GSMA

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

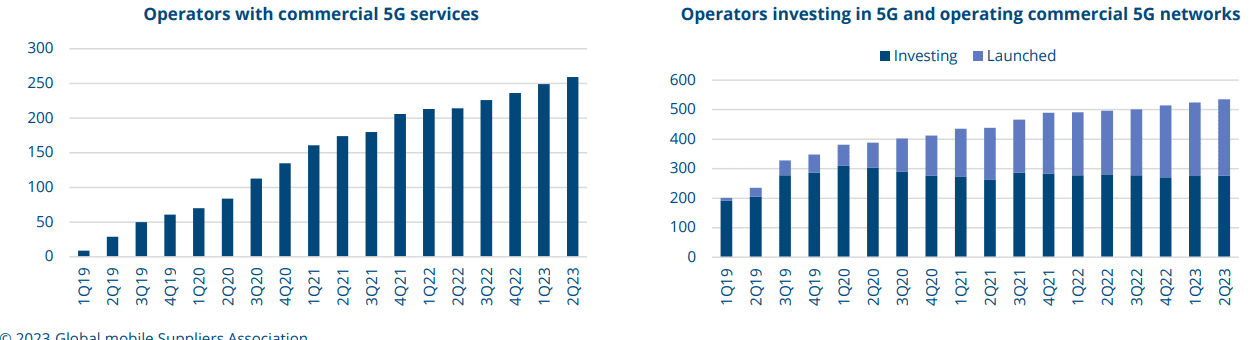

By the end of June 2023, GSA had identified 535 network operators in 162 countries and territories were investing in 5G, including trials, acquisition of licences, planning, network deployment and launches.

This number excludes nearly 200 additional companies awarded priority access licences in the U.S. auction of CBRS spectrum, which could potentially be used for 5G

Of those, a total of 259 operators in 102 countries and territories had launched one or more 3GPP-compliant 5G services 252 operators in 100 countries and territories had launched 5G mobile services 113 operators in 62 countries and territories had launched 3GPP-compliant 5G fixed wireless access services (just over 43% of those with launched 5G services)

13 operators had announced soft launches of their 5G networks that are not counted in the above launch figures 115 operators are identified as investing in 5G standalone (including those evaluating/testing, piloting, planning and deploying, as well as those that have launched 5G standalone networks).

GSA has catalogued 41 operators as having deployed or launched 5G standalone (SA) in public networks.

115 network operators are identified as investing in standalone 5G (including those evaluating, testing, piloting, planning and deploying as well as those that have launched standalone 5G networks).

GSA has catalogued 2,039 announced 5G devices, up by more than 62% from 1,257 at the start of 2022 GSA has identified 1,083 announced 5G phones, up more than 76% from 613 at the start of 2022

There are at least 1,650 commercially available 5G devices, up more than 66% annually from 990

References:

GSA: 5G Device Ecosystem June 2023 Summary

GSA FWA Report: 38 commercially launched 5G FWA networks in the EU; Speeds revealed

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

The GSMA and the European Space Agency (ESA) on Wednesday announced the signing of a memorandum of intent (MoI) that covers collaboration on new satellite and terrestrial network technologies. GSMA’s Foundry innovation accelerator will work closely with the ESA’s 5G/6G Hub based at the ESA’s European Centre for Space Applications and Telecommunications in Harwell, Oxfordshire.

Non-terrestrial networking (NTN) has been incorporated into the 3GPP’s 5G specification since Release 17 (but not in the ITU-R M.2150 5G RIT/SRIT standard which covers only terrestrial networks), and work is already well underway to turn it into a commercial reality. The partnership between the GSMA and the ESA represents a more coordinated effort in that direction. What’s more, when it comes to 6G, non-terrestrial networking is expected to be baked in from the start. Again, cooperation between these two sectors will be invaluable.

The GSMA and ESA’s goal then is to create an ecosystem that can fast-track the development of new complimentary solutions for businesses and consumers. They also aim to accelerate the integration of satellite communications with 5G and, when the time comes, 6G networks.

“By collaborating more closely with the European Space Agency, and its satellite network operator ecosystem, we hope to accelerate the immense potential satellite and terrestrial telecommunications networks can create for consumers and businesses when they are more closely connected. By working together, we can help the communications industry bring innovative solutions to market, which in turn will create tremendous benefits to society by connecting even more people, wherever they are in the world,” said GSMA CTO Alex Sinclair, in a statement.

What the MoI means in practical terms is that the GSMA and ESA’s respective innovation hubs plan to start working together, sharing knowledge, ideas, and the outcomes of trials with one another.

On the telecoms side, the GSMA has the Foundry, which fosters collaboration between telcos and various industries with the aim of developing initial ideas into globally-scalable, commercial solutions. Completed projects include using 5G to enable drones to fly beyond visual line of sight (BVLOS), a 5G broadcast solution, and using 5G for automated farming solutions, among others.

