44 Chinese companies have joined the O-RAN Alliance

by John Strand, Strand Consult (edited by Alan J Weissberger)

In 2019, the world’s mobile network operators earned just over $1 trillion and spent $30 billion on Radio Access Network (RAN) equipment, which was some 3 percent of revenue. To reduce cost, mobile operators leverage the pool of network equipment vendors, for example by developing new interfaces in network equipment to lower barriers to entry, under the industry term OpenRAN or “Open Radio Access Network.”

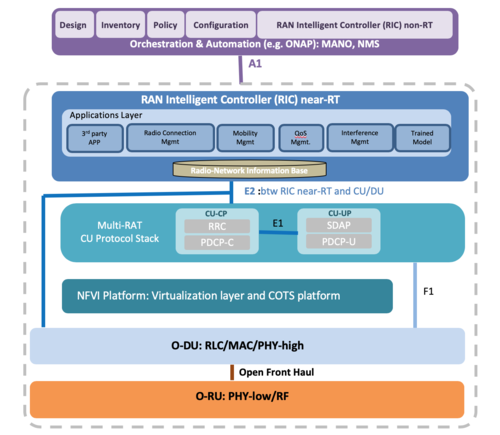

OpenRAN is not a standard, but a collection of technological features purported to allow different vendors to supply 5G networks with “standardized open interfaces” specified by the O-RAN ALLIANCE.

Source: O-RAN Alliance

……………………………………………………………………………………………………………………….

O-RAN only addresses internal RAN components. The wireless telecom industry still relies on 3GPP, the 3rd Generation Partnership Project, to build an end-to-end mobile cellular network and to connect end-user devices.

OpenRAN has become a hot topic in tech policy as an antidote to Huawei network equipment in mobile networks, but dozens of Chinese companies have joined the O-RAN ALLIANCE and are poised to drive OpenRAN standards and manufacturing

Chinese technological threats extend beyond Huawei

As the practices and relationships between Huawei and the Chinese government have been revealed, many nation state leaders have demanded the removal of Huawei equipment from communications networks. Huawei itself has not succeeded to demonstrate that it is an employee- owned company free from Chinese government control. China’s practice of civil military fusion means that all economic inputs can be commandeered for military purposes. Its de facto information policy asserts sovereignty over the internet and can thus enjoin any Chinese firm or subject to participate in surveillance and espionage. This means that restricting Huawei alone is not sufficient to secure 5G; the presence of any Chinese product in the network poses a security risk. Now that the Huawei brand name is toxic, many non-Chinese firms see an opportunity to enter the 5G network equipment market, but it is not clear whether and to what degree they will use Chinese standards, components, and manufacturing.

The O-RAN ALLIANCE was established in 2018 by Deutsche Telekom, NTT DOCOMO, Orange, AT&T, and China Mobile and has grown to 237 mobile operators and network equipment providers. The US has 82 O-RAN Alliance members; China, 44 (3 from Hong Kong); Taiwan, 20; Japan, 14; United Kingdom, 10; India, 10; and Germany, 7. Notably the 44 Chinese member companies exert significant control on the technical specifications and supply chain of OpenRAN 5G products and services. The conundrum of engagement with restricted Chinese entities does not end there. Citing security concerns, the Federal Communications Commission rejected a US operating license to China Mobile and may revoke approvals for China Telecom for its failure to demonstrate that it is not influenced the Chinese government. Other O-RAN ALLIANCE members include Inspur, Lenovo, Tsinghua, and ZTE, companies the US government restricts for security reasons given their ties to the Chinese government and/or military. The O-RAN ALLIANCE did not return a request for comment.

Some mobile operators cite OpenRAN to avoid ripping and replacing Huawei equipment

While many mobile operators are taking precautions to protect their customers by removing Huawei equipment, Vodafone, Telefonica, and Deutsche Telekom have resisted. They posit the promise of OpenRAN (with the O-RAN ALLIANCE specification) to justify a delay of rip and replace efforts, knowing that OpenRAN products will not be available for some years. Thus, these three operators can extend the life of Huawei in their 5G networks with the promise of using so called “open” equipment built with Chinese government standards. Separately the cost to rip and replace Huawei in European networks is minimal, about $7 per European mobile subscriber. The mobile operators which have switched out Huawei equipment have not experience increased cost or delay to the rollout of 5G.

Local politicians jump on the OpenRAN bandwagon thinking it has no Chinese connection

With the manufacturing base decimated in the countries they represent, many policymakers have looked to OpenRAN to get back into the network equipment game. Presumably OpenRAN would provide some high-end software jobs, though manufacturing is likely to be dominated by established Chinese entities. A US House bill would offer a whopping $750 million for OpenRAN development, though the location of manufacturing is not conditioned. Similar bills have been offered in UK, Japan, India, Germany, and Brazil. However commendable the notion of OpenRAN may be from a technical perspective, it appears that China has already outwitted Western leaders. China can afford to lose the Huawei battle if it wins the war on standardizing and building billions of “open”, “interoperable”, and “vendor neutral” devices. As long China influences the O-RAN specifications and manufacturing, it does not care whose brand is used.

