MoffettNathanson: AT&T, Verizon set to lose wireless market share to Cablecos; 5G to disappoint – no real use cases

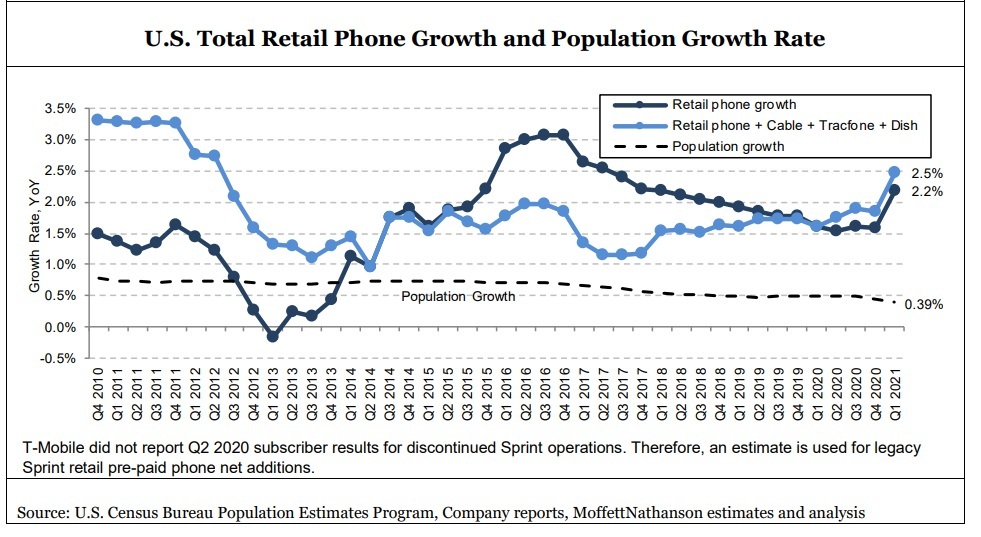

Our esteemed colleague Craig Moffett of MoffettNathanson says that the wireless market is now growing fast enough for both telcos and cablecos to meet their expectations. However, longer term growth that’s much above population growth is clearly unsustainable.

The market research firm has long argued that above-population phone growth in a more or less fully penetrated

market owes to the industry’s willingness to give away free phones in return for additional lines, even when those additional lines aren’t needed and won’t be used.

MoffettNathanson had earlier reported that it expects cablecos to continue to take wireless market share from telcos, bolstered by what is now much more competitive pricing from Comcast.

Craig wrote in a note to clients [we recommend you become one if not truly interested in telecom and/or cable]:

That leaves AT&T and Verizon to bear the brunt of the impact. AT&T has been growing its market share of late, but only because Verizon had been slow to match their aggressive retention offer. Now that Verizon has finally introduced its own, similar, retention offer, the two are likely to be in closer equilibrium… …which is to say, we believe they are likely to now both lose equally. Both companies have guided to low-single digit consolidated revenue growth in the near term, accelerating to the mid-single digits over the coming years.

With continued contraction in the Business Wireline segment all but a given, that means growth in wireless will have to be even faster than that. How? Their guidance seems awfully optimistic to us. We are also projecting significant losses for prepaid as low-priced post-paid plans accelerate pre-paid to post-paid conversions.

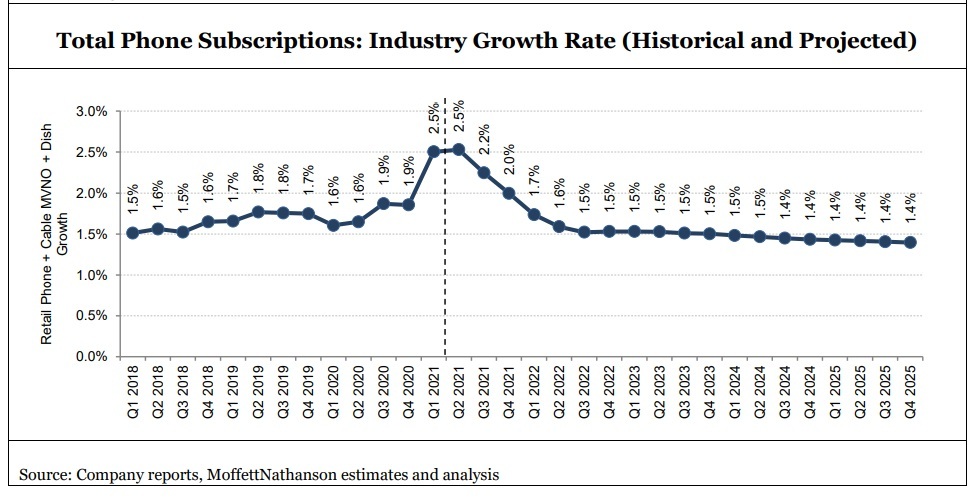

Moffett’s revised estimates are for mobile phone subscriber net additions to drop from about 6 million this year to approximately 4.5 million per year in the next few years. That works out to 5.8 million postpaid net adds vs. a loss of 1.3 million prepaid subscribers.