Similarly, on the satellite side of the equation, the ESA has its 5G/6G Hub. Opened in February 2022, it provides a space where new 5G and satcom technologies can be developed and integrated. Developers can also use it to test and verify their 5G converged network applications and services. The ESA announced in January that it is expanding the facility to accommodate new areas of research, which it aims to identify via a consultation with industry experts.

Recent research findings by GSMAi showed that the increased adoption and integration of satellite technologies by the communications industry could lead to potential revenue gains of $35bn by 2035 (a 3% uplift on telecommunications industry revenues).

Speaking following the signing of the MOI at ECSAT in Oxfordshire, Alex Sinclair, Chief Technology Officer at the GSMA said: “By collaborating more closely with the European Space Agency, and its satellite network operator ecosystem, we hope to accelerate the immense potential satellite and terrestrial telecommunications networks can create for consumers and businesses when they are more closely connected. By working together, we can help the communications industry bring innovative solutions to market, which in turn will create tremendous benefits to society by connecting even more people, wherever they are in the world.”

Antonio Franchi, Head of Space for 5G and 6G Strategic Programme, ESA, said: “Collaboration is key to telecommunications innovation and, from our 5G/6G Hub, we are fostering industry partnerships to advance the 5G digital transformation of society and industry. We look forward to working with GSMA to explore and realise the huge potential of next-generation satellite-enabled connectivity.”

ABI Research predicts that global 5G non-terrestrial networking (NTN) service revenue will achieve a compound annual growth rate (CAGR) of 59% between 2024 and 2031, reaching $18 billion. By then, connections are expected to number 200 million.

About GSMA

The GSMA is a global organisation unifying the mobile ecosystem to discover, develop and deliver innovation foundational to positive business environments and societal change. Our vision is to unlock the full power of connectivity so that people, industry, and society thrive. Representing mobile operators and organisations across the mobile ecosystem and adjacent industries, the GSMA delivers for its members across three broad pillars: Connectivity for Good, Industry Services and Solutions, and Outreach. This activity includes advancing policy, tackling today’s biggest societal challenges, underpinning the technology and interoperability that make mobile work, and providing the world’s largest platform to convene the mobile ecosystem at the MWC and M360 series of events.

We invite you to find out more at gsma.com

For more information on GSMA Foundry, please visit: gsma.com/foundry

About the European Space Agency

The European Space Agency (ESA) provides Europe’s gateway to space.

ESA is an intergovernmental organisation, created in 1975, with the mission to shape the development of Europe’s space capability and ensure that investment in space delivers benefits to the citizens of Europe and the world.

ESA has 22 Member States: Austria, Belgium, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Romania, Spain, Sweden, Switzerland and the United Kingdom. Slovenia, Latvia and Lithuania are Associate Members.

ESA has established formal cooperation with five Member States of the EU. Canada takes part in some ESA programmes under a Cooperation Agreement.

By coordinating the financial and intellectual resources of its members, ESA can undertake programmes and activities far beyond the scope of any single European country. It is working in particular with the EU on implementing the Galileo and Copernicus programmes as well as with Eumetsat for the development of meteorological missions.

References:

GSMA AND EUROPEAN SPACE AGENCY LAUNCH NEW COMMUNICATIONS INNOVATION PARTNERSHIP

https://telecoms.com/522665/gsma-esa-forge-stronger-ties-between-satellite-and-cellular-industries/

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

GSMA Calls for 2 GHz of Mid-Band Spectrum to meet ITU-R speed requirements (explained)

The mobile industry will need an average of 2 GHz of mid-band spectrum this decade to meet the ITU data speed requirements (ITU-R recommendation not stated, but this author believes it to be M.2410 (11/2017)) [1.]. Achieving this will also minimize environmental impact and lower consumer costs of 5G, according to a global study of 36 cities published by the GSMA but carried out by Coleago Consulting.

The “Vision 2030 Insights for Mid-band Spectrum Needs” study suggests that policymakers should license spectrum to mobile operators in harmonized bands, such as 3.5 GHz, 4.8 GHz and, 6 GHz to meet the ITU’s requirements by 2030. Without the additional spectrum, it will be impossible to realise the full potential of 5G in some cases. In others, the number of antennas and base stations needed will lead to higher carbon emissions and consumer prices. The additional spectrum will lower the carbon footprint of networks by two-to-three times while enhancing the sustainable development of mobile connectivity, according to the study.

This spectrum will also make 5G more affordable. Total costs would be three- to five-times higher over a decade in cities where a deficit of 800-1000 MHz would increase the number of base stations needed and increase deployment costs in each city by $782 million to $5.8 billion.

The actual amount of mid-band spectrum required varies significantly by city, mid-band being roughly 1500 MHz-6 GHz. Population density, spread of base stations, availability of small cells and WiFi offload, and 5G activity levels, amongst other things, will have an impact on how much spectrum any given city needs.

Hong Kong tops the list of 36 cities studied by Coleago Consulting with an upper estimate of 3.7 GHz of mid-band spectrum required, while Tehran ranks at the bottom with a requirement of up to 1.2 GHz. As such, the amount of additional spectrum each city needs is also variable. However, the important message is that all cities need more spectrum than they are set to have, and the additional amount required is “far greater” than that currently planned for release, the GSMA said.