Policymakers in the US and EU have today a lot of focus on communications network equipment from Chinese vendors. In 2019 and 2020 Strand Consult published many research notes and reports to help telecom companies navigate a complex world. We focused heavily on the problem of Chinese equipment in telecommunications networks. While the media has largely focused on Huawei, the discussion should be broadened to the many companies that are owned or affiliated with the Chinese government including but not limited to TikTok, Lexmark, Lenovo, TCL, and so on. Although some of our customers disagree with our views, Strand Consult’s job is to publish what is actually happening and how policy decisions may affect their business in the future.

Here are some of Strand Consult’s research.

44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G

https://www.o-ran.org/membership

…………………………………………………………………………………………………………………..

Open RAN first surfaced nearly three years ago at Mobile World Congress 2018. It promised a new set of interfaces that would allow service providers to mix and match vendors at the same mobile site, instead of buying all products from the same supplier. Operators hoped it would inject competition into a market dominated by Ericsson, Huawei and Nokia.

Since then, geopolitics has propelled it to the very top of the telecom agenda. Non-Chinese policymakers have latched onto open RAN as an alternative to Huawei, a Chinese vendor that governments are banning and operators are ditching because of its suspected links to an increasingly authoritarian Chinese state.

Avoiding Chinese equipment makers is one thing. Skirting Chinese technology expertise is not so easy. Already, there is concern that China, through Huawei and ZTE, has too much influence in the 3GPP, the group that develops the 5G standard. Further worsening of relations between Western democracies and China could prompt a future break-up of international standards-setting bodies, according to several experts.

Chinese influence:

These circumstances leave open RAN in an awkward situation. Anyone listening to the Open RAN Policy Coalition might think the technology was born in the USA and has never set foot in China. The O-RAN Alliance shows otherwise. Its most prominent Chinese members include ZTE, an equipment vendor that was on a US trade blacklist until it hawked up billions in fines. Also named are China Mobile and China Telecom, two state-backed operators that turned up on a Pentagon blacklist in June.

China Mobile is a busy member of the group, says a source who requested anonymity. That is hardly surprising as it was arguably the main force in the C-RAN Alliance, a Chinese group whose merger with the largely American xRAN Forum created the O-RAN Alliance in 2018. Today, the Chinese operator is a very active contributor to specifications, according to Light Reading’s source. ZTE has been similarly engaged, said sources within the company at the start of the year.

None of this will be very palatable to US politicians determined to block China’s influence. Yet any break-up of the O-RAN Alliance into C-RAN Alliance and xRAN Forum camps would be a major setback for open RAN. It would complicate development and threaten new disputes over intellectual property.

Right now, the issue of technology patents means the O-RAN Alliance faces a potential dilemma about involving Huawei. The group’s interfaces build heavily on specifications developed outside the O-RAN Alliance by Ericsson, Nokia, NEC and Huawei. The Nordic and Japanese vendors have all now joined the club, agreeing to license their patents on fair, reasonable and non-discriminatory (FRAND) terms. But Huawei has not. There is concern it could attempt to thwart open RAN by arguing its patents have been infringed.

While addressing that risk, its membership of the O-RAN Alliance would create other problems. For one thing, China’s biggest slab of tech R&D muscle would – paradoxically – have gained entry to the design room of the technology touted as a Huawei substitute. US policymakers able to live with China Mobile and China Telecom might balk at the involvement of telecom public enemy number one.

It would also make all three big telecom equipment vendors a part of the specifications group. That would increase the likelihood that Ericsson, Huawei and Nokia become the main suppliers of open RAN products, frustrating efforts to nurture competitors. There are already doubts that smaller rivals will be able to land much open RAN work. Appledore Research, an analyst firm, reckons open RAN will generate $11.1 billion in revenues in 2026. As much as $8 billion will go to the incumbents, it predicts.

Ever wary of open RAN, Huawei signaled its growing interest in the technology in July, when Victor Zhang, its vice president, was being grilled by UK politicians. “We are watching open RAN as one of the choices,” he told a parliamentary committee. “Once it has comparable performance to single RAN, we believe Huawei will be one of the best suppliers of open RAN as well.” Outside China, an open RAN ecosystem that makes space for Huawei could fast lose its appeal.

https://www.lightreading.com/open-ran/chinas-role-in-open-ran-is-looming-problem/d/d-id/766204?

5 thoughts on “44 Chinese companies have joined the O-RAN Alliance”

Comments are closed.