Moreover, the phone subscriber loss for mobile telcos will become more acute if the growth rate recedes from a recent increase of 2.5% year-over-year (a number five times higher than population growth), to more moderate levels – down to about 1.4% by 2025, according to Moffett’s forecast.

Moffett has significantly lowered his estimates for postpaid phone net adds for both AT&T and Verizon. T-Mobile’s sub growth will slow to a smaller degree, reflecting “greater competition from cable operators,” Moffett wrote.

- AT&T: For 2022, Moffett has cut an original forecast of 1.05 million postpaid net adds, to net adds of 505,000. Looking to 2025, he has lowered an original forecast of 888,000 postpaid adds, to 261,000.

- Verizon: For 2022, the analyst cut original expected postpaid adds of 1.03 million to 673,000. For 2025, he now expects Verizon, which does benefit from Comcast’s and Charter’s mobile businesses thanks to the aforementioned MVNO agreements, to pull in postpaid adds of 306,000, versus an original 1.09 million.

- T-Mobile: For 2022, Moffett has reduced his original postpaid net adds of 2.93 million, to 2.73 million. For 2025, he has lowered T-Mobile’s expected postpaid net adds to 2.97 million, versus an original 3.35 million.

Ahead of its national 5G network build, Dish Network remains largely a prepaid operator following its acquisiton of the Boost business from T-Mobile, along with a mix of pre- and post-paid subs coming from last year’s Ting deal. Moffett expects to see a faster decline at Dish’s Boost prepaid business as the company prepared to “compete more vigorously in post-paid.”

The wireless industry hasn’t grown mid-single digits in years, and, with competitive intensity rising, there is little reason to expect that to change. Unfortunately, MoffettNathanson is skeptical (to say the least) that 5G will create incremental revenue streams that fundamentally alter the industry’s growth trajectory. [1.]

Note 1. With URLLC performance requirements not met by either 3GPP Release 16 or IMT 2020 (M.2150), no ITU standard or 3GPP implementation spec for 5G SA core network (which is required for all 5G features like network slicing), no 5G SA roaming, and no ITU-R agreement on 5G mmWave frequencies (revision to M.1036 companion recommendation for M.2150), we think there are very few legitimate use cases for 5G at this time. Furthermore, the network build out costs, especially for hundreds of thousands of small cells with fiber backhaul) will overwhelm any revenue increases and result in a net LOSS for almost all wireless telcos that deploy 5G SA (T-Mobile may be an exception for many reasons).

…………………………………………………………………………………………………………………………………………………………………………….

Craig continues:

And if AT&T and Verizon are both going to be share losers – this seems to us to be a relatively non-controversial assertion – in an industry that barely grows, then how on earth will they achieve faster than mid-single digit growth?

In sum, our calculation suggests industry phone growth – again, to be clear, this is before the minting of unneeded and unused additional lines – should be about 1.2% per year.

With Cablecos taking a bite out of that smaller pie, Craig expects growth of incumbent telco’s – AT&T and Verizon, in particular – to suffer.

References:

MoffetNathanson July 6, 2021 Report: Cable Wireless: The Impact on TelCos (subscribers only)

3 thoughts on “MoffettNathanson: AT&T, Verizon set to lose wireless market share to Cablecos; 5G to disappoint – no real use cases”

Comments are closed.

It will be interesting to see how Verizon’s 5G Home product with its millimeter-wave delivery last-mile delivery will impact its wireless phone business. For instance, Verizon seems to have a fairly compelling product that is discounted by $20 to $50/month if bundled with their cellular phones. No data caps, 300/50 Mbs download/upload speeds, and an included router are some of the features.

https://www.verizon.com/5g/home/

If Verizon’s apparent slow rollout in San Jose, CA is an indication, then there could be a great deal of upside if VZ ever starts to get traction and it brings along its mobile service through bundling.