“Without the additional spectrum, it will be impossible to realize the full potential of 5G in some cases. In others, the number of antennas and base stations needed will lead to higher carbon emissions and consumer prices,” GSMA warned.

…………………………………………………………………………………………………………………………………………………………………….

Note 1. ITU-R M.2410 data rate requirements for IMT 2020 (11/2017):

Peak data rate: is the maximum achievable data rate under ideal conditions (in bit/s), which is the received data bits assuming error-free conditions assignable to a single mobile station, when all assignable radio resources for the corresponding link direction are utilized (i.e. excluding radio resources that are used for physical layer synchronization, reference signals or pilots, guard bands and guard times). This requirement is defined for the purpose of evaluation in the eMBB usage scenario. The minimum requirements for peak data rate are:

– Downlink peak data rate is 20 Gbit/s.

– Uplink peak data rate is 10 Gbit/s

Peak spectral efficiency: is the maximum data rate under ideal conditions normalized by channel bandwidth (in bit/s/Hz), where the maximum data rate is the received data bits assuming error-free conditions assignable to a single mobile station, when all assignable radio resources for the corresponding link direction are utilized (i.e. excluding radio resources that are used for physical layer synchronization, reference signals or pilots, guard bands and guard times).

This requirement is defined for the purpose of evaluation in the eMBB usage scenario. The minimum requirements for peak spectral efficiencies are:

– Downlink peak spectral efficiency is 30 bit/s/Hz.

– Uplink peak spectral efficiency is 15 bit/s/Hz.

User experienced data rate: is the 5% point of the cumulative distribution function (CDF) of the user throughput. User throughput (during active time) is defined as the number of correctly received bits, i.e. the number of bits contained in the service data units (SDUs) delivered to Layer 3, over a certain period of time. This requirement is defined for the purpose of evaluation in the related eMBB test environment. The target values for the user experienced data rate in the Dense Urban – eMBB test environment:

– Downlink user experienced data rate is 100 Mbit/s.

– Uplink user experienced data rate is 50 Mbit/s.

…………………………………………………………………………………………………………………………………………………………………………..

Mid-band spectrum availability also will enhance Fixed Wireless Access (FWA). The study shows that with the additional 2 GHz, five-times more households will be covered with each base station, allowing affordable high-speed internet to reach beyond the fiber footprint at a fraction of the cost.

The World Radiocommunication Conference in 2023 is a crucial opportunity to align global policies for mid-band solutions for mobile. This spectrum will ensure mobile operators can deliver the ITU targets of 100 Mbps download speeds and 50 Mbps upload speeds to meet future needs of consumers and businesses.

Therefore, the GSMA asks that regulators:

- Plan to make an average of 2 GHz of mid-band spectrum available in the 2025-2030 time frame to guarantee the IMT-2020 requirements for 5G;

- Carefully consider 5G spectrum demands when 5G usage increases and advanced use cases will carry additional needs;

- Base spectrum decisions on real-world factors including, population density and extent of fibre rollout; and

- Support harmonized mid-band 5G spectrum (e.g., within the 3.5 GHz, 4.8 GHz and 6 GHz ranges) and facilitate technology upgrades in existing bands.

“Coordinated regional decisions will lead to a WRC which enables the future of 5G and supports wider broadband take-up by increasing capacity and reducing costs,” the GSMA said.

…………………………………………………………………………………………………………………………………………………………………

References:

https://www.gsma.com/spectrum/wp-content/uploads/2021/07/5G-Mid-Band-Spectrum-Needs-Vision-2030.pdf

https://telecoms.com/510489/lack-of-mid-band-spectrum-could-cost-operators-billions-of-dollars-gsma/

GSMA Mobile Economy 2021: 5G has momentum, 4G has peaked, global mobile subscriber growth slowing