Awesome IEEE Techblog post on Chinese companies participating in Open RAN alliances.

Thought-provoking article. It reminds me of the U.S. government’s attempt to open the set-top box market to competition and to allow consumers to choose their own set-top (like they can a telephone handset). There were specifications that attempted to decouple conditional access from the set-top and create an open system (e.g. TV sets with a slot for a decryption card). It never really happened the way regulators envisioned.

Like those government attempts to open up the set-top market, it will be interesting to see what the unintended consequences of the push for Open RAN will be.

John Strand of Strand Consult:

The reality check on OpenRAN

In 2020 OpenRAN was portrayed as a miracle “technology”. Many believe OpenRAN will increase innovation, reduce operators’ costs, and help rid Chinese equipment in telecommunications networks. Other OpenRAN boosters want more nations to become manufactures of telecommunications infrastructure.

2021 will bring a needed reality check. It will take years before OpenRAN can replace regular RAN on a 1:1 basis. Promised savings for operators will not be so great, and the purported openness of the solution will not necessarily deliver security, at least in the expectation of OpenRAN reducing reliance on Chinese vendors. China Mobile, China Unicom and China Telecom are among some 44 Chinese government technology companies in the O-RAN Alliance. Other members are ZTE and Inspur, which the US bans because of links to the Chinese military. While purporting to offer the way out from Huawei, O-RAN appears to substitute one Chinese government owned firm for another, like Lenovo. OpenRAN specifications may already violate cybersecurity rules in UK, Germany and France. Patent challenges are also likely as OpenRAN is 100% dependent on 3GPP and the patents of non-members of the O-RAN Alliance.

Strand Consult believes that industrial cooperation is important for technological development, investment, and innovation. Some of this cooperation is done in 3GPP, the O-RAN Alliance, and other organizations. Mobile operators should be free to choose the technological solutions that make sense for their business, provided the adherence to national security laws. OpenRAN should not be the justification for protectionism.

I would like to read more about Chinese companies in the O-RAN Alliance. Brilliant post!

Is Open RAN Too Little, Too Late for 5G? by Matt Kapko

Open RAN bears all the histrionics of an emerging technology that pits wireless industry giants and the status quo against those who want to unlock and open network interfaces to a larger group of players. It’s also mired in geopolitical posturing, highlighting a troubling chasm that threatens global cooperation and agreement on cellular technology standards.

Hundreds of billions of dollars are on the line, including the power and influence of multinational companies that effectively control the market today. It may sound hyperbolic, but it’s not a stretch to consider open RAN the most divisive technology to confront the wireless industry in many years, perhaps decades.

Open RAN commands a lot of attention, and for good reason. If it succeeds at scale, it will completely change how mobile networks are designed, deployed, and operated.

In theory, open RAN enjoys broad support. In practice, it remains rare.

“Open RAN is certainly complex, particularly given the numerous stakeholders that you have. Everyone from the OEMs to the operators, to the regulators, software companies, you name it — a lot of different people to try to align behind a common purpose,” said Dan Hays, principal at PwC’s Strategy& consultancy.

“While open RAN has run into some challenges, I don’t think that it’s going to impede the progress of the general move toward a more open architecture and toward a more software driven set of network infrastructure. That seems inevitable, but what we are seeing is that open RAN may well miss most of the 5G generation,” he said.

Of the at least 180 commercially deployed 5G networks today, one, Rakuten Mobile, is running on open RAN. Dish Network is poised to be the second sometime in early 2022.

“If you look at 5G rolling out in the most economically developed and populous countries in the world, as it already is, it’s unlikely that you’re going to have operators go back and rip and replace the 5G equipment that they’ve already invested in just to deploy open RAN,” Hays said.

Moving the Goalposts to 6G

“At this point even though it seems far away, open RAN may wind up being more of a 6G type of architecture versus one that’s widely adopted for 5G,” he added.

John Strand, CEO at the Denmark-based consultancy Strand Consult, agrees with this assessment and claims Ericsson and Nokia, despite their heavy involvement in open RAN development, don’t expect the technology to gain significant traction until the latter end of this decade.

“This is too little, too late for 5G,” he said. “Some of these things will be part of 6G,” but the standardization hasn’t yet effectively leveled up to the industry’s primary standards body 3GPP.

“The question is: How big of a percent of the installed base will be open RAN?” Strand said. “I think in 2025, less than 1%. And in 2030, less than 3%.”

Projections aside, questions also remain as to the technical readiness of open RAN, particularly in brownfield networks. Bear in mind that “decisions on mobile network infrastructure purchases, which can range in the billions of dollars, typically get made years before we ever see a commercially available service,” Hays explained.

https://www.sdxcentral.com/articles/news/is-open-ran-too-little-too-late-for-5g/2021/11/