Verizon’s 5G Home product with its millimeter-wave, last-mile delivery is on a very, very slow rollout. It does have the potential to enhance Verizon’s subscribers and the revenue base.

That said, Verizon does apparently want to cover all the bases.

1. Its leading MVNO is Comcast/Xfinity, a Cableco.

2. Verizon is likely to acquire another MVNO, Tracfone.

3. Verizon also operates via its wholly-owned subsidiary, Visible, which prices its services like an MVNO.

Altice Mobile is ready to ramp up its MVNO biz, by Sue Marek, special to Light Reading. Another example of how cablecos are increasing their mobile/cellular customers at the expense of legacy wireless telcos like AT&T and Verizon!

Altice Mobile is the mobile virtual network operator (MVNO) arm of cable company Altice USA that runs on T-Mobile’s network. And the company is now ready to ramp up its promotional efforts and add more customers as it shoots to achieve break-even status by the end of 2022 and profitability in 2023.

The company’s new break-even goal represents a delay from its initial plans. Altice USA CEO Dexter Goei said back in 2019 that he believed the company would reach profitability by late 2020.

By contrast, Comcast revealed that its own Xfinity Mobile MVNO, which runs on Verizon’s network, achieved break-even status earlier this year – just four years since its debut.

A very cheap deal

Altice made headlines back in September 2019 when it launched its wireless service with a price-tag that was much lower than any other unlimited offering. Altice at that time offered unlimited data for just $20 per line per month for its existing Optimum and Suddenlink cable customers, and $30 per line per month for all others regardless of whether they resided in Altice’s wireline footprint.

At the time, the company said it could offer the low price of $20 per month because it operated the service on its own core mobile core network. When the company initially launched its mobile service, it was operating primarily on Sprint’s network with additional coverage via a roaming deal with AT&T.

However, when T-Mobile closed its purchase of Sprint in 2020, Altice quickly inked a new, seven-year wholesale agreement with T-Mobile that included being able to use the company’s emerging 5G network.

Working out the kinks

During Credit Suisse’s 23rd Annual Communications Conference earlier this summer, Altice USA CFO Mike Grau told investors that Altice has finally ironed out some of its issues with its mobile product, including completing the migration of its customers from Sprint’s network to T-Mobile’s network. At the end of the first quarter, Grau said that “substantially” all of its customers are now on T-Mobile’s network, which contributed to a 20% decline in churn in the first quarter of 2021 compared to the first quarter of 2020.

Altice is already touting the fact that its wireless service runs on T-Mobile’s network. The company has cited various network performance achievements that T-Mobile has been awarded, such as “fastest 5G” based upon Opensignal’s 5G User Experience report from January 2021.

Grau also said that during the past year the company looked critically at its wireless product and decided it needed to solve two things: it had to make sure its wireless customers were profitable and it had to fix its pricing.

To solve those issues, Altice added more rate plans and increased its prices. It currently offers a 1 GB plan for $14 per month for existing Optimum and Suddenlink wireline customers and $24 per month for everyone else, and a 3 GB plan for $22 per month for existing customers and $32 per month for everyone else. It also sells an unlimited data plan for $45 per month for existing customers and $55 per month for everyone else.

Grau noted that the company is seeing a lot of interest in its 1 GB and 3 GB plans. “Our take rates on the limited plans are encouraging,” he said.

According to financial analyst firm MoffettNathanson, about 60% to 70% of Altice Mobile’s new customers are buying its 1 GB or 3 GB plans instead of its unlimited data plan.

Altice is currently substantially smaller than its MVNO peers in the cable industry. The company ended the first quarter with just 174,000 mobile lines and added only 5,000 new lines during the quarter.

By contrast, Comcast’s Xfinity Mobile MVNO added 278,000 mobile lines in the first quarter of 2021, bringing its total customer base to 3.1 million lines. And Charter’s Spectrum Mobile MVNO added 300,000 new lines in the first quarter for a total of 2.7 million mobile lines.

But Altice hopes to reduce the gap between it and the other cable MVNOs. Grau said that now that Altice’s brick-and-mortar stores are fully open post-pandemic and the company has made some necessary pricing adjustments, it is now in position to “turn up the sales” and be more aggressive with its marketing and sales efforts at the end of the third quarter and into 2022.

https://www.lightreading.com/5g/altice-mobile-is-ready-to-ramp-up-its-mvno-biz/d/d-id/770762?