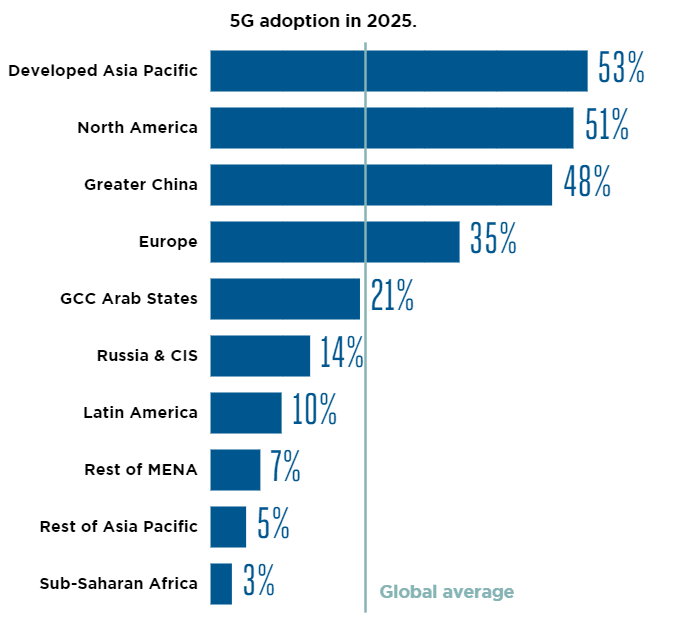

The launch of commercial 5G services in Latin America and Sub-Saharan Africa over the last year means that 5G technology is now available in every region of the world. The pandemic has had little impact on 5G momentum; in some instances, it has even resulted in operators speeding up their network rollouts, with governments and operators looking to boost capacity at a time of increased demand. By the end of 2025, 5G will account for just over a fifth of total mobile connections and more than two in five people around the world will live within reach of a 5G network. In leading 5G markets, such as China, South Korea and the U.S.

4G – LTE has peaked and, in some cases, begun to decline. In many other countries, particularly in developing regions, 4G still has significant headroom for growth. Much of the growth in 4G will come from existing 4G – LTE infrastructure, as 5G will account for 80% of total capex over the next five years. Globally, 4G adoption will peak at just under 60% by 2023 as 5G begins to gain traction in new markets.

Subscriber growth is slowing, but mobile’s contribution to the global economy remains significant. By the end of 2020, 5.2 billion people subscribed to mobile services, representing 67% of the global population. Adding new subscribers is increasingly difficult, as markets are becoming saturated and the economics of reaching rural populations are becoming more difficult to justify in a challenging financial climate for mobile operators. That said, there will be nearly half a billion new subscribers by 2025, taking the total number of subscribers to 5.7 billion (70% of the global population). Large under-penetrated markets in Asia and Sub-Saharan Africa will account for the majority of new subscribers. In 2020, mobile technologies and services generated $4.4 trillion of economic value added (5.1% of GDP) globally. This figure will grow by $480 billion by 2025 to nearly $5 trillion as countries increasingly benefit from the improvements in productivity and efficiency brought about by the increased take-up of mobile services. 5G is expected to benefit all economic sectors of the global economy during this period, with services and manufacturing seeing the most impact.

At the end of 2020, 67% of the world’s population had a mobile network subscription of some sort. This means 5.2 billion people, generating $4.4 trillion of world GDP through mobile technologies and services. This also means adding new subscribers is increasingly difficult, with markets getting saturated. Plus a challenging financial climate for mobile operators is making them less tempted to invest to reach untapped rural populations.

There will be a half billion new subscribers between now and 2025. Most of them – nearly two thirds – will be in large, under-reached markets in Asia and sub-Saharan Africa. Not to mention a billion more mobile Internet subscribers. Mobile Internet users, now 51% of the world’s population at 4.0 billion, will reach 60% or 5 billion by 2025, the GSMA forecasts.

We will quickly get smarter, too – smartphones will make up 81% of mobile connections in 2025, up from 68% in 2020. End point devices will also get smarter, and fast. There will be 24.0 billion Internet of Things (IoT) connections in 2025, up by 85% from 13.0 billion in 2020. Still, COVID is stretching out replacement cycles – from 2.25 years on average, up to three years or more. With many consumers pinched in the pocket, there’s a pivot to lower-cost handsets, with average retail prices for 5G handsets falling more than a third since 2019.

References:

https://www.gsma.com/mobileeconomy/wp-content/uploads/2021/06/GSMA_MobileEconomy2021.pdf

T-Mobile Announces “World’s 1st Nationwide Standalone 5G Network” (without a standard)

T-Mobile USA claims they are the first wireless network operator in the world to launch a commercial nationwide standalone 5G network (5G SA). The “Un-carrier” is also expanding 5G coverage by 30 percent, now covering nearly 250 million people in more than 7,500 cities and towns across 1.3 million square miles.

“Since Sprint became part of T-Mobile, we’ve been rapidly combining networks for a supercharged Un-carrier while expanding our nationwide 5G footprint, and today we take a massive step into the future with standalone 5G architecture,” said Neville Ray, President of Technology at T-Mobile. “This is where it gets interesting, opening the door for massive innovation in this country — and while the other guys continue to play catch up, we’ll keep growing the world’s most advanced 5G network.”

