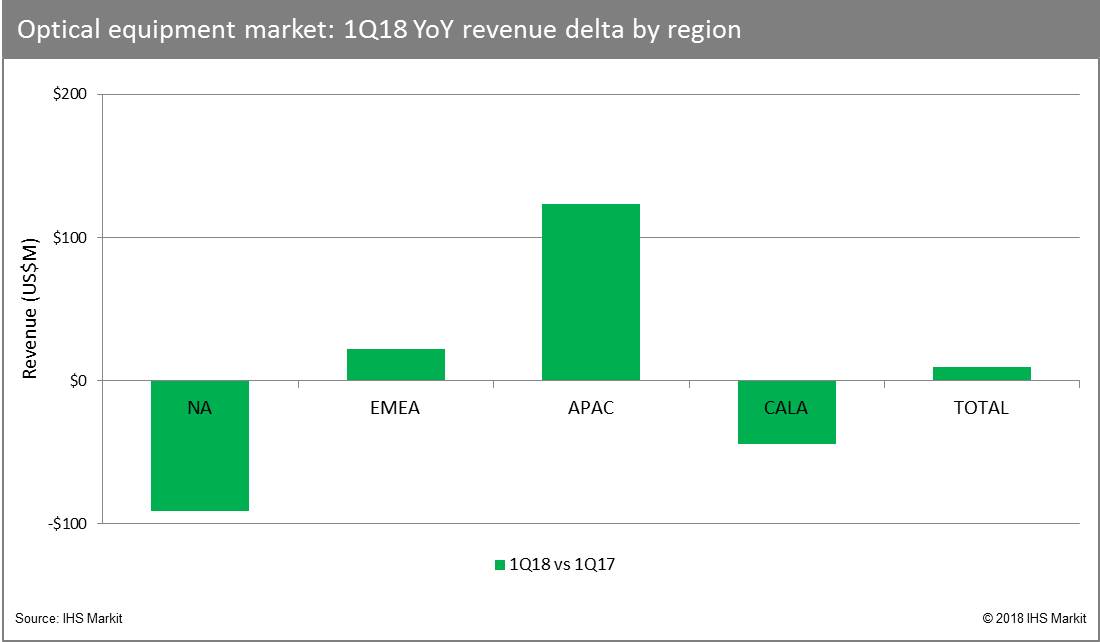

After a strong close to 2017, the optical equipment market got off to a lackluster start in 2018. Modest year-over-year growth in Europe, the Middle East and Africa (EMEA) and Asia Pacific was not sufficient to overcome year-over-year spending declines in North America and the Caribbean and Latin America (CALA) regions in the quarter. Total optical equipment market spending was down 25 percent on a sequential basis, with all regions seeing quarter-over-quarter declines.

Wavelength-division multiplexing (WDM) continues to be the growth engine for the market. In Q1 2018, the WDM segment totaled $2.9 billion, up 3 percent year-over-year, thanks to gains in EMEA and Asia Pacific. Both the metro and long haul segments experienced low single-digit year-over-year growth in Q1 2018.

Synchronous optical networking (SONET)/synchronous digital hierarchy (SDH) continued its overall decline. Global revenue came to $206 million in Q1 2018, down over 25 percent year over year. This segment represented less than 10 percent of the total optical network equipment market in the quarter.

Huawei continued to lead the total optical equipment market by a wide margin in Q1 2018. Nokia secured second place based on continuing strength in EMEA and increasing business in Asia Pacific. Ciena maintained its leadership position in North America and remained number three overall in the global market. ZTE rounded out the top four, but faces a difficult journey ahead with the impact of US sanctions and a subsequent halt in major operations.

Unstoppable bandwidth demand drives long-term growth

IHS Markit anticipates a continuing ramp in network capacity to address growing bandwidth demand. In the metro, the primary driver is burgeoning bandwidth demand—to, from and between data centers.

Not to be ignored is the coming broader introduction and adoption of consumer 4K and higher video content and services on a variety of devices. The shift from data to video to virtual reality (VR)/augmented reality (AR) will add yet another set of bandwidth-intensive and latency-sensitive services to the mix toward 2022.

Finally, a further evolutionary shift in mobile network architectures in preparation for 5G and a range of new fixed and mobile machine-to-machine (M2M) and Internet of Things (IoT) applications will set the stage for an investment cycle at the farthest reaches of the optical access network.

Based on these industry trends, the optical equipment market will grow at a compound annual growth rate (CAGR) of 4.5 percent from 2017 to 2022, according to IHS Markit forecasts.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Editor’s Note:

We believe much of the anticipated fiber optic network growth will come from a variety of factors in the metro, including data center interconnect demands, higher-bandwidth video transmission (with the advent of 4K video) and eventually virtual and augmented reality. We think 5G mobile backhaul support is questionable in the next few years considering all the “5G” hype and lack of standards till IMT 2020 (5G radio aspects ONLY) recommendations are finalized in late 2020.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Optical Network Hardware Market Tracker – Q1 2018

This report tracks the global market for metro and long-haul WDM and SONET/SDH equipment and SONET/SDH and WDM ports. It provides market size, market share, forecasts through 2022, analysis and trends.

One thought on “IHS Markit: Optical Network Equipment Market off to slow start in 2018”

Comments are closed.

IMHO the 5G mobile backhaul build-out as many years away. I believe the big driver will be metro WDM and fiber to the curb (FTTC) or Fiber to the premises (FTTP).