GSMA Mobile Economy 2021: 5G has momentum, 4G has peaked, global mobile subscriber growth slowing

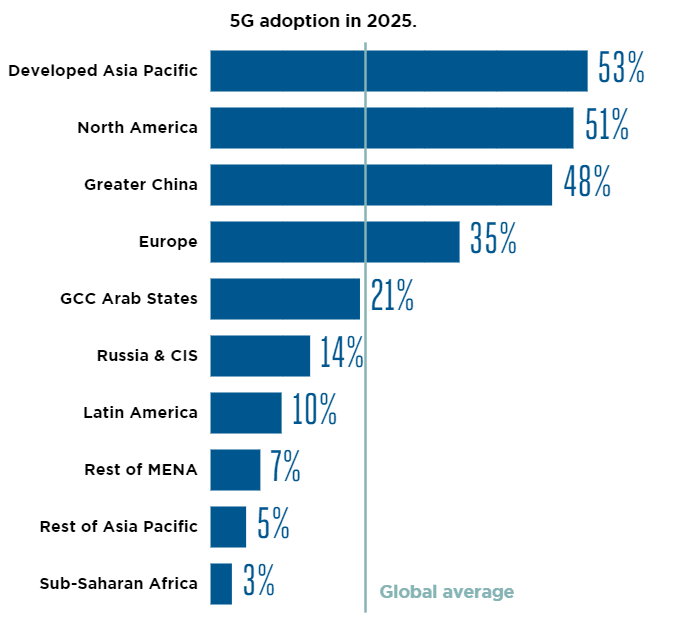

The launch of commercial 5G services in Latin America and Sub-Saharan Africa over the last year means that 5G technology is now available in every region of the world. The pandemic has had little impact on 5G momentum; in some instances, it has even resulted in operators speeding up their network rollouts, with governments and operators looking to boost capacity at a time of increased demand. By the end of 2025, 5G will account for just over a fifth of total mobile connections and more than two in five people around the world will live within reach of a 5G network. In leading 5G markets, such as China, South Korea and the U.S.

4G – LTE has peaked and, in some cases, begun to decline. In many other countries, particularly in developing regions, 4G still has significant headroom for growth. Much of the growth in 4G will come from existing 4G – LTE infrastructure, as 5G will account for 80% of total capex over the next five years. Globally, 4G adoption will peak at just under 60% by 2023 as 5G begins to gain traction in new markets.

Subscriber growth is slowing, but mobile’s contribution to the global economy remains significant. By the end of 2020, 5.2 billion people subscribed to mobile services, representing 67% of the global population. Adding new subscribers is increasingly difficult, as markets are becoming saturated and the economics of reaching rural populations are becoming more difficult to justify in a challenging financial climate for mobile operators. That said, there will be nearly half a billion new subscribers by 2025, taking the total number of subscribers to 5.7 billion (70% of the global population). Large under-penetrated markets in Asia and Sub-Saharan Africa will account for the majority of new subscribers. In 2020, mobile technologies and services generated $4.4 trillion of economic value added (5.1% of GDP) globally. This figure will grow by $480 billion by 2025 to nearly $5 trillion as countries increasingly benefit from the improvements in productivity and efficiency brought about by the increased take-up of mobile services. 5G is expected to benefit all economic sectors of the global economy during this period, with services and manufacturing seeing the most impact.

At the end of 2020, 67% of the world’s population had a mobile network subscription of some sort. This means 5.2 billion people, generating $4.4 trillion of world GDP through mobile technologies and services. This also means adding new subscribers is increasingly difficult, with markets getting saturated. Plus a challenging financial climate for mobile operators is making them less tempted to invest to reach untapped rural populations.

There will be a half billion new subscribers between now and 2025. Most of them – nearly two thirds – will be in large, under-reached markets in Asia and sub-Saharan Africa. Not to mention a billion more mobile Internet subscribers. Mobile Internet users, now 51% of the world’s population at 4.0 billion, will reach 60% or 5 billion by 2025, the GSMA forecasts.

We will quickly get smarter, too – smartphones will make up 81% of mobile connections in 2025, up from 68% in 2020. End point devices will also get smarter, and fast. There will be 24.0 billion Internet of Things (IoT) connections in 2025, up by 85% from 13.0 billion in 2020. Still, COVID is stretching out replacement cycles – from 2.25 years on average, up to three years or more. With many consumers pinched in the pocket, there’s a pivot to lower-cost handsets, with average retail prices for 5G handsets falling more than a third since 2019.

References:

https://www.gsma.com/mobileeconomy/wp-content/uploads/2021/06/GSMA_MobileEconomy2021.pdf

2 thoughts on “GSMA Mobile Economy 2021: 5G has momentum, 4G has peaked, global mobile subscriber growth slowing”

Comments are closed.

GSMA has issued a new report that predicts 5G will account for 21% of global mobile connections by 2025.

According to the industry group’s research arm, GSMA Intelligence, 5G connections will reach 500 million by the end of this year. That number is on course to cross the 1 billion threshold by 2023, and by 2025 will have reached 1.8 billion, just more than one fifth of the expected total of 8.8 billion SIM connections (excluding licensed cellular IoT). By then, the world is expected to have passed peak 4G, with connections topping out at 5.1 billion in 2024.GSMA, has issued a new report that predicts 5G will account for 21% of global mobile connections by 2025.

According to the industry group’s research arm, GSMA Intelligence, 5G connections will reach 500 million by the end of this year. That number is on course to cross the 1 billion threshold by 2023, and by 2025 will have reached 1.8 billion, just more than one fifth of the expected total of 8.8 billion SIM connections (excluding licensed cellular IoT). By then, the world is expected to have passed peak 4G, with connections topping out at 5.1 billion in 2024.

https://www.telecomtv.com/content/5g/5g-set-to-account-for-21-of-global-mobile-connections-by-2025-gsma-41850/

Please keep us up to date with telecom related market articles like this one from GSMA. Thanks for sharing.