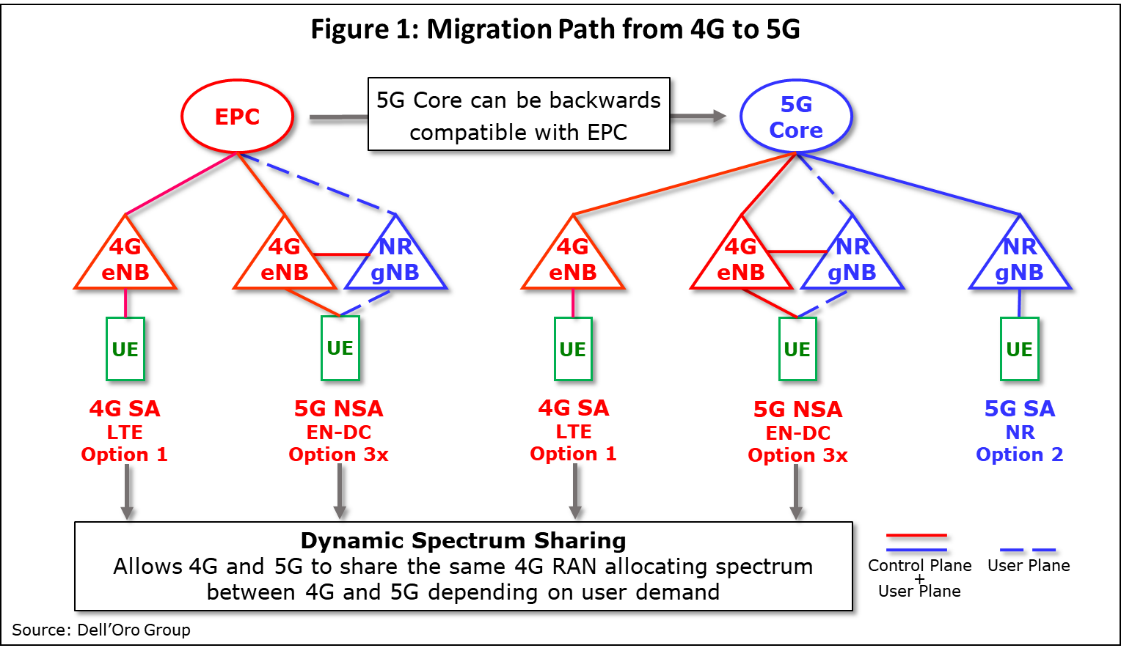

IEEE Techblog readers know that all previously deployed (pre-standard) “5G” networks focused on delivering new 5G radio (3GPP Rel 15 5G NR) in the data plane while leveraging existing LTE core networks, management and signaling in the control plane. With a new 5G Core network, T-Mobile engineers have already seen up to a 40% improvement in latency during testing. T-Mo claims:

“This is just the beginning of what can be done with Standalone 5G. When coupled with core network slicing in the future, 5G SA will lead to an environment where transformative applications are made possible — things like connected self-driving vehicles, supercharged IoT, real-time translation … and things we haven’t even dreamed of yet.”

In the near-term, 5G SA enables T-Mobile US to unleash its entire 600 MHz footprint for 5G. With non-standalone network architecture (NSA), 600 MHz 5G is combined with mid-band LTE to access the core network, but without SA the 5G signal only goes as far as mid-band LTE. With today’s launch, 600 MHz 5G can go beyond the mid-band signal, covering hundreds of square miles from a single tower and going deeper into buildings than before.

To make the world’s first nationwide commercial SA 5G network a reality, T-Mobile partnered closely with Cisco and Nokia to build its 5G core, and Ericsson and Nokia for state-of-the-art 5G radio infrastructure.

OnePlus, Qualcomm Technologies and Samsung have helped the Un-carrier ensure existing 5G endpoint devices can access 5G SA with a software update, based on compatibility. The 5G SA software update is required to activate the 5G SA functionality. For example, the Samsung Galaxy S20+ 5G requires a software download (available August 4, 2020) to enable 5G SA operation.

For more information about T-Mobile’s 5G vision, visit: www.t-mobile.com/5g. To see all the places you’ll get T-Mobile’s current 5G down to a neighborhood level, check out the map here: www.t-mobile.com/coverage/5g-coverage-map.

……………………………………………………………………………………………………………………………………

Comment and Analysis: Specs for 5G Core (there is no standard)

T-Mo’s launch of standalone 5G is noteworthy considering there are no standards for 5G Core from any SDO! ITU-T IMT 2020 non radio aspects SG’s aren’t even working on it!

Yeah, we know about 3GPP Rel 16 5G Core/Architecture specs:

- TS 23.501 5G Systems Architecture, with annexes which describe 5G core deployment scenarios

- TS 23.502 [3] contains the stage 2 procedures and flows for 5G System

- TS 23.503 [45] contains the stage 2 Policy Control and Charging architecture for 5G System

Collectively, all three of the above referenced 3GPP Rel 16 5G Systems Architecture documents do not specify the detailed mechanisms, protocols and procedures to implement a 5G core network.

For example, there are many software choices for implementing a “cloud native” 5G Core: containers, virtualized network functions, kubernetes, micro-services. Each Network Function (NF) offers one or more services to other NFs via Application Programming Interfaces (APIs). And there is no standard for the APIs associated with a given NF!

The only 5G Core implementation spec we know of is from GSMA. It’s titled: “5G Implementation Guidelines: SA Option 2.” That document provides a checklist for operators that are planning to launch 5G networks in SA (Standalone) Option 2 configuration, technological, spectrum and regulatory considerations in the deployment. The current version of the document currently provides detailed guidelines for implementation of 5G using Option 2, reflecting the initial launch strategy being adopted by multiple operators. There is an implementation guideline for NSA Option 3 already available.

However, as described in “GSMA Operator Requirements for 5G Core Connectivity Options” there is a need for the industry ecosystem to support all of the 5G core connectivity options (namely Option 4, Option 5 and Option 7). As a result, further guidelines for all 5G deployment options will be provided in the future.

GSMA says “5G Stand Alone to Become Reality“:

“The deployment of fully virtualized networks using 5G Stand Alone Cores, thereby facilitating Edge Computing and Network Slicing, will enable enterprises and governments to reap the many benefits from high throughput, ultra-low latency and IoT to improve productivity and enhance services to their customers,” said Alex Sinclair, Chief Technology Officer, GSMA.

………………………………………………………………………………………………………………..

Other Voices on 5G Core Deployments:

1. From Rakuten CTO Tareq Amin via email to this author:

– Containerization/Cloud native 5G Core from Rakuten-NEC:

3GPP specification requires cloud native architecture as the general concept like distributed, stateless, and scalable. However, an explicit reference model is out of scope for 3GPP specification (TS 23.501). Therefore NEC 5GC cloud native architecture is based on 3GPP “openness” concept as well as ETSI NFV treats “container” and “cloud native,” which NEC is also actively investigating to apply its product.

2. Alex Quach, VP of Intel’s Data Platforms Group, said most operators around the world are still leveraging a 4G core network. “The way different service providers implement their 5G core is going to vary,” said Quach. “Every service provider has unique circumstances. The transition to a new 5G core is going to be different for every operator.”

4. Asked if SK Telecom has now completed its 5G Standalone core network, the South Korean carrier was vague in an email reply to FierceWireless. “To commercialize standalone 5G service in Korea, we are currently making diverse R&D efforts including conducting tests in both lab and commercial environment. Our latest achievements include the world’s first standalone (SA) 5G data session on our multi-vendor commercial 5G network.

……………………………………………………………………………………………………………………………

Other References:

https://www.gsma.com/futurenetworks/resources/5g-implementation-guidelines-sa-option-2-2/

3GPP Rel 16 5G Core/Architecture specs:

- TS 23.501 5G Systems Architecture, with annexes which describe 5G core deployment scenarios:

https://www.3gpp.org/ftp/

- TS 23.502 [3] contains the stage 2 procedures and flows for 5G System

https://www.3gpp.org/ftp/

- TS 23.503 [45] contains the stage 2 Policy Control and Charging architecture for 5G System

https://www.3gpp.org/ftp/

GSMA to ITU-D: Addressing Barriers to Mobile Network Coverage in the Developing World

by Ms. Lauren Dawes, GSMA-UK [email protected]

Abstract:

- While mobile broadband (3G or 4G) coverage in the developed world is ubiquitous, 800 million people are still not covered by mobile broadband networks. In rural areas the cost of building and operating mobile infrastructure can be twice as expensive compared to urban areas, with revenues up to 10 times smaller.

- In addition, 3.2 billion people live in areas covered by mobile broadband networks but are not using mobile internet services. A large scale consumer survey conducted by the GSMA revealed that affordability was the greatest barrier to using mobile internet services.

- Both the private sector and public sector have important roles to play in improving the business case for mobile network coverage expansion.

- By providing precise and granular data on mobile coverage, GSMA Mobile Coverage Maps can help operators determine the costs of providing mobile broadband services in uncovered areas and support the development of mobile networks.

- For example, GSMA Coverage maps can help mobile operators assess the relevance of infrastructure sharing deals. Indeed, infrastructure sharing can help to lower the risk and costs of investments in network expansion. Regulators should seize this opportunity and ensure all forms of voluntary infrastructure sharing between operators are permitted.

- GSMA Coverage Maps can also help other stakeholders – including governments, NGOs, and private companies that rely on mobile connectivity – to strategically target their activity, by helping them identify the locations with existing coverage.

- In this context, policy-makers are encouraged to adopt policies that will support mobile operators’ efforts to provide affordable mobile internet services. This includes:

- Removing sector specific taxes which have an impact on the price of mobile devices and the costs of providing mobile internet services;

- Adopting pro-investment supply side policies in areas such as spectrum policy and planning;

- Providing open and non-discriminatory access to state-owned public infrastructures.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………

Discussion:

Mobile is now the most common – and often the only way – that many people around the world access the internet, with 3.6 billion now subscribing to mobile internet services. However, while mobile broadband (3G or 4G) coverage in the developed world is ubiquitous, 800 million people are still not covered by mobile broadband networks. In rural areas the cost of building and operating mobile infrastructure can be twice as expensive compared to urban areas, with revenues up to 10 times smaller. As a result, mobile operators who expand their networks to rural areas often find that they lose money or take a long time to produce a return on investment. While seeking to grow their coverage (and hence their subscriber base) they can struggle to identify locations that could be economically viable.

In addition, 3.2 billion people live in areas covered by mobile broadband networks but are not using mobile internet services – thus indicating that whilst coverage is a necessary criteria, it alone cannot address the problem of digital inclusion. A large scale consumer survey conducted by the GSMA[1] revealed that affordability was the greatest barrier to using mobile internet services, for people who were aware of mobile internet. In almost all the sample countries, the greatest barriers to mobile internet use are access to, and the cost of, internet-enabled handsets and data. These barriers are clearly interlinked, representing the importance of the overall cost of mobile internet access. The analysis also indicates that, although cost is an important consideration for both women and men in many of the surveyed countries, this barrier disproportionately affects women. For example, in Dominican Republic, 53% of female mobile users who do not use mobile internet, but are aware of it, cited handset cost as a key barrier to mobile internet use compared to 37% of men. In a similar sample in Kenya, 43% of women and 31% of men stated that not having access to an internet-enabled mobile phone was a major barrier to using mobile internet.

Both the private sector and public sector have important roles to play in improving the business case for mobile network coverage expansion.

Precise and granular data is key to help mobile operators, governments and others to determine the costs of providing mobile broadband services in uncovered areas and support the development of sustainable networks. In this context, the GSMA developed Mobile Coverage Maps[2]: a tool to help operators and others estimate the precise location and size of uncovered populations. These maps will allow users to:

- Gain an accurate and complete picture of the mobile coverage in a given country by each generation of mobile technology (2G, 3G and 4G)

- Estimate the population living in uncovered or underserved settlements with a very high level of granularity (e.g. small cities, villages or farms)

- Search for uncovered settlements based on population size.

GSMA Mobile Coverage Maps are therefore a key tool to help operators improve the efficiency of their investments. For example, GSMA Coverage maps can help mobile operators assess the need for infrastructure sharing deals. Indeed, infrastructure sharing can help to lower the risk and costs of investments in network expansion. Regulators should seize this opportunity and ensure all forms of voluntary infrastructure sharing between operators are permitted. This is especially the case since the costs savings of such commercial arrangements can be significant, reducing capital investment and on-going operating costs by between 50% and 80% -depending on market structure and the sharing model – which can be reinvested in network expansion[3]. This helps to close the ‘coverage gap’ and encourage operators to venture into rural areas they might otherwise have not wanted or could not afford to go to.

GSMA Mobile Coverage Maps can also help other stakeholders – including governments, NGOs, and private companies that rely on mobile connectivity – to strategically target their activity, by helping them identify the locations with existing coverage.

In this context, it is critical for policy makers to adopt economic policies that will support mobile operators’ efforts to provide affordable services.

- Mobile is the main gateway to the internet for consumers in many parts of the world today, particularly in developing countries. Despite this, governments in many of these countries are increasingly imposing – in addition to general taxes – sector-specific taxes on consumers of mobile services and devices and on mobile operators. This poses a significant risk to the growth of the services among citizens, limiting the widely acknowledged social and economic benefits associated with mobile technology. This latest report from GSMA Intelligence https://www.gsmaintelligence.com/research/?file=8f36cd1c58c0d619d9f165261a57f4a9&download examines mobile sector taxation over time and its impact on affordability and connectivity. The report highlights the taxes applied to mobile services and how certain taxes can raise the affordability barrier and reduce the ability of citizens to take part in digital society. It also explores the impact of uncertain tax regimes on operators’ ability to continue investing in new networks. The report shows how sector-specific taxes can create inefficiency, inequity and complexity, and hinder achievement of the UN Broadband Commission’s target for affordable broadband for all by 2025.

- Effective pro-investment supply side policies should also be adopted in areas such as spectrum policy and planning to encourage long term investment in the sector and result in more affordable mobile internet services being made available to all.

- Providing open and non-discriminatory access to state-owned public infrastructures such as public buildings, roads, railways and utility service ducts can also significantly reduce the costs of network roll-out and can be key to providing the site access and necessary backhaul capacity so critical to operator investments.

[1] The analysis is based on findings from quantitative face-to-face surveys with women and men in 23 low- and middle-income countries across Asia, Africa and Latin America. Source: Gender Gap Report 2018. GSMA (2019). Available here: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2018/04/GSMA_The_Mobile_Gender_Gap_Report_2018_32pp_WEBv7.pdf

[2] GSMA Mobile Coverage Maps use data collected directly from mobile operators and overlay it with the High Resolution Settlement Layer, a dataset developed by Facebook Connectivity Lab and the Center for International Earth Science Information Network (CIESIN) at Columbia University. This data estimates human population distribution at a hyperlocal level, based on census data and high-resolution satellite imagery. We have further enriched this data by adding socioeconomic indicators and key buildings such as schools, hospitals, and medical centres. The Mobile Coverage Maps are accessible here: www.mobilecoveragemaps.com

[3] Unlocking rural coverage: Enablers for commercially sustainable mobile network expansion. GSMA (2016). Available here: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/07/Unlocking-Rural-Coverage-enablers-for-commercially-sustainable-mobile-network-expansion_English.pdf

GSMA calls for 5G policy incentives in China + 2018 MWC Shanghai a big success!

China is expected to become the world’s largest 5G market by 2025, accounting for around 430 million 5G connections, representing a third of the global total.

Industry verticals where 5G are expected to play a key role include: automotive, drones and manufacturing. The report calls for China to promote the development of legislation for areas such as car-hacking and data privacy to support China’s connected car market.

The report notes that China Mobile, China Telecom and China Unicom are all currently trialing 5G autonomous driving and working on solutions such as cellular vehicle-to-everything (C-V2X) for remote driving and autonomous vehicles.

To accelerate the development of the drone market, the report calls for common standards for connectivity management. The drone market is expected to be worth around $13 billion by 2025.

Finally, the report calls for common standards for interconnection between Industry 4.0 platforms and devices (more below) to avoid market fragmentation, drive economies of scale and increase speed to market.

“China’s leadership in 5G is backed by a proactive government intent on delivering rapid structural change and achieving global leadership – but without industry-wide collaboration, the right incentives or appropriate policies in place, the market will not fulfil its potential,” commented Mats Granryd, Director General, GSMA. “Mobile operators should be encouraged to deliver what they do best in providing secure, reliable and intelligent connectivity to businesses and enterprises across the country.”

“Wide collaboration and a right policy environment are essential for 5G to unleash its potential in various verticals, and the three sectors addressed in the report are only a beginning,” said Craig Ehrlich, Chairman of GTI. “The Chinese government and all three operators have been propelling 5G trials and cross-industrial innovation, and the valuable experience gained from the process should serve as a worthwhile reference for the other markets around the globe.”

velopment of legislation for areas such as car-hacking and data privacy. New policies should be pro-innovation and pro-investment to encourage future developments in the sector. All three operators are currently trialling 5G autonomous driving and working on solutions such as Cellular Vehicle-to-Everything (C-V2X) for remote driving, vehicle platooning and autonomous vehicles.

Accelerated Growth of Drones Market:

The report also calls for common standards for connectivity management in the drones market to help accelerate investment and the deployment of new infrastructure and service models. The drones market, estimated to be worth RMB80 billion ($13 billion) by 2025, is developing rapidly in China in applications such as parcel delivery and tracking, site surveying, mapping and remote security patrols, among others. Improvements in mapping, real-time video distribution and analytics platforms are also helping to establish the technology in industrial verticals.

China Entering Age of Industry 4.0:

Backed by government support, China is transforming its manufacturing industry through embracing the use of artificial intelligence, the Internet of Things (IoT), machine learning and analytics. The government’s aim is to increase productivity and drive new revenue opportunities. The report calls for common standards for interconnection between platforms and devices to avoid market fragmentation, drive economies of scale and increase speed to market. GSMA Intelligence estimates that there will be 13.8 billion global Industrial IoT (IIoT) connections by 2025 with China accounting for 65%.

………………………………………………………………………………………………………..

Separately, GSMA today reported that more than 60,000 unique visitors from 112 countries and territories attended the 2018 GSMA Mobile World Congress Shanghai, from 27-29 June in Shanghai. The three-day event attracted executives from the largest and most influential organisations across the mobile ecosystem, as well from companies in a range of vertical industry sectors. In addition to this business-to-business audience, nearly 8,800 consumers from the greater Shanghai metropolitan area attended the Migu Health and Fitness Festival, which was held in the Mobile World Congress Shanghai halls at the Shanghai New International Exhibition Centre (SNIEC).

“We are extremely pleased with the results for the 2018 Mobile World Congress Shanghai, particularly the very strong growth in our business-to-business segment,” said John Hoffman, CEO, GSMA Ltd. “Attendees were able to truly “Discover a Better Future”, from the thought leadership conference to the exhibition and everywhere in between. With more than two-thirds of the world’s population as subscribers, mobile is revolutionising industries and improving our everyday lives, creating exciting new opportunities while providing lifelines of hope and reducing inequality. Mobile truly is connecting everyone and everything to a better future.”

Covering seven halls at the SNIEC, the 2018 Mobile World Congress Shanghai hosted 550 exhibitors, nearly half of which come from outside of China. The conference programme attracted nearly 4,000 attendees, with more than 55 per cent of delegates holding senior-level positions, including nearly 320 CEOs. Nearly 830 international media and industry analysts attended Mobile World Congress Shanghai to report on the many industry developments highlighted at the show.

………………………………………………………………………………………………………………………………………………….

About the GSMA:

The GSMA represents the interests of mobile operators worldwide, uniting nearly 800 operators with more than 300 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces industry-leading events such as Mobile World Congress, Mobile World Congress Shanghai, Mobile World Congress Americas and the Mobile 360 Series of conferences.

For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA

About the GTI:

GTI (Global TD-LTE Initiative), founded in 2011, has been dedicated to constructing a robust ecosystem of TD-LTE and promoting the convergence of LTE TDD and FDD. As 4G evolves to 5G, GTI 2.0 was officially launched at the GTI Summit 2016 Barcelona, aiming not only to further promote the evolution of TD-LTE and its global deployment, but also to foster a cross-industry innovative and a synergistic 5G ecosystem.

For more information, please visit the GTI website at http://gtigroup